Original|Odaily Planet Daily(@OdailyChina)

Author|Wenser(@wenser2010)

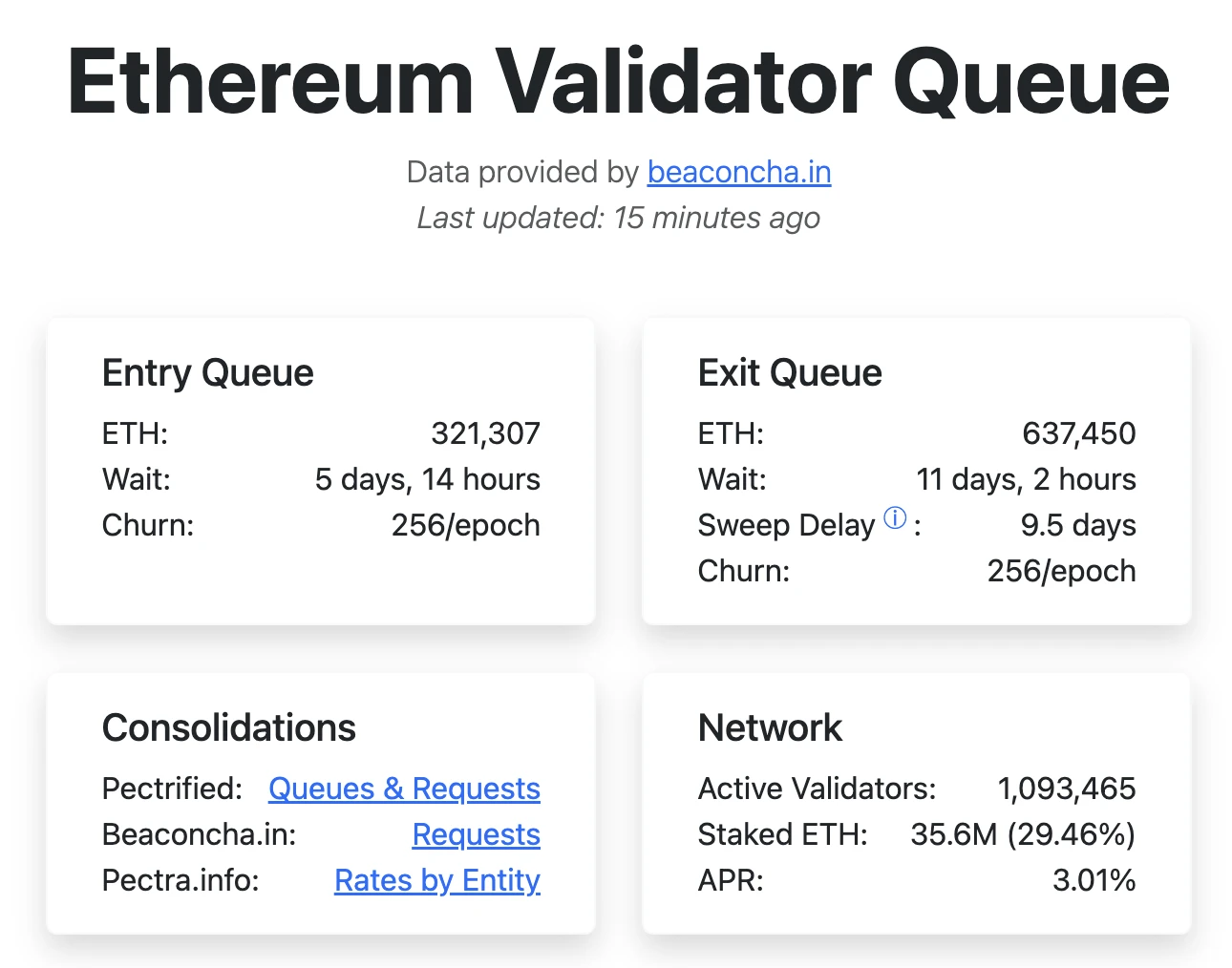

As the price of ETH rebounded and broke through $3,800 before falling back above $3,500, ETH officially entered the "Mutual Fool Moment" for holders—on one hand, institutions and listed companies continue to increase their holdings of ETH, either holding for a price increase or establishing strategic reserves; on the other hand, the waiting time for ETH POS unstaking has exceeded 11 days, reaching a historical high, with the total amount of ETH waiting to be unstaked surpassing 637,000 coins. In comparison, the total amount of ETH waiting to be staked is about 321,000 coins, only about 50% of the total amount waiting to be unstaked. This has led to panic in the market regarding institutional unstaking and potential sell-offs; however, is the truth really as it seems? Odaily Planet Daily will analyze this in conjunction with the main market viewpoints for readers' reference.

Behind the New High in ETH Unstaking Wait Time: ETH Returns Above $3,800 After 7 Months

According to OKX market data, the price of ETH briefly broke through $3,800 this week, rising to $3,858.88. The last time ETH was above $3,800 was about 7 months ago, around December 19, 2024.

The rebound in ETH price naturally caused a stir in the crypto market, with many whales, institutions, and even retail investors who previously bought the dip choosing to take profits, leading to a new high in the total amount of unstaked ETH and consequently increasing the waiting time for unstaking.

According to the latest data from validatorqueue website, as of July 24, the total amount of ETH waiting to be unstaked is 637,450 coins, with the waiting time extending from about 9 days to 11 days and 2 hours; the total amount of ETH waiting to be staked is approximately 321,000 coins, with a market waiting time of about 5 days and 14 hours.

ETH Staking Related Information

In addition, the total amount of ETH staked is currently about 35.6 million coins, accounting for approximately 29.46% of the total ETH supply, with an APR yield of about 3%.

Aside from the overall information, it is worth highlighting the waiting time for unstaking, clearing delay time, node validator queue, and 7-day staking yield APR.

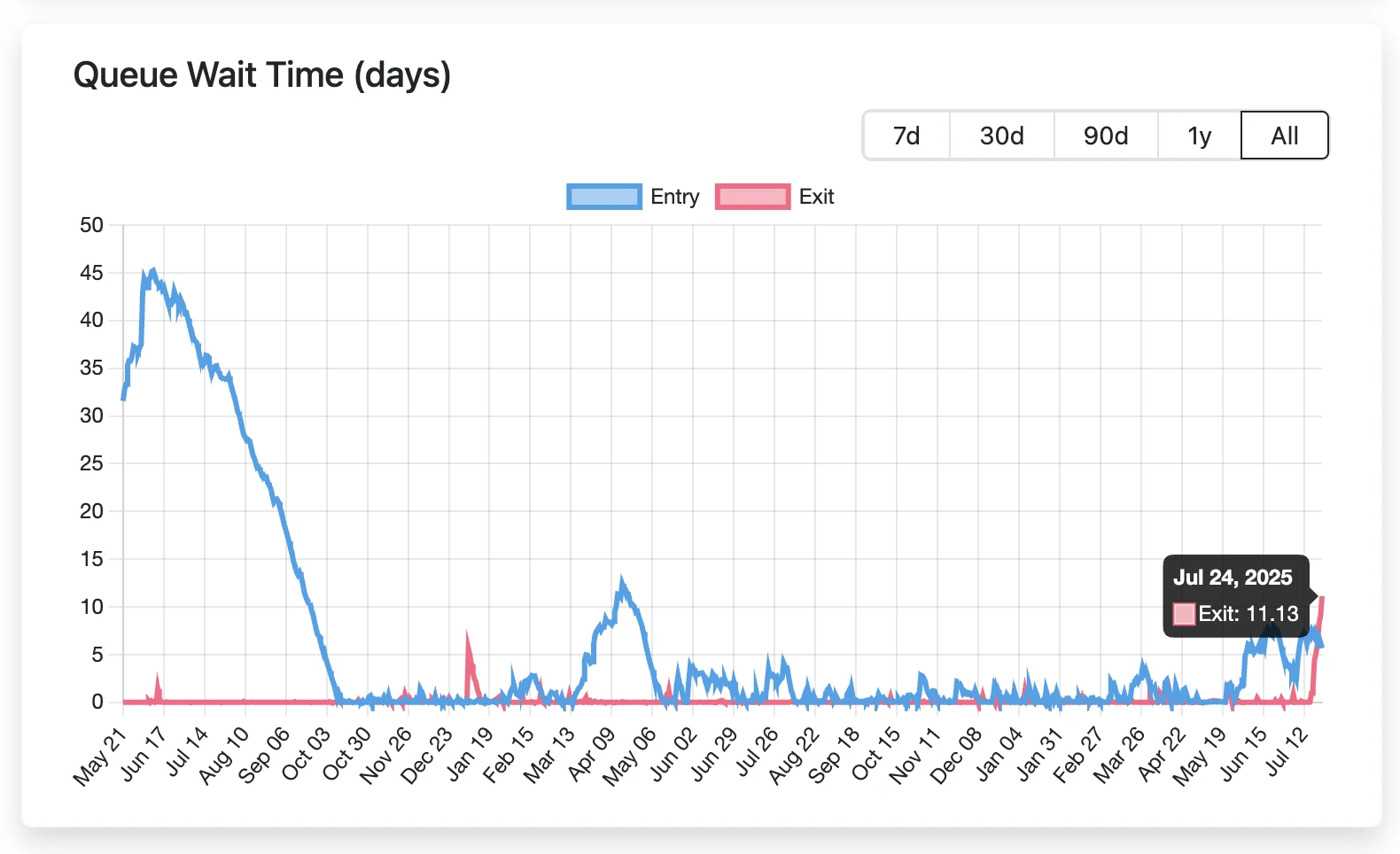

First, regarding the waiting time for unstaking, on July 24, this time reached a historical high of 11.13 days; in contrast, the previous historical high occurred on January 5, 2024. According to crypto KOL Chen Jian (@jason_chen998), at that time, Celsius was in bankruptcy liquidation and urgently needed funds, instantly unstaking over 500,000 ETH, with a waiting time of up to 5.6 days.

However, unlike that time, there was not enough demand for ETH staking, and the waiting time for ETH staking was 0 days; currently, this number is about 5.67 days, which fully indicates that the demand for ETH staking in the market is still extremely strong.

ETH Unstaking Waiting Time

Secondly, regarding the clearing delay time, a brief explanation of the clearing (Sweep) action is needed, which refers to how long it takes for staked funds to be withdrawn to the corresponding address after exiting the queue. According to the information in the above image, this time is currently about 9.5 days. In other words, the market still needs to wait a certain amount of time before facing a true "sell-off test."

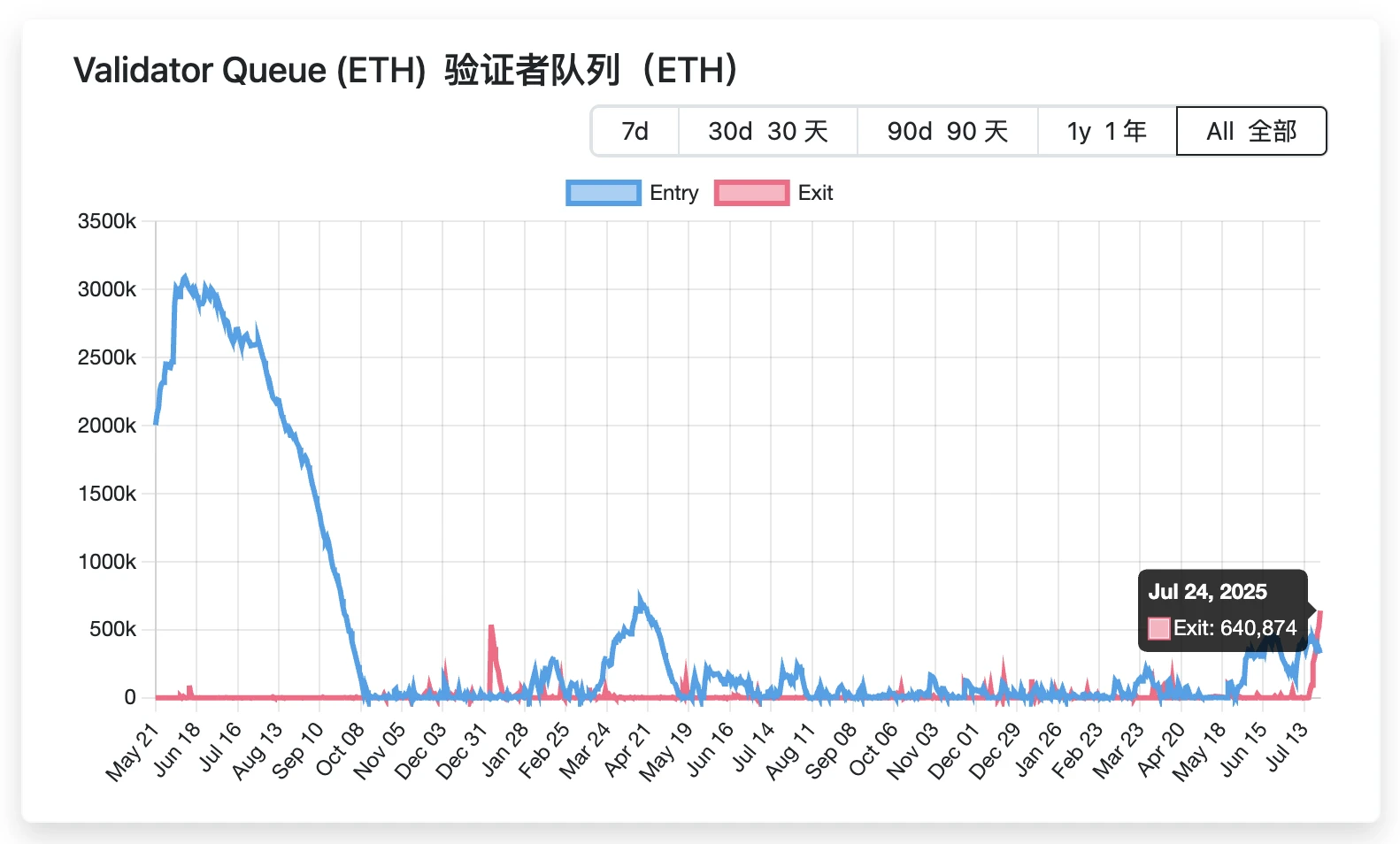

Next, in terms of node validator queue data, in the past week, the number of validators exiting the queue has increased exponentially. On July 24 alone, the amount of ETH exited by node validators exceeded 640,000 coins, while the amount entering was 326,800 coins. Here, we refer to the analysis by crypto KOL @0x_Todd and relevant information from validatorqueue website for explanation. In short, currently, a maximum of 8 nodes can be added/removed per Epoch (32 blocks, each block takes 12 seconds to produce). Based on the single node threshold of 32 ETH (the current ETH staking node threshold), this results in 256 ETH/epoch, thus calculating the overall unstaking waiting time and staking queue waiting time. Subsequently, with the ongoing Prague upgrade, the ETH limit per node has increased from 32 to 2,048 coins, which will significantly shorten both staking and unstaking times as the number of large nodes increases.

Node Validator Queue Count

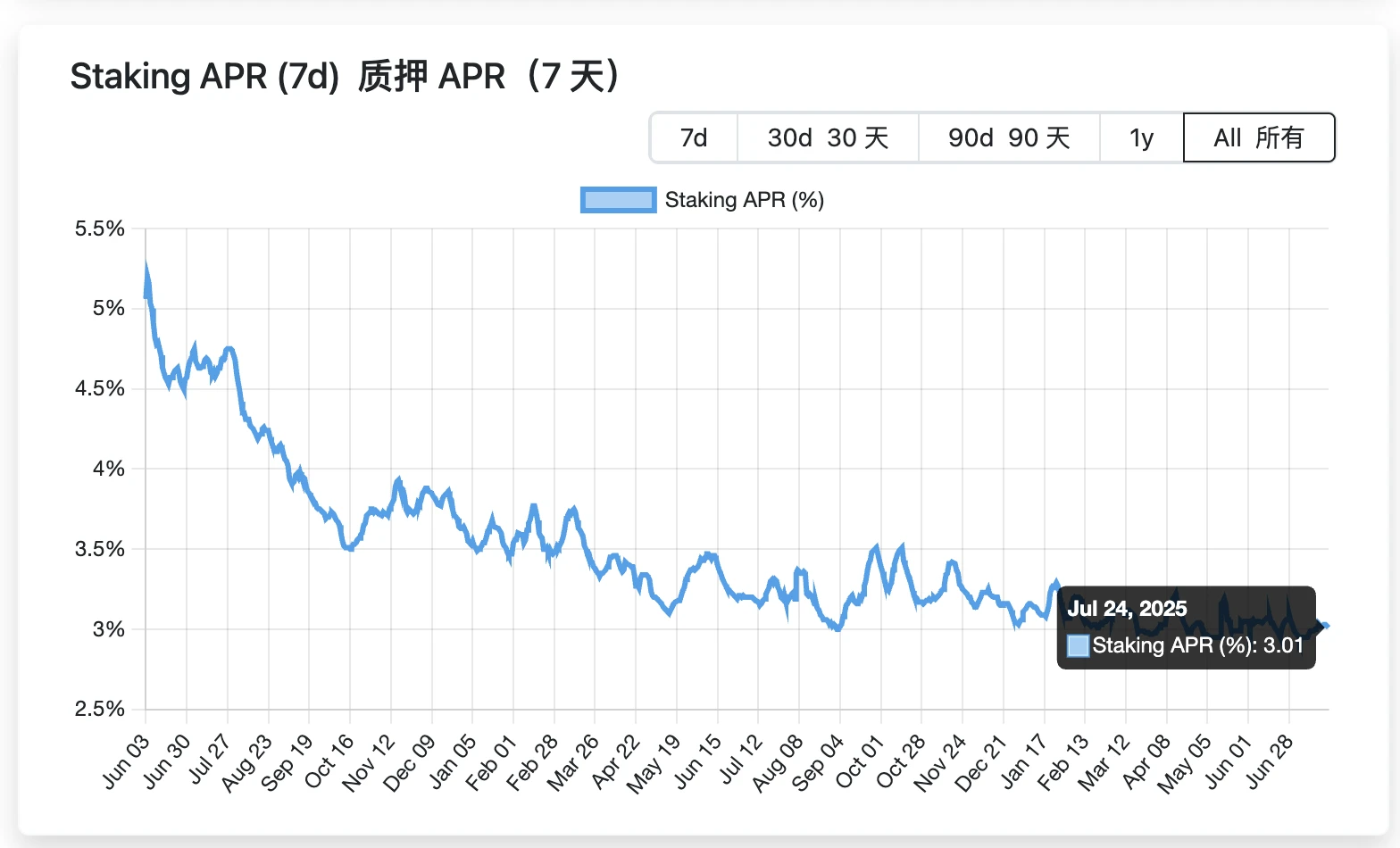

Finally, regarding the changes in the 7-day APR yield for ETH staking. Overall, the staking yield for ETH has shown a gradual decline, which aligns with the increase in total ETH supply and staking volume, thus diluting staking yields. From 5.2% in early June 2023, this figure has now dropped to 3.01%. Of course, compared to other cryptocurrencies, ETH's POS staking yield remains a rare "stable yield," which is also the business strategy of many US-listed companies aiming to become "ETH version Strategies"—Sharplink Gaming officially announced yesterday that its Ethereum holdings amount to 360,807 coins, generating a yield of 567 ETH through staking.

ETH 7-Day Yield APR Data

For more on the on-chain changes regarding ETH staking and unstaking, readers can also check directly from https://beaconcha.in/.

Exploring the Reasons Behind Large-Scale ETH Unstaking: Institutional Moves or Aave Platform's Loop Loan Turmoil?

Regarding the reasons behind the large-scale ETH unstaking, the mainstream viewpoints in the market mainly include the following three:

Reason One: Institutions like HTX Unstaking on a Large Scale

On-chain data shows that in the past week, two wallets from HTX have collectively redeemed 110,000 ETH, with a total value exceeding $400 million. Additionally, on-chain analyst Yu Jin monitored that since ETH broke $3,000 on July 11, ETH has continuously flowed from HTX to Binance, with a cumulative inflow of 320,600 coins to date, valued at approximately $1.123 billion based on the current average price, with an average transfer price of $3,504. Other institutions, such as Abraxas Capital Mgmt, have also conducted staking redemptions.

Reason Two: Aave Platform's Loop Loan Turmoil

According to on-chain data analyst Ai Yi, citing the analysis of crypto blogger darkpool stated that the batch unstaking of 620,000 ETH may be related to a large withdrawal of ETH deposits from the Aave platform, causing borrowing rates to soar.

The specific reason is that a large withdrawal of Aave ETH deposits in a short time led to a spike in borrowing rates, causing loop loan players to shift from profit to loss, forcing them to redeem stETH to deleverage, resulting in the current situation. Aave's ETH borrowing APR once soared to 10%, and the waiting period for Lido stETH withdrawal has now extended to 21 days (normally within a week); there is still a nearly 0.4% discount for on-chain stETH to be exchanged for ETH. For a more detailed explanation of the loop loan mechanism, Aave's collateralization rate for ETH is 93%, meaning arbitrage players can use up to 14 times leverage to gain interest rate spreads, with annualized returns on principal reaching 7% under normal circumstances.

In other words, the rise in ETH price has led to a large amount of borrowing on the Aave platform, causing borrowing rates to soar; loop loan players found that their previous leverage spread turned into leverage losses, forcing them to redeem stETH to reduce leverage, thus significantly increasing the demand for ETH staking. For a more detailed explanation of this reason, please refer to the Odaily Planet Daily's translation of Galaxy's article “The Real Reason Behind the $1.9 Billion ETH Collective Unstaking Queue is…”.

Reason Three: Institutional-Level Accumulation Demand

This reason is a personal speculation by the author.

According to SoSoValue data, on July 22, the total net inflow of Ethereum spot ETFs reached $534 million, marking the third-highest figure in history. Combined with the recent demand for coin accumulation from listed companies and institutions such as SBET, BMNR, and The Ether Machine in the "ETH version Strategy" debate, the unstaking of hundreds of thousands of ETH is undoubtedly a result of large ETH holding clusters, with a significant possibility that some of the funds will be used for OTC transactions and inflows to exchanges.

Additionally, on-chain analyst Yu Jin monitored that address 0x8eE previously increased its holdings by 32,368 ETH (worth $116 million) through FalconX. Since July 19, this address has accumulated 138,345 ETH (worth $503 million) at an average price of $3,644. A whale/institution accumulating ETH through Kraken added 8,223 ETH (worth $29.4 million) today, and since July 14, this address has accumulated a total of 58,156 ETH (worth $211 million) at an average price of $3,564.

In summary, the net inflow of ETFs and the demand for ETH strategic reserves provide an outlet for the large-scale unstaking of ETH, and the market demand for ETH remains strong.

Conclusion: The Market Enters the "Mutual Fool Moment" for ETH Holders

In stark contrast to the market at the end of June and the beginning of July, the crypto market has now entered a "Mutual Fool Moment," especially for ETH holders, where this situation is particularly pronounced.

Unlike the previous one-sided mockery of ETH during the "continuously weak ETH price" phase or the triumphant expressions of the E-Guardians during the "gradually rising ETH price" phase, the market has once again entered a state of divergence as BTC's market cap retraced below $120,000 after breaking historical highs. This is similar to the current division between those in the ETH unstaking camp and those in the staking camp. With Trump's "tariff stick" gradually coming into play, whether altcoins, including ETH, can continue their bull market may face a phase of judgment in early August.

Profit Taking vs. Continuing to Surge?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。