On July 17, global asset management giant BlackRock made another precise move—its iShares Ethereum Trust (ETHA) officially submitted a 19b-4 filing to the U.S. Securities and Exchange Commission (SEC), proposing to introduce staking functionality for its Ethereum ETF.

Although prior to this, peers including Franklin Templeton, Grayscale, 21Shares, and Fidelity had already submitted similar proposals, the market sentiment instantly heated up when BlackRock entered the fray. The reason is simple: BlackRock may not be the fastest to act, but it always seems to be the one that ultimately "passes the test," reigniting strong expectations from the outside world for the SEC to approve staking-based crypto ETFs.

According to analysts' estimates, the SEC is expected to provide an initial response to the early submitted staking proposals by October this year. If the review goes smoothly, the official approval time could be advanced to the fourth quarter of 2025.

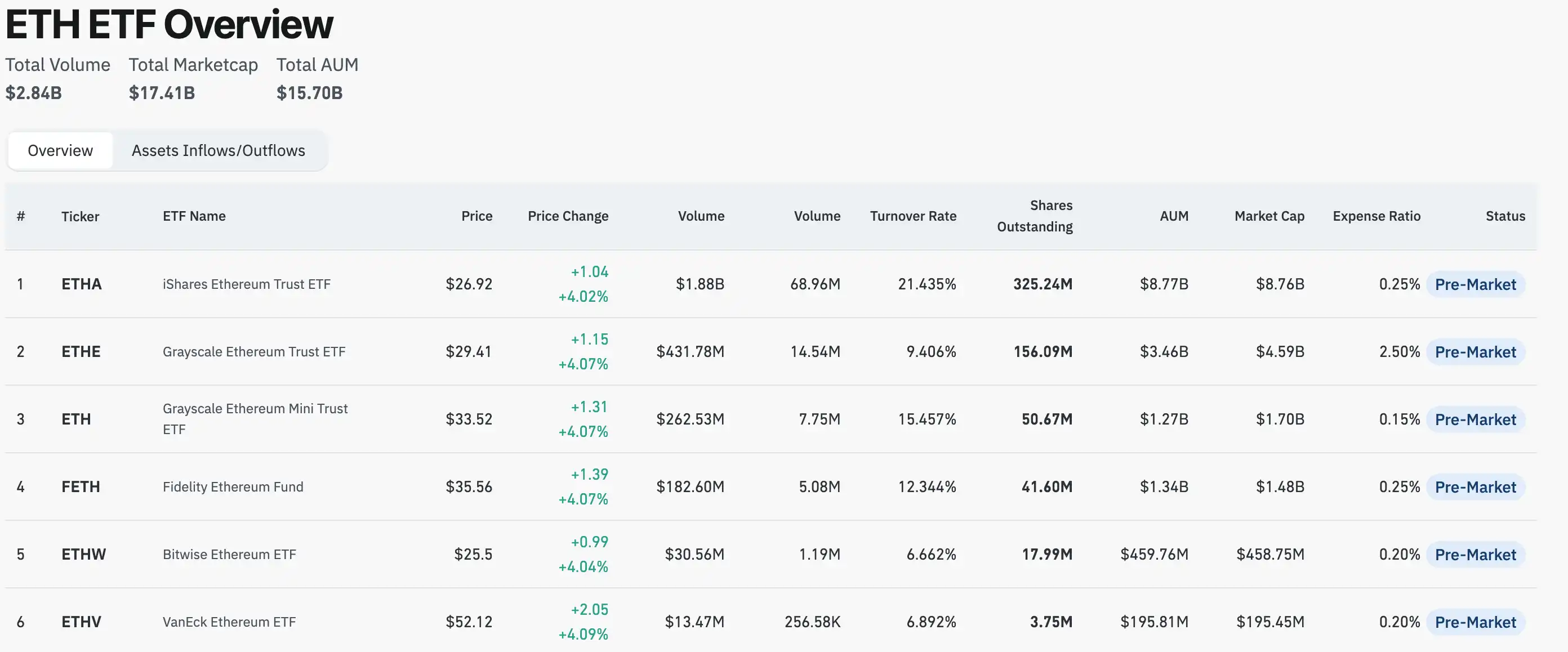

Currently, the total managed assets of Ethereum spot ETFs have exceeded $17 billion, with ETHA leading the pack at $8.7 billion. If the staking functionality is approved, it will not only reshape the investment logic of Ethereum but also inject new growth momentum into the entire on-chain ecosystem. This article will focus on this historic turning point and systematically outline which sectors and projects will benefit first after the introduction of the staking mechanism in Ethereum ETFs.

From Speculative Tool to Yield Asset, the Asset Attributes of ETH Are Being Reshaped

For ETH, the launch of a staking ETF may signify a structural re-evaluation of its asset nature.

Compared to traditional financial assets, Ethereum has a "native advantage"—it is not only a speculative asset but can also earn staking rewards by participating in on-chain validation, with the current actual annualized return rate at about 3.5%. Once the ETF is approved to introduce staking mechanisms, its investment logic will upgrade from a single expectation of price increase to a dual-engine drive of "price + yield." This model is similar to earning interest from holding government bonds or receiving dividends from holding blue-chip stocks, and it will become the first U.S. cryptocurrency ETF to provide yields to both institutional and retail investors. This shift could transform Ethereum into a revenue-generating financial asset within regulated investment tools, making it an attractive option in traditional finance.

Eric Jackson, founder of EMJ Capital, has predicted that Ethereum could reach $10,000 or even higher in this cycle. His model attributes the potential growth momentum of ETH to four main factors: its stable 3.5% staking yield, the net negative issuance trend since the merge, the new demand brought by the soon-to-be-approved staking ETF, and the growth in network activity driven by Layer 2 and tokenized assets. Jackson's team points out that the supply-demand structure of ETH is tightening rapidly, and if the ETF approval progresses faster than expected, combined with the large-scale adoption of Layer 2, breaking through $15,000 in the coming quarters is not a fantasy.

Who Are the Real Winners in the Staking Sector?

Liquid Staking Protocols

Integrating staking functionality into Ethereum ETFs presents the biggest technical and operational challenge: liquidity management. Unlike the "T+0 tradable" characteristic of traditional financial assets, once ETH is staked, it gets locked in the network, and exiting requires a formal unbonding process. According to Ethereum's protocol design, when validators choose to exit staking, they must wait through multiple stages such as block confirmation and queuing, and the exit queue is limited by the current network load—during peak times, this process can take days or even weeks.

This poses a tricky problem for ETF issuers. ETF products need to ensure that users can buy, sell, and redeem their shares at any time. However, if a large amount of ETH held by the fund is locked in staking and faces sudden large-scale redemption requests, the fund may not be able to liquidate assets quickly, leading to liquidity mismatch risks.

To alleviate this issue, ETFs typically reserve a portion of unstaked ETH as a liquidity buffer, but this sacrifices staking yields and weakens the product's inherent appeal of "on-chain yields." A more operational solution is to leverage Liquid Staking Derivatives (LSD).

The core mechanism is to generate tradable "staking receipt" tokens (such as Lido's stETH and Rocket Pool's rETH) from staked ETH. These tokens represent ownership of the staked ETH and can be traded on secondary markets, allowing the staked assets to maintain on-chain liquidity. If Ethereum ETFs utilize LSD protocols, they can continuously earn staking yields while also meeting redemption demands through derivative assets like stETH, thus solving the liquidity pain points of traditional staking. This makes LSD protocols a key "liquidity intermediary" between ETFs and the Ethereum network.

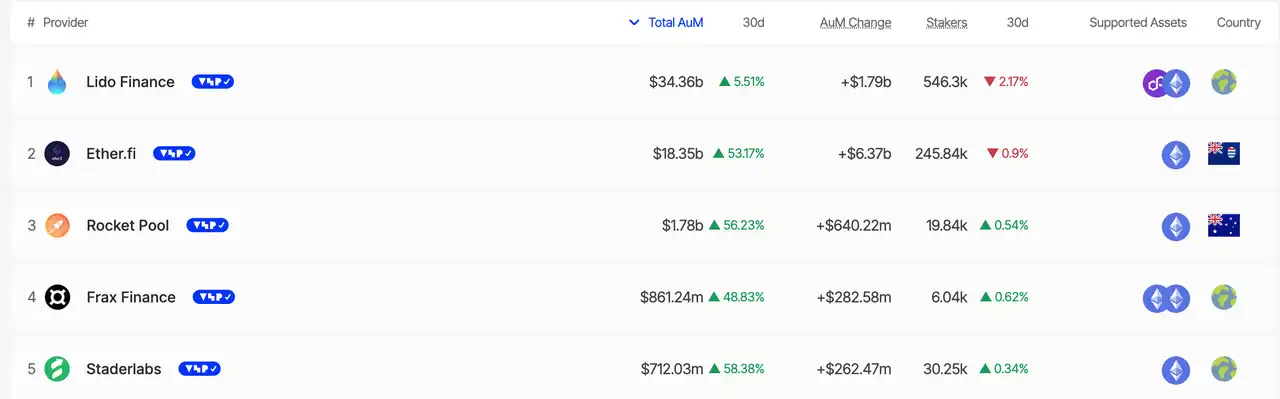

The market has quickly reacted to this logic. After the news of BlackRock's ETHA staking application was announced, Lido's governance token LDO surged over 20% within 24 hours, indicating that funds are rapidly flowing into the potentially beneficial LSD sector. Once the SEC officially approves Ethereum ETFs that support staking, the Total Value Locked (TVL) of protocols like Lido and Rocket Pool is expected to expand significantly, and their native tokens will also undergo a new round of valuation reassessment.

Centralized Exchanges

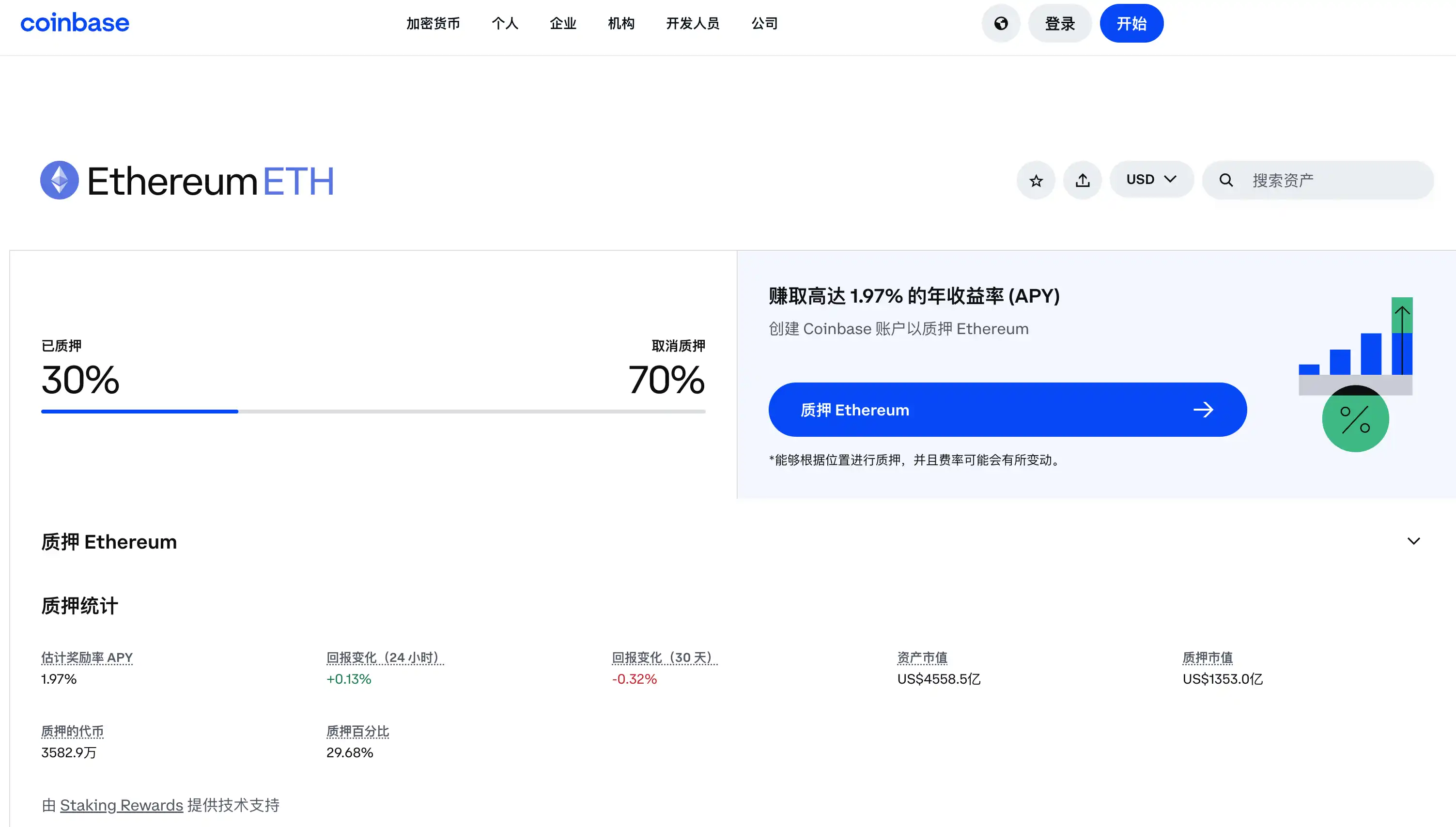

If the Ethereum ETF issuer chooses not to build its own nodes and does not rely on decentralized protocols, the most practical and convenient solution is to use centralized staking service providers, such as Coinbase and OKX. These platforms have established mature node infrastructure and can provide institutional clients with one-stop staking solutions, including node operation, reward distribution, and key management, significantly lowering the technical barrier.

For example, Coinbase's liquid staking token cbETH (Coinbase Wrapped Staked ETH) offers users a way to enjoy both staking yields and on-chain liquidity simultaneously. cbETH represents the ETH staked by users on Coinbase, allowing them to transfer, trade, or use it for on-chain interactions without needing to unbond. Its principle is similar to Lido's stETH, but it is issued and managed by a regulated centralized platform, making it more acceptable to regulatory agencies and better aligned with the compliance needs of traditional financial institutions.

Other trading platforms like Kraken and OKX also offer similar staking services, providing customized solutions for institutional users. It is worth mentioning that while centralized staking services have clear advantages in convenience and compliance, they also face certain risks. For instance, the SEC has previously initiated enforcement actions against centralized exchanges' staking services, claiming they constitute "unregistered securities offerings."

Overall, in the current context of tightening compliance requirements, centralized exchanges, with their technological maturity and licensing resources, remain one of the important options for ETF issuers to achieve on-chain staking functionality. Especially products like cbETH may become representative assets of liquidity and yield in the "compliant version of LSD" sector in the future.

Conclusion

The strong expectations for the approval of Ethereum ETF staking not only signify that traditional finance is officially entering the "on-chain yield era," but also mark a complete transformation of ETH from a speculative product to a yield-generating asset. With institutions like BlackRock leading the way into this sector, LSD protocols, node operators, and centralized exchanges are stepping into the spotlight, ushering in a new window for valuation reassessment.

As regulations become clearer and infrastructure improves, this multi-party collaboration around "ETH staking yields" may become a key point of convergence between Web3 and Wall Street. Whoever can secure ETF collaboration resources first will occupy a more central position in the next crypto cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。