Written by: Lucas Tcheyan, Research Assistant at Galaxy Digital

Translated by: Jinse Finance xiaozou

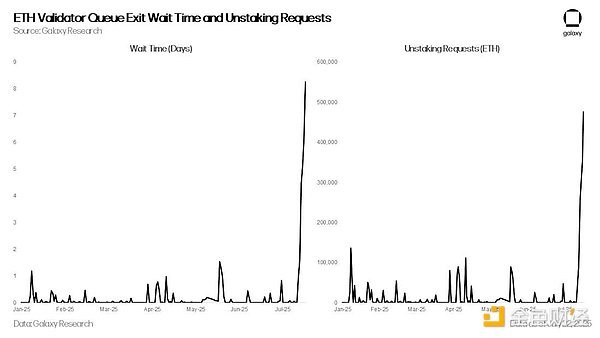

Since July 16, the number of ETH unbonding requests has surged dramatically, with validator exit requests skyrocketing from 1,920 to over 475,000 by July 22, and waiting times extending from less than an hour to over eight days. Although ETH has recently performed well in price and the ETH Pectra upgrade has adjusted the staking requirements for validators, leading to an expected increase in unbonding activity, this surge is primarily driven by the spike in ETH lending rates that began on July 16. The rise in rates triggered widespread unwinding of ETH circular strategies, further exacerbating the decoupling pressure on liquid staking and re-staking tokens (LSTs and LRTs).

1. Ethereum Staking Queue

The Ethereum staking exit queue is a built-in mechanism designed to manage the orderly withdrawal of staked funds by validators from the network. To maintain network stability and prevent large-scale validator exits from jeopardizing consensus, Ethereum limits the number of validators that can exit during each epoch. This limit, known as the "churn limit," is related to the total number of active validators, allowing approximately 8 to 10 validators to exit per epoch (about 6.4 minutes). When validators initiate a voluntary exit, they enter the queue and wait for processing. After exiting, funds must undergo a mandatory delay (approximately 27 hours) before they can be withdrawn. During periods of high exit demand, the queue can become severely congested, leading to waiting times of several days or even weeks.

This week is not the first time Ethereum has experienced unbonding backlogs. In January 2024, due to the bankrupt crypto lending platform Celsius needing to withdraw 550,000 ETH during its restructuring, the waiting time reached six days.

2. ETH Circular Strategy Unwinding: Lending Rate Surge Triggers Chain Reaction

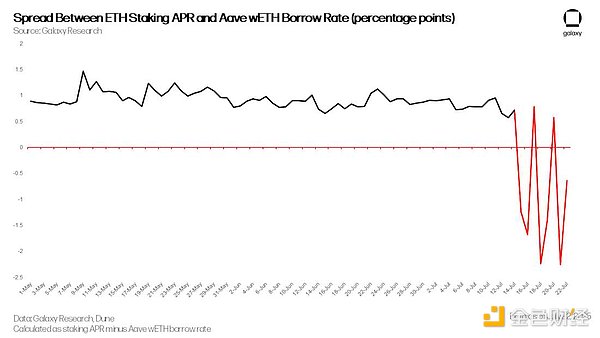

Since July 14, the ETH lending rates in the Aave decentralized finance protocol have begun to spike periodically. While lending rates typically remain in the range of 2% to 3%, they surged to a high of 18% on July 16, 18, and 21. This extreme volatility stemmed from large withdrawals by a wallet associated with the HTX exchange, leading to a sharp reduction in the ETH supply on the Aave platform. This wallet has withdrawn over 167,000 ETH since June 18, and the sudden decrease in available deposits has put pressure on users operating ETH circular strategies on Aave, contributing to the surge in unbonding requests.

Circular strategies are widely adopted ETH staking yield amplification strategies among crypto traders. The standard operating procedure is as follows: users deposit liquid staking tokens (LST) or liquid re-staking tokens (LRT) as collateral on platforms like Aave, borrow ETH, and then exchange it for more LST to redeposit, thereby establishing leveraged positions through repeated operations. When staking yields exceed ETH lending rates, users can profit from the interest rate spread. This strategy can be operated manually or executed through automated vaults provided by protocols like EtherFi and Instadapp.

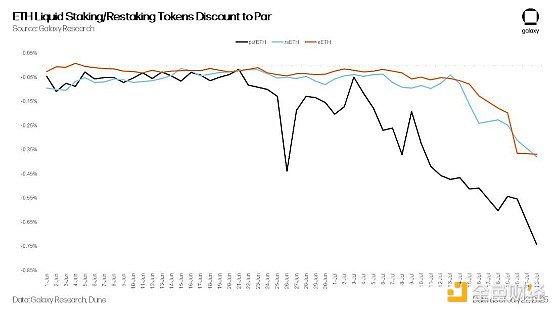

However, with the tightening ETH supply that began on July 16, the spread between staking yields and borrowing costs turned negative. As of July 21, this spread fell to a low of -2.25%, rendering circular strategies unprofitable. This triggered a massive unwinding wave, with users beginning to withdraw their deposited ETH, repay loans, and gradually reduce leverage. Since most traders use LST/LRT as collateral, they need to convert these assets back to ETH or unbond them, adding extra pressure to the LST/LRT secondary market and the Ethereum validator exit queue.

As lending rates climbed, the decoupling phenomenon of LST and LRT from ETH further intensified. Typically, LST/LRT trades at a slight discount to ETH to compensate for redemption delays caused by Ethereum's exit queue, DEX liquidity constraints, and protocol-specific risks (such as penalties or smart contract risks). During forced deleveraging or redemption periods, this selling pressure drives LST/LRT prices further below par. Additionally, automated circular strategy vaults respond differently to market volatility—some choose to unbond, while others directly sell on the secondary market. For instance, as of now, EtherFi's liquidity strategy still has about 20,000 ETH in the Ethereum exit queue.

Another factor exacerbating the queue congestion is that some market participants have begun to arbitrage the decoupling of LST/LRT. By purchasing LST/LRT at a discount on the secondary market and then redeeming for the full ETH value through unbonding, they can profit from the price difference. This behavior further increases the number of ETH exit requests.

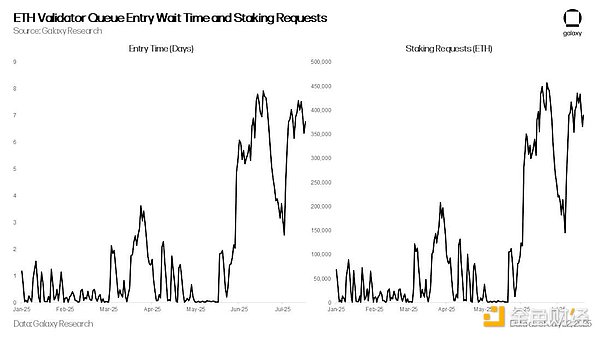

3. New Staking Demand Surges Concurrently

Counterbalancing the surge in unbonding requests is a significant uptick in new staking demand. Since June, ETH staking applications and validator admission requests have risen to their highest levels since April 2024.

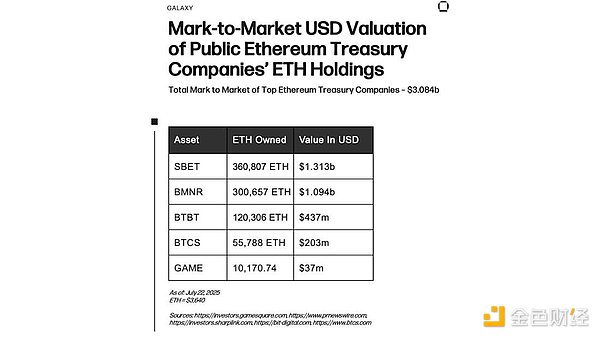

This is primarily driven by two factors: first, the superior performance of ETH compared to Bitcoin has reignited market enthusiasm; second, several digital asset treasury companies (DATCOs) have recently purchased over $2.5 billion worth of ETH.

4. Outlook

Although the headlines about unbonding ETH may initially suggest a wave of profit-taking, a closer examination reveals that most of the activity is actually driven by the turmoil in the ETH lending market and the spike in lending rates that began on July 16. This perspective is supported by the continued strength of new staking demand—new staking volumes have nearly offset the current withdrawal scale.

Despite the surge in demand, the ETH staking architecture continues to operate as expected. While some may complain about the significant extension of waiting times, this is precisely a design feature of the network rather than a flaw. Its purpose is to limit the rate at which validators can enter or exit, thereby protecting the stability and security of Ethereum's proof-of-stake (PoS) consensus mechanism.

However, this event highlights the ongoing vulnerability of the ETH liquid staking and re-staking ecosystem. These assets remain highly sensitive to leveraged strategies and are prone to pressure under extreme market conditions. The widespread impact of LST/LRT decoupling and redemption delays further underscores the importance of considering duration risk and liquidity bottlenecks.

Looking ahead, protocols that rely entirely on Ethereum's native exit mechanism may face stricter scrutiny. We anticipate that the market will increasingly focus on solutions that enhance redemption flexibility—such as peer-to-peer exit markets, optimized LST/LRT automated market makers (AMMs), and protocol-native liquidity vaults specifically designed to alleviate exit queue congestion and smooth capital flows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。