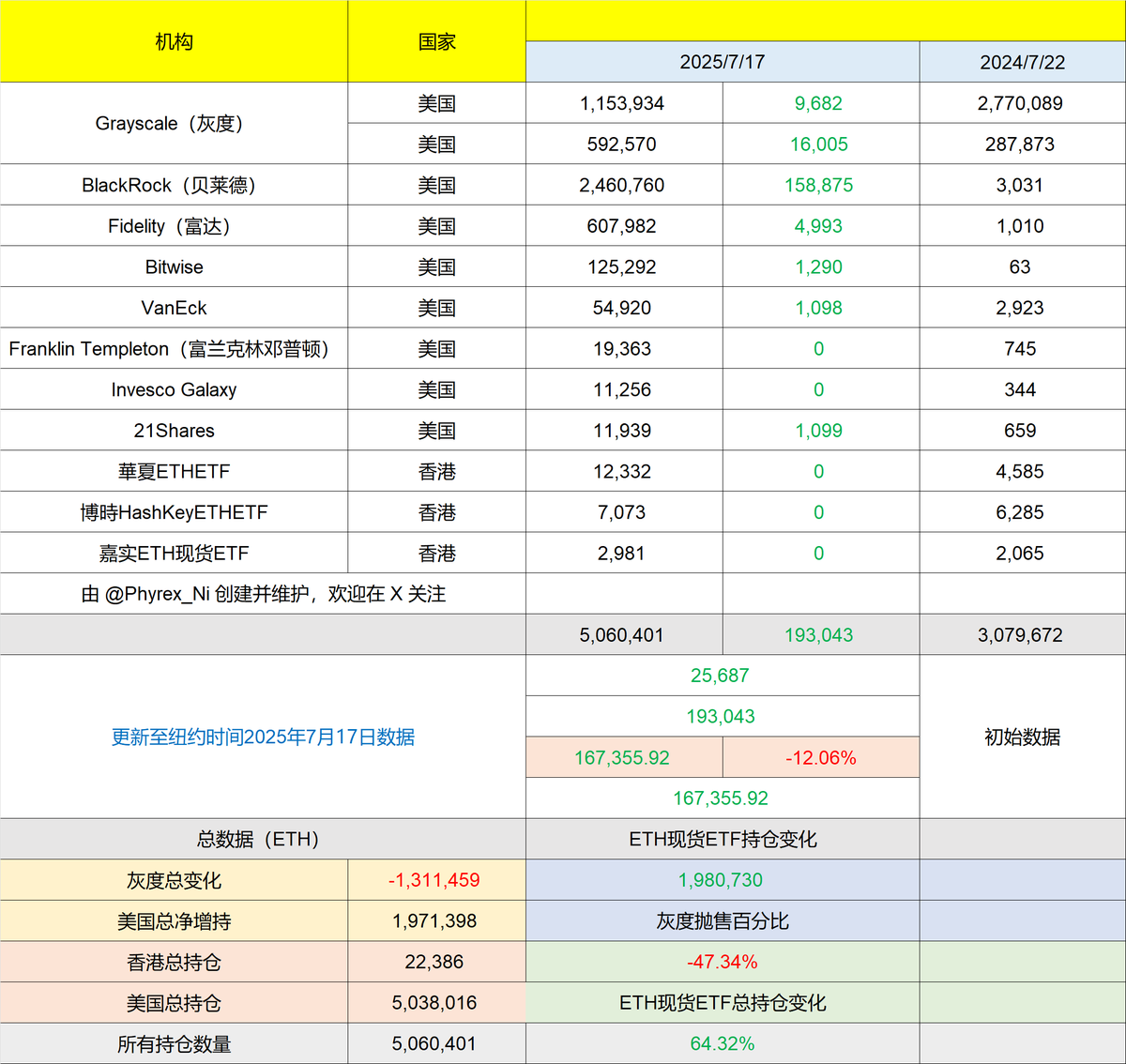

Here’s some data-related information: The $ETH spot ETF was approved on July 22, 2024, and it has been almost a year since then. Over the past year, the average price of ETH has been around $2,500, while the average purchase cost for investors in the spot ETF is above approximately $2,800, with some even exceeding an average cost of $3,000.

Daily purchase volume record: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

Therefore, for most institutional users, the current price of ETH is not high, similar to the ETH price of around $60,000 after January 11. More importantly, the institution that has bought the most ETH through the spot ETF is BlackRock, followed by Fidelity and Grayscale.

BlackRock investors account for more than half of the purchasing power (the same goes for $BTC). So, it would be more accurate to say that it is BlackRock that is optimistic about ETH rather than all American investors, and BlackRock conveys this optimism to investors through financial managers and other means.

It has been proven that only BlackRock investors tend to be long-term investors, while Fidelity investors are more sensitive to price. Other than BlackRock, Fidelity, and Grayscale, other spot ETF institutions can be disregarded.

Thus, whether ETH is popular may not depend on what ETH is, but rather on what BlackRock thinks ETH is. Although it sounds a bit harsh, the data suggests that this might be the case. Of course, this is my personal opinion, and it may not be correct.

The net holdings of U.S. spot ETF institutions amount to 5,038,016 ETH, of which BlackRock holds 2,460,760 ETH. Over the past year through the spot ETF, BlackRock investors have net purchased 2,457,729 ETH.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。