Original Title: "SBET Surges Over 95% in 5 Days, How Long Can the ETH Flywheel Last?"

Original Source: Biteye

@SharpLinkGaming This Nasdaq small-cap stock, originally valued at only about $10 million, has seen its stock price soar over 200% in the past month! The key driving force behind this price surge is a "flywheel effect" strategy centered around ETH.

So, what exactly is SBET's "ETH flywheel" model? Can this round of ETH's rise lead to a new bull market? This tweet will answer your questions:

1. Analyzing the "ETH Flywheel" Behind SBET's Surge

The surge of SBET (SharpLink Gaming) stems from its multiple purchases of ETH, becoming a new player behind ETH. In simple terms, the company has established a self-reinforcing capital flywheel using ETH: buying ETH through stock financing - leveraging the ETH market and narrative effect to boost stock prices - then financing at a higher valuation to purchase more ETH, repeating this cycle and continuously expanding its asset scale.

Breaking it down, this flywheel consists of three steps:

(1) Low-cost fundraising to buy coins: In May of this year, Ethereum co-founder Joe Lubin's ConsenSys and other crypto venture capitalists participated in a PIPE private placement for SBET, investing $425 million at a price of $6.15 per share, allowing SBET to purchase approximately 163,000 ETH.

(2) Market enthusiasm drives up stock prices: With the narrative of the "Ethereum Treasury," investors flocked in, and SBET's stock price quickly climbed, creating a psychological premium that rapidly inflated the company's market value.

(3) High valuation refinancing to expand the balance sheet: The surge in stock price provided an opportunity for further issuance. SBET could then sell new shares at a high price to raise funds and buy more ETH, repeating this process to create a snowball effect.

Today, SBET has purchased a total of 32,892 ETH (approximately $115 million), and as of now, SBET holds about 326,074 ETH, with a total value of approximately $1.14 billion. This scale of holdings has allowed SBET to surpass the Ethereum Foundation, becoming a new player in ETH and significantly increasing its influence in the market.

2. Review: From Gambling Marketing to Ethereum Reserves, a "Desperate Battle"

SBET's strategic transformation is not coincidental. According to its 2024 financial report, SharpLink Gaming's annual revenue has decreased by 26.1%, with traditional gambling marketing struggling to grow, and the pressure of losses prompting the company to seek new capital injections and diversified asset allocations.

In this context, SBET turned its attention to blockchain, announcing in February this year the acquisition of a 10% stake in the UK blockchain online gambling company CryptoCasino, and later collaborating with ConsenSys to attempt to break through its business with an "Ethereum Reserve Strategy."

So, why is the market optimistic about SBET's ETH reserves?

First, the "productive asset" nature of ETH: Unlike Bitcoin's value storage attribute as "digital gold," Ethereum possesses natural yield capabilities in staking and the DeFi ecosystem, meaning holding it is not just about waiting for its price to rise. Bitcoin lacks such native yield mechanisms and relies more on price fluctuations.

Second, filling the gap in traditional market ETH yield exposure: As of now, U.S. regulators have not approved any ETH staking ETFs, meaning traditional market investors find it difficult to access ETH's staking yield directly. However, SBET is expected to operate protocol-based strategies through partnerships with ConsenSys, bringing substantial on-chain returns to fill this gap, potentially even surpassing the future yields of ETH staking ETFs.

Finally, the higher implied volatility of ETH brings option value: Primitive Ventures believes that ETH's implied volatility (69) is significantly higher than BTC's (43), creating greater option value for convertible arbitrage and structured derivatives. This leaves room for SBET to engage in more complex financial operations in the future.

3. How Long Can SBET's "Unlimited Ammo" Last?

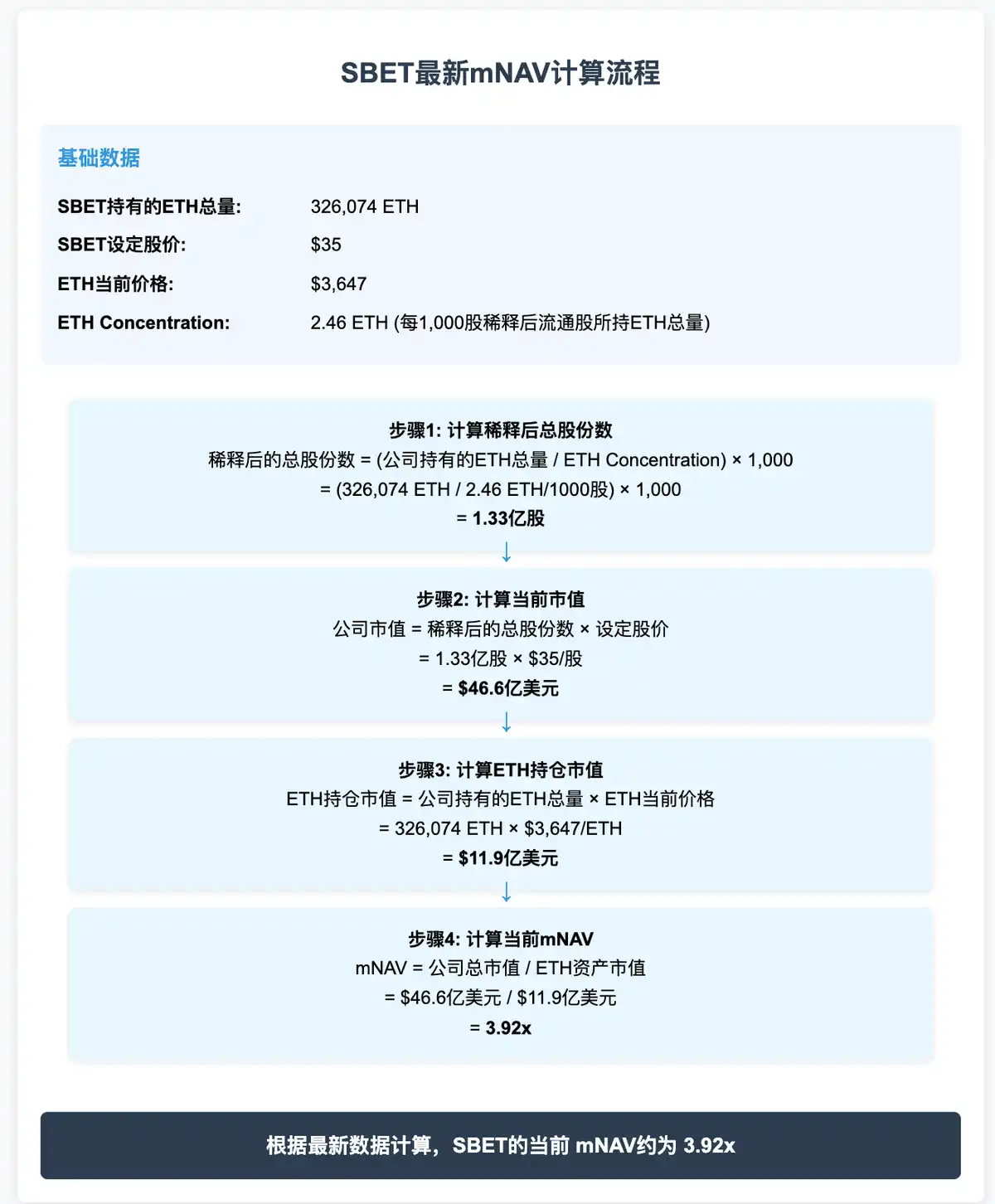

As the stock price skyrockets, SBET's valuation has significantly exceeded the net value of its held crypto assets, showing a "mNAV" (market cap to net asset) premium of several times. Currently, SBET's market cap is estimated to be about 3.92 times the market value of the ETH it holds, indicating that investors are providing substantial narrative premiums.

In comparison, MicroStrategy, which holds Bitcoin, reached a market cap/net asset ratio of about 4.5 times at the peak of the market. This also means that SBET's valuation model could potentially approach this level in an optimistic scenario. (Note: This comparison method may be subject to reflexivity and is for reference only. @Joylou1209

A new calculation approach is proposed, https://x.com/Joylou1209/status/1946070821883257040)

The calculation process in the image below is based on the ETH already purchased, not on SBET's future expectations. If considering an additional $5 billion ATM, the future mNAV estimate for SBET can refer to: https://x.com/0x_RayBTC/status/1946103032267301322

At the same time, we must consider how long this flywheel model can continue.

On one hand, as discussed earlier, the core logic behind SBET's rise lies in the "flywheel effect" built around ETH, with the key variable being the growth of "ETH per share = total ETH held by the company / total shares outstanding."

Theoretically, if SBET's stock price increase > ETH price increase, this is the most favorable situation: the stock price rises quickly, allowing the company to finance more cash with fewer shares; if ETH's price rises slowly, it remains relatively cheap to buy. The result is that new financing buys more ETH, increasing the ETH per share, and accelerating the flywheel.

On the other hand, this model cannot continue indefinitely, and potential adjustment risks mainly include two points:

Slowing growth of ETH per share: As the total shares continue to expand, even with ongoing ETH purchases, it becomes difficult to maintain a high growth rate of ETH concentration. Once the growth rate of ETH per share declines, market expectations for its future growth will weaken, and the valuation premium may subsequently decrease.

Risk of ETH price correction: SBET's asset value is highly dependent on ETH, and once ETH's price corrects, market risk appetite declines, leading to a revaluation of the valuation system, triggering a simultaneous adjustment in stock prices. Especially in a downtrend, if SBET's decline > ETH's decline, the risk is maximized.

4. Outlook for ETH: Flywheel Accelerating, Bull Market Far from Over?

SBET's surge is essentially a pre-pricing of Ethereum's future value, and ETH's future performance will directly determine whether SBET's "flywheel" can continue to turn. Here are some recent positive news about ETH for your reference:

The largest regulatory benefits and policies in history: Last night, the U.S. House of Representatives overwhelmingly passed three legislative proposals regarding the regulation of cryptocurrencies, including stablecoins. Among them, the "GENIUS Act" provides a clear framework for stablecoin issuance, solidifying ETH's position as the infrastructure for stablecoins. Additionally, a recent U.S. court ruling clarified that ETH is a commodity rather than a security, reducing regulatory uncertainty regarding its "non-security" status. This is crucial—it means that legal barriers for institutions investing in ETH are decreasing.

Institutional capital inflow: With clearer regulations, capital inflows into ETH trading products in the North American market have reached new highs. Statistics show that on July 17 alone, the net inflow of U.S. spot ETH ETFs reached $779.6 million, setting a historical record. This indicates strong institutional demand for ETH allocation, with funds accelerating towards the ETH market.

Rapid advancement of Ethereum's Pectra upgrade roadmap: The Pectra upgrade (Prague + Electra hard fork), set to launch on May 7, 2025, raises the staking limit for individual validators to 2048 ETH and recalibrates fees to significantly enhance Layer-2 throughput while supporting account abstraction. Vitalik Buterin and Ethereum core developers are also actively promoting an increase in Gas Limit and ZK integration, with the future TPS of ETH expected to break into triple digits.

Favorable macroeconomic expectations: As U.S. inflation rates decline, the market predicts that the Federal Reserve may begin a rate-cutting process in 2025-2026. Lower interest rates mean that traditional risk-free yields will decrease, highlighting the relative attractiveness of ETH staking yields.

5. Conclusion

Regardless, ETH's strong fundamentals provide fuel and imaginative space for SBET's market value, also determining the ceiling for SBET's valuation to some extent.

Currently, Ethereum is in a "positive flywheel" situation with multiple favorable factors overlapping. The value of ETH as a "productive asset" is being re-recognized and re-priced by the market, and its on-chain yield mechanisms, scarcity, and future institutionalization process all provide strong upward momentum.

Do you think this round of ETH's rise can support the start of a new bull market? Feel free to leave comments for discussion!

Risk Warning: Be aware of the slowing growth of ETH per share and the risk of ETH price correction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。