Original Author: Fairy, ChainCatcher

Original Editor: TB, ChainCatcher

Pantera is building a "multi-coin version of the MicroStrategy investment matrix."

As one of the earliest bettors in the crypto world, Pantera Capital has successfully predicted the dawn of Bitcoin, the summer of DeFi, and has also stumbled into the deep pit of FTX.

Twelve years later, it remains active and even more aggressive in the new wave of coin stocks. Behind many publicly listed companies that finance and buy coins, there is a shadow of Pantera.

What kind of VC is this veteran of the crypto narrative, an immortal player on the cyclical battlefield? What new layout is it planning now?

The Betting Story of Pantera

Pantera Capital began betting on the crypto industry in 2013 and is one of the earliest crypto venture capital firms. It launched the first investment fund in the U.S. focused on Bitcoin and purchased about 2% of the world's Bitcoin between 2013 and 2015, ultimately achieving over 1000 times return.

However, what truly supports Pantera through cycles is not a single successful bet, but its continuous ability to respond to changes in market structure.

When the ICO boom arose, Pantera was the first to launch an early token fund; after the arrival of DeFi Summer, it established the Pantera Blockchain Fund, providing comprehensive investment opportunities in the cryptocurrency and blockchain market. From fund types to strategic allocations, Pantera's adaptive thinking closely follows the market.

Currently, Pantera manages five main funds: a venture fund, a Bitcoin fund, an early token fund, a liquid token fund, and the Pantera fund. According to official data, its managed assets exceed $4.2 billion, with cumulative realized returns of approximately $547 million.

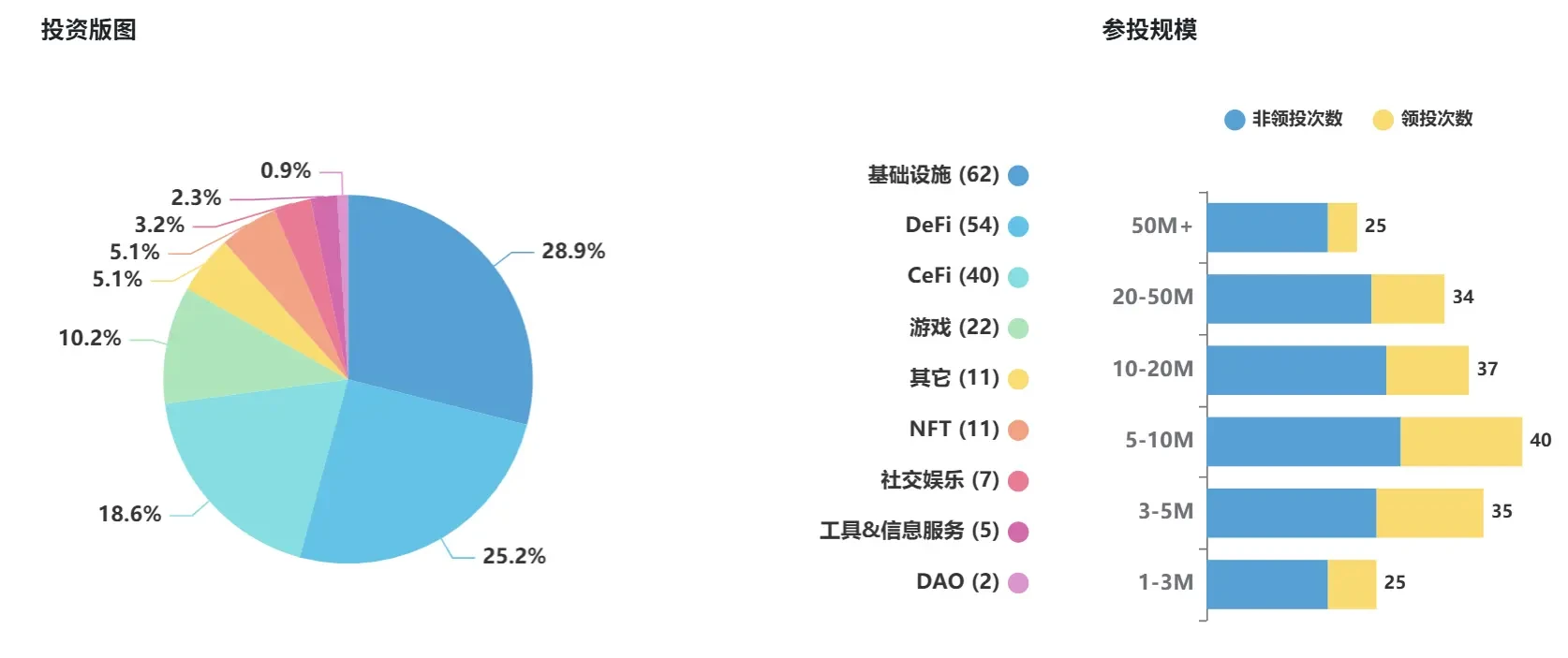

Pantera's investment pace remains tight. According to RootData, it has invested in 214 projects, ranking 13th among all investment institutions, with 18 projects participated in over the past year. The investment layout mainly focuses on four major sectors: infrastructure, DeFi, CeFi, and blockchain gaming.

In its investment portfolio, there are many star projects such as Circle, Ripple, Polkadot, Coinbase, and StarkNet. However, not every move has led to success; as of now, 33 projects have announced their termination, including FTX and Lithium Finance.

In 2024, Pantera made a high-profile bet on TON, believing it has the potential of a network with 900 million active users. This judgment prompted it to make the largest investment in the fund's history. According to on-chain analyst AI Yi, Pantera's investment in TON may exceed $250 million. However, the price of TON has now retraced over 60% from its peak in 2024.

Even so, Pantera's investment trajectory still clearly shows the self-iteration and phased risks of an established crypto VC.

New Battlefield: The Rise of Coin Stocks and Pantera's Strategic Shift

At the beginning of 2025, the primary market cooled down, and liquidity and exit paths became new topics for crypto VCs. However, against this backdrop, the "coin stock wave" quietly emerged.

This time, Pantera Capital once again sensed the taste of a battlefield switch. Within a few months, it evaluated over 50 publicly listed companies with a core strategy of "financing + buying coins" and began to participate deeply.

To capture this new cake, Pantera also specifically launched the "DAT Fund." Currently, several limited partners of Pantera have committed to invest, expecting to accumulate over $100 million in multiple DAT projects.

Now, in different coin "micro-strategies," its investments and layouts can be seen. Here are some digital asset treasury (DAT) companies that Pantera has invested in:

It is worth noting that several companies in the table have seen their stock prices increase by more than a hundred times in just one month. Pantera partner Cosmo Jiang describes this type of investment as a structure where "you win on the upside and lose little on the downside."

[Note: Pantera typically enters DAT companies before they are publicly traded or when they are still priced close to their token net asset value (1.0x NAV), avoiding the high premiums of the public market.]

Regardless, Pantera Capital has secured a key position in this wave of coin stocks. As crypto KOL AB Kuai.Dong said: "Life, death, Pantera."

Dan Morehead, the "macro player" of crypto

To understand Pantera Capital's style, one cannot overlook its founder, Dan Morehead.

Dan Morehead's background is extremely "traditional": a graduate of Princeton University's engineering department, he later entered Wall Street, honing his trading skills at Goldman Sachs, Deutsche Bank, and other institutions, ultimately becoming the CFO and macro strategy head of hedge fund giant Tiger Management. At that time, he managed assets worth billions of dollars, skillfully navigating global currencies and interest rates.

In 2003, he founded Pantera Capital, initially as an ordinary investment company. Until 2013, he had a deep discussion lasting four hours with two friends. That conversation ignited his interest in Bitcoin. From then on, Pantera transformed into a venture capital firm in the crypto space.

At that time, the price of Bitcoin was comparable to that of Tesla, and Morehead made a bold decision: to sell all Tesla stocks and fully bet on Bitcoin. This also led to Pantera Capital's first success—the Bitcoin investment fund.

Dan Morehead has openly stated that the key to investing is to lock in those opportunities where potential returns far exceed risks. Risks always exist, but what truly matters is identifying targets that can deliver explosive returns.

He emphasized: "If you want to achieve excess returns, you cannot follow the mainstream; you cannot invest in projects that every Wall Street firm has twenty analysts watching." This is also why we repeatedly emphasize in our investor letters to "make alternative investments more alternative."

Today, although Morehead rarely appears in the public eye, Pantera Capital still retains the profound imprint he left behind: bold, forward-looking, and closely aligned with market structure.

Twelve years, multiple narratives, hundreds of projects, Pantera Capital seeks signals in chaos and reshapes paths amid structural changes.

In this endless race of crypto, Pantera continues to place its bets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。