Author: Heechang Kang, Jinsol Bok

Compiled by: Block unicorn

Key Points

Although the current use of stablecoins primarily stems from cryptocurrency trading, blockchain and stablecoins have the potential to transform traditional complex and cumbersome financial systems, such as securities markets and payment systems.

Recently, there has been a growing momentum for adopting stablecoins as payment systems, mainly in two directions: 1) integrating stablecoin functionality around credit card networks; 2) completely bypassing credit card networks and issuing banks.

In the latter direction, PayPal's PYUSD and the USDC payment system developed in collaboration with Shopify, Coinbase, and Stripe are typical examples. As the stablecoin industry develops, it is expected that more companies with large user and merchant bases will build their own payment systems. This could pose a threat to banks and credit card networks.

1. The Potential of Stablecoins

1.1 The Use of Stablecoins is Still Primarily Exchange-Based

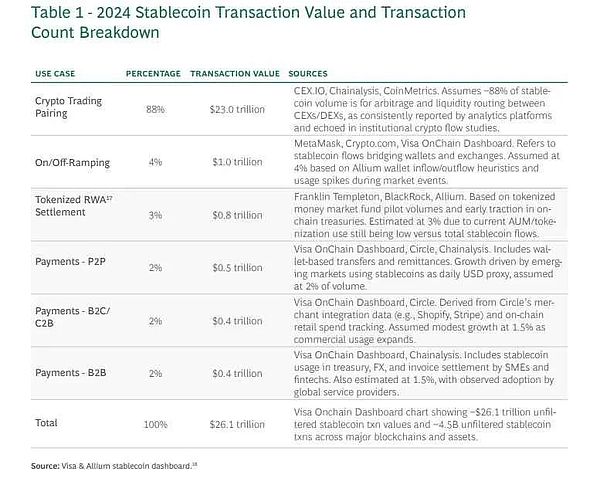

Stablecoins are gaining attention not only in the United States but globally. Discussions are actively underway regarding their innovative potential in areas such as remittances, payments, real-world assets (RWA), and interbank settlements. However, according to a report by the Boston Consulting Group (BCG), 88% of stablecoin transaction volume in 2024 will come from crypto trading. This reflects the current limitations of stablecoin usage, indicating that their application in the real world has yet to meet expectations.

1.2 Stablecoins Can Fundamentally Change the Financial System

Despite significant advancements in fintech that have improved the user-friendliness of financial systems, the backend systems handling actual transactions remain inefficient and outdated. In this regard, blockchain and stablecoins have the potential to revolutionize the backend of financial systems. This is not merely about supplementing existing infrastructure but providing a technology that can completely replace current systems, similar to historical transformations in financial systems.

1.2.1 Securities Market

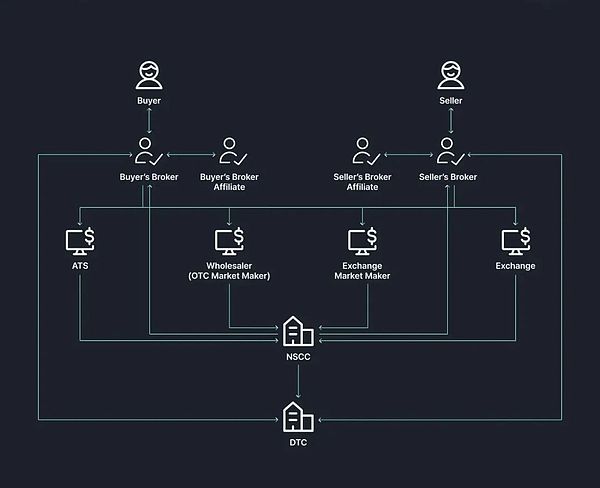

The complexity of the securities market backend stems from the paperwork crisis in the U.S. securities market during the 1960s and 70s and the policy responses taken to address this issue. At that time, securities transactions were processed on paper. As trading volumes surged, the system nearly came to a standstill. To address this, the U.S. Congress passed the Securities Investor Protection Act (SIPA) and amendments to the Securities Act, establishing a centralized clearing and settlement structure and an indirect securities holding system.

Initially, this system digitized securities ownership and improved settlement efficiency. However, it also made numerous intermediaries, such as brokers, clearinghouses, and custodians, indispensable, leading to structural complexity and cost issues. Today's securities market is a product of policy compromises and incremental improvements under technological constraints. This system has persisted for decades without the benefit of superior technologies like blockchain.

1.2.2 Cross-Border Remittances

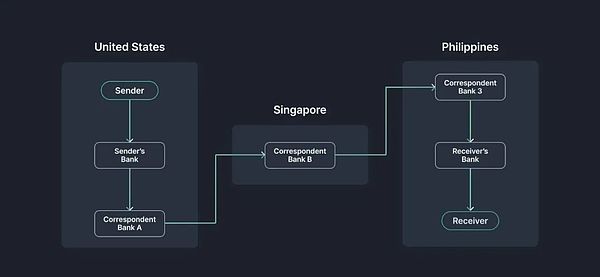

SWIFT is the most widely used system for cross-border remittances, established in 1973 by 239 banks in Brussels to replace the slow and error-prone telegraphic international interbank communication system. At that time, banks used their own communication standards, leading to low compatibility, slow speeds, and security issues. To address these problems, SWIFT developed a universal language and secure network.

However, SWIFT only transmits messages. Actual fund transfers are conducted through correspondent banks or central bank accounts, with settlements handled separately. The involvement of multiple intermediary banks increases delays caused by fees, KYC/AML checks, currency conversions, time zone differences, holidays, etc. This results in high costs and low transparency. If blockchain and stablecoins had existed at that time, message transmission and fund transfers could have been handled on a single unified platform, leading to a more efficient cross-border payment infrastructure.

2. Can Stablecoins Change the Payment Market?

While potential use cases such as securities markets and cross-border remittances are considered systems that stablecoins can innovate, the next most anticipated use case after exchange trading is payment systems. In fact, in the payment sector, not only Web3 companies but also major Web2 companies like Visa, Mastercard, Stripe, and PayPal are actively exploring new business opportunities.

To determine whether stablecoins can truly change existing payment systems, we must first understand how current payment systems operate, the reasons for their inefficiencies, and whether stablecoins can address these issues.

2.1 How Existing Payment Systems Operate

2.1.1 How Payment Systems Work

When a customer makes a payment to a merchant, the process is as follows:

Authorization

The customer attempts to make a payment using a credit card.

The POS terminal or online payment gateway sends an authorization request containing payment information to the acquiring institution.

The acquiring institution forwards this request to the credit card network (e.g., VisaNet, Mastercard Banknet).

The credit card network passes the request to the issuing bank.

Verification

The issuing bank verifies the card's validity, account balance, credit limit, and whether the transaction is suspicious.

Once verification is complete, an approved or declined response is sent back to the acquiring institution through the credit card network.

If approved, the corresponding amount is temporarily held on the customer's account.

If declined, the merchant receives a response with the reason for the decline.

Capture

- In industries such as gas stations, hotels, and online shopping, the final amount is confirmed after the initial authorization. Therefore, the timing of the merchant's capture request is when the transaction is actually completed, and this request is sent to the acquiring institution.

Batch Processing

All authorized transactions throughout the day are grouped into a batch and sent to the acquiring institution in one go after business hours.

Clearing and Exchange Fees

The acquiring institution sends the batch data to the credit card network.

The credit card network routes each transaction to the relevant issuing bank and calculates exchange fees in the process.

Settlement

- Funds are transferred from the issuing bank's settlement account to the acquiring bank's settlement account. The credit card network aggregates daily transactions and generates settlement files to coordinate both parties, but the actual fund transfer occurs through interbank payment networks.

Fund Allocation

- The acquiring institution deposits the payment amount (after deducting relevant fees) into the merchant's account and sends the funds to the merchant via ACH or wire transfer.

Reconciliation

- Finally, the merchant checks whether the received funds match their records and reviews for any discrepancies, omissions, or duplicate charges.

2.2 What Are the Issues? What Are Not Issues?

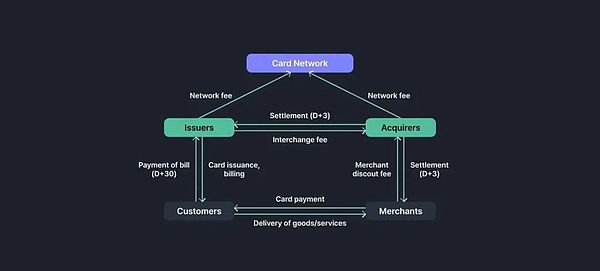

The biggest issues often pointed out in traditional credit card systems are high fees and slow settlement times. Are these drawbacks inevitable, or can they be resolved?

2.2.1 Regarding Payment Fees

First, let's look at the fees associated with credit card payments. From the merchant's perspective, there are three main types of fees involved in card transactions:

Exchange fees: the largest portion, charged by the issuing bank.

Scheme fees: fees charged by the card network for processing transactions.

Acquiring institution markup fees: fees charged by the acquiring bank.

Can blockchain and stablecoins reduce these fees? The first potential area for savings is global transactions. When merchants and cardholders are in different countries, settlements must go through SWIFT. If this process were replaced with blockchain or stablecoins, costs could be significantly reduced.

The second area is bypassing credit card networks and issuing banks to lower fees. What is the essence of credit card networks? It is a communication network connecting the bank holding the customer's funds with the bank receiving the funds from the merchant. If stablecoin payments were fully adopted, customers could pay directly from their self-custodied stablecoin wallets to the merchant's Web3 account via the blockchain network.

2.2.2 Regarding Settlement Times

Next, let's look at settlement times. In credit card payments, transaction authorization is almost real-time. In this regard, the scalability of public blockchain networks may be far inferior to centralized credit card networks. However, in traditional credit card payments, clearing typically takes an additional 1 to 2 days, and settlement takes another 1 to 5 days.

There are multiple reasons for the time-consuming settlement, some of which can be resolved, while others cannot:

Clearing time: Credit card payments typically batch process all daily transactions and clear once a day. A system fully based on blockchain or stablecoins would not need to follow this daily clearing cycle.

Disputes, suspicious transactions, cancellations, refunds: Even with stablecoin-based payments, these issues cannot be resolved. Since such situations are inevitable in payments, settlement delays remain necessary.

Cross-border payments: When conducting cross-border transactions, funds must be settled through SWIFT, leading to further delays. This is an obvious area where blockchain can provide solutions.

3. Stablecoin-Based Payment Systems

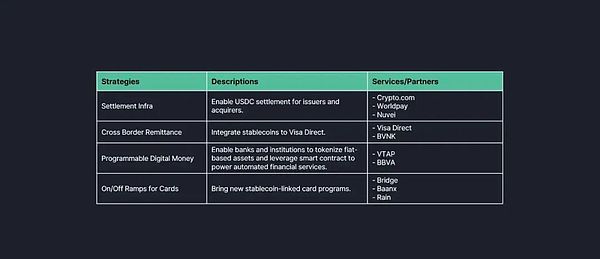

Recently, we have seen various financial institutions and companies begin to shift towards adopting stablecoin-based payment systems. I believe this significant shift is achieved through two strategies. The first strategy is led by card networks like Visa and Mastercard. The second strategy attempts to completely bypass card networks and issuing banks.

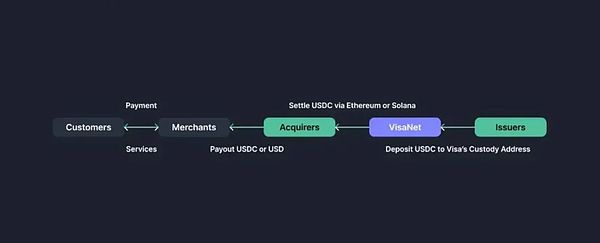

3.1 Card Network-Centric Stablecoin Payments

As I discussed in the article "Visa and Mastercard, Designing the Next Generation Payment System," Visa and Mastercard are actively exploring ways to integrate stablecoin functionality into their infrastructure.

Crypto debit cards: These cards allow customers to make payments using stablecoins stored in Web3 wallets or exchange accounts. In this case, the customer's stablecoins are either converted to fiat currency by the issuing bank and processed through existing payment systems, or the card network directly receives stablecoins through its funding account and processes them according to traditional card payment procedures.

Stablecoin settlement: As mentioned above, card networks can accept stablecoins through funding accounts and settle with acquiring institutions in stablecoins.

Essentially, card network-centric stablecoin payments only add support for stablecoin payments and settlements on top of traditional systems. The participants and infrastructure remain unchanged. Therefore, this system does not provide significant advantages in terms of cost or time. However, for customers and companies that naturally use stablecoins, such a system can reduce transaction friction by skipping the conversion process between fiat currency and cryptocurrency. Additionally, if the entire payment process is settled in stablecoins, there will be significant benefits for cross-border transactions.

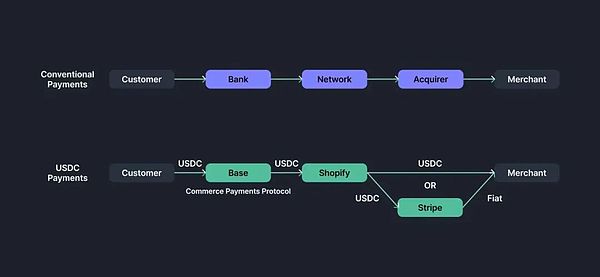

3.2 Initiatives to Bypass Card Networks and Issuing Banks

Meanwhile, some payment service providers (PSPs) are processing payments by using stablecoins to bypass card networks like Visa and Mastercard. These cases include PayPal's PYUSD payments and the USDC payment program developed in collaboration with Shopify, Coinbase, and Stripe.

3.2.1 PYUSD Payments

PayPal users can make payments using their PYUSD balance within the PayPal app. These PYUSD holdings are not stored in the user's own wallet but exist in the account of the PYUSD issuer, Paxos. When a PYUSD payment occurs, there is no actual movement of PYUSD on-chain. Instead, the ownership of PYUSD is transferred from the customer to the merchant in PayPal's backend. If the merchant wishes to settle in fiat currency, PayPal converts PYUSD to USD at a 1:1 ratio and settles the payment to the merchant through bank networks like ACH.

If the customer's PYUSD balance is insufficient, they can top up via bank account or card, which may incur fees. Similarly, if the merchant requests settlement in fiat currency, this may lead to additional fees and time through the bank network. However, if the entire payment cycle is completed in PYUSD, there is no need to go through card networks or issuing banks, which can significantly reduce time and costs.

3.2.2 Shopify x Coinbase x Stripe Payments

PayPal's stablecoin payments do not directly involve blockchain networks, while Shopify's USDC payments go a step further.

In June 2025, Shopify announced a partnership with Coinbase and Stripe to integrate USDC payments into Shopify Payments. Customers can select USDC as a payment method in Shopify stores and connect a crypto wallet holding USDC on the Base network to make payments.

Here, the smart contract "Commerce Payments Protocol" on the Base network uses the traditional "authorize first, capture later" process to pre-authorize payments, with actual fund transfers occurring later. Shopify and Coinbase aggregate USDC transaction data throughout the day and settle on the Base network.

For settlement, the default method is for Shopify to convert USDC to the merchant's local currency and deposit it into the merchant's bank account via bank payment networks like ACH or SEPA. This conversion is handled by Stripe's infrastructure. Merchants can also choose to settle directly in USDC, allowing them to access funds more quickly.

4. Final Thoughts

The most frequently asked question about stablecoin-based payment systems is: "How do you handle cancellations or refunds since blockchain transactions are inherently irreversible?" While a fully peer-to-peer payment system between customers and merchants may eventually emerge, issues such as fraud detection, cancellations, and refunds will always exist, making intermediaries in the payment process still essential. Therefore, the roles traditionally fulfilled by card networks and issuing banks will not completely disappear.

However, in the aforementioned cases of PayPal and Shopify's stablecoin payments, intermediaries like PayPal and Stripe act as payment service providers (PSPs), handling issues such as fraud detection, cancellations, and refunds. In the case of PYUSD, transactions are not processed on-chain but occur in PayPal's backend, leaving room for dispute resolution. In Shopify's case, the Commerce Payments Protocol smart contract on the Base network introduces a buffer time instead of immediately approving payments, allowing for dispute handling. Additionally, the USDC issuer Circle has released a refund protocol for non-custodial dispute resolution.

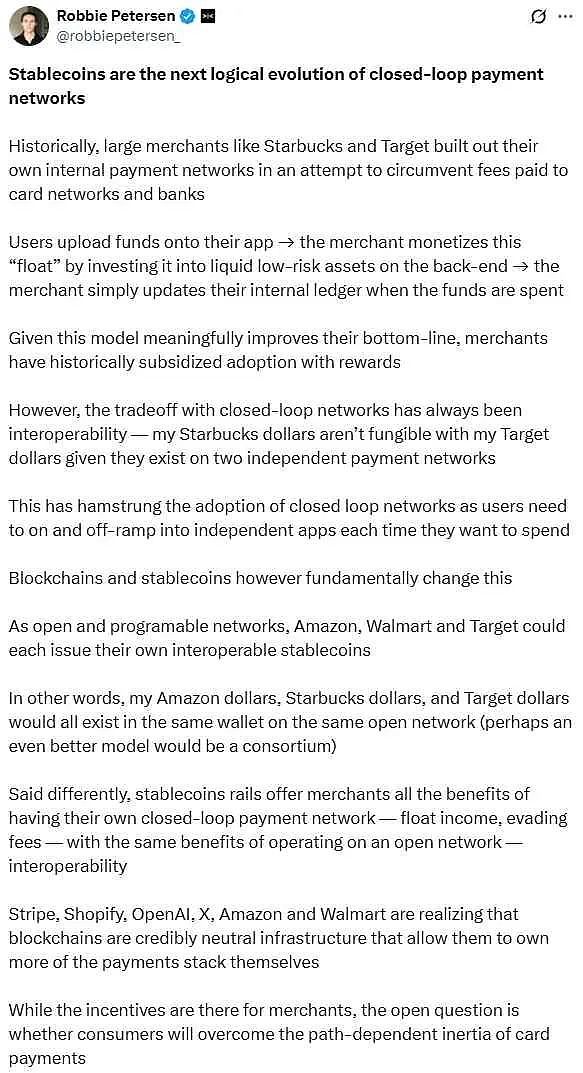

Stablecoin-based payments are an inevitable future. Just as issuance is important, distribution is equally crucial. As Robbie Petersen from Dragonfly pointed out, companies with large merchant and customer bases will increasingly adopt stablecoin payments and bypass card networks and issuing banks. Stablecoins may even enable interoperability between these closed-loop payment systems. Given these trends, stablecoins could pose a real threat to card networks and issuing banks, which need to explore new opportunities in this unstoppable wave of the stablecoin industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。