Original Title: "Trump's Fed Site 'Pressure', Powell: Read but No Reply!"

Original Source: BitpushNews

On July 24 local time, the Federal Reserve headquarters welcomed an unusual "high-profile inspection." President Trump personally inspected the renovation site of the Mariner Eccles Building in Washington, accompanied by Fed Chairman Powell. However, despite both wearing white hard hats, the "gunpowder smell" in their conversation was anything but "site safety."

This visit sharply contrasts with previous presidential visits to the Fed.

President Roosevelt cut the ribbon for the new Fed headquarters in 1937, and President George W. Bush attended Bernanke's swearing-in ceremony in 2006. These were scenes symbolizing cooperation and support, while Trump's visit was filled with open friction and challenges, ostensibly revolving around renovation costs but hiding deeper political motives.

Trump and Powell: Old Grudges, New Resentments

Since 2018, Trump has been unhappy with Fed Chairman Powell's lack of "cooperation." Whether during the rate hike cycle at that time or the later rate cut pace, Powell has consistently resisted White House pressure with a "data-driven" technical stance.

In 2025, this old grudge erupted again for a new reason—the Fed's renovation budget rose from the initial $1.9 billion to $2.5 billion, and Trump even claimed it was $3.1 billion on-site, jokingly saying, "If you were the project manager, you would have been fired by now."

Powell rebutted on the spot: "You included the Martin Building, which was renovated five years ago."

When asked if he still considered the project a fireable offense, Trump replied, "Look, I really want to see it completed. I don't want to categorize it that way."

Although he downplayed the conflict in front of the cameras, saying, "I don't plan to fire Powell," this scene still deepened concerns about presidential interference in central bank independence.

Powell Stands Firm: Data Determines Rates, Politics Shouldn't Interfere

Powell's response was characteristically restrained; he did not directly "confront" the president's emotions, awkwardly smiling when Trump repeatedly mentioned "rate cuts."

Previously, the Fed headquarters explained the sources of the budget changes based on transparency principles:

- Significant increases in material prices and construction labor costs;

- Enhanced safety standards for the underground three-level garage, structural reinforcement, and blast-resistant windows;

- Washington's height restrictions on buildings, forcing more structures to be developed underground;

- The Trump administration's tariffs on steel and aluminum starting in 2018, which still have lingering effects.

To prove their "innocence," the Fed also launched a renovation tour video, budget details, and proactively requested the inspector general's involvement.

In a recent press conference, when Powell was asked if Trump's frequent personal attacks made it difficult for him to fulfill his duties, he stated, "I am very focused on doing my job. What really matters is using our tools to achieve the goals Congress has given us: maximum employment, price stability, and financial stability. This is our 100% focus."

Powell's position remains clear: "Whether rates are cut must be based on inflation and employment data, not political sentiment."

Is "Renovation Gate" the Focus? The Real Sensitivity Might Be the Epstein Case

Just as this "renovation storm" hit the headlines, another news story in the U.S. worth digging into was heating up—the latest developments in the Jeffrey Epstein case.

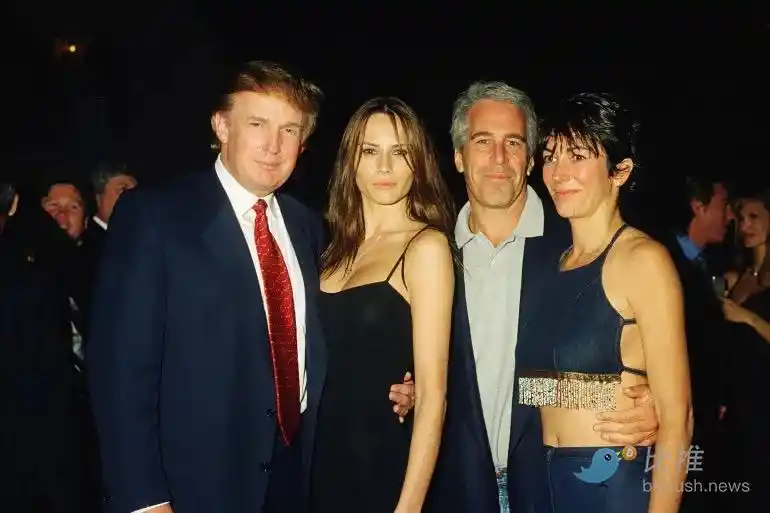

Jeffrey Epstein was a Wall Street financier and a controversial figure due to allegations of sexual crimes, underage sex trafficking, and human trafficking. He "committed suicide" in prison in 2019, but many mysteries remain in the case. He had long-standing close relationships with several prominent figures in American politics and business, including Bill Clinton, Prince Andrew of the British royal family, and even Trump himself.

In July 2025, a series of Epstein-related materials were unsealed in U.S. court, some of which involved public figures potentially mentioned in Epstein's "underage companions" and "confidential lists," sparking a new round of public discussion.

Although there is currently no evidence indicating Trump's criminal responsibility in this case, his name frequently intersects with Epstein's private flights and social records at Mar-a-Lago, providing opponents and the media with ongoing questions.

Against this backdrop, Trump's sudden high-profile appearance at the Fed renovation site, attacking Powell's budget and reintroducing the topic of rate cuts—was it an intentional effort to create a "distraction"?

Mainstream media outlets like The New York Times and The Washington Post generally believe that the high profile of this Fed event significantly exceeds its actual policy significance, and Trump's team may be attempting to achieve "narrative dominance" through three objectives:

- Divert public attention from the Epstein case;

- Create a "populist frugality" persona: I am watching the taxpayers' money;

- Pressure the Fed to push for rate cuts before September, paving the way for the election.

Wall Street investment firms remain cautious about this. Most traders still bet that the Fed will decide its policy pace based on inflation and unemployment data, without making abrupt changes due to short-term political interference.

Pressure Test for Fed Independence

Although Trump has temporarily stated that he "does not plan to fire Powell," this public dispute has sounded alarm bells in the market. The Fed is currently at a delicate juncture: on one hand, inflation is easing, but core prices still face pressure; on the other hand, the midterm elections are approaching, and both parties are particularly sensitive to interest rate trends; at the same time, Powell's term will end in May 2026, and whether he will be reappointed has also become a point of observation. While it is difficult to fire the Fed chairman, frequent political interference could still lead to being sidelined or marginalized within the "institutional framework."

Although Trump claims he "does not plan to fire Powell," there is widespread speculation that when Powell's term ends in 2026, he is likely to be replaced by someone more "White House-friendly."

So who might be Trump's ideal "Fed chief"?

1. Kevin Warsh, former Fed governor, was once considered by Trump for the chair; supports tax cuts and looser monetary policy; has a hawkish stance but emphasizes "flexibility."

2. Kevin Hassett, former chairman of Trump's Council of Economic Advisers, is a conservative economist with in-depth research on government policy and taxation.

3. Christopher Waller: He is a current member of the Fed Board, appointed by Trump. He has a strong background in macroeconomics and extensive experience in monetary policy, being one of the policymakers within the Fed.

These candidates share a commonality: they are more willing to align with the White House's macro policy rhythm and are more inclined towards "goal-oriented" rather than "data-neutral."

Powell has less than a year left in his term. Whether he can complete his term depends on three factors:

- Legal: The president cannot arbitrarily dismiss the Fed chairman; there must be "illegal or gross misconduct";

- Market: The financial community still generally supports Powell's neutral monetary policy stance;

- Political: If hardliners in the Republican Party continue to apply pressure, public opinion pressure may exacerbate his situation.

But for now, Powell has no intention of resigning; his strategy is to "resist interference through the system," insisting that "rates depend on data, and renovations depend on standards," responding unemotionally and not catering to the media—this is also one reason he is considered the most "steady" chairman of the Fed in recent years.

Market Reaction: Temporary Caution, but Tension Remains

So far, the financial market has reacted calmly to Trump's surprise inspection. On one hand, this is because the Fed has not yet made any actual policy changes, and on the other hand, most analysts still expect the earliest rate cut to occur in September.

However, this does not mean the market is indifferent. An increasing number of traders are beginning to incorporate "political interference risk" into their Fed observation parameters, especially in the context of Powell's term ending in 2026 and the possibility of the president replacing Fed executives, which may lead to greater uncertainty in future monetary policy direction.

If we view this inspection as the latest scene in a "drama," the next plot may unfold as follows:

- Powell continues to observe data, does not immediately cut rates → Trump and his allies intensify public attacks, continuing to focus on renovation costs/perjury;

- If CPI drops in September, the Fed begins to cut rates → Trump attributes it to his "successful pressure," solidifying his economic governance image;

- In 2026, Powell's term expires → If Trump is re-elected, he may appoint a new chairman who is more "cooperative," completely reshaping the Fed's style;

- If the Epstein case further escalates → The renovation topic may become a temporary smokescreen, with the real political focus returning to legal and moral realms.

Conclusion

Renovating the Fed involves not just workers but also politics. Those wanting to lower interest rates include not just the market but also the president.

This "renovation storm" between Trump and Powell may just be the intermission of this grand drama. The real climax awaits the revelation of data, ballots, and time.

So after watching this political palace drama, who do you stand with?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。