Author: Wealth

This article systematically reviews the evolution of Decentralized Autonomous Organizations (DAOs), combining the governance experiences of Non-Governmental Organizations (NGOs) and the ESG assessment framework to explore the potential development of future governance models for DAOs.

The research content is divided into three parts: The first part reviews the rise and evolution of DAOs, focusing on MakerDAO as an example to analyze its "progressive decentralization" strategy—from the dual-token governance model to the evolution path of the "Endgame" sub-DAO modular architecture, revealing the practical model of large-scale DAOs transitioning from centralized team governance to community autonomy. The second part introduces the governance logic of NGOs, using the efficient charity evaluation organization GiveWell as a case study to analyze its successful experiences in mission orientation, governance division, transparency mechanisms, and impact assessment, providing references for optimizing DAO governance. The third part explores the application prospects of the ESG (Environmental, Social, Governance) framework in DAOs, constructing a DAO-ESG assessment system that emphasizes positive impact indicators, including automated data collection, quantitative scoring models, and grading assessment mechanisms.

Keywords: DAO; governance evolution; MakerDAO; NGO; GiveWell; ESG; performance evaluation; social responsibility; governance transparency

01 DAO Development and Governance Evolution

History and Key Events of DAOs

The concept of DAO (Decentralized Autonomous Organization) was expanded by Ethereum founder Vitalik Buterin in 2014 from Daniel Larimer's DAC (Decentralized Autonomous Company). Its earliest application can be traced back to the famous "The DAO" project in 2016, which quickly raised over $150 million through token crowdfunding but was hacked for nearly $50 million due to a smart contract vulnerability, leading to a hard fork of Ethereum. Although this event brought setbacks to DAOs, it also prompted the community to reflect on governance mechanisms and security. Subsequently, a new generation of DAOs represented by MakerDAO (which launched the DAI stablecoin in 2017), Aragon, MolochDAO, and MetaCartel DAO emerged, rapidly spreading the DAO concept in decentralized finance (DeFi) and open governance. DAO organizations evolved from single projects to platforms providing governance frameworks. According to DeepDAO's 2024 data, the number of active DAOs worldwide has exceeded 10,000, with a total treasury asset value of $40.1 billion (CCN, March 2024).

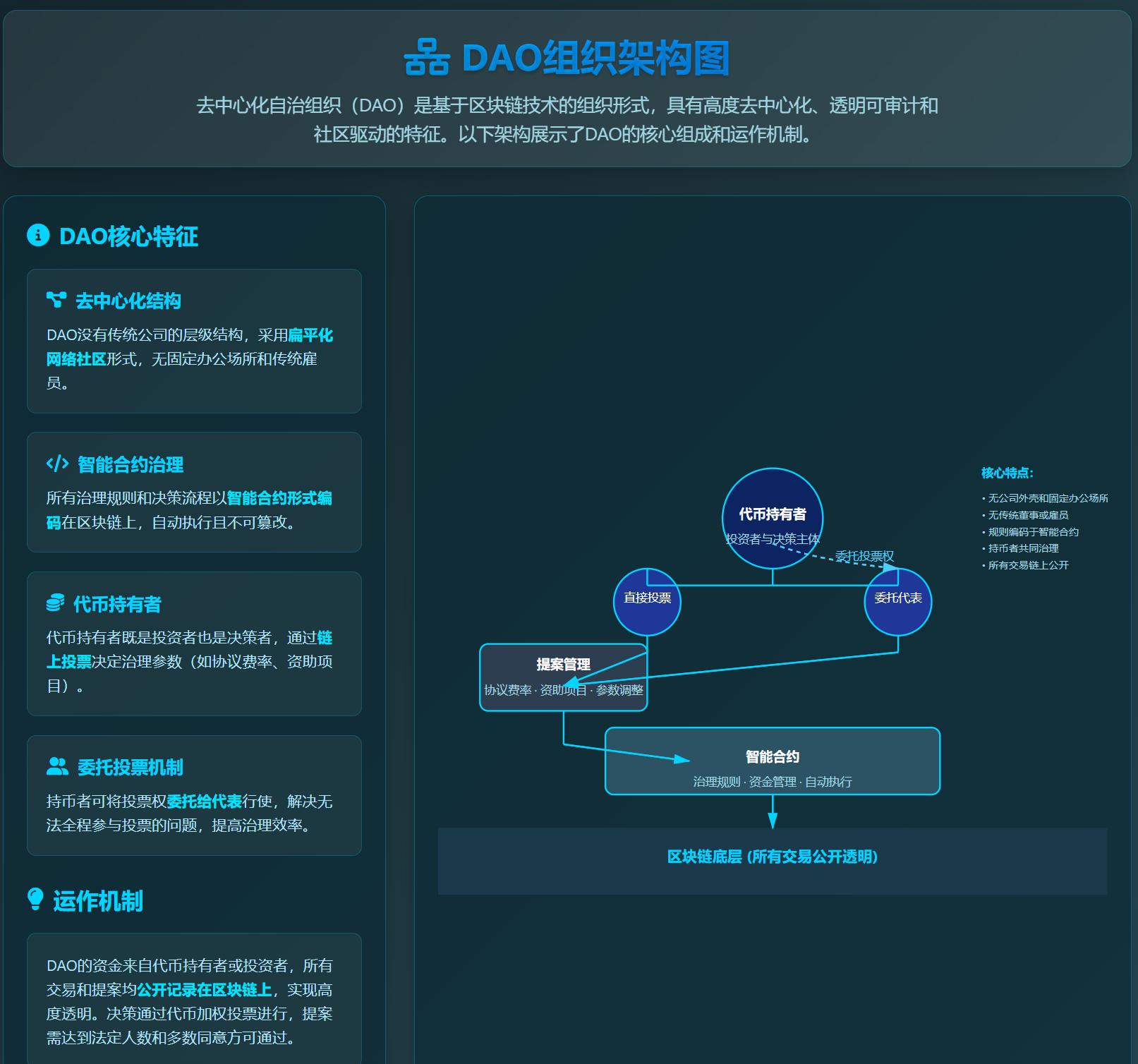

General Organizational Structure of DAOs

Structurally, DAOs are typically "network communities without a corporate shell or fixed office location." DAOs do not have traditional boards or employees; their governance rules and decision-making processes are encoded in smart contracts on the blockchain, executed and supervised collectively by token holders. For example, the funding for DAOs often comes from token holders or investors, and all transactions and proposals are publicly recorded on-chain, achieving high transparency. Token holders are both investors in the DAO and voting entities, voting on proposals on-chain, with governance parameters (such as protocol fee rates and funding projects) decided through token voting. Meanwhile, to address the issue of individual token holders being unable to participate in voting throughout the process, many DAOs (such as MakerDAO) have introduced a delegated voting mechanism: token holders can delegate their voting rights to others, improving governance efficiency. Overall, the organizational structure of DAOs exhibits characteristics of high decentralization, transparency, auditability, and community-driven governance.

MakerDAO Governance Mechanism and Evolution

Taking MakerDAO as an example, its governance model reflects an important path of DAO evolution. MakerDAO was initiated by Rune Christensen in 2015, with the core function of issuing a decentralized stablecoin DAI pegged to the US dollar. MakerDAO adopts a dual-token model: MKR serves as the governance token, with holders voting to decide key parameters (such as stability fee rates, collateral types, and risk parameters); users generate DAI by collateralizing crypto assets into smart contracts, thus facilitating the operation of the stablecoin. Traditionally, MakerDAO's on-chain proposals and decisions were put forward by core teams such as the "Maker Foundation," but as the community developed, governance rights gradually transitioned to on-chain public holders. In 2021, the Maker Foundation transferred 84,000 MKR (valued at $530 million) of the development fund to the DAO governance contract, allowing MKR holders to jointly decide on the use of funds: MKR holders began to propose governance proposals and participate in multiple rounds of voting. To reduce governance complexity and concentration risk, MakerDAO adopted a "progressive decentralization" strategy, introducing "delegated voting" and supporting multiple stability fee mechanisms, enhancing participation flexibility.

Entering 2022-2024, the "MakerDAO Endgame" proposal initiated the next phase of governance restructuring: launching sub-DAOs (SubDAOs) to modularize MakerDAO. In the second phase of Endgame, MakerDAO plans to deploy the first six sub-DAOs, divided into "Facilitator DAOs" and "Allocator DAOs": the former focuses on governance process management, while the latter is responsible for the allocation of new collateral and operational efficiency. Each SubDAO has independent governance tokens and community operations, making decisions within a smaller scope, with their operational results incorporated into the main DAO's ledger. This move aims to "streamline MakerDAO governance, reduce operational complexity, and disperse risk." In other words, MakerDAO is evolving from the initial single core team governance model to a modular governance system "macro-controlled by MKR holders, with each SubDAO executing autonomously." The introduction of the SubDAO structure represents an innovative attempt at governance for large-scale decentralized organizations: by dividing responsibilities among specialized branch entities, governance becomes more flexible and professional while still retaining the ultimate control of MKR holders. It is foreseeable that this exploration by MakerDAO may become a new paradigm for managing complex protocols and innovative expansions in the DeFi field.

02 NGO Development Experience and GiveWell Case Analysis

Origins and Governance Logic of NGOs

Non-Governmental Organizations (NGOs) are an important component of civil society, emerging in the late 19th century, with a formal definition appearing in the post-World War II United Nations framework (Article 71 of the UN Charter first mentioned NGOs). NGOs are typically independent, non-profit groups supported by volunteers and donors, aimed at promoting social or environmental welfare. The UN officially defines NGOs as "non-profit, voluntary groups organized for the public good." They cover various fields such as human rights, health, environmental protection, and poverty alleviation, and some even act as advocates and overseers of corporate and government policies. Broadly defined, DAO organizations are naturally NGO organizations.

In governance, NGOs emphasize mission orientation and accountability: on one hand, they organize activities around their mission and beneficiaries, focusing on project outcomes rather than profits; on the other hand, to ensure public trust and the rational use of resources, good NGO governance requires establishing a clear internal checks and balances system. Specifically, organizations typically have a dual structure of a board of directors (or council) and management, with the board responsible for strategic decision-making and oversight, while management handles daily operations. This ensures that no single individual or team can monopolize power, and that organizational resources are used for public service rather than internal interests. Efficient NGOs also publicly disclose financial and operational information, establishing external audit and evaluation mechanisms to respond to donor and public scrutiny. For example, a governance manual for NGOs providing operational advice states: "Good governance means that the organization should have clear power and function distribution… and ensure that public interests are maintained through internal checks and balances." Overall, the governance culture of NGOs emphasizes transparency, accountability, and mission priority, which is distinctly different from traditional corporate governance.

Case Analysis of GiveWell: Mission and Division of Labor

GiveWell is a charity evaluation organization established in 2007, representing a model of efficient non-profit organizations. Founded by two individuals from the financial industry, GiveWell adheres to the mission of "helping donors do the most good," recommending a limited number of "high-impact" charitable projects through concentrated resources and rigorous analysis. Unlike most charitable organizations, GiveWell does not advocate for the lowest cost expenditures but measures the "life-saving" effects of every dollar spent, emphasizing results orientation. They publicly promote the independence and transparency of their research: all evaluation processes and data are made freely available for anyone to access.

In terms of organizational structure, GiveWell's governance clearly follows the NGO model: its staff team is divided into multiple departments by function—such as the CEO's office responsible for strategy, research departments organized by topics (malaria, nutrition, vaccines, etc.), operations departments handling finance, human resources, technology, and outreach departments managing fundraising and public communication. The board of directors is composed of well-known philanthropists, with Cari Tuna, co-founder of the prominent philanthropic fund Good Ventures, serving as the chair of GiveWell's board. The board is responsible for overseeing GiveWell's overall strategy and policies, ensuring that its operations align with its mission. Notably, GiveWell emphasizes zero fees for the organization, not taking a cut from donations; all operational expenses are covered by unconditional grants from supporters of the organization, with a strict limit that administrative operating expenses must remain within 10% of total expenses. If fundraising exceeds its needs, excess funds are fully allocated to recommended charitable organizations. This financial arrangement highlights GiveWell's standard for measuring success as "making money go as far as possible for good."

Transparency and Impact Assessment Process of GiveWell

One major highlight of GiveWell's governance is its high level of transparency. The official website features sections such as "Public Records," "Annual Reviews," and "Transparency Policies," providing the public with detailed information including financial statements, operational strategies, and decision-making processes. Its organizational values explicitly list "transparency" as one of the core principles. GiveWell's evaluation process for each fundraising project is rigorous and multi-step: it first reviews independent academic research (such as randomized controlled trials) and consults field experts to confirm whether the project has indeed achieved its goals; then it constructs a detailed cost-benefit model, continuously refining it through budget and monitoring data to estimate how much improvement can be generated per dollar invested (for example, how many lives can be saved); it also conducts interviews and on-site visits with potential grantees to verify actual implementation; the evaluation will also review the organization's financial transparency and past performance records, ultimately resulting in a written report and quantitative indicators. After a project receives funding, GiveWell commits to continuously following up on its progress: if it finds that the goals cannot be effectively achieved, the team will promptly stop funding support. This entire evidence-based evaluation process ensures high cost-effectiveness and ongoing supervision of funded projects, distinguishing it from traditional donation evaluation methods that rely solely on self-reported performance by organizations.

Comparison of GiveWell and DAO Models

Structurally, there are significant differences between NGOs like GiveWell and DAO organizations. On one hand, GiveWell has a clear legal entity and organizational hierarchy: it has a headquarters, employees, and a board of directors, and relies on statutory fundraising channels; whereas DAOs typically do not have a formal legal entity and are entirely built on blockchain protocols and token economies, with community members participating directly in governance from around the world. As mentioned earlier, DAOs do not require a board or managers; all decision-making rules are defined by code and executed through token voting; NGOs rely on human management and oversight. Culturally, NGOs like GiveWell emphasize mission and values, actively engaging in external promotion and donor communication; DAOs, on the other hand, tend to follow open-source and consensus cultures, with autonomous communities focusing on protocol goals through token incentives, where membership is determined by token ownership rather than traditional identity verification. Nevertheless, there are also commonalities between the two: for example, GiveWell's emphasis on transparency aligns with the on-chain auditability of DAOs; the public welfare orientation of NGOs and the community autonomy concept of DAOs both pursue the goal of "disintermediation." In the future, combining the professional governance methods of NGOs with the technological advantages of DAOs may lead to the emergence of new organizational forms.

Prospects for the Integration Trend of NGOs and DAOs

Although traditional NGOs like GiveWell and DAOs have differences in governance structure, their commonalities in transparency and mission-driven approaches are driving the integration of organizational forms. This integration is not a one-way evolution but a "mutual pursuit" process: due to their long-standing low-profit nature and public welfare orientation, DAO organizations may naturally evolve into NGO organizations in competition with commercial entities, with financial metrics becoming secondary; at the same time, traditional NGOs may also transition towards DAO organizations under the influence of developments in blockchain and other network technologies, driven by demands for governance transparency and participation.

From the perspective of the NGO transformation of DAOs, the ongoing low-profit operational model allows these organizations to gradually move away from purely financial profit orientation, instead prioritizing public welfare and social value creation as core evaluation criteria. The collective decision-making mechanism in DAO governance cultivates members' awareness of public interest, and its open-source collaborative culture aligns closely with the knowledge-sharing philosophy of NGOs, while community autonomy practices provide a new organizational paradigm for addressing social issues. The token incentive mechanism also shifts from purely economic returns to value recognition and social impact-driven motivations, making DAOs fundamentally closer to the operational logic of traditional NGOs.

Conversely, the DAO transformation of traditional NGOs also has intrinsic motivation. Donors' demands for traceability of fund flows are increasing, and the immutable nature of blockchain can thoroughly address the long-standing transparency concerns faced by NGOs, as demonstrated by the pilot of UNICEF CryptoFund. The automatic execution mechanism of smart contracts not only reduces governance costs but also enables conditional release of donations, ensuring precise allocation of funds. More importantly, the board governance model of traditional NGOs struggles to meet the diverse participation needs, while the token governance mechanism of DAOs provides equal decision-making rights for donors, beneficiaries, and volunteers, enhancing the democratic and inclusive nature of organizational decision-making.

This mutual integration is giving rise to a hybrid organizational form of NGO + DAO. The "Association Legal Entity + On-Chain Governance" model in Switzerland (such as Aragon entities) has validated the legal compliance path, where the hybrid entity structure maintains legal subject status while enjoying the flexibility of DAO governance. In terms of governance mechanisms, this integration can form a layered decision-making system: strategic decisions can adopt DAO community voting mechanisms to enhance stakeholder participation in NGOs, while the execution level retains the specialized hierarchical governance experience of NGOs to optimize DAO decision-making quality. In terms of technological empowerment, blockchain technology provides infrastructure support for cross-border donations and project execution, recording all key decisions and fund flows on-chain, while executing specific project activities off-chain, creating an operational structure that balances transparency and professionalism.

Although this integration model has clear advantages in optimizing resource allocation, improving governance efficiency, and reconstructing trust mechanisms, it also faces challenges such as regulatory adaptability, technical barriers, and governance complexity. As the maturity of blockchain technology improves and regulatory frameworks are refined, the NGO + DAO hybrid model will become an important direction for the development of public welfare organizations, ultimately forming a new public welfare ecosystem characterized by transparency, democracy, and efficiency.

03 Possibilities of Combining ESG Assessment Systems with DAO Governance

Evolution of the ESG Framework and Core Concepts

ESG, which stands for Environmental, Social, and Governance, is a non-financial performance assessment framework encompassing three dimensions. Its origins can be traced back to the ethical investment and corporate social responsibility concepts of the late 20th century. The idea of avoiding investments in harmful industries was first proposed by religious groups in the 18th century and environmental/social movements in the 20th century; the 1987 United Nations report "Our Common Future" introduced the concept of sustainable development; in 2004, the United Nations Global Compact published the report "Who Cares Wins," which formally introduced the term "ESG"; in 2006, the Principles for Responsible Investment (PRI) were launched, providing guidance for investors to incorporate ESG into practice. In recent years, governments and regulatory bodies in various countries have also required companies to disclose ESG data, such as the EU's sustainable finance regulations and amendments to the UK Companies Act, promoting ESG reporting to become mainstream. To standardize information disclosure, various standards and frameworks have emerged: the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the EU Corporate Sustainability Reporting Directive (CSRD), and the Task Force on Climate-related Financial Disclosures (TCFD) all guide companies in quantitatively or qualitatively reporting their performance in areas such as carbon emissions, diversity, and governance structures.

Balanced Development of Negative and Positive ESG Assessment Indicators

Currently, ESG assessment agencies or organizations often focus their evaluation metrics on negative indicators, such as environmental pollution, labor violations, or corporate governance scandals, due to promotional effects and vested interests. While this approach helps identify risks, it may overlook the positive contributions and innovative value of organizations. However, with the development of sustainable investment concepts, an increasing number of organizations are beginning to shift their evaluation focus towards positive impact indicators.

For example, some leading rating systems (such as MSCI ESG and Sustainalytics) are introducing quantitative and weighted scoring for companies' positive contributions in areas such as renewable energy investment, employee diversity, community building, and green innovation. The introduction of positive indicators not only provides a more comprehensive representation of a company's ESG performance but also offers investors a more forward-looking basis for decision-making. Some studies (such as those in Harvard Business Review) indicate that companies excelling in social responsibility and environmental innovation often exhibit stronger risk resilience and long-term financial performance.

Therefore, future ESG assessments should evolve towards "double materiality," considering both the positive contributions of companies to society and the environment and their potential negative impacts. This balanced assessment approach aligns more closely with the essential requirements of sustainable development and provides a more suitable evaluation framework for emerging organizational forms like DAOs.

Advantages and Innovations of DAOs in the Dimension of Social Responsibility

In the dimension of social responsibility, DAOs possess advantages that traditional organizations find difficult to match. The openness and globalization of DAOs allow them to transcend geographical and identity limitations, providing opportunities for a broader range of stakeholders to participate in governance. Through token economies and incentive mechanisms, DAOs can achieve fairer value distribution, enabling community members to directly share in the benefits of organizational development.

Specifically, the positive impact indicators of DAOs in terms of social responsibility include:

Community Inclusivity Indicators: The diversity of geographic distribution among DAO members, the proportion of participants from different backgrounds, and the extent of decision-making participation. These indicators reflect whether the DAO has truly achieved decentralized governance rather than being controlled by a few large holders.

Knowledge Sharing and Educational Impact: Many DAOs promote knowledge dissemination through open-source code, public research, and community education. Measurement indicators include the number of contributions to open-source projects, the coverage of educational content, and the number of participants in skills training.

Creation of Economic Opportunities: DAOs provide new economic opportunities for global remote workers, freelancers, and creators. Relevant indicators include the number of members earning income through the DAO, average income levels, and the creation of job opportunities.

Attention to Social Issues: Some specialized social DAOs focus directly on public welfare, such as environmental DAOs, education DAOs, and medical research DAOs. The impact of these organizations can be measured by indicators such as the number of beneficiaries, the scale of problems addressed, and the effectiveness of collaboration with traditional public welfare organizations.

Technical Advantages of DAOs in the Dimension of Governance Efficiency

The dimension of governance efficiency (G) is the area where DAOs have the most significant advantages over traditional organizations. The immutability of blockchain technology and the automatic execution capabilities of smart contracts bring unprecedented transparency and efficiency to organizational governance.

Transparency and Auditability: All proposals, voting results, and fund flows of DAOs are recorded on a public blockchain, allowing anyone to verify them in real-time. This "code is law" governance model eliminates the possibility of "black box operations" found in traditional organizations. Relevant positive indicators include:

- Governance Transparency Score: Based on the degree of information disclosure and traceability of decision-making processes.

- Audit Convenience: The cost and efficiency of external audits.

- Community Oversight Participation: The activity level of community members in supervising and providing feedback on the governance process.

Decision-Making Efficiency and Execution Power: Smart contracts can automatically execute voting results, reducing human intervention and execution delays. The delegated voting mechanism increases governance participation rates, while the modular sub-DAO structure (such as MakerDAO's Endgame proposal) further enhances specialized decision-making efficiency. Key indicators include:

- Proposal Processing Cycle: The average time from proposal submission to execution.

- Voting Participation Rate: The proportion of active governance participants among total token holders.

- Decision Execution Success Rate: The proportion of proposals that pass voting and are actually executed.

Risk Management and Compliance: Advanced DAOs adopt mechanisms such as multi-signature, time locks, and emergency pauses to manage risks. At the same time, some DAOs are beginning to proactively comply with regulatory requirements and establish compliance frameworks. Relevant indicators include:

Incident rate of security events: Frequency of negative events such as smart contract vulnerabilities and financial losses.

Compliance level: Adherence to relevant regulations.

Effectiveness of risk control: The effectiveness of risk warning and response mechanisms.

Stakeholder participation: DAO token holders are both investors and governance participants, which naturally achieves broad stakeholder involvement. Impact indicators include:

Distribution uniformity of governance tokens: Avoiding excessive centralization.

Participation levels of different types of stakeholders: Participation of developers, users, investors, and other groups.

Cross-cultural and cross-timezone governance participation: Reflecting the inclusiveness of global governance.

Theoretical Basis and Implementation Principles of DAO-ESG Assessment

Theoretical Adaptability Analysis

The traditional ESG framework is primarily designed for conventional enterprises, while the decentralized characteristics of DAOs naturally align with ESG assessment concepts. The on-chain governance transparency of DAOs addresses the information asymmetry issues found in traditional ESG reports; the token governance mechanism enables direct participation of stakeholders, bringing it closer to the pluralistic governance ideals of ESG than traditional enterprises; its borderless nature allows it to generate social and environmental impacts globally, aligning closely with the United Nations Sustainable Development Goals.

Core Implementation Principles

Data-Driven Principle: Fully utilize the objectivity and completeness of blockchain data to establish a quantitative indicator system based on on-chain data, reducing subjective bias.

Dynamic Adaptation Principle: Different types of DAOs have varying ESG focuses—DeFi protocols emphasize financial stability and inclusiveness, public welfare DAOs highlight social impact, and infrastructure DAOs focus on technological governance. The assessment framework needs to have a flexible weighting adjustment mechanism.

Incentive Compatibility Principle: Combine ESG performance with mechanisms such as token distribution, governance weight, and community reputation, forming a positive feedback loop where "the better the ESG performance, the more incentives received."

Community Co-Building Principle: Establish a diverse assessment system involving community members, third-party organizations, and industry experts to avoid monopolization of assessment power by a single entity.

Key Challenges and Solutions

Technical Challenges: Low standardization of on-chain data and difficulties in integrating off-chain ESG data.

Solution: Develop open-source assessment toolkits and establish cross-chain data standards.

Standardization Challenges: Lack of dedicated DAO-ESG assessment standards, with significant differences among different types of DAOs.

Solution: Establish a tiered assessment system, using a simplified version during the startup phase and a full version during the mature phase.

Regulatory Adaptability Challenges: Unclear regulatory requirements for DAOs in various countries, raising doubts about the legal validity of assessment results.

Solution: Adopt a gradual advancement strategy, starting with pilot projects and then expanding, establishing a dialogue mechanism with regulatory agencies.

Community Acceptance Challenges: Some communities believe that external assessments conflict with the decentralization concept.

Solution: Strengthen ESG education and demonstrate the positive impact of assessments on the long-term development of DAOs.

Expected Value

Through systematic ESG assessments, DAOs can enhance social recognition, proving their social value to traditional investors and regulatory agencies; promote industry standardization, providing references for regulatory policy formulation; optimize resource allocation, guiding capital towards quality projects; and facilitate the integration of technology and social welfare, promoting blockchain technology to better serve sustainable development goals.

DAO-ESG Simple Assessment Operational Framework

To address the gap between theoretical construction and practical application in current DAO organization ESG assessments, this paper constructs a systematic DAO-ESG simple assessment operational framework. This framework aims to provide standardized, quantifiable ESG assessment tools for decentralized autonomous organizations, promoting the sustainable development of the DAO ecosystem.

1. Core Assessment Indicator Construction

Environmental Dimension Indicators

Blockchain environmental footprint: Quantitatively calculate annual carbon emissions based on the consensus mechanism, transaction frequency, and energy consumption intensity of the blockchain network used by the organization.

Proportion of green asset allocation: The proportion of investments in environmentally friendly projects relative to the total assets of the DAO treasury, reflecting the organization's financial commitment to sustainable development.

Environmental governance participation: The number, approval rate, and execution effectiveness of environmentally related proposals, measuring the organization's governance activity on environmental issues.

Social Dimension Indicators

Governance inclusivity index: A comprehensive indicator constructed based on the geographic distribution, cultural background, and participation thresholds of members.

Economic fairness coefficient: Quantifying the fairness of token distribution and profit sharing using inequality indicators such as the Gini coefficient.

Social value creation effect: Assessing the organization's positive externalities through the number of open-source contributions, the coverage of public welfare projects, and the number of social beneficiaries.

Governance Dimension Indicators

Information transparency score: A comprehensive assessment based on financial disclosure, the openness of decision-making processes, and the ease of information access.

Democratic participation effectiveness: Quantitative analysis of governance processes such as voting participation rates, proposal quality, and decision execution rates.

System security indicators: Coverage of smart contract audits, frequency of security vulnerabilities, and the completeness of risk control mechanisms.

Automated Assessment Process Design

Data Acquisition Mechanism

On-chain data collection: Automatically capture native data such as governance voting, fund flows, and transaction records through blockchain API interfaces.

Off-chain data integration: Aggregate multi-source data such as GitHub code contributions, Discord community activity, and official website information disclosure.

External data supplementation: Introduce third-party environmental impact assessment data, industry benchmark data, and regulatory compliance information.

2. Scoring Algorithm Model

A weighted average method is used to construct a comprehensive scoring model:

DAO-ESG Comprehensive Score = E Dimension Score × αE + S Dimension Score × αS + G Dimension Score × αG

Where the weight coefficients are dynamically adjusted based on the type of DAO:

DeFi protocol type: αE=0.30, αS=0.35, αG=0.35

Public welfare charity type: αE=0.20, αS=0.50, αG=0.30

Governance tool type: αE=0.20, αS=0.30, αG=0.50

Grading Standards

Establish a five-level grading system: Excellent (A, 90-100 points), Good (B, 80-89 points), Qualified (C, 70-79 points), Needs Improvement (D, 60-69 points), Unqualified (E, below 60 points).

3. Technical Implementation Architecture

System Architecture Design

Frontend Display Layer: Build an ESG data visualization dashboard using the React framework.

Business Logic Layer: Backend services based on Node.js handle data analysis and scoring calculations.

Data Storage Layer: A hybrid storage solution that integrates blockchain data and traditional relational databases.

Functional Modules

Real-time Monitoring Module: Dynamically track key ESG indicator trends.

Report Generation Module: Automatically output assessment reports that comply with international ESG disclosure standards.

Comparative Analysis Module: Provide horizontal comparisons and improvement suggestions for similar types of DAOs.

4. Framework Validation and Multi-Scenario Application Analysis

Multi-Type DAO Assessment Validation

To validate the applicability and differentiation of the framework, this study constructs theoretical assessment models for three typical DAOs:

Dynamic Validation: Taking a green finance DAO as an example, a 12-month assessment simulation shows that the framework can effectively capture differences in DAO development stages (Initial Stage 75 points → Development Stage 85 points → Mature Stage 88 points).

Core Application Scenarios

Investment Decision Support: ESG investment funds screen quality DAO projects to reduce investment risks.

Regulatory Compliance Tool: Regulatory agencies establish industry ESG standards to promote self-regulation.

Internal Governance Optimization: DAOs self-assess and improve, enhancing community cohesion and external trust.

Third-Party Certification: Rating agencies provide professional certification to promote market standardization.

Framework Evaluation

Core Advantages: Strong technical adaptability, high degree of automation, strong dynamic updating capability.

Main Limitations: Difficulty in quantifying off-chain data, standardization needs improvement, and complexity in cross-chain assessments.

Subsequent Research Recommendations

Empirical Validation: Select real DAOs for framework testing.

Standard Development: Collaborate with international ESG organizations to establish industry standards.

Technical Upgrades: Optimize data collection and analysis algorithms.

Regulatory Engagement: Improve the compliance indicator system.

04 Conclusion and Outlook

This paper reveals the deep synergistic relationship between DAO organizations in governance evolution, non-profit experience borrowing, and ESG performance assessment through a systematic analysis across three dimensions, and identifies an important trend of organizational form integration:

1. The Maturation Path of DAO Governance Evolution

DAOs have gradually evolved from the security and governance vulnerabilities exposed in the early "The DAO" incident to a dual-token model and delegated voting mechanism represented by MakerDAO, further advancing to the modular structure of "Endgame" sub-DAOs, achieving a transition from single community governance to a multi-layer governance system with more refined divisions of labor and clearer responsibilities. This evolution reflects the continuous maturation and innovation of DAOs in governance mechanism design.

2. The Borrowing Value of NGO Governance Experience and the Trend of Mutual Integration

Efficient NGOs exemplified by GiveWell demonstrate mature practical methods in mission-driven, layered governance, transparent accountability, and continuous impact assessment. More importantly, the research finds that NGOs and DAOs are undergoing a "mutual pursuit" integration process: DAO organizations naturally evolve into NGO forms due to their long-standing low-profit nature and public welfare orientation, with financial metrics yielding to social value creation; while traditional NGOs are transitioning to DAO governance models under the impetus of blockchain technology, seeking higher transparency and participation. This integration has given rise to a hybrid organizational form of NGO + DAO, combining the dual advantages of specialized management and decentralized governance.

3. The Adaptability and Innovativeness of the ESG Assessment Framework

The ESG framework has become an important standard for measuring the sustainable development of organizations, while DAOs possess unique advantages in social responsibility and governance efficiency dimensions. By emphasizing positive impact indicators rather than solely focusing on negative risks, DAOs can better demonstrate their value contributions in promoting social inclusion, enhancing governance transparency, and creating economic opportunities.

Future Outlook:

Deepening of Organizational Form Integration: The NGO + DAO hybrid model will become an important direction for public welfare and governance innovation. Legal framework innovations such as "association legal entities + on-chain governance" in Switzerland provide a compliant path for this integration, and more organizations are expected to adopt layered decision-making systems in the future, achieving an organic combination of on-chain transparency and off-chain professional execution.

Deep Integration of Technology and Governance: In the future, DAOs are expected to introduce more specialized governance mechanisms, such as expert committees, multi-layer decision structures, and risk management systems, while maintaining their decentralized advantages, achieving a dual enhancement of technological innovation and governance maturity. The combination of smart contracts and traditional governance practices will create new organizational operation paradigms.

Reconstruction and Customization of ESG Assessment Standards: For emerging forms such as DAOs and NGO + DAO hybrid organizations, more suitable ESG assessment indicators and methodologies need to be developed, highlighting their unique value and social contributions in the digital economy era. In particular, the on-chain quantification of social impact and real-time monitoring of governance efficiency will become new assessment focuses.

Building a Cross-Disciplinary Collaborative Ecosystem: Collaboration among DAOs, NGOs, traditional enterprises, and regulatory agencies will become closer, forming a diversified governance ecosystem. This collaboration is not limited to resource integration; more importantly, it involves mutual learning and innovation in governance models, jointly promoting the achievement of sustainable development goals.

Exploration of Global Governance Models: As the NGO + DAO integration model matures, its decentralized and transparent governance concepts are expected to provide new ideas and tools for solving global issues, becoming an important component of global governance in the digital age. This model is particularly suitable for addressing cross-border social issues and the provision of public goods.

Interdisciplinary empirical research and tool development will be important directions for validating the effectiveness of the aforementioned integration framework and guiding practice. In particular, more in-depth research and practical exploration are needed in areas such as summarizing best practices of the NGO + DAO hybrid governance model, quantifying positive impact indicators of ESG, and designing collaborative mechanisms across organizational forms. This trend of integration not only represents innovation in organizational forms but also reflects the development direction of public welfare and social governance in the digital age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。