In the perception of countless users, this round of the bull market has presented an unprecedented face. Making money has become more difficult than ever. In the past, simply betting on a narrative, such as DeFi, NFT, public chains, or blockchain games, could allow one to ride the wave of sector rotation and achieve a leap in wealth. However, now, despite the market continuously throwing out new narratives—from Meme, AI+Crypto, RWA to modularization, ZK, Restaking, etc.—various labels are emerging, yet very few projects have truly succeeded. The era of blindly buying and seeing all sectors rise together seems to have ended.

As the market begins to weed out the weak, and as emotional cycles become restrained rather than frenzied, narratives and positive news appear to be powerless, and opportunities that can truly realize wealth effects have become extremely scarce.

The change in investment rhythm has also profoundly affected the community ecosystem.

In this cycle, where filtering quality assets is far more difficult than before, various coin selection KOLs have sprung up like mushrooms after rain, overwhelming users with recommendations and airdrop guides, turning information into noise. However, among them are both experienced and trustworthy analysts, as well as brokers who harvest retail investors and cut leeks. For ordinary investors, discerning truth from falsehood and judging motives from the overwhelming information often requires more effort than making the investment decision itself.

So, is there a way that no longer relies on rhetoric but instead speaks directly with data and historical performance? Is there a tool that allows retail investors to participate like institutions, with strategies that are comparable and daring to engage?

On July 16, 2025, the world's first licensed on-chain derivatives exchange, Grvt, officially launched "Grvt Strategies," the world's first compliant on-chain peer-to-peer (P2P) investment strategy marketplace.

Grvt has identified the core issue in the current market: retail investors lack a strategic entry point, cannot discern the authenticity of information, and have no ability to track the real trading capabilities of traders. What Grvt Strategies aims to solve is to transform professional trading strategies into an open market that is "transparent, verifiable, and reusable," with clear pricing that everyone can use.

As Grvt co-founder Hong Yea stated, "Wealth growth should be as simple as sending a message or hailing a ride." This is not just a slogan but a logic of action against market opacity and lowering the threshold for retail investors.

If the previous bull market was a carnival of luck, then now it is time to use strategies to combat uncertainty and replace KOL noise with systematic understanding. Grvt Strategies is the first step in initiating this transformation.

Low Threshold and Transparency, Investment Strategies as Simple as Online Shopping

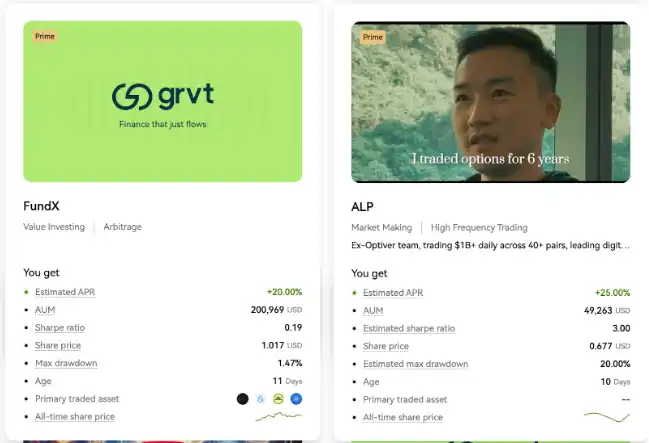

Grvt Strategies discards the complex dashboards commonly found in traditional finance and DeFi. What users see is not the dazzling APY, TVL, or Vaults of traditional DeFi platforms, but a clear, intuitive, and structured list of strategies. Each strategy has a concise introduction, historical returns, risk control models, and other information. Users can filter strategies of interest based on criteria such as strategy type, expected annualized return, maximum drawdown, and investment asset class.

In traditional finance, most quality investment products and structured strategies are only open to institutional investors or high-net-worth individuals. Moreover, related products are often hidden within layers of nested structures, making it difficult for retail investors to access truly quality strategies.

Unlike traditional finance and some DeFi, Grvt Strategies is entirely based on blockchain and automatically manages fund flows through smart contracts. All trading logic and operational rules are publicly available on-chain, and anyone can review them. Not only can users see the historical performance of strategies, but they can also see how funds are specifically invested, how trades are executed, and when dividends are distributed, without needing to trust any intermediaries. More importantly, it adopts a non-custodial model, where users' funds are controlled by their own wallets and can never be misappropriated by the platform or strategy managers.

Whether it is the extremely high-threshold traditional investment system or the many inadequately supported DeFi vaults, neither can meet the needs of ordinary retail investors. In this market gap, Grvt Strategies proposes a solution, aggregating professional-level strategies and launching a strategy marketplace, making zero-threshold investment possible.

Of course, Grvt Strategies was not launched hastily but has been in the works for a long time. The first batch includes six deeply involved strategy managers, all of whom are strong, diverse in style, and possess extensive market experience and practical achievements, with backgrounds spanning traditional finance and quantitative trading. This includes Ampersan, founded by members of the former global top market maker Optiver, which has a trading volume exceeding $400 billion, and the AI crypto quantitative platform b-cube.ai operated by a VASP-regulated team. There are also Cambridge University math PhD Meerkat and practical traders who rank high in profitability on both Binance and Bybit.

Not Copy Trading, But Simultaneous Trading

Compared to traditional copy trading models, Grvt Strategies ensures that retail investors trade simultaneously with strategy managers.

Common copy trading models suffer from time lag and price slippage issues. After a lead trader buys in, the following retail investors often have to wait a certain amount of time to see that trade in their accounts. If the price fluctuates sharply, the retail investor may find that the asset has already risen or fallen by the time they execute their trade, leading to increased buying costs or missed opportunities. This delay of even a few seconds can be particularly fatal in high-frequency trading and volatile markets, and repeated occurrences can significantly diminish copy trading profits.

Due to the delayed nature of copy trading, many well-known KOLs even use this to offload or take advantage of retail losses. KOLs use large accounts to trigger buy orders for copy trading users, and then sell off large amounts through different accounts. Users seem to be "following the strategy," but in reality, they become "liquidity takers."

Grvt Strategies, on the other hand, discards the pure copy trading model. Investors do not lag behind in copying strategies but directly participate in the same trading strategy, with all operations executed synchronously through on-chain smart contracts, eliminating any additional delays and slippage. In other words, your funds operate in the contract alongside the strategy manager's money, with identical buying and selling prices, enjoying the same investment returns.

Additionally, traditional copy trading functions tend to focus on single trading strategies and provide insufficient support for high-frequency or quantitative strategies. Strategies such as arbitrage and market making, which require orders to be completed in milliseconds, often cannot be responded to in time by copy trading systems. Grvt Strategies allows strategy managers to execute complex trading strategies, including quantitative algorithms, high-frequency arbitrage, and hedging trades, fully automatically on-chain. Retail investors only need to connect to the strategy contract without needing to copy each trade.

In short: Traditional Copy Trading is "I follow after you buy," while Grvt Strategies is "We buy together."

Innovation and Compliance, P2P Investment Debut

In the development of financial technology, P2P was once regarded as one of the most disruptive models. P2P changed the role of financial intermediaries, allowing ordinary users to directly participate in financial transaction processes, bringing profound changes in cost, efficiency, and accessibility.

However, P2P has been limited to the lending field for many years. Whether in Web2 or Web3, it essentially focuses on the time value of money, achieving capital circulation through agreement on interest rates between borrowers and lenders.

A more imaginative model that truly connects fund owners with strategy executors, sharing profits and risks in a P2P investment form, has yet to emerge.

Until now, with the launch of Grvt Strategies, the P2P model has been introduced into the investment field for the first time. This is not only a breakthrough at the technical level but also a comprehensive innovation in model and compliance systems. On Grvt Strategies, investors can browse strategies like shopping, freely choose to sign one-on-one smart contracts with strategy managers, and funds automatically participate in the execution process of corresponding strategies. More critically, as a licensed on-chain derivatives trading platform, all strategy products on Grvt are designed and operated within a compliant framework, providing users with unprecedented trust assurance.

Grvt Strategies can achieve such innovation thanks to advanced on-chain technology and a strict compliance system, with its core logic built on the transparency of smart contracts and blockchain. The platform is based on high-performance Layer 2 scaling solutions like ZKsync, ensuring efficient, low-cost operations with cross-chain scalability.

Grvt itself, as a licensed derivatives trading platform, is at the forefront of compliance in the industry. Every strategy product in its strategy marketplace must pass KYC, AML, historical performance audits, and risk model testing. Strategy managers must clearly present their trading philosophy, asset distribution methods, and risk control measures, subject to continuous supervision by Grvt's internal risk control team. User assets are not held in custody by the platform but are directly controlled by contracts, ensuring that no one can misappropriate them.

Additionally, the Grvt platform has integrated fiat deposit channels, allowing users to directly purchase stablecoins through bank transfers or credit cards, eliminating the need for retail investors to register additional crypto wallets or switch between multiple platforms, achieving a truly smooth transition from Web2 to Web3.

The future of finance is a collaborative on-chain network where everyone can have professional strategies and participate. If past DeFi was more like a financial experiment, then Grvt Strategies is becoming a wealth entry point that everyone can participate in.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。