Chinese blockchain developer Conflux has launched the third iteration of its public network and announced a stablecoin plan pegged to the offshore renminbi.

According to a report from the Shanghai municipal government, Conflux revealed these latest updates during a three-day conference held over the weekend. At the meeting, the company stated it would collaborate with fintech company AnchorX and IT security provider Eastcompeace to bring the offshore renminbi-backed stablecoin to market.

Previously, AnchorX had received in-principle approval for the renminbi-supported currency AxCNH from the Astana Financial Services Authority in Kazakhstan and announced this news. It is currently unclear whether Conflux's initiative falls under the AxCNH category, and as of the time of publication, Conflux, AnchorX, and Eastcompeace have not commented on this.

Conflux has also reached an agreement with crypto wallet company TokenPocket to help promote the renminbi-backed stablecoin to a broader user base. TokenPocket stated in a post on X that it would collaborate with AnchorX and Conflux to launch pilot projects in Southeast Asia, Central Asia, and other key regions.

In addition to the stablecoin news, Conflux also released the Conflux 3.0 upgrade. The company mentioned that the new version can process over 15,000 transactions per second and includes built-in support for on-chain AI agent calls.

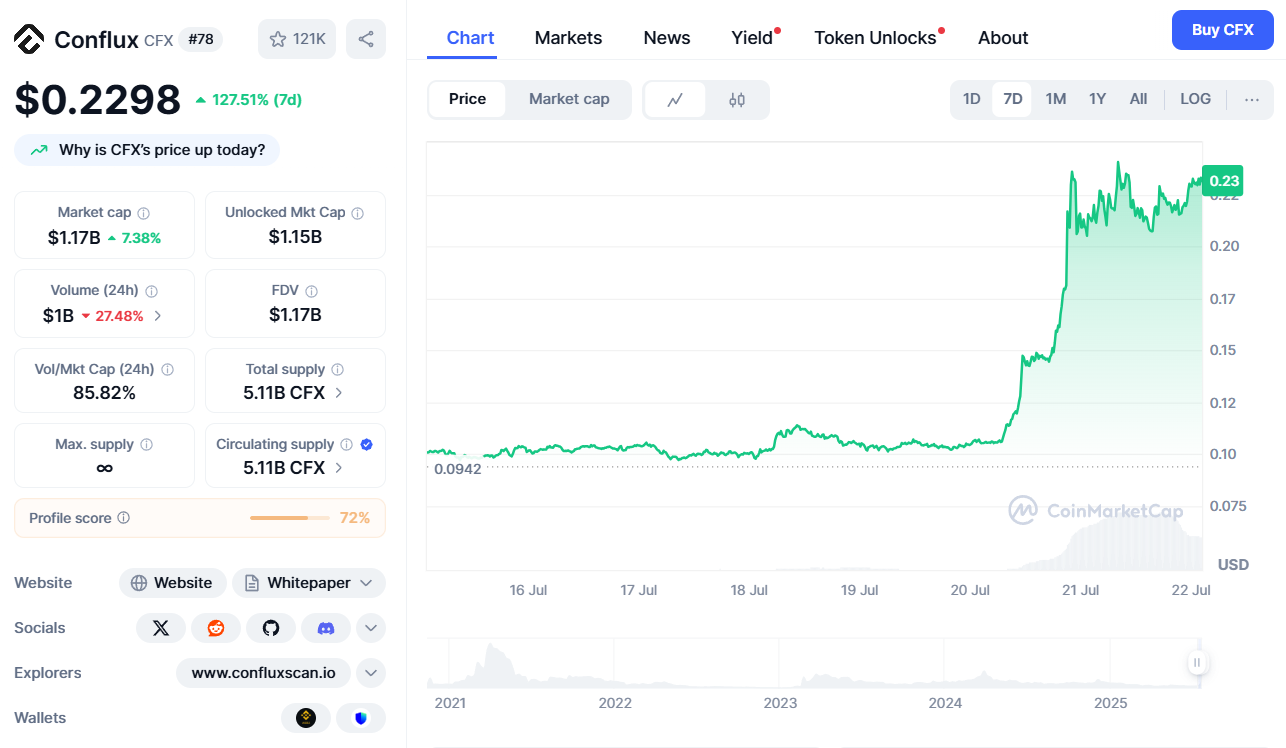

The market reacted quickly. Conflux's native token CFX surged from $0.1055 on Sunday to $0.2298 at the time of the reporter's publication, an increase of nearly 127.51%.

Conflux CFX token price. Source: CoinMarketCap

Conflux stated that this renminbi-backed stablecoin will target offshore Chinese enterprises and countries participating in China's "Belt and Road" initiative. As part of its promotional efforts, it will explore asset applications in the real world.

China proposed the "Belt and Road" initiative in 2013, aiming to enhance its global influence through large-scale infrastructure construction and trade connections.

The plan aims to connect continents such as Europe, Asia, and Africa through land and maritime corridors, supporting investment and trade via road, rail networks, digital systems, and ports.

China's Second Largest Fund Launches the World's First Renminbi Tokenized Money Fund

In related news from the stablecoin sector, interest in stablecoins has surged in Hong Kong in recent weeks. Hong Kong has submitted up to 40 stablecoin license applications.

Applicants include major companies such as JD.com, Circle, and Ant Group. Their applications were made after the Hong Kong government announced a framework called "LEAP," which will take effect on August 1 and establish licensing rules for stablecoin issuers.

Under the new system, the Hong Kong Securities and Futures Commission will oversee the licensing of stablecoin providers, a move that authorities say will help promote real-world use cases.

Meanwhile, China’s second-largest fund company—China Asset Management’s Hong Kong branch—launched the world’s first renminbi-denominated tokenized money fund this Thursday.

"Our tokenized products are designed to welcome the arrival of stablecoins, whether they are in Hong Kong dollars, renminbi, or US dollars," said Tian Gan, CEO of China Asset Management Hong Kong. He referred to the stablecoin rules that will be implemented in Hong Kong starting August 1.

Gan added that his company aims to be one of the first to tailor yield products for stablecoin users.

According to a report by Reuters earlier this month, leading Chinese tech companies have urged the central bank to allow stablecoins pegged to the offshore renminbi to be launched in Hong Kong. They believe this move could promote the development of the Chinese currency globally and counterbalance the growing digital dominance of the US dollar.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。