Discussion: Will $TAKER be the next $UXLINK?

At first glance, the two seem unrelated, yet they share many similarities in detail:

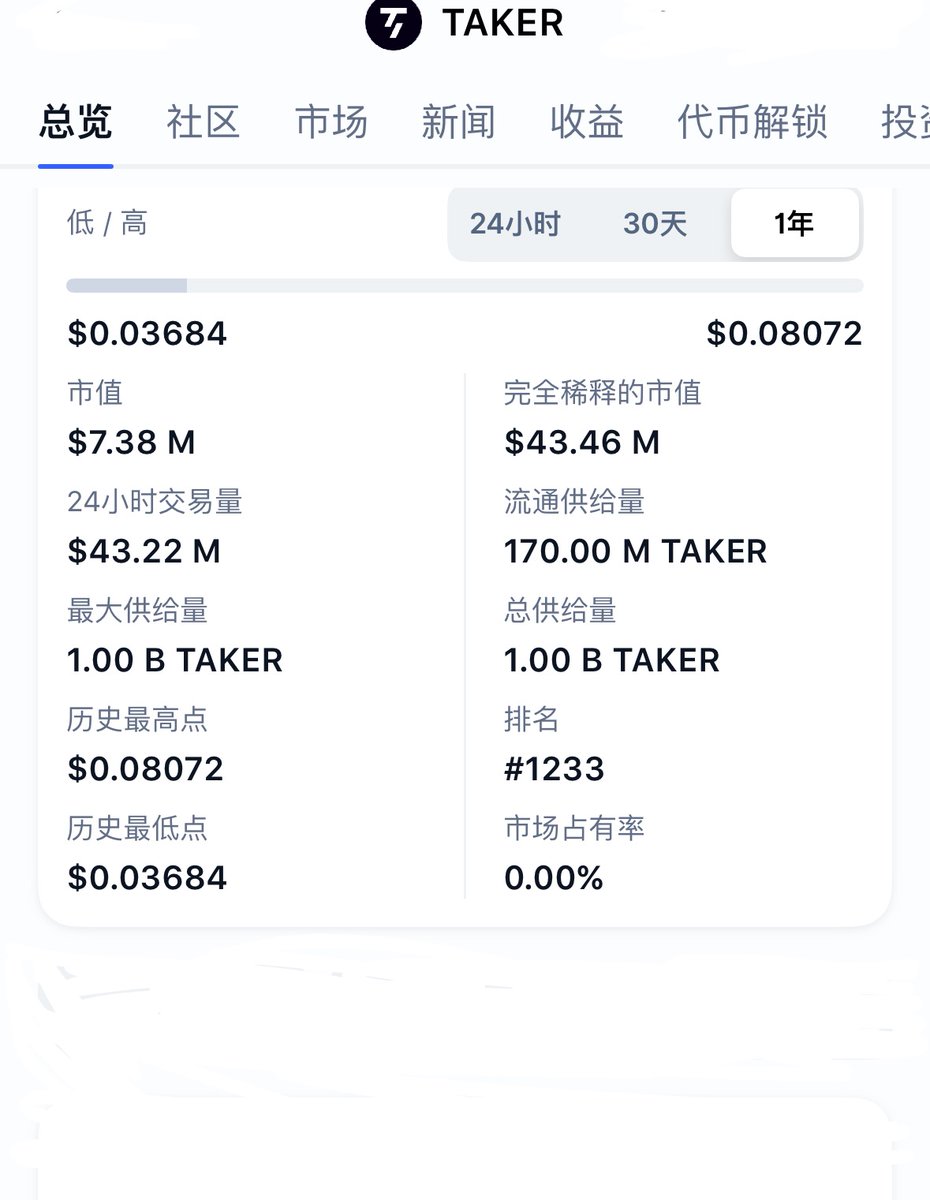

Low opening price. $UXLINK typically opened low and rose high, from $0.15 all the way up to around $2; $TAKER was listed on Binance Alpha yesterday, with a current circulating market cap of only $7 million.

Strong Korean community. Like $UXLINK, $TAKER also has a strong Korean community, with the Taker Korean TG group totaling 150,000 members (if the official hasn't bought bots, this data is indeed impressive).

Another point is that Taker and UXLINK are long-term partners, with a relationship so strong that both CEOs have to appear together for community AMAs. It is believed that Taker has learned from UXLINK.

Returning to the project itself, Taker positions itself as the "liquidity layer of the Bitcoin ecosystem," attempting to build a financial ecosystem that connects Bitcoin's native assets and derivatives with liquidity at its core. Its biggest innovation is the NPOL consensus mechanism.

The characteristics of the NPOL consensus mechanism are:

Liquidity as computing power: Users become validators by staking Bitcoin and its derivative assets (such as BRC20, etc.), earning transaction fees and block rewards by providing liquidity.

Decentralized liquidation: Bad debts are recovered in a decentralized manner through an auction mechanism, avoiding chain liquidation risks.

Additionally, Taker's core product line can be summarized as:

Taker chain: EVM-compatible L1

Taker Sowing: Incentive and task system to guide users into the Taker ecosystem

Taker Swap: Low-slippage DEX designed for BTC LSD assets

Taker Lend: Decentralized lending platform for Bitcoin LSD assets

If previous BTCFi platforms operated on the philosophy of "build it and they will come," believing that once the stage is set, users will continuously flow in, Taker's approach is "build-incentivize/attract-retain," evolving a step further in product philosophy. The specific implementation path is: attracting users through NPOL consensus and task incentives, and providing rigid demand through Swap and Lend.

The biggest challenge is that Taker chain needs a continuous stream of innovation and opportunities to convert user traffic into on-chain value, allowing funds and users to stay and settle long-term, which cannot be solved solely by the current DEX and lending models.

From the perspective of coin price, the current low opening may be a good opportunity, and Taker's large Korean community has yet to be fully tapped. These are all potential points for price growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。