Just as I was about to go out, I saw this tweet from Teacher Jason, which happens to relate to my research on stablecoins. Recently, many colleagues in the industry have been asking me if there are any solutions. In fact, the United States already has mature solutions, and there are even interest-bearing stablecoins approved by the SEC. Even after the Genius Act (Stablecoin Act) comes into effect, interest-bearing stablecoins will still be compliant.

Why?

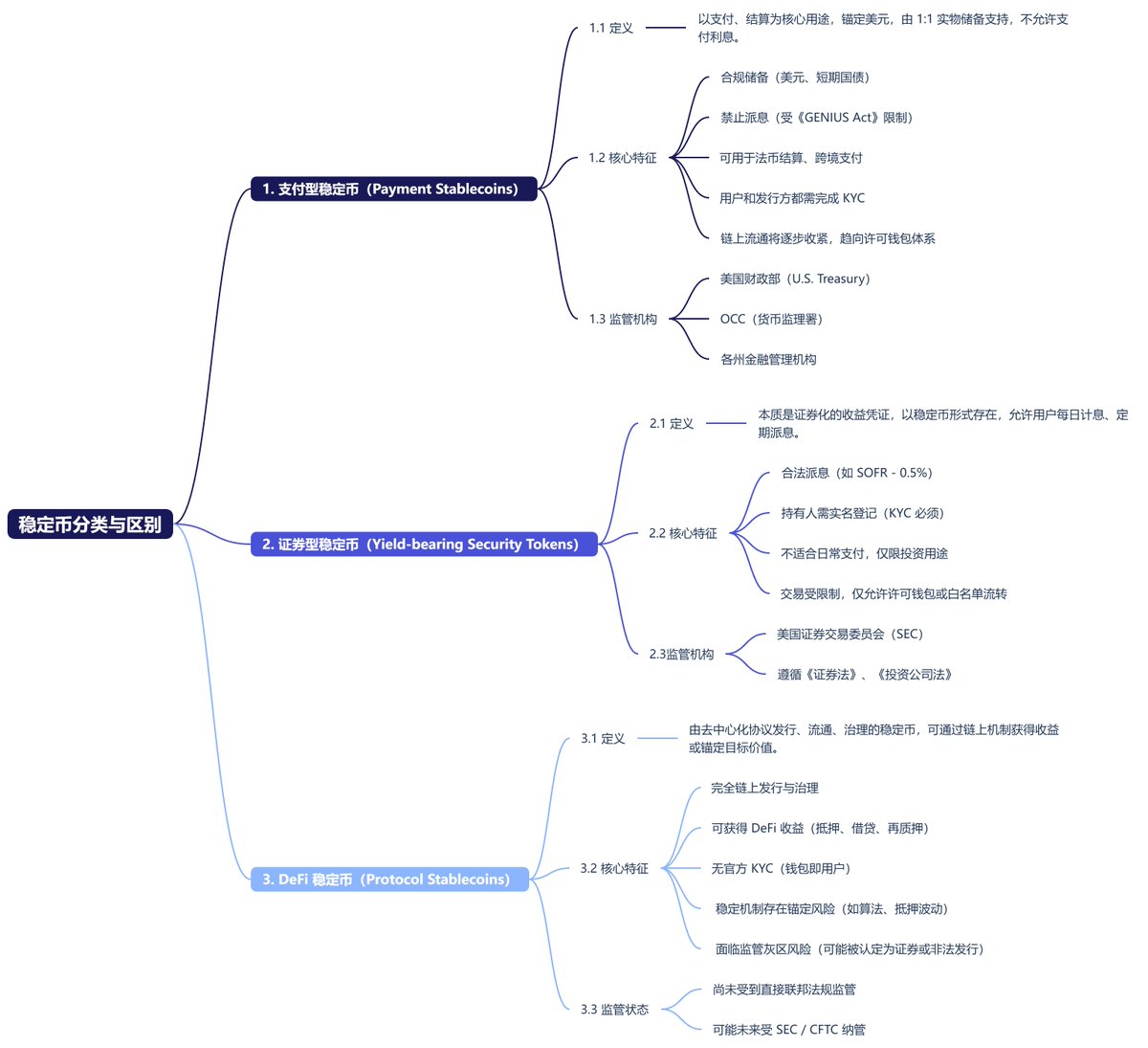

Because there are two types of stablecoins permitted under U.S. law:

Payment stablecoins

Yield-bearing security stablecoins

Currently, the commonly used USDC, USDT, etc., fall under the first category, payment stablecoins. The recently signed stablecoin act targets this type of payment stablecoin, while the YLDS registered by Figure Certificate Company, which is approved by the SEC, is a yield-bearing security stablecoin.

Moreover, what's interesting is that although payment stablecoins cannot provide direct yields, yield-bearing security stablecoins can be used as a means of payment. In simpler terms, if USDC obtains a payment stablecoin license, it cannot provide interest to users, but YLDS can not only provide interest to users but can also be used for payments, transfers, and other solutions. However, it does not allow open transfers like USDC; generally, it only permits transfers between permitted addresses, making it a closed system on-chain. This experience is still different from the "free circulation" of payment stablecoins.

The biggest difference lies in the design of the stablecoin. YLDS was initially applied for under the category of securities, and it is essentially about the on-chainization of bonds. More importantly, both payment stablecoins and yield-bearing security stablecoins require KYC, which many may not have noticed.

For example, currently, USDC does not require KYC for end users; it is only needed during redemption. However, the stablecoin act stipulates that end users also need to undergo KYC. Therefore, theoretically, if USDC obtains a license, on-chain transfers would also require KYC. Of course, this end-user KYC requirement may gradually be implemented through mechanisms like licensed wallets and whitelisted addresses, and it is expected to be progressively advanced after the regulations come into effect.

(At the same time, this is also an advantage for USDT, if USDT is not compliant in the U.S.)

I digressed a bit, so overall, interest-bearing stablecoins can still be realized. One way is to use stablecoins that meet SEC securities standards to generate interest, and the other is to use payment stablecoins to purchase compliant treasury-type tokens. This introduces a new term: tokenized U.S. Treasuries. Currently, compliant options include BENJI / FOBXX issued by Franklin Templeton, which is already SEC compliant.

BENJI / FOBXX is a traditional Money Market Fund (MMF), with investment targets primarily in short-term U.S. Treasuries, repurchase agreements, and cash, accruing interest daily and settling earnings every day, fully regulated by the U.S. SEC under the Investment Company Act of 1940.

I won't go into the details of BENJI; interested parties can look it up themselves. In summary, USDC can be used to purchase BENJI to achieve interest on stablecoins, and KYC is also required. If someone without KYC obtains BENJI, they can hold it but cannot earn interest income.

Essentially, although the stablecoin act does not directly allow payment stablecoins to earn interest, there are actually many solutions available, and it is even possible to directly issue interest-bearing stablecoins for exchange, such as simply using USDC to buy YLDS.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。