The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome all coin friends to follow and like, and I refuse any market smoke screens!

Originally, I planned to spend the entire month of July traveling, but in less than half a month, the market has undergone tremendous changes; this market fluctuation indeed caught Lao Cui by surprise. At the same time, there have been too many users messaging me privately. Although there has been no loss for the users I manage, many fans have taken short positions. I sincerely apologize for this. Fortunately, the layout for spot users has been quite profitable. This market fluctuation is mostly driven by market trends, followed by strategic pushes. It seems extremely bizarre and completely lawless, which is a consistent tactic of capital. Returning to the market, we also need to start anew. Users with questions can message me directly. Starting today, I will launch a new round of layouts based on this market trend. Yesterday, I also reviewed a day in the coin circle. Currently, the only coins that still have investment value may be SOL, so everyone can focus on that!

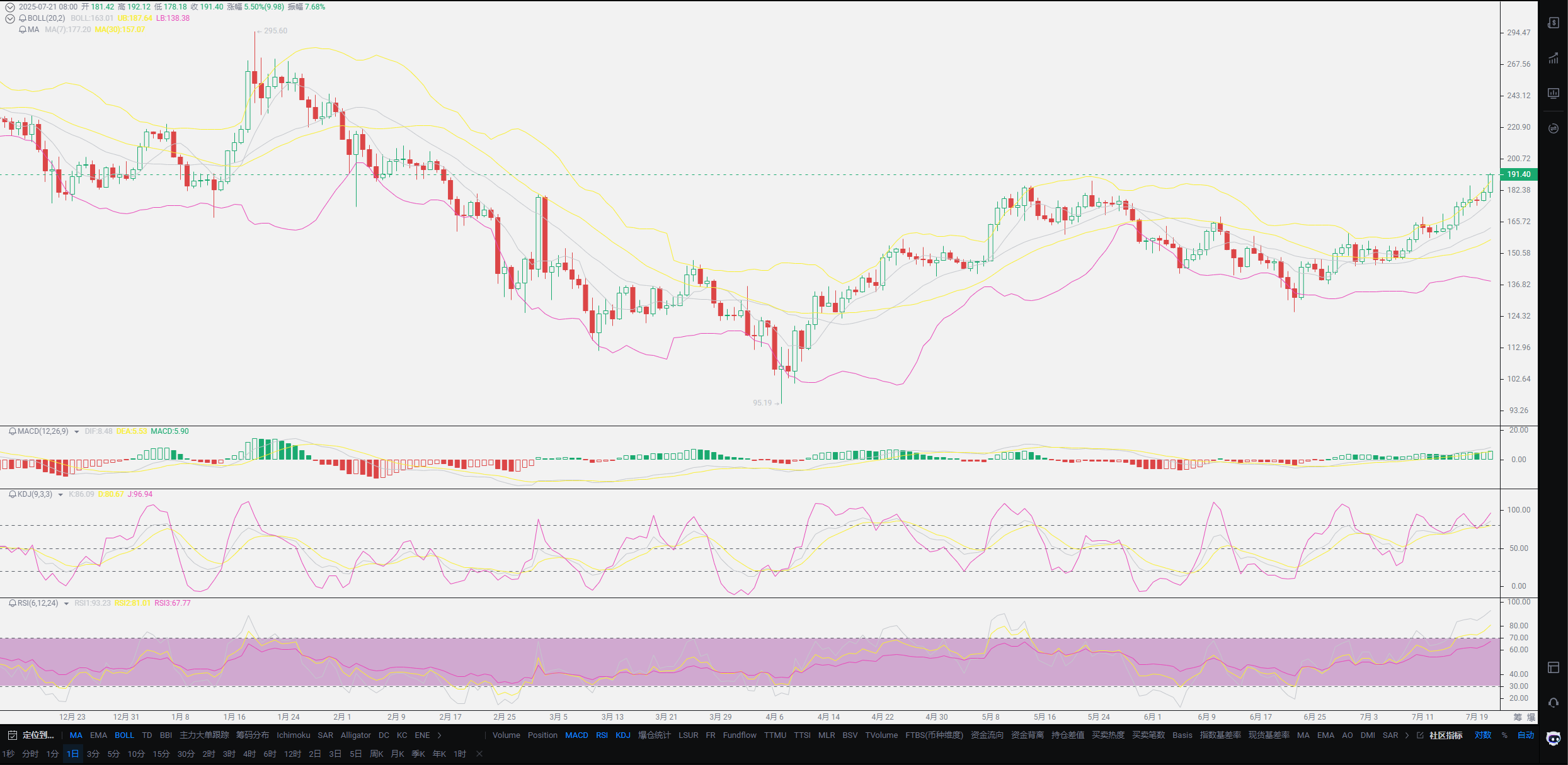

This fluctuation can basically be considered the beginning of Ethereum's wave, and the daily over-issuance of USDT is also extremely astonishing. Observing stablecoins, we can see that there are a large number of newcomers entering the coin circle, which will push the market towards an extreme bullish trend. The interest rate cut decision on the 18th did not have a negative effect on the market. The entire market is basically in an extreme bullish sentiment, supported by both funds and retail investors. Everyone is waiting for the interest rate cut in September, and combined with a weak dollar strategy, it is likely that this bull market's growth cycle will be extended. Of course, this does not mean that this round of the bull market has officially begun; rather, I attribute this growth to the influence of the stablecoin legislation. Especially the continuous over-issuance of USDT has not been subject to regulation, which is worth pondering. The elimination of the impact of US-China tariffs has also become a driving force for this growth. It can be seen that this growth is not primarily driven by American funds, but rather from Asia!

This frequent turnover has already created a supply-demand imbalance, so predicting a short-term decline is actually quite difficult. This market belongs to the battle of capital; to take over, one can only enter the market in the form of spot trading. For the entire spot market, we can only hope for a pullback before the interest rate cut. From my perspective, the only significant event in the past half month was when U.S. President Trump officially signed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" at the White House, marking the implementation phase of U.S. stablecoin regulatory legislation. Additionally, as the next target for legislation in the "coin circle," the U.S. House of Representatives has passed a bill to establish a regulatory framework for cryptocurrencies—the "CLARITY Act," which will be sent to the Senate for review. David Sachs, the White House's cryptocurrency affairs director, has urged the Senate to pass this legislation before September to establish the first comprehensive rules for the cryptocurrency industry. These two pieces of news will redefine the coin circle!

Previously, I always emphasized the importance of legislation, and the actual passage of a bill is completely different from merely proposing a concept. This is undoubtedly a long-term positive message for the trend, but the second piece of news detailing trading rules may not be a good thing for ordinary people. Once it is on the right track, it means the arrival of taxes and the shackles of real-name systems. You may think that this is not implemented domestically, but the dominance of the cryptocurrency market has always been in Europe and America. Even a one percent tax would be an astronomical figure for the entire coin circle. Coupled with the aforementioned over-issuance of USDT, the platform with the most inflow is Binance, which also shows that the growth of BNB is considerable. The second most inflow coin is ETH, which has finally completed its mission. More users are concerned about when a pullback will occur. Regarding this issue, I hope everyone can give me a little time. After nearly half a month away, I have not yet analyzed the overall situation.

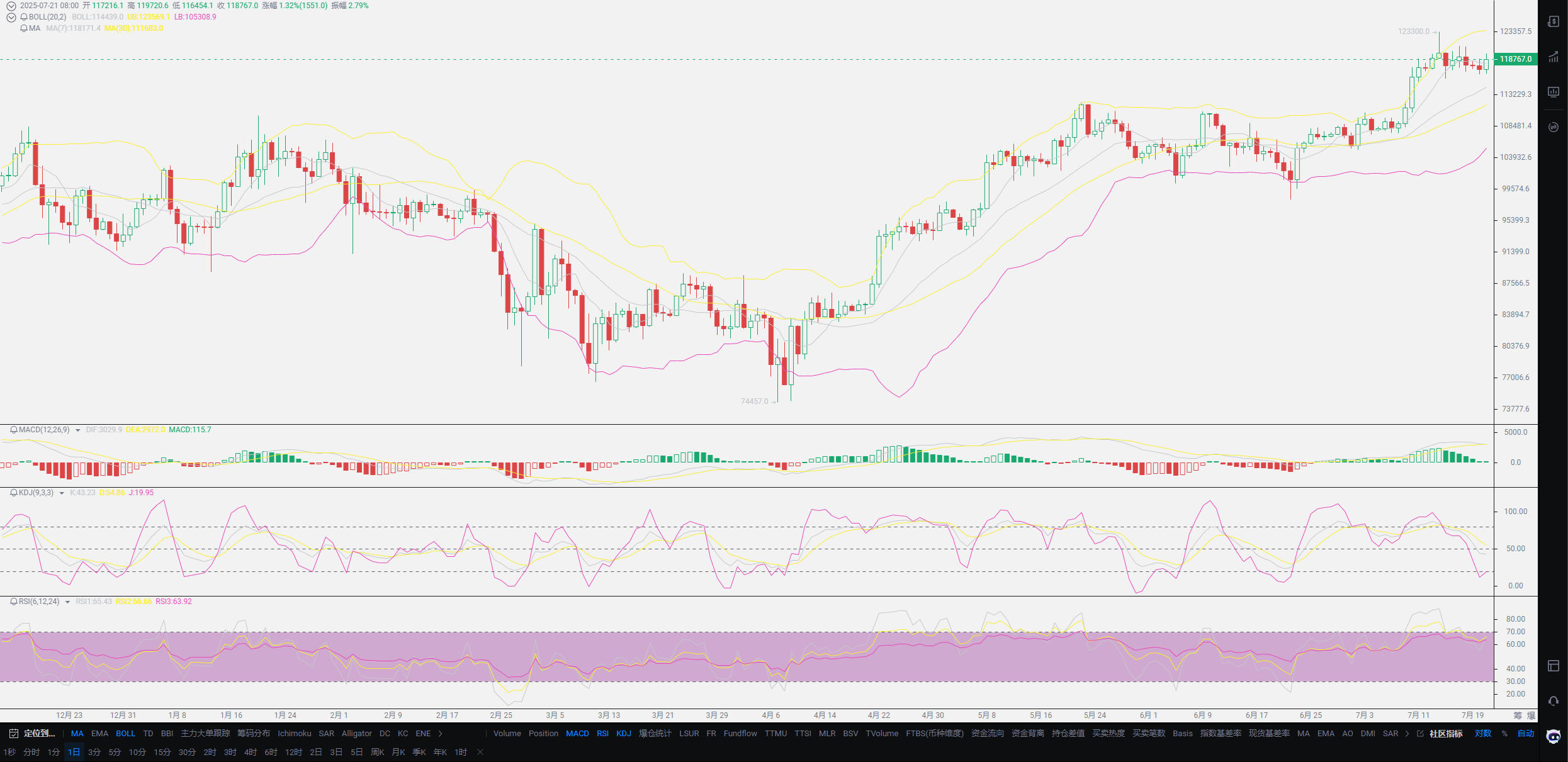

Regarding the pullback issue, there will definitely be one before the interest rate cut, but the exact timing depends on Asia's absorption capacity. From the perspective of capital flow, Bitcoin has basically maintained an inflow of around 30 million per day, and this amount of capital can only maintain the current price; breaking through is still quite difficult. The 120,000 resistance can currently only be broken through in a short-term manner, and a stable signal has not yet emerged. Capital seems to prefer Ethereum more, with nearly 100 million flowing in within 24 hours, which aligns with our previous analysis. Only when Bitcoin is stagnant will there be opportunities for other coins to grow. Conversely, SOL has seen an inflow of 50 million, but the market has not shown significant growth, seemingly brewing a trend after its listing. For users who have not yet entered the market, this year they can focus on SOL. The peak may see a growth space of 2-3 times. The more critical the period, the more inexplicable expectations I have for SOL's value.

In summary, due to the rush of this article, I have not delved into too many layers of analysis. I just returned home today, and the materials have not been organized. There is not much reference information for the future market trend. Therefore, I still need to be cautious in expressing my views, focusing on spot users. Many friends are quite satisfied with this round of profits and are considering exit points. Regarding whether to exit with profits, what I want to express is quite easy to understand. Based on the following two points, for users who have doubled their profits, especially friends holding Ethereum, I support the choice to exit and invest in SOL. Secondly, for those who feel that their profits are sufficient and are not optimistic about the future market, they can also take profits and exit. Since I have been a firm supporter of short positions in the early stages, this wave of movement is not inclined towards bullishness, so the short signals before the interest rate cut have always been on my mind. As for SOL, if it has not grown this round, it means that the market makers are preparing their chips, waiting for a stunning performance after the listing. Therefore, at this stage, if SOL does not rise but instead falls, it is the time for everyone to act. Remember one thing: at the current position, even if there is a deep pullback this year, new highs will still appear. I am more inclined to suggest that you hold your spot positions until the end of the year! I have no specific advice for contract users, as I cannot grasp the short-term situation for now. Once I understand the recent data a bit more, I will discuss it with everyone. This article is more about informing you that I have returned today, and if you have any questions, feel free to chat with me! I apologize for not responding to many friends' questions while I was abroad.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。