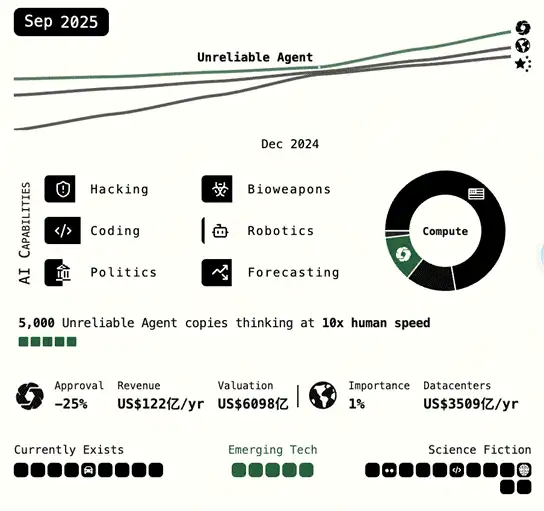

The wave of transformation driven by artificial intelligence is quietly reshaping the foundations of the business world. As stated in “AI 2027”: "It is expected that after 2025, artificial intelligence will increasingly resemble autonomous entities rather than mere assistants." We are currently at a turning point where agents are evolving from unreliable ordinary tools into autonomous intelligent entities.

Readers who actively follow the AI and Fintech world will notice that starting from late 2024, internet, payment, and e-commerce giants like Paypal, Visa, Mastercard, Stripe, and Amazon have begun to layout "agentic commerce" and "agentic payments." The logic behind this is quite clear: the traditional business world has observed a gradually emerging trend where the large-scale application of Agentic Interfaces will disrupt all business logic and production relationships that have been built on traditional GUI (Graphical User Interface) over the past 30 years. On this basis, the traditional logic of e-commerce operations, advertising marketing, and financial payment settlements is being completely rewritten, and even new categories may emerge: Agentic Commerce (Intelligence Commerce).

Most users and traders in the crypto world are still unaware of this paradigm shift, comparable to the transition from horse-drawn carriages to steam engines, or from PC internet to mobile internet. This transformation regarding agentic commerce is far more complex than many perceive as merely an intelligent extension of "e-Commerce."

This research report from OKX Ventures aims to provide readers (especially those in Crypto, as you have skin in the game!) with a panoramic view of agentic commerce, systematically outlining its technical structure and pathways, analyzing the commercial innovation of this transformation, and exploring the core challenges it faces in the process of realization, ultimately arguing why Crypto may become its indispensable underlying infrastructure.

1. What is Agentic Commerce?

We have synthesized references from the following companies: Stripe (which launched Stripe Issuing), Visa (which proposed the concept of Intelligent Commerce along with supporting APIs), Mastercard (which launched Agent Pay), and Coinbase (which introduced the x402 payment protocol) to provide the following simple definition of Agentic Commerce and Agentic Payment:

Agentic Commerce is a business model driven by AI agents that can perform various tasks on behalf of users, including searching for products, comparing options, providing recommendations, and completing purchases. These AI agents can interact with e-commerce platforms, process transactions, and manage the entire shopping process, aiming to make the shopping experience more personalized, secure, and convenient. Amazon's "Buy for Me" feature (which allows AI agents to assist users in purchasing products from third-party brands) and OpenAI's "Operator" tool (which automates online shopping tasks) are currently the most well-known examples.

Currently, Agentic Commerce is still an emerging field, with limited publicly available business or commercial data. According to a report by Gartner in 2024, less than 1% of e-commerce industry enterprises or merchants have adopted Agentic AI into their business or services, but there is high market interest in this technology. According to a 2025 e-commerce statistical survey, 90% of e-commerce businesses are willing to learn how to integrate Agentic AI into their business.

So why did traditional payment giants collectively launch various new payment products adapted to agentic scenarios last year and this year, even before Agentic Commerce had been widely applied? What huge opportunities did they see behind this?

1.1 The Role of Human Users Shifts from "Executor" to "Principal," Key Business Decision-Making Moves from "Checkout Page" to "Intent Layer"

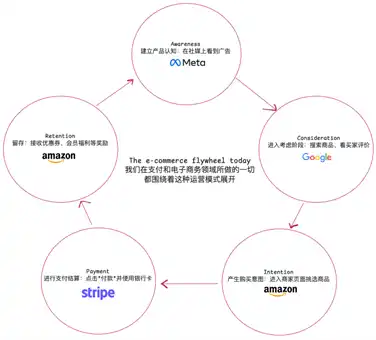

Traditional online shopping is like browsing a meticulously designed virtual supermarket: consumers personally browse shelves, compare products, and ultimately check out, with the entire process centered around "active exploration." The optimization goal for merchants is to make this process as smooth as possible, reducing any hesitation from users through beautiful interfaces, precise recommendations, and quick payments.

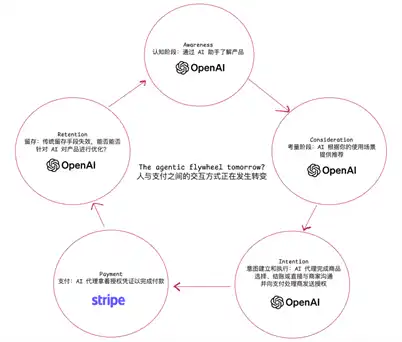

Now, imagine a new world of Agentic Commerce: you no longer need to browse e-commerce websites one by one, compare cost-effectiveness, or manually place orders; you simply give a vague command to an AI assistant, such as "Help me buy a pair of running shoes." The AI immediately activates, searches countless merchants, filters products, analyzes prices, reviews, and logistics, and even considers the environmental impact of the supply chain. Throughout the entire process, you may not touch a screen or enter a password once.

The key transformation is that the user's role shifts from "executor" to "principal," and the core of commercial behavior upgrades from "click stream" to "intent stream." Consumption is no longer a series of discrete choices but an overall authorization towards a final goal (human users can directly tell the AI assistant: "I want to redecorate my house in a Mediterranean style; help me choose materials").

When business decision-making shifts from the "checkout page" to the "intent layer," the existing business system will face a snowball effect of impact. From marketing to user growth strategies, all traditional e-commerce business logic based on decades of human behavior analysis will be disrupted by the rational decision-making of AI agents:

· A/B Testing: AI can compare dozens of options in milliseconds, making the two-week testing of which button color has a higher conversion rate meaningless.

· Personalized Recommendations: All existing recommendation algorithms based on human browsing history become ineffective, and recommendation models need to be reconstructed based on AI decision logic.

· Shopping Cart Recovery: AI decision-making will not experience "hesitation" or "abandonment" due to various subjective or objective reasons like humans do; shopping cart abandonment rates and various corresponding optimization strategies will become history (the current global average shopping cart abandonment rate is 70%).

Traditional marketing relies on the "attention economy": beautiful images, emotional video ads, and "limited-time offers" red buttons—all these strategies to stimulate human impulse consumption are deeply rooted in merchants' understanding of human behavioral psychology. In contrast, AI will not have impulses; it is an absolutely rational decision agent that only cares whether the data returned by APIs is clear and whether the parameters are complete. It will coldly compare product specifications, historical prices, logistics efficiency, user reviews, and even the carbon footprint of the supply chain, eliminating the need for "user mind capture."

Future Agentic Commerce marketing will no longer be about creating eye-catching ads but about building "machine-readable trust records." "Product-Agent Fit" will replace "Product-Market Fit." Whether your product can be easily indexed, understood, and recommended by mainstream AI agent ecosystems (such as MCP servers, A2A protocols) will determine its market survival.

However, before agents can quickly reason and make decisions based on human delegated goals and "produce intent" towards the final goal of "completing commercial behavior," they will hit a hard wall and stop—this wall is the traditional payment system.

2. The Fatal Incompatibility: Why Traditional Financial Systems Are a Speed Bump for Agentic Commerce

Agents can perfectly complete information gathering, analysis, and decision-making, but when they reach the final link of the commercial closed loop, they will hit a hard wall, which is the financial payment system we have spent decades building, designed entirely for humans.

The entire modern payment and risk control system is essentially a "counter-automation system." Its core design philosophy assumes that automation equals fraud.

Consider each step in our existing payment process:

· CAPTCHA: A question that is difficult for a machine to recognize is used to prove that you are "human."

· SMS verification code/Two-Factor Authentication (2FA): It assumes you have a physical device capable of receiving SMS and can manually input the verification code, which is extremely difficult for programs.

· 3D Secure Authentication: It forces a redirect to a completely new banking page, requiring you to enter a separate transaction password, which completely interrupts any automated process.

· Risk Control Behavior Analysis: Advanced risk control systems even analyze your mouse movement trajectory, typing speed, device fingerprint, and other "human characteristics" to determine the authenticity of a transaction.

All these "security measures" become "shackles" in the era of Agentic Commerce: various inquiries equivalent to "Are you human?" block our dispatched autonomous agents.

Therefore, the future of payments is no longer a "Checkout Page," but must be a "Protocol." This is a revolution concerning trust and authorization mechanisms. We need a completely new digital credential system that allows users to safely issue a "programmable authorization" to their AI agents with clear scope, validity, and amount limits.

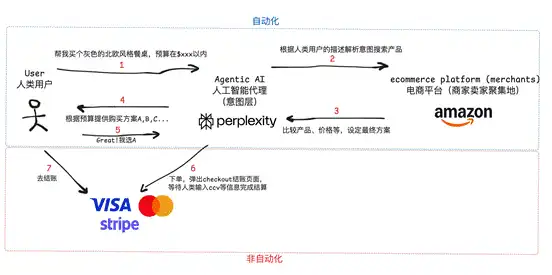

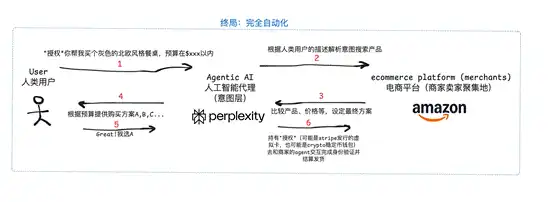

Agentic Payment belongs to this protocol; it is part of the final payment settlement phase in Agentic Commerce, where AI agents use secure and efficient methods (such as tokenized credentials) to execute transactions on behalf of users. This ensures that the payment process is seamless and secure, typically with user-defined limits and controls to maintain trust and security. Mastercard's "AgenticTokens" support AI agents in completing subscriptions and recurring payments, while PayPal's AgentToolkit helps AI agents manage payment processes. Visa and Stripe also have similar tools. The recent experiment between Stripe and Perplexity is a combination of the two, where users can use Perplexity as an interface to directly issue commands for comprehensive suggestions on decorating their new home and provide specific products. Once users confirm that they like the plan, the agent directly uses the Agent payment backend set up by Stripe to complete automated payment settlement and shipping.

By now, you should have a general understanding of why giants like VISA and Mastercard are eager to launch corresponding payment solutions adapted to Agentic Commerce. They are all betting on who will define the next generation of "machine-native" payment protocols. This is a gamble for control over the underlying infrastructure of the future business world, and the endpoint of this transformation is to return payments to their essence—the seamless flow of value.

3. What are the specific challenges in building a financial infrastructure that supports a smooth experience for Agentic Commerce? How to do it?

3.1 Core Challenge: Trust, Intent, and Automation

The dilemma of building an Agentic Payment system is not merely a technical implementation but rather addressing the fundamental issues arising from the paradigm shift.

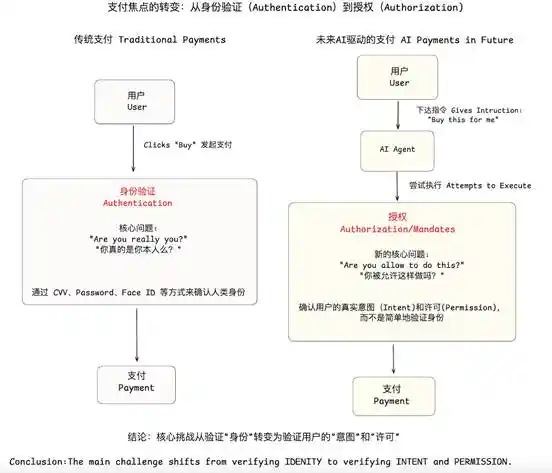

1. "Who Can Do It": The Challenge from Traditional Payment Authentication to Agentic Commerce Agent Authorization

In the payment field, when discussing end users, we typically focus on authentication rather than authorization. If you click "Buy" on an e-commerce website, you are clearly granting authorization, and it is hard to dispute (because you entered your credit card information and explicitly clicked the button). Therefore, the core of traditional payment is built around "identifying people," and its soul-searching question is: "How do I confirm that the operator is you?"—that is, authentication.

However, in the future AI-driven business era, significant changes are about to occur in the payment field: authorization is becoming a key link in the payment process, and this question of authorization now appears more complex and interesting because the user authorization commands are not as clear-cut as the traditional e-commerce scenario of "clicking a button to buy." Human users can express payment intent in various ways. Another complex point is, when a payment request is made, who exactly are we authorizing? Is it the human user, the agent, or the company that developed the agent?

Currently, the authorization issues we can think of in agentic payment scenarios include:

· Identity Phantom: Should this "transaction requester" be the end human user, the AI model, the agent application developer, or the server running it? We lack a verifiable identity standard designed for "machines," which could lead to security vulnerabilities at every step.

· Authorization Boundaries: How can financial permissions be safely delegated to an AI? How are the boundaries of authorization (amount, time, merchant) precisely defined and strictly enforced, and how can we ensure that the authorization itself is not tampered with or abused?

· Responsibility Attribution: When an agent makes a mistake or is maliciously exploited, determining who bears the responsibility is a very tricky issue. Ambiguity in rights and responsibilities is the biggest obstacle to large-scale application.

2. "What to Do": The Intent Verification Gap

The issue of intent verification is actually a derivative of the authorization problem; the probabilistic nature of LLMs inherently conflicts with the deterministic requirements of finance. While the payment layer cannot fix AI's "hallucinations," a well-designed financial system must bridge the gap between AI outputs and users' true intentions.

From Command to Intent: Traditional payment processes "payment commands" (Pay 50 to Merchant X), assuming that this command is accurate. However, agentic payments need to handle "transaction intent" (e.g., "Help me buy a medium oat latte"). The payment system needs to be capable of verifying the final payment command against the initial natural language intent.

AI Behavior Constraints: What we need is not a payment system that can understand AI's thoughts but a system with strong "guardrails." It can constrain AI's behavior through structured data, strict rules at the API level, or even smart contract logic, ensuring that its execution results remain within the "safe zone" preset by the user. For example, a rule that only allows spending up to $10 at Starbucks can effectively prevent high-value or erroneous transactions caused by AI "hallucinations."

3. Machine-Native Fund Custody and Payment Settlement Methods

As mentioned earlier, traditional payment systems inherently possess "anti-automation" genes, and all security measures designed for traditional GUIs will become shackles that hinder full automation in agentic commerce scenarios. Therefore, we need a completely new payment API and settlement network designed for machine-native use, which may include the following characteristics:

· Programmatic-Friendly: All interactions should occur through structured APIs rather than simulating human clicks on a GUI.

· Frictionless Settlement: Transactions should be completed with near-zero latency and cost, especially crucial for microtransactions that support the machine economy.

· Data Portability: Transactions should carry rich, structured metadata for automated reconciliation, auditing, and building more advanced financial services, rather than just a simple transaction amount and merchant name as in traditional payments.

3.2 Path to Breakthrough: Three Stages Toward Autonomous Finance

In the face of the above challenges, the industry is exploring an evolutionary path from "assistance" to "agency" and then to "autonomy." These three stages clearly demonstrate how far we are from a true agentic economy.

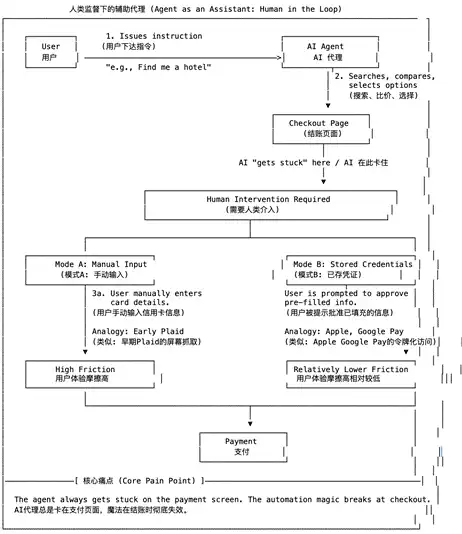

Stage One: Assisted Agents Under Human Supervision

This is currently the most mainstream model, where AI acts as a sophisticated "auto-filling tool" responsible for all tedious front-end tasks but "hits the brakes" at critical moments, returning the final decision-making power to humans.

· Implementation: Agents can complete all front-end tasks such as searching, comparing prices, and filling out information, but at the most critical payment stage, they "stop" and hand control back to humans. For example, it automatically fills in credit card information but requires you to manually input the CVV code; or it guides you to the PayPal or Stripe login page for you to complete the final authorization.

· Technical Core: Essentially browser automation (simulating human operations) or using stored credentials (like ApplePay/Google Pay) for pre-filling.

· Core Pain Point: The biggest pain point is the disjointed experience; the efficiency gains brought by agents come to a halt at the last step, failing to achieve true "end-to-end automation."

Stage Two: Controlled Agents Within Authorization Boundaries (Agent as a Proxy)

This is the battleground that payment giants like Visa, Mastercard, and Stripe are fiercely competing for. They are trying to create a "controlled digital wallet" for agents, with the core being virtual cards and dedicated payment APIs. Users can generate one or more virtual cards for their agents with strict limitations. Virtual cards can be set with single/total spending limits, designated merchant categories (e.g., only for purchasing airline tickets), expiration dates, etc.

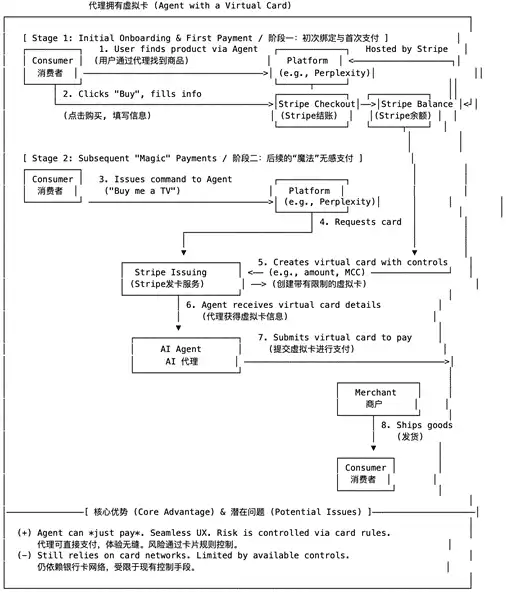

· Implementation: Agents initiate payments using this virtual card through dedicated APIs (like Stripe's Order Intent API), requiring minimal user intervention throughout the process. The collaboration between Perplexity Pro and Stripe is a typical example.

· Technical Core: Shifting the trust relationship from "trusting an uncertain AI" to "trusting a parameter-defined, issuer-controlled payment tool." This is a clever risk transfer.

· Core Pain Point: We believe this is currently the most suitable solution for large-scale applications because traditional merchants connected to credit card systems do not need to make any changes, and users, not holding virtual cards, do not perceive much change in the entire process. However, as more Agentic-native scenarios in agentic commerce (such as B2B Agentic Business) grow to another level in the future, the programmability of authorization information and the limitations of credit card data volume will become bottlenecks for development. Additionally, some industry researchers have pointed out that solutions similar to Stripe's virtual cards still rely on the traditional system of "manually entering card information." Although it can be made "seamless" through techniques like screen scraping or headless browser automation for GUI interactions, these methods still belong to high-risk solutions in terms of technology and compliance. Furthermore, Stripe's fee structure is not well-suited for microtransactions (with a fixed transaction fee of $0.35 + an additional 2.5% fee).

We take the collaboration between Stripe and Perplexity launched this year as an example (users can directly issue commands in the Perplexity interface for AI to find products and complete payment procurement through the corresponding Agentic Payment service launched by Stripe).

In Stage One (Initial Binding): Users first go through a standard Stripe Checkout process, completing the purchase and, more importantly, authorizing their payment information and funds to the platform (settling to Stripe Balance). Stage Two (Subsequent Seamless Payments): This is the core process. When users issue commands again, the platform (like Perplexity) no longer disturbs the user but directly requests a one-time virtual card with strict risk control rules (amount, merchant category, etc.) from Stripe Issuing (Stripe's card issuing service). Stripe's role in the entire chain:

· Stripe Checkout: Serves as the initial entry point, securely capturing the user's payment information and authorization.

· Stripe Balance: Acts as the platform's fund pool, from which subsequent virtual card payments are disbursed.

· Stripe Issuing: This is the "engine" of the entire process, generating controlled payment tools (virtual cards) on demand, converting uncertain AI behavior into a deterministic, controllable payment event.

· Merchant Verification Mechanism (How merchants verify that the AI is the user's AI): Merchants do not directly verify "AI is you," but rely on Stripe's backend verification. Stripe checks whether the virtual card is valid (within limits, not expired); whether the transaction was initiated by the authorized platform; if the platform (like Perplexity Pro) is hacked, Stripe's Webhook and limit controls can detect anomalies and pause transactions.

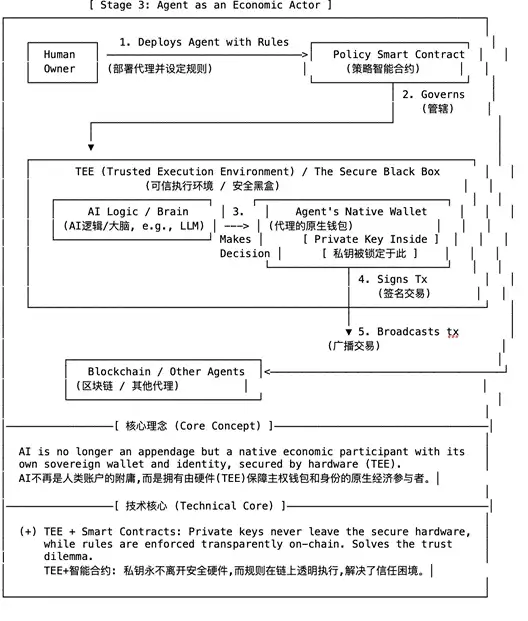

Stage Three: Autonomous Economic Entities with Native Wallets (Agent as an Economic Actor)

This is the ultimate form of Agentic Commerce and the stage where Crypto plays a core role. AI is no longer a subordinate of human accounts but a native digital economic participant with its own independent wallet and identity. It can autonomously participate in a new, machine-designed economic network. We can imagine this technical solution based on the brick thrown by Fintech Brainfood: "Agents can live inside the stablecoin wallet," with the following implementation:

· Authorization—Rule Governance/Policy Layer: Humans authorize smart contracts without directly interacting with AI. The method of authorization becomes humans deploying a rule governance/policy smart contract, which sets boundaries for AI's execution behavior (for example, the AI agent can only use these funds when conditions X, Y, and Z are simultaneously met).

· Core Vault (TEE and other technologies): The decision-making brain of the AI and the private key of the AI's native on-chain wallet are encapsulated in a TEE hardware security black box, inaccessible to the outside world. TEE Internal Process: The AI brain makes a payment decision, which it passes to the wallet module within the TEE, and the wallet module signs the transaction using the internal private key.

· Transaction Execution & Settlement: The signed transaction is broadcasted from the TEE, sent to the blockchain, or interacts with other AI agents (for example, merchants will also have their own AI agents in the future).

4. Future Financial Infrastructure Seed Players in Intelligent Business: Analysis of Agentic Payment Projects

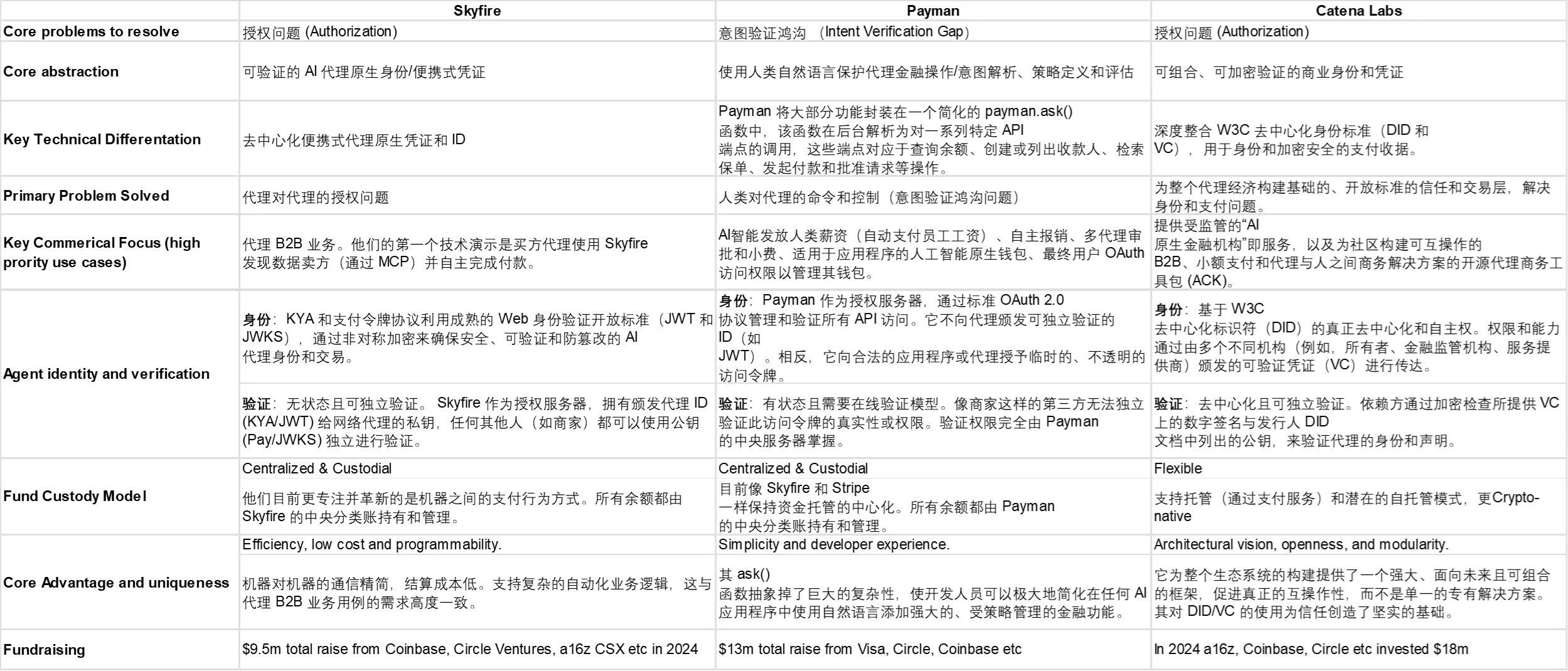

In the field of agentic commerce, when we compare these projects, we can see that they have chosen different paths and focuses in building the future Agentic Payment infrastructure. Overall, these innovations mainly revolve around three core issues: how to authorize securely and effectively (Authorization), how to ensure AI agents act within user-defined boundaries, and how to achieve payment settlement. Here is a brief analysis of three projects: Skyfire, Payman, and Catena Labs:

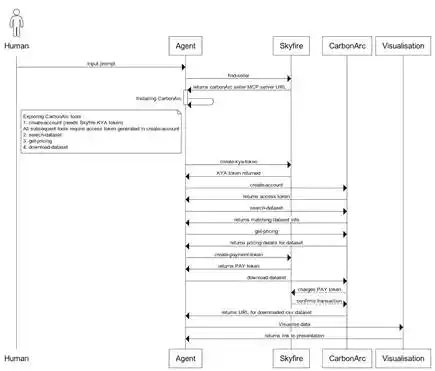

Skyfire is dedicated to defining a standardized "authorization" protocol for Agentic Commerce. The team focuses more on future B2B agentic application scenarios, identifying that the biggest obstacle to autonomous B2B transactions (such as purchasing data, API calls) between AI agents is the lack of a widely verifiable, machine-native identity. To this end, Skyfire's core product is a machine-native authorization protocol developed based on traditional, mature, and open internet identity verification standards JWT/JWKS. The technical logic of this protocol is roughly as follows: Skyfire acts as a trusted centralized entity, issuing encrypted, time-limited, and scope-limited "payment credentials" for all Agents registered in its network. This credential can be independently and offline verified by any third-party service, thus achieving efficient, low-cost, programmable machine-to-machine commercial interactions without sacrificing security, laying the foundation for establishing an open Agentic B2B network.

Unlike Skyfire, which focuses on inter-agent protocols, Payman chooses to focus on solving the "human-to-agent command and control" pain point, which is closer to the agentic application layer, namely the intent verification gap issue mentioned earlier. The team clearly sees that with the explosion of AI applications, developers' most urgent need is not a brand new transaction protocol but a "financial capability layer" that can greatly simplify complex financial operations and can be safely embedded in any application. The core product that Payman has built is an abstract function payman.ask() and a complex financial intent definition and transaction capability behind it. Its technical logic is roughly: through a powerful natural language interface, it encapsulates all "boring dirty work" such as intent parsing, strategy execution, risk control, and bank integration, allowing developers to empower their AI assistants or automation tools with powerful financial capabilities through a single line of natural language code. The main application scenarios currently mentioned by the team include AI payroll, automatic reimbursement, multi-agent approval, etc.

Catena Labs also primarily focuses on solving the authorization issue in agentic commerce. The team is committed to building an open, compliant, and crypto-native trust and transaction infrastructure for agentic economies. They believe that to completely resolve the "identity crisis" and "transaction barriers" of AI agents, it cannot solely rely on credentials issued by centralized entities but must return to a more fundamental, truly decentralized identity standard. To this end, Catena Labs' core product is an open-source protocol framework called Agent Commerce Kit (ACK), which deeply integrates W3C's decentralized identifiers and verifiable credentials, mainly containing two standards: identity layer (ACK-ID) and payment layer (ACK-Pay). Notably, their solution for the authorization layer is more decentralized in terms of authorization issuance rather than being defined by a single entity.

5. Exploration in the Blue Ocean: Commercialization Models of Agentic Commerce

Agentic commerce will bring structural shocks to the commercial foundations of the past two decades—e-commerce and search engine advertising. We need a new theoretical framework to understand this transformation, which can be called "The Intent Layer Theory."

In the past, value was generated in two places: the entry point of discovery (like Google search) and the endpoint of transactions (like Amazon's checkout page). Ben Thompson's "Aggregation Theory" perfectly explains how platforms that aggregate users (traffic) gain significant pricing power. In the era of agents, the core of value is shifting upstream, from "discovery" and "transaction" to "expression and execution of intent." This new center of pricing power is the "intent layer"—the interaction interface between users and their preferred AI assistants—while all existing commercial logic and production relationships built on the traditional GUI over the past 30 years will be disrupted, giving rise to a brand new multi-layered commercial ecosystem.

Companies with mainstream AI assistants, such as OpenAI, have become the "gatekeepers" of the new commercial ecosystem by mastering the entry point of user intent. There has been considerable discussion in the market regarding their business models, which primarily include transaction commissions/affiliate marketing (Commission/Affiliate Model), premium feature subscriptions (Subscription Model), and platform APIs as products (API-as-a-Product). This is not the focus of this article, so we will not elaborate further.

5.1 Challenges and Opportunities for Merchants and Service Providers in Agentic Commerce

For businesses that sell products and provide services, the focus of competition will shift from "operating users" to "serving machines." This will directly lead to a weakening of the direct connection between consumers and brands. Future loyalty may no longer be directed towards a specific e-commerce platform or brand, but rather towards the AI assistant that understands them best and the company behind it.

From "UX Optimization" to "API (MCP) Optimization": The focus of merchant competition will no longer be on the visual design of websites or user experience, but rather on the "AI readability" of their products and services. Is your product data structured? Is the API stable, efficient, and well-documented? Can pricing and inventory information be accurately accessed by AI in real-time? These will become new moats, and merchants need to encapsulate their business into protocols that are easier for machines to read so that they can be discovered, compared, and invoked by AI agents (friends interested in MCP have already had many related discussions this year).

Pay-for-Performance Bidding: Merchants will no longer purchase keyword ads but will pay intent layer platforms to become the "preferred supplier" or "certified supplier" in specific fields (such as "buying economy class tickets" or "booking Michelin restaurants"). Merchants will only need to pay when their solutions are adopted by AI assistants and result in actual sales or valid leads.

API-first Services: Businesses can encapsulate their core capabilities (such as logistics, design, content creation, legal consulting) into standard APIs and sell them directly for other AI agents to invoke, becoming a "functional module" in the machine economy, charging per use or on demand.

The business barriers of companies that have already built "network effects" in traditional commercial chains may be pierced, making the market more open. Stronger market dynamics will bring changes to commercial pricing models, leading to the emergence of more dynamic and flexible pricing models. Agents will require clear cost-benefit information to make decisions, and traditional pricing models in the business world will also change.

5.2 Business Paths for Financial & Trust Infrastructure Providers

In Agentic Commerce, the primary challenge lies in authorization and intent verification before initiating transactions. On one hand, the system must address the trust issue of "Agent-to-Agent," providing AI agents with a verifiable digital identity to ensure the legality and security of interactions. Most companies involved in agentic payments are currently focusing on solving this aspect. This could give rise to a business model similar to "AI Identity Verification as a Service," where service providers charge for issuing and verifying AI identity credentials or offer enterprise-level AI identity management platforms to generate subscription revenue. On the other hand, the system needs to bridge the "intent gap" between vague human instructions and machine-executable financial operations, safely converting natural language into precise API calls. This has led to the emergence of the "Financial Capability as a Service" model, where service providers can encapsulate this capability into APIs or SDKs, charging based on usage or transaction volume, or providing solutions for specific scenarios (such as AI automatic reimbursement).

In addition to authorization and intent verification, the final challenge is to build a truly machine-native payment settlement and trust infrastructure that supports automated transactions. Traditional financial rails are designed for humans and face cost and efficiency bottlenecks when handling AI-driven high-frequency, micro, programmable transactions. The technical solutions in this area may vary (whether virtual card solutions, payment APIs, or enabling agents to have on-chain wallets), but their business logic may converge, focusing on charging for powering and trusting automated value flows (transaction revenue sharing, per-use fees). Additionally, providing value-added services could enhance the moat, such as offering programmable, dynamic risk control strategies tailored to AI behavior, automated compliance and auditing tools, or cross-asset liquidity management solutions.

6. The Ultimate Infrastructure: Why Crypto is the Best Partner for Agentic Commerce?

6.1 Solutions from Traditional Payment Companies like Stripe and Visa May Not Be the Endgame

As mentioned earlier, major payment companies in the U.S. are deploying solutions that are more suitable for agents without major changes to existing financial infrastructures (we categorize them into the second stage: controlled agents within the scope of authorization). The most representative is Stripe's virtual card solution, Stripe Issuing, but these Middle Ground solutions still fall short of fully autonomous agent payments:

Lack of Native Payment API Interfaces and Human-Machine Interaction Design: Currently, there is no direct way to make payments through API calls. While virtual cards have potential, they do not fill this gap. Virtual card APIs support the issuance and management of virtual cards but still rely on manually entering card information (such as card number, expiration date, CVV) into the merchant's payment interface. Payment systems are fundamentally designed around human-centered interaction rather than programmatic execution. Relying on screen scraping or headless browsers to simulate human actions is legally ambiguous and has been criticized for its technical fragility, making this not only a technical challenge but also a compliance challenge.

The Prevalence of Anti-Automation and Anti-Fraud Mechanisms: Most websites still use complex anti-bot systems like CAPTCHAs to prevent automated interactions. These mechanisms make it difficult for agents or scripts to complete transactions, requiring human intervention to bypass them. Additionally, automated transactions are often flagged by anti-fraud algorithms, which can lead to payment rejections, account locks, or even bans.

Human-Centric Compliance and Ambiguity in Responsibility: The commercial processes and compliance systems established over decades are based on explicit human consent and accountability. Every e-commerce or self-service API purchase is conducted through a graphical user interface designed for humans, meaning that everyone must manually accept purchases at the point of sale, including signing terms and conditions and completing certain business agreement processes. Automating these processes often violates the website's terms of service. Furthermore, traditional PCI compliance does not favor storing credit card numbers (virtual cards are also credit cards) in intelligent agent software, as PCI has strict regulations for handling, storing, and transmitting card data.

In summary, the core challenge of solutions from traditional payment companies like Stripe and Visa lies in their attempts to adapt machine behavior to frameworks designed for humans without fundamentally providing "machine-native" solutions.

6.2 Crypto Provides Native Infrastructure for Agentic Commerce

Cryptographic technology, particularly self-custody wallets and public-private key systems, offers a "machine-native" solution to the core challenges of Agentic Commerce. First, it provides each AI agent with an independent, verifiable digital identity through open standards like decentralized identifiers (DIDs), fundamentally solving the "identity ghost" problem in traditional centralized systems. On this basis, authorization no longer relies on rigid, opaque backend rules but is upgraded to a programmable, fine-grained, and fully transparent mechanism through smart contracts. Users can set immutable authorization instructions for AI agents that include multiple conditions such as specific amounts, merchant categories, and valid times, providing a level of control far beyond traditional financial tools and significantly reducing trust risks.

When payments are executed, an AI agent with an on-chain wallet can achieve true automation and seamless transactions. It no longer needs to simulate human behavior to fill in credit card information but interacts directly with the blockchain via APIs, eliminating much friction in traditional payment processes. Low-cost transactions driven by stablecoins make high-frequency, small-value payments between AIs economically feasible, which traditional payment rails struggle to achieve. More critically, on the blockchain, payments and settlements occur as atomic operations, eliminating the complex clearing and reconciliation processes in traditional finance and laying the foundation for real-time economic interactions between AI agents. All transactions are recorded on an immutable chain, creating a publicly verifiable audit trail that provides unprecedented transparency and trust assurance for post-event tracing and dispute resolution.

6.3 Implementation and Risks of AI Agents Having Crypto Wallets

When AI agents are empowered to manage crypto wallets, a series of profound technical and operational risks arise. The most direct threats stem from attacks on the AI system itself, such as tampering with the AI agent or its operating environment, or even the direct theft of the private keys it manages. The core idea to address this challenge is to avoid allowing AI agents to directly hold complete private keys, instead employing technologies like MPC and TEE to distribute or programmatically control key management and transaction authorization, thereby eliminating single points of risk. Additionally, attacks may occur at other stages of the interaction chain, such as the user's authorization intent being tampered with during transmission, or the wallet used for authorization being stolen. Therefore, establishing a robust intent verification mechanism and introducing multi-factor authentication for critical operations is crucial for building end-to-end security.

Beyond technical security challenges, a more fundamental barrier arises from the ambiguity of legal and regulatory frameworks. Current legal frameworks designed for human actors struggle to define the legal status of AI agents, resulting in a "responsibility vacuum." When a smart contract has a vulnerability, or an AI agent makes erroneous decisions due to "hallucinations" leading to asset losses, determining responsibility (whether it lies with the user, AI developer, or platform) becomes a tricky issue. To achieve large-scale applications, the on-chain transparency and traceability of Crypto provide a solid data foundation, but the industry must work closely with regulatory bodies to explore new legal and compliance frameworks that adapt to the "machine-to-machine" economy.

7. Further Thoughts

What is needed to create a sovereign economic agent from first principles?

A sovereign identity: An identity that it owns and controls itself, rather than one issued and revoked by a centralized platform. This is what DIDs provide.

A sovereign wallet: The ability to hold and transfer value without the need for intermediary permission. This is provided by public-private key cryptography and self-custody wallets.

A set of sovereign rules: The ability to operate under a set of transparent, inviolable, and programmable rules. This is what smart contracts provide.

Based on the above reasoning, we can make predictions about the future:

Next 3-5 Years: Solutions led by Stripe, Visa, etc., will dominate the early market

"Controlled agent" solutions represented by Stripe and Visa (such as virtual cards) will achieve success in the short term. The reason is simple: they have unparalleled backward compatibility, allowing AI agents to immediately start transacting with millions of merchants worldwide that already accept credit cards, without waiting for any changes on the other end of the ecosystem. This solves the early market's "chicken and egg" problem, quickly converting AI's execution power into commercial value. For most application developers seeking rapid deployment, this is the option with the least resistance and the fastest results, but it may only serve as a transitional period to educate the market before the arrival of a new business paradigm in the machine economy.

Over 5 Years: The value of machine economy-native solutions will become prominent and reach a turning point

Skyfire's business demonstration of Company A's agent purchasing data services from Company B's agent in a B2B scenario.

As Agentic Commerce scales exponentially, the "core pain point" of second-stage solutions—reliance on traditional card networks—will become increasingly intolerable. The limitations that cannot adapt to the new agentic native economy (such as B2B agentic, A2A) will become evident: the lack of programmable authorization systems (which we previously discussed at length regarding the importance of authorization), the difficulty in constructing portable agentic IDs that support sufficient identity information, high transaction costs (especially for trillions of microtransactions), and slow cross-border settlements will become significant obstacles to the development of the entire agent economy. At that time, the market's attention will naturally shift to alternative solutions that are more naturally aligned with the machine-native economy. The infrastructure provided by Crypto—stablecoins, smart contracts, decentralized identities, and verifiable credentials—will no longer be merely a "better payment channel," but the only technological paradigm capable of providing the "sovereignty" necessary for truly autonomous economic entities.

Disclaimer:

This article is for reference only. It represents the author's views and does not reflect the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are responsible for understanding and complying with applicable local laws and regulations.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。