# Table of Contents

Comprehensive Analysis of Stablecoin Ecosystem: Mechanism Comparison, Data Insights, and Regulatory Trends

Overview of Stablecoins

Types and Anchoring Mechanisms of Stablecoins

2.1 Asset-Backed Stablecoins

2.2 Over-Collateralized Crypto Asset Stablecoins

2.3 Algorithmic Stablecoins

2.4 Yield-Generating Stablecoins

2.5 RWA-Supported Stablecoins

2.6 Native Stablecoins of Public Chains/Exchanges

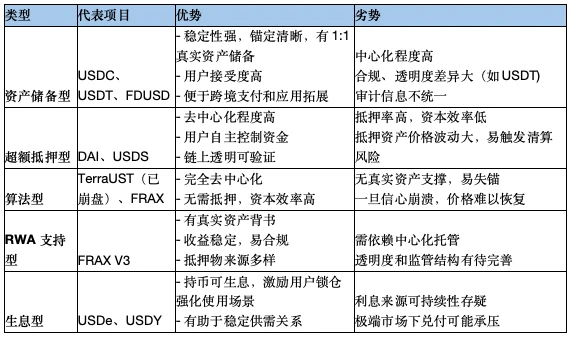

2.7 Comparison of Advantages and Disadvantages of Different Types of Stablecoins

2.8 Programmable Stablecoins

- Core Application Scenarios of Stablecoins

3.1 Medium of Exchange

3.2 Multiple Roles of Stablecoins in DeFi

3.3 Payments and Settlements

3.4 Store of Value and Hedging Assets

3.5 Role of Stablecoins in GameFi and the Metaverse

3.6 Stablecoins as Settlement Tools for RWA

3.7 Others

- Market Status and Development Trends

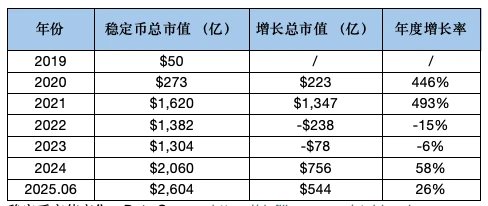

4.1 Total Market Capitalization and Change Trends

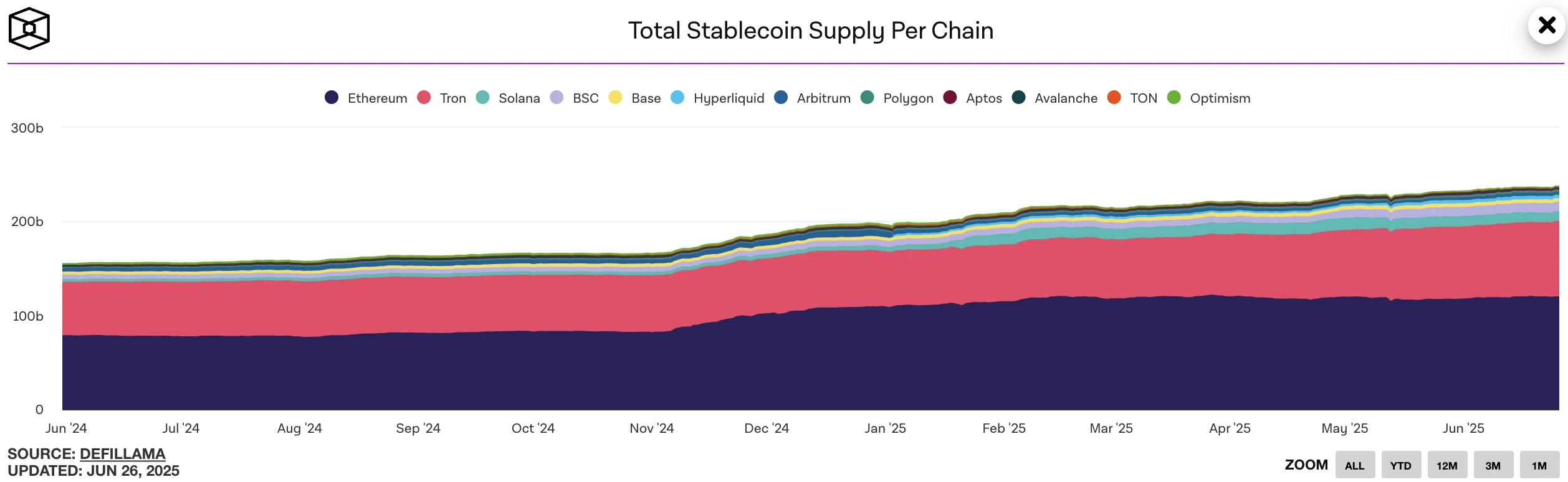

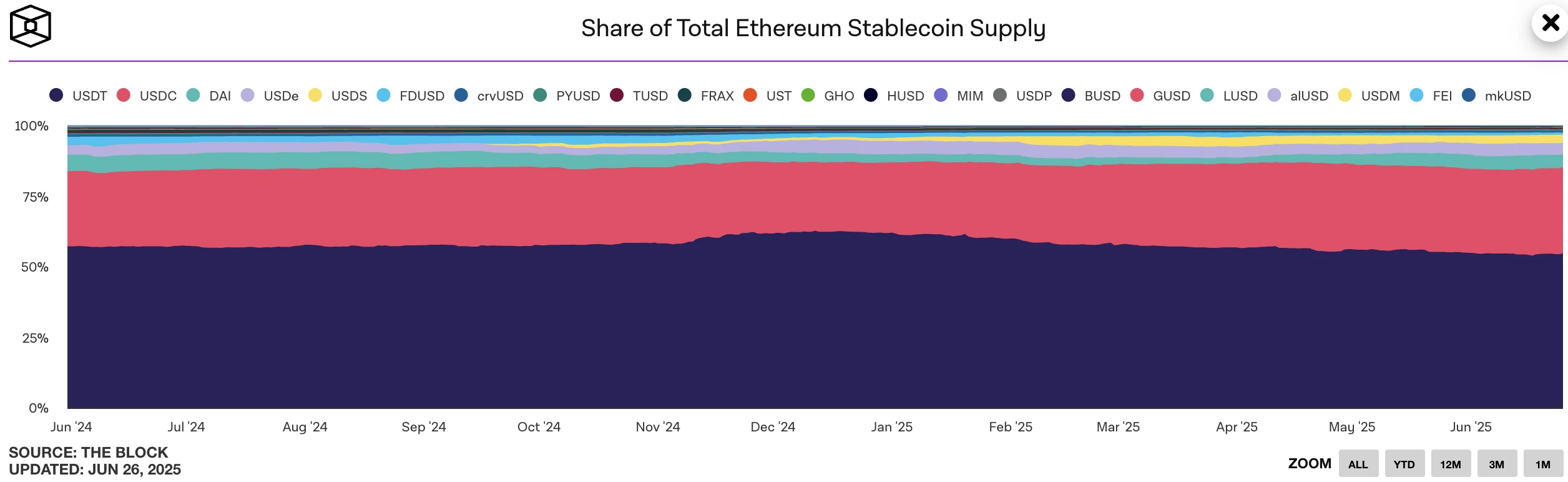

4.2 Competitive Landscape and Market Structure

4.3 On-Chain Data Analysis

- Global Regulatory Policies

5.1 US GENIUS Act

5.2 EU MiCA

5.3 Singapore Stablecoin Regulatory Framework

5.4 Regulatory Policies of Other Countries

- Risks and Outlook

6.1 Risks

6.2 Outlook

References

1. Overview of Stablecoins

Stablecoins are a type of cryptocurrency whose price is typically pegged to a stable asset, such as the US dollar, euro, gold, or even certain commodities. The emergence of stablecoins primarily aims to address the issue of high volatility in cryptocurrencies. One of the earliest stablecoins, Tether (USDT), was created in 2014, promising that for every USDT issued, one dollar would be held in a bank as collateral to ensure that the price of USDT remains pegged to the dollar. Over time, more types of stablecoins have emerged, such as asset-backed, over-collateralized crypto asset, and algorithmic stablecoins.

Stablecoins hold significant importance in the crypto market. They can serve as a hedging tool for users; when market volatility is high, users can convert their crypto assets into stablecoins to avoid risk. Additionally, they are core assets in DeFi, with many lending, trading, and mining products based on stablecoins. Furthermore, they help enhance the liquidity and trustworthiness of the crypto market, as both users and project parties prefer to use stable-priced assets for settlement and storage. Moreover, stablecoins are gradually becoming a bridge connecting traditional finance and the crypto world, allowing fiat currencies to be tokenized, enabling fast transfers globally, and saving on cross-border fees; they can circulate like cash but with faster speeds and lower costs.

With the rapid development of the crypto market, stablecoins have gradually become core assets in scenarios such as DeFi, exchanges, and on-chain payments. This article will provide a comprehensive analysis of stablecoins, considering their market development status, types and mechanisms, application scenarios, policy compliance, challenges, and prospects.

2. Types and Anchoring Mechanisms of Stablecoins

2.1 Asset-Backed Stablecoins

Asset-backed stablecoins (Fiat-collateralized Stablecoins) are a type of cryptocurrency supported by actual fiat currency reserves (such as the US dollar, euro, etc.), typically pegged at a 1:1 ratio to a specific fiat currency. This type of stablecoin is one of the earliest and most mainstream forms, where the issuer usually deposits an equivalent amount of fiat currency or related assets into a bank or centralized custodian account to support the quantity of stablecoins circulating in the market. Users can redeem stablecoins for the corresponding fiat currency at a 1:1 ratio at any time. Its advantages include price stability and ease of use, making it widely applied in trading, payments, and DeFi scenarios. However, it also requires users to trust that the centralized issuer indeed has sufficient reserves, making transparency and audit reports crucial for this type of stablecoin. Typical examples include USDT, USDC, and FDUSD.

2.1.1 USDT

Currently, the market capitalization of USDT is approximately $153.2 billion (https://www.coingecko.com/en/global-charts), making it the highest-valued stablecoin. USDT is issued by Tether, with each USDT backed by equivalent asset reserves to ensure its value stability. The main types of reserve assets include US Treasury bonds, Bitcoin, gold, cash, and cash equivalents. To reassure users, Tether provides daily circulation data and quarterly reserve status, which can be viewed on its official Transparency page (https://tether.to/en/transparency/?tab=usdt). Tether's reserve reports are audited by the independent accounting firm BDO, providing detailed composition and total amount of its reserve assets, and are regularly published to enhance transparency.

According to the latest data from Tether's official website, in the first quarter of 2025, the circulating supply of USDT increased by approximately $7 billion, and the number of user wallets grew by about 46 million. As of March 31, 2025, Tether's total reserve assets amounted to $149.2 billion, exceeding its total liabilities of $143.6 billion, showing an excess reserve of approximately $5.59 billion.

Figure 1. The last Reserves Report (March 31, 2025) of Tether. Source: https://tether.to/en/transparency/?tab=usdt

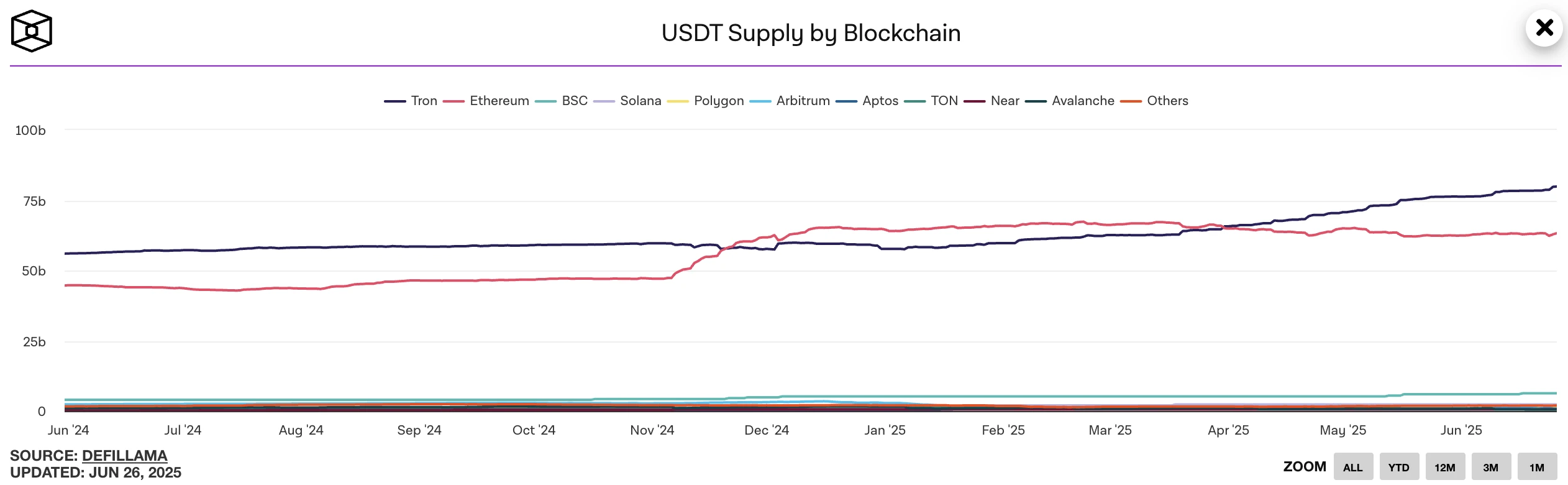

Currently, USDT supports more than a dozen mainstream blockchains, including Ethereum (ERC-20), Tron (TRC-20), BNB Chain (BEP-20), Solana, and Ton. Initially, USDT was mainly issued on the Ethereum chain (ERC-20), but as transaction fees increased, more users shifted to the lower-cost Tron chain (TRC-20) for transfers. Currently, over half of USDT circulates on Tron, reflecting users' demand for high-frequency, small-amount, low-fee cross-border usage. This also indicates Tether's flexibility in on-chain deployment strategies, allowing for rapid adjustments based on market feedback.

Moreover, USDT holds an irreplaceable position in practical use cases. In almost all mainstream centralized exchanges globally (such as Binance, Coinbase, OKX, etc.), USDT is the default trading unit. In the DeFi space, it also has a wide range of applications, serving as a primary trading pair on many decentralized trading platforms (such as Curve, Uniswap). Additionally, in emerging market countries (such as Argentina, Turkey, etc.) and in cross-border payments and OTC trading, USDT is widely accepted due to its strong liquidity and ease of exchange.

Although USDT is the largest and most widely used stablecoin globally, its path to compliance has not been smooth. Tether was fined $41 million by the US Commodity Futures Trading Commission (CFTC) for insufficient information disclosure. To date, USDT has not obtained the electronic money issuer license required by the EU MiCA, nor has it applied for a federal regulatory stablecoin license in the US. As regulatory frameworks tighten in various countries, USDT still needs to continuously improve its compliance transparency; otherwise, it may face risks of restricted circulation in certain regions.

With the implementation of the EU MiCA and the US GENIUS Act, stablecoins will gradually enter an era of stringent regulation. If USDT wishes to maintain its leading position in the global stablecoin market, it must not only sustain its market circulation advantages but also enhance its regulatory compliance and information disclosure standards. Otherwise, even if it currently holds the highest market capitalization share, it may lose its first-mover advantage in a new round of compliance reshuffling.

2.1.2 USDC (USD Coin)

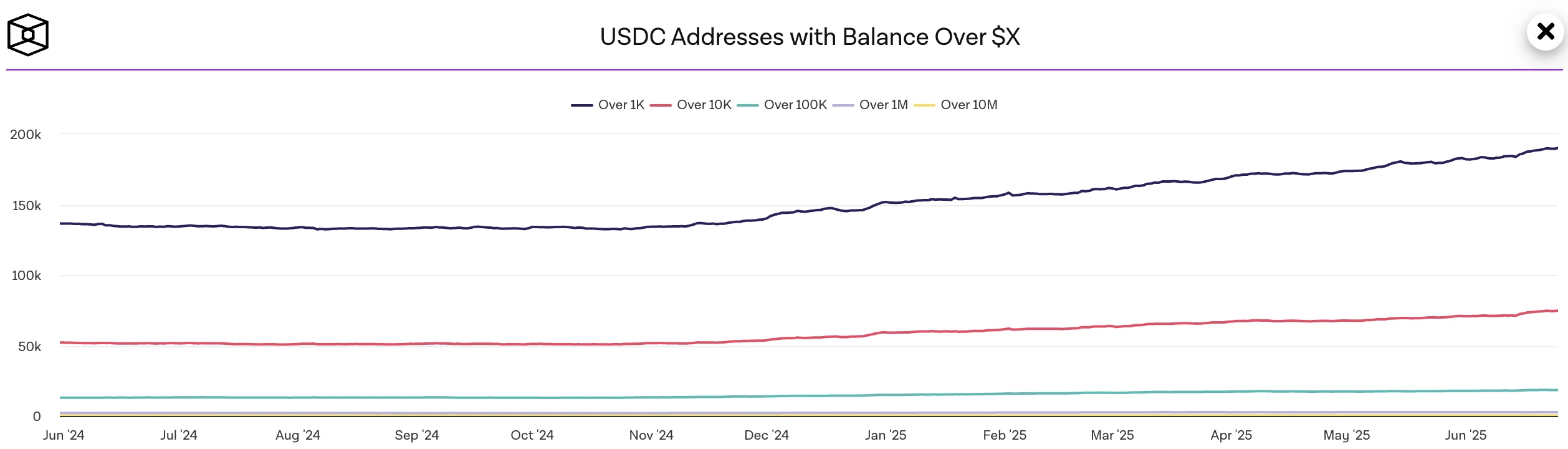

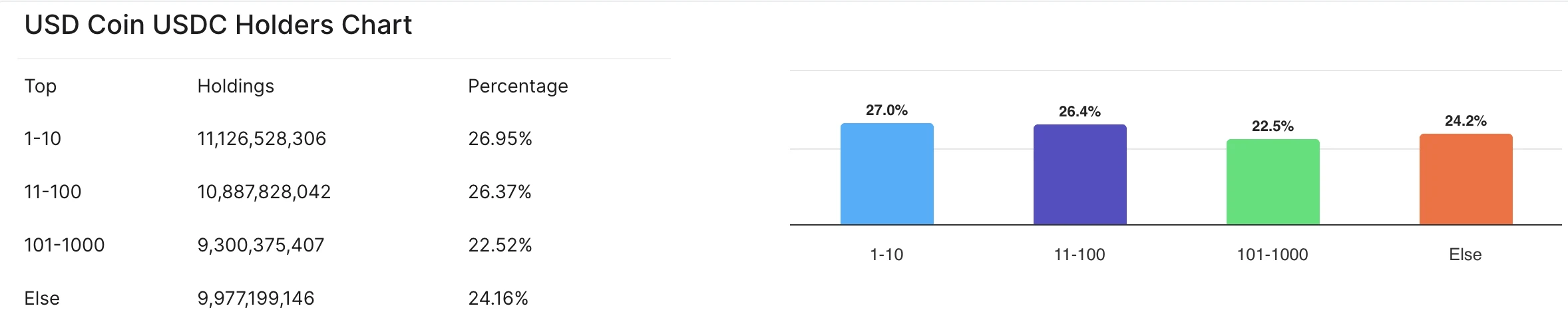

USDC (USD Coin) is issued by Circle, aiming to combine the stability of the US dollar with the flexibility of blockchain, providing a digital dollar that can be traded quickly, securely, and at low cost globally. USDC is currently the second-largest stablecoin by market capitalization, with a market cap of approximately $61.18 billion, second only to USDT.

USDC is 100% backed by highly liquid cash and its equivalent assets (such as short-term US Treasury bonds, cash, and repurchase agreements), allowing users to redeem it for US dollars at a 1:1 ratio at any time. Its reserve funds mainly consist of the Circle Reserve Fund (USDXX) and cash. USDXX is a government money market fund registered with the US Securities and Exchange Commission (SEC), primarily composed of cash, short-term US Treasury bonds, and overnight repurchase agreements. The cash reserves are held in some of the world's strongest, most liquid, and strictly regulated top banks (such as Bank of New York Mellon).

In terms of transparency and auditing, Circle provides users with real-time reserve asset and circulation data, with reserve assets independently reported daily by BlackRock, available for public review. Additionally, a monthly audit report issued by the independent accounting firm Deloitte ensures the transparency and security of USDC's reserve assets, enhancing user trust.

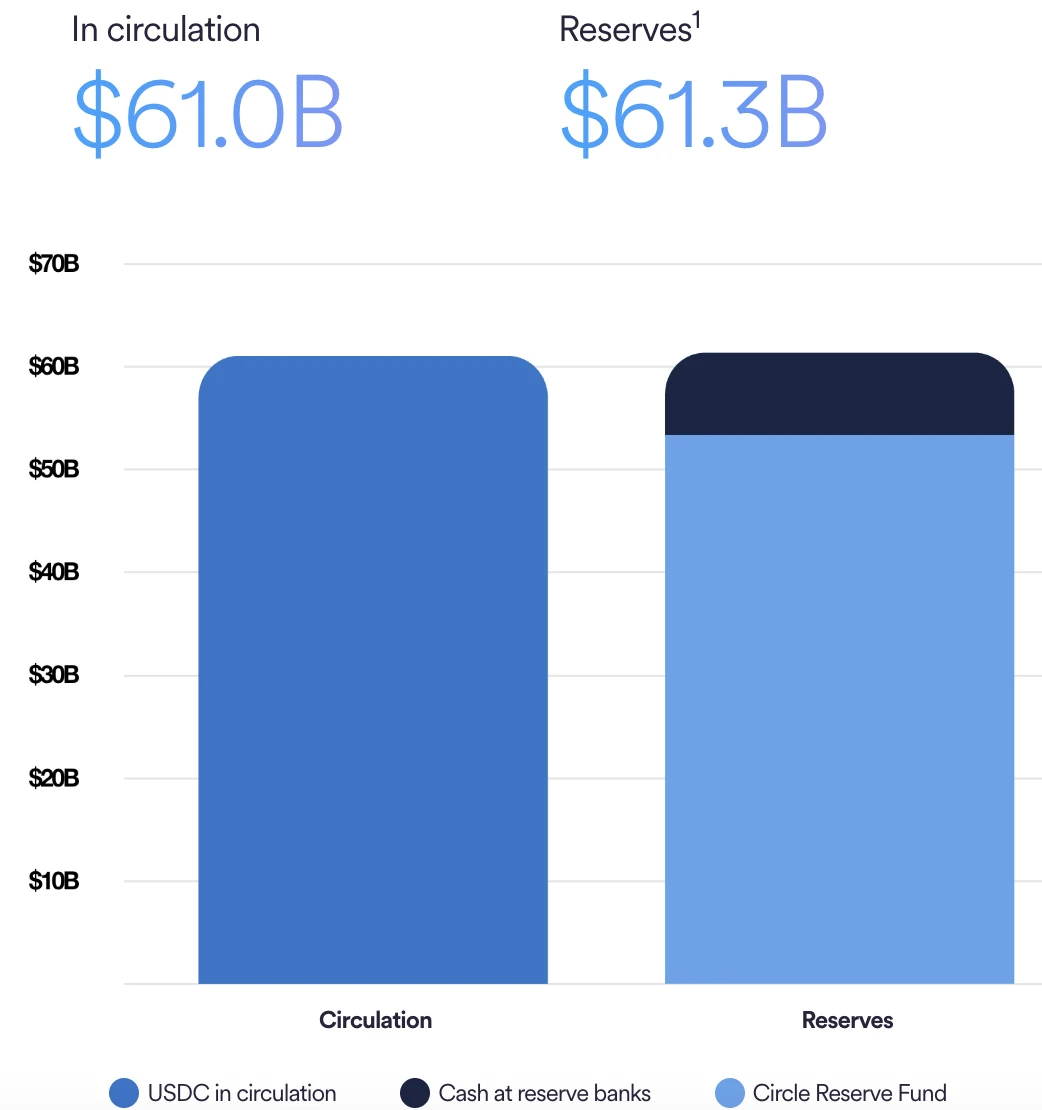

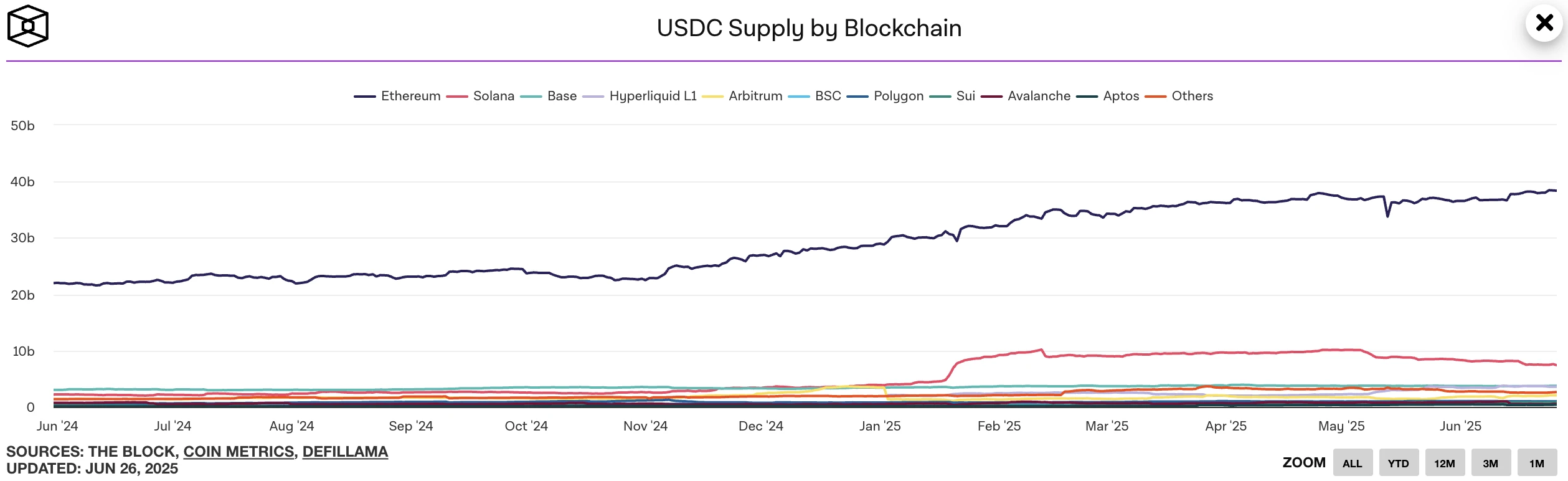

According to data released by Circle, as of June 2025, the total issuance of USDC was $61 billion, with total reserve funds amounting to $61.3 billion. It has been natively issued on more than 15 public chains and listed on over 100 exchanges, allowing users to transfer, save, pay, and trade in DeFi at very low costs in over 180 countries worldwide.

Figure 2. USDC Reserves composition. Source: https://www.circle.com/transparency

USDC currently supports native issuance on over 15 mainstream blockchains, including Ethereum, Solana, Avalanche, Base, Polygon, Arbitrum, Optimism, and more. Circle adopts a native issuance approach rather than a bridging method, effectively reducing cross-chain asset risks. By deeply collaborating with multiple L2 ecosystems (such as Base and OP Stack), it strengthens its underlying position in Web3, making it one of the most integrated stablecoins in DeFi and CeFi.

In terms of compliance, USDC has consistently made compliance a core strategy, actively promoting license applications and regulatory connections globally. It is one of the few stablecoins that proactively applied for an EMT (Electronic Money Token) license under the EU MiCA framework and is recognized as a stablecoin issuer in multiple states in the US. Circle also holds a BitLicense issued by the New York State Department of Financial Services (NYDFS) and a money transmission license in California, demonstrating its strong regulatory adaptability. This makes USDC the most compliance-friendly stablecoin currently, making it easier to gain favor from institutions, corporate users, and government departments.

Globally, USDC is not just an on-chain stablecoin; it is rapidly evolving into a payment bridge between Web2 and Web3. Circle has established partnerships with payment giants such as Visa, Mastercard, Stripe, and Worldpay to promote the use of USDC in real-world payments, merchant settlements, and cross-border remittances. For example, Visa has piloted the use of USDC for cross-border settlements in several countries, bypassing traditional banking systems and significantly reducing costs and time delays. This gives USDC the potential to serve as a real financial bridge that surpasses traditional stablecoins.

2.1.3 FDUSD

FDUSD (First Digital USD) is issued by FD121 Limited, a subsidiary of Hong Kong's First Digital Labs, and is an asset-backed stablecoin. It adopts a 1:1 reserve mechanism, meaning that for every FDUSD issued, the issuer must deposit an equivalent amount of US dollars or its cash equivalents (such as short-term government bonds, money market instruments) into a regulated custodial account, ensuring that each FDUSD is backed by one dollar's worth of assets. The reserve assets are managed and held by the regulated custodian First Digital Trust Limited and are subject to third-party audits to ensure that the on-chain circulation matches the off-chain reserve assets.

First Digital Labs is part of Hong Kong's First Digital Group, focusing on the research and issuance of stablecoins. It is responsible for the contract deployment, cross-chain issuance, and ecosystem expansion of FDUSD, while closely cooperating with the custodian First Digital Trust Limited to ensure that the issuance process is compliant and secure. The institution has registered as a Virtual Asset Service Provider (VASP) in Lithuania and is actively applying to be included in the proposed stablecoin regulatory framework by the Hong Kong Monetary Authority (HKMA). Additionally, FDUSD employs an asset isolation protection mechanism, meaning that user funds and the company's own assets are completely separated, ensuring that even in the event of company bankruptcy, user assets remain unaffected.

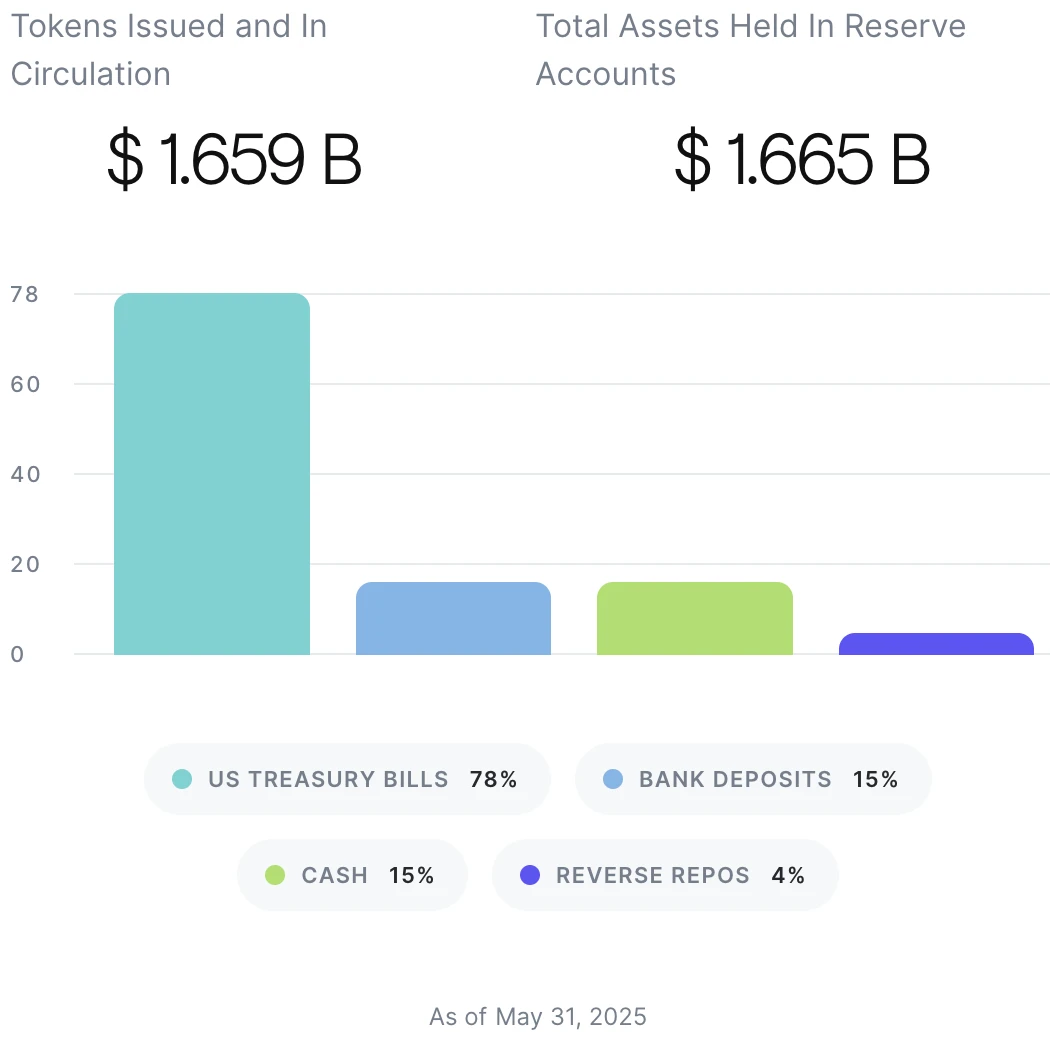

FDUSD currently has a market capitalization of $1.54 billion and is deployed on mainstream public chains such as Ethereum, Solana, Sui, and BNB Chain. According to the latest data updated on May 31, 2025, on the First Digital Labs official website, the total amount of FDUSD issued and in circulation is $1.659 billion, while the total assets in the reserve account amount to $1.665 billion, with reserve assets slightly exceeding the total amount of circulating tokens, ensuring 1:1 reserve support. The reserve assets consist of 78% US Treasury Bills, 15% cash, 4% reverse repos, and 15% bank deposits.

Figure 3. FDUSD Data. Source: https://firstdigitallabs.com/transparency

In terms of collaborative promotion, FDUSD has a close partnership with Binance. At the beginning of 2023, due to regulatory pressure on Paxos, the issuer of BUSD (Binance's own stablecoin), Binance ceased support and promotion of BUSD and urgently sought a compliant, secure, and sustainable next-generation stablecoin alternative. FDUSD, with its solid compliance structure, stable asset reserves, public audit mechanism, and regulatory expectations from the Hong Kong market, became a key focus of support for Binance. Although there is no equity or financial relationship between Binance and FDUSD, Binance provides extensive access at the exchange level for FDUSD, including mainstream trading pairs, zero-fee support, cross-chain deposit and withdrawal functions, and deep integration into Binance's financial and earning products, enhancing FDUSD's liquidity and market usage. Compared to other stablecoins, FDUSD enjoys stronger support and more promotional resources within the Binance ecosystem, making it a priority for promotion following BUSD.

Although FDUSD has not yet obtained a formal stablecoin issuance license in Hong Kong or other major jurisdictions, First Digital Labs is actively applying and maintaining communication with governments and regulatory bodies, which clarifies FDUSD's compliance path and enhances its market recognition, positioning it with the potential to become a mainstream compliant stablecoin.

2.1.4 USD1

USD1 is a stablecoin issued by World Liberty Financial (WLFI) that is pegged 1:1 to the US dollar, aiming to provide users with a stable, secure, and auditable digital dollar option. Each USD1 is backed by equivalent US dollar assets, including short-term US Treasury bonds, bank deposits, and cash equivalents. Its reserves are held by the institutional-grade custodian BitGo and are verified in real-time on-chain through Chainlink's Proof-of-Reserves (PoR) mechanism, enhancing transparency and user trust. Additionally, WLFI states that it will conduct a third-party accounting audit quarterly, but has not yet disclosed specific auditing firms or the content of the audit reports.

USD1 is one of the few stablecoins that supports Chainlink PoR. PoR is an oracle-based on-chain reserve verification system that synchronizes the balances of reserves such as US dollars and Treasury bonds held by BitGo in real-time to the blockchain for public access. This provides unprecedented asset transparency for users, auditors, and third-party developers. However, while WLFI claims it will conduct regular audits in the future, it has not provided any specific names of auditing firms or detailed reports to date, leaving room for further information disclosure to enhance credibility.

One significant reason for the widespread attention on USD1 is its political background. Its issuer, WLFI, is currently controlled by the Trump family, with Trump being referred to as a crypto advocate in this project. His sons, Eric Trump and Donald Trump Jr., serve as Web3 ambassadors, while his youngest son, Barron Trump, is dubbed a DeFi pioneer. Although WLFI publicly claims that its governance mechanism has community characteristics, in reality, core decision-making power involving the Trump family is not open to ordinary token holders, and decentralized governance remains a subject of significant controversy. This strong political color has led USD1 to be commonly referred to as a Trump-affiliated political stablecoin, creating a unique label in the market.

USD1 has been deployed on Ethereum and BNB Chain, with plans to expand to more mainstream chains. Users can purchase it through centralized exchanges that support this stablecoin (such as Binance) using US dollars or other stablecoins (like USDT, USDC), or obtain it through OTC or DEX trading methods. Additionally, large users or institutions that support off-chain bank transfers can mint or redeem in real-time through BitGo-controlled platforms, with the process requiring strict KYC certification.

Regarding compliance, USD1 has not publicly obtained relevant licenses from the EU MiCA or US financial regulatory agencies. Its strict KYC mechanism and custodial arrangements indicate its intention to comply with the requirements of major jurisdictions, but due to the lack of publicly available third-party audit reports and regulatory approval documents, the market remains somewhat cautious about its compliance. Compared to stablecoins that have actively applied for and hold compliance licenses (such as USDC and FDUSD), USD1 still has room for improvement in transparency and regulatory cooperation.

USD1 officially launched in March 2025, leveraging its strong political background and market expectations to gain support from multiple mainstream exchanges within a few months, quickly surpassing the cold start phase. As of now, its market capitalization has exceeded $2.1 billion, placing it among the top ten stablecoins by market capitalization. This performance reflects the market's high attention to its political endorsement and reserve model, while also highlighting the unique appeal of political capital combined with financial instruments in the current crypto market.

In the future, if USD1 can improve audit transparency and clarify regulatory permissions, it will be more favorable for obtaining legal circulation qualifications in major global markets, enhancing the confidence of users and institutional investors.

2.2 Over-Collateralized Crypto Asset Stablecoins

Over-collateralized crypto asset stablecoins ensure the value of the stablecoin by collateralizing more cryptocurrency than the amount issued. For example, if a user wants to obtain $100 worth of stablecoins, they need to lock up $150 or more worth of crypto assets (such as ETH, BTC, etc.) in a smart contract. This over-collateralization method can mitigate the risks associated with the high volatility of cryptocurrency prices, ensuring that the stablecoin always has sufficient assets to support its value. If the value of the collateralized assets drops significantly, the system will trigger a forced liquidation mechanism to ensure the stablecoin's redemption capability.

This mechanism does not require the intervention of centralized institutions, thus providing a higher degree of decentralization and security. However, since it requires collateralizing more assets than the amount of stablecoins issued, capital efficiency is relatively low, and compared to centralized stablecoins, the barriers to entry for users may be relatively high.

2.2.1 DAI (USDS)

DAI is a decentralized stablecoin launched by MakerDAO, pegged 1:1 to the US dollar, and employs an over-collateralization mechanism to ensure stability. Users can deposit supported crypto assets such as ETH, WBTC, and stETH into the Maker protocol's vault to generate the corresponding amount of DAI. Additionally, users can directly purchase DAI through exchanges for payments, storage, trading, and other purposes. To cope with market fluctuations, the system requires users to over-collateralize, typically with collateralization rates between 110% and 200%; if the value of the collateralized assets falls below the minimum requirement, the system will automatically liquidate part of the collateral to ensure DAI's stable peg.

The Maker protocol also introduced the Dai Savings Rate (DSR) mechanism, allowing users to earn interest by depositing DAI. There is no minimum threshold for DSR, and users can deposit and withdraw at any time. This mechanism is also one of the important tools for stabilizing the price of DAI: MKR holders can adjust the DSR through governance voting. When the price of DAI exceeds $1, the interest rate can be lowered to reduce demand; conversely, the interest rate can be increased to attract users to hold DAI, thus balancing market supply and demand. Currently, DAI's market capitalization has exceeded $3.5 billion, making it one of the most important stablecoins in the DeFi ecosystem.

In September 2024, MakerDAO announced a rebranding, upgrading to Sky Protocol and launching a new stablecoin, USDS, along with a governance token, SKY. USDS is positioned as an upgraded version of DAI, also a decentralized over-collateralized stablecoin, pegged to $1. It supports a variety of collateral assets, including ETH, USDC, USDT, and RWA (real-world assets). Users can voluntarily convert DAI to USDS at a 1:1 ratio or directly exchange USDC, USDT, ETH, or SKY for USDS through the Sky.money platform. At the same time, the existing MKR token can also be exchanged for SKY at a ratio of 1:24,000. It is important to emphasize that DAI and MKR will continue to circulate, and users can choose whether to migrate as needed.

While maintaining decentralization, USDS further enhances its mechanism design and user incentives. Users can deposit USDS into the Sky Savings Rate (SSR) module to receive sUSDS savings certificates, which will automatically grow as the protocol sets interest rates, supporting redemption at any time. Additionally, users can earn STRs (Sky Token Rewards) points, which can be used for future redemption rights or participation in governance. The entire operation is fully executed by smart contracts, with assets managed independently by users, ensuring both security and transparency.

As of now, USDS's market capitalization has surpassed $7.15 billion, making it the third-largest stablecoin globally, after USDT and USDC. Its rapid development not only reflects the market's trust in the Maker/Sky system but also shows a new balance found between compliance and mechanism innovation in decentralized stablecoins.

Although USDS is an upgraded version of a decentralized stablecoin with advanced mechanisms and transparent operations, it also carries some risks. For instance, it relies on crypto assets as collateral, and in the event of severe market fluctuations (such as a sharp drop in ETH), it may trigger large-scale liquidations, affecting stability. Additionally, some collateral assets are real-world assets (RWA), which involve off-chain compliance and execution issues, potentially leading to legal risks. Overall, the innovation of USDS is commendable, but users still need to pay attention to the uncertainties that may arise during its operation.

In terms of compliance, both DAI and USDS are decentralized, over-collateralized stablecoins that emphasize censorship resistance and self-management, but they still face certain challenges in compliance under current mainstream regulatory frameworks. DAI, launched by MakerDAO, is generated entirely based on on-chain mechanisms, without a centralized issuer, and has not obtained financial licenses or provided external audits, making it difficult to meet the requirements for identity verification, reserve compliance, and redemption mechanisms set by regulations such as the EU MiCA and Singapore SCS. Although USDS, as a new generation stablecoin launched after MakerDAO rebranded to Sky Protocol, has introduced some assets with stronger compliance (such as USDC and RWA) to enhance credibility, it still has not been incorporated into any regulatory licensing system. Both are widely used in the DeFi space but lack significant compliance.

2.3 Algorithmic Stablecoins

Algorithmic stablecoins differ from asset-backed or over-collateralized stablecoins; they typically do not rely on fiat or crypto assets as reserves but instead control supply and demand through smart contracts to maintain a 1:1 peg with the US dollar or other fiat currencies.

2.3.1 Terra USD (UST)

TerraUSD (UST) is an algorithmic stablecoin launched by the Terra project, aimed at maintaining a 1:1 peg with the US dollar through a mechanism linked to its sister token, LUNA. The core of UST's price stability lies in its exchange relationship with LUNA. When the price of UST exceeds $1, users can mint UST by burning LUNA, increasing the supply of UST in the market and thus lowering the price. Conversely, when the price of UST falls below $1, users can burn UST to mint LUNA, reducing the supply of UST in the market and raising the price. This mechanism relies on the arbitrage actions of market participants to maintain the price stability of UST.

In 2022, when the price of UST fell below $1, the system's algorithm allowed users to exchange discounted UST for LUNA at a price of $1, leading to a large amount of UST being burned while new LUNA was minted. As more LUNA was released into the market, the price of LUNA rapidly declined, and LUNA was the only support for UST's value. When the price of LUNA plummeted, market confidence in UST further declined, leading to more people selling UST and LUNA, creating panic. This death spiral ultimately caused the price of UST to drop to a few cents, and the price of LUNA nearly reached zero, resulting in the collapse of the entire Terra ecosystem.

The collapse of UST and LUNA had a direct and profound negative impact on the algorithmic stablecoin sector, causing the entire Web3 market to question the mechanisms of algorithmic stablecoins. Algorithmic stablecoins incentivize users to mint or burn tokens through price differentials to maintain their peg, but once market confidence is shaken, the arbitrage mechanism struggles to function, significantly increasing the risk of decoupling. Moreover, algorithmic stablecoins do not hold sufficient or high-quality collateral assets, making it impossible to provide stable value support during large-scale redemptions. To date, while algorithmic stablecoins have not completely disappeared, their market capitalization has significantly shrunk, and multiple countries regard them as high-risk assets. Coupled with regulatory pressures, algorithmic stablecoins may struggle to survive without making changes.

2.3.2 FRAX

Frax was initially a partially collateralized, partially algorithmically adjusted stablecoin that used a portion of assets (such as USDC) as collateral, while the other portion was automatically adjusted by the system's algorithm to maintain price stability. When the price of the stablecoin deviated from the target price, the algorithm would incentivize users to actively mint or burn FRAX through an arbitrage mechanism, thereby adjusting supply and demand to maintain price stability. For example, when the price of FRAX is $1.02, exceeding $1, the system encourages users to mint more FRAX to increase supply: users can use $1 worth of collateral (such as USDC + FXS) to mint 1 FRAX and then sell it on the market for $1.02, earning a $0.02 profit. This increases the number of FRAX in the market, causing the price to revert to around $1. Conversely, when the price is below $1 (e.g., $0.98), users are encouraged to burn FRAX: they can buy FRAX for $0.98 in the market and then redeem collateral assets worth $1 according to the system's settings, earning the price difference. This leads to the burning of FRAX, reducing its quantity in the market and naturally raising the price. This mechanism resembles "market self-regulation," allowing FRAX to maintain a value close to $1 through changes in supply and demand.

Although algorithmic stablecoins are highly decentralized, the entire market lost confidence in them after the collapse of Terra/UST. While Frax is not a 100% algorithmic stablecoin, its partially collateralized + algorithmically adjusted model is still viewed as high-risk. Additionally, various countries have begun tightening regulations on stablecoins, particularly emphasizing that stablecoins must have clear, real, and transparent reserve assets.

To adapt to changes and retain users, Frax made significant improvements in its latest V3 version. Frax V3 abandoned the original partial algorithmic mechanism and fully transitioned to a model that is 100% backed by external assets. Each FRAX stablecoin is now supported by an equivalent value of assets, no longer relying on the market value of the governance token FXS. Users can deposit specific assets, such as USDC, sDAI, short-term US Treasury bonds, overnight reverse repurchase agreements (ON RRP), or FDIC-insured dollar deposits, into the protocol's vault to mint FRAX at a 1:1 ratio. This "full collateralization" model significantly enhances stability and compliance. Frax V3 also introduces a dynamic collateralization rate mechanism. The protocol ensures that the overall collateralization ratio (CR) remains above 100% through algorithmic market operations (AMO) and on-chain governance measures, and it will be adjusted upward as necessary to enhance the system's risk resistance.

In the context of tightening global regulations and a crisis of trust in algorithmic stablecoins, Frax has shifted to a new model supported by 100% real assets, such as USDC, sDAI, and short-term US Treasury bonds, in its V3 version. This transformation helps it align more closely with regulatory requirements from the EU MiCA and Singapore MAS. However, as of now, Frax has not obtained any stablecoin issuance licenses from major countries, nor has it conducted regular third-party audits. Its asset custody is still managed internally by the protocol, lacking an authoritative independent custody mechanism. Therefore, while Frax is actively moving towards compliance, it still has a distance to cover from a regulatory perspective. If it hopes to develop long-term in markets like Europe and the US, it will need to make more efforts in audit disclosure, license applications, and risk isolation.

2.4 Yield-Generating Stablecoins

Yield-generating stablecoins are a type of stablecoin that can automatically generate returns during the holding period. They not only peg the value of fiat currencies like the US dollar but also utilize protocol income or on-chain hedging to generate returns, distributing the interest income from the underlying assets back to the token holders.

The main feature of these stablecoins is that users can automatically earn returns just by holding them, without needing to participate in mining or staking. They are typically backed by interest-generating assets, such as US Treasury bonds, on-chain lending, or staked tokens, and the interest generated is distributed to token holders through a certain mechanism. They function like ordinary stablecoins pegged to the US dollar while also acting as a type of interest-bearing account, allowing users' funds to remain stable while gradually growing. Yield-generating stablecoins can meet the needs of users seeking low-risk options, providing stability while also offering some interest.

2.4.1 Ethena USDe

USDe is a synthetic dollar stablecoin launched by Ethena, using crypto assets as support and employing on-chain custody and centralized liquidity yield. It combines synthetic asset collateralization and smart hedging strategies to achieve a 1:1 peg to the US dollar while generating returns.

USDe uses over-collateralization of crypto assets, where users deposit crypto assets like stETH and ETH into the Ethena protocol. To hedge against the price decline of these assets, Ethena establishes corresponding short positions on centralized exchanges, such as shorting ETH perpetual contracts, thereby creating a portfolio that is insensitive to market fluctuations. This strategy is known as "delta-neutral hedging," aiming to avoid significant fluctuations in the value of the asset portfolio and maintain the dollar value of the collateral relatively stable. The essence of this mechanism is not to directly control the price of USDe but to stabilize the value of the underlying assets, providing assurance for the 1:1 minting of USDe.

However, this does not directly determine whether USDe equals $1. To address this, the Ethena protocol has designed a core arbitrage mechanism based on a delta-neutral strategy to adjust market supply and demand and stabilize the pegged price. When the price of USDe in the secondary market is below $1 (for example, dropping to $0.98), arbitrageurs can buy USDe at a lower price from the market and then go to the Ethena protocol to redeem these USDe for an equivalent amount of underlying crypto assets (such as ETH or stETH) at a 1:1 price. Since the internal pricing at redemption remains $1, arbitrageurs earn a 2% risk-free profit through the operation of "buying at 0.98 and redeeming at 1.00." This arbitrage operation increases market demand for USDe, thereby pushing its price up and gradually returning it to $1.

Conversely, when the market price of USDe is above $1 (for example, rising to $1.02), users can collateralize crypto assets (such as ETH) in the protocol to generate new USDe at a 1:1 ratio and then sell it in the market for profit. For instance, a user can generate 1 USDe by collateralizing $1 worth of ETH and sell it for $1.02, earning a 2% profit. This leads to an increase in the supply of USDe in the market, alleviating the supply-demand imbalance and causing the price to gradually fall back to around $1. This mechanism guides the price of USDe to fluctuate around $1 through market forces, ensuring stability.

In this process, the Ethena protocol obtains protocol cash flow through two main channels: one is funding fee income, and the other is staking income. In the perpetual futures market, a funding rate mechanism is set up to keep the contract price aligned with the spot price. When the market is bullish (high long sentiment), those going long must pay funding fees to those going short. When the market is bearish (high short sentiment), those going short must pay funding fees to those going long. If the current market is bullish (generally long), Ethena's short positions can steadily earn funding fee income. Additionally, some assets that inherently generate yield, such as stETH (staked ETH, which generates ETH staking rewards), also allow Ethena to earn this portion of staking income. Therefore, the entire protocol has cash flow, and USDe is indeed a yield-generating stablecoin supported by income-generating assets.

However, the yield is not automatically distributed to every holder of USDe; only when users stake USDe as sUSDe will they receive protocol dividends. In other words, USDe is a yield-generating stablecoin, but its yield is distributed through sUSDe, and holding USDe itself does not directly entitle users to interest. Users can redeem sUSDe back to USDe at any time, exiting the interest-bearing state.

Furthermore, Ethena employs an off-chain custody mechanism, where all assets supporting USDe are always stored in an institutional-grade exchange custody system. Assets only briefly flow to the exchange during the settlement of funding fees or actual profits and losses, thereby reducing the risk exposure of centralized exchanges.

According to data from Ethena's official website, USDe is currently deployed on 24 public chains, with a user count of 713,000 and a market capitalization of $5.89 billion, making it the fourth-largest stablecoin by market cap, following USDT, USDC, and USDS (DAI).

2.4.2 USDY

USDY (US Dollar Yield Token) is a yield-bearing stablecoin issued by Ondo Finance, which officially defines it as a tokenized note. It is backed by short-term U.S. Treasury bonds and bank demand deposits, held and secured by a trust institution (such as Ankura Trust), ensuring that each USDY is backed by an equivalent amount of U.S. dollar assets. The current market capitalization of USDY is $580 million.

There are two versions of USDY. One is the accumulating USDY, where the token's face value increases daily with earnings, reflecting asset appreciation. The other is rUSDY, which maintains a constant price of $1, with interest income returned through an increase in the number of tokens. For example, if a user purchases 100 rUSDY at $1 each, when the underlying asset's yield causes the price of USDY to rise to $1.01, the price of rUSDY remains $1, but the holder's wallet will automatically increase to 101 rUSDY. This entire process is executed automatically daily based on yield conditions. The two versions can be exchanged for each other, allowing users to choose based on their preferences.

USDY is primarily open to non-U.S. individual and institutional investors. After completing KYC, users can purchase USDY via bank wire or using stablecoins (such as USDC, USDT), and the system will start accruing interest. Ondo mints transferable tokens within 40-50 days, during which users will receive temporary certificates; thus, the actual USDY tokens are typically issued to users' wallets after 40-50 days. Once users' subscription funds enter the system, Ondo Finance will uniformly use these funds to purchase low-risk, high-quality U.S. dollar assets such as short-term Treasury bonds and bank demand deposits, while setting a certain proportion of excess reserves to ensure the adequate collateralization and redemption safety of USDY. Based on the daily interest income generated from these underlying assets, the USDY in users' hands will gradually appreciate (or automatically increase in quantity in the form of rUSDY), achieving a stable peg to the U.S. dollar while automatically earning yield. Throughout this process, users do not need to stake or manually operate; the yield is automatically generated and distributed.

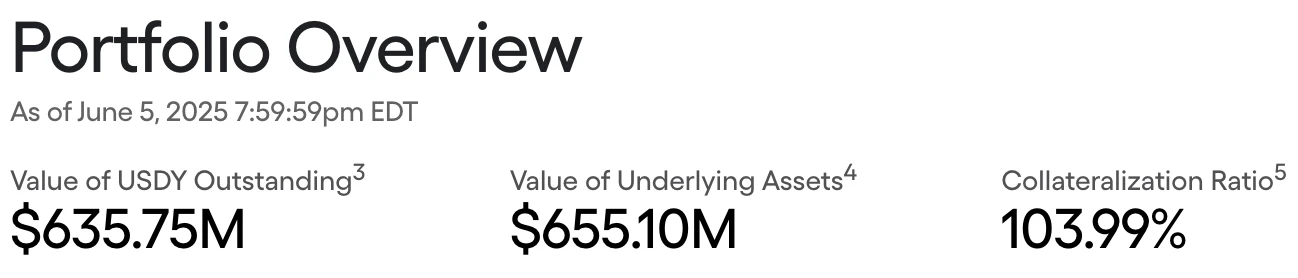

USDY ensures asset transparency and reserve safety through various means. Ondo Finance regularly discloses the assets held behind USDY, including short-term Treasury bonds and demand deposits from regulated banks, and manages them through a trusted custody institution. Every week, the official team releases a transparency report detailing USDY's total supply, the proportion of various underlying assets, cash reserves, and yield rates. According to the latest information updated on June 5 from the official website, the USDY system has issued $636 million in stablecoins, backed by real assets valued at $655 million, with a collateralization rate of 103.99%, reflecting high capital safety and sufficient asset backing.

Figure 4. USDY portfolio overview. Source: https://ondo.finance/usdy

2.5 RWA-Supported Stablecoins

RWA (Real World Assets) supported stablecoins are those issued with real assets (such as cash, government bonds, commercial paper, etc.) as reserve backing. These stablecoins typically emphasize asset transparency, compliance, and auditing mechanisms.

2.5.1 USD0

USD0 is an RWA-supported stablecoin launched by Usual Protocol, where all minted USD0 is fully backed by real assets, meaning the reserve amount is greater than or equal to the circulating amount, ensuring a 1:1 peg.

The collateral assets supported by Usual are primarily U.S. Treasury bills (T-Bills), but it does not directly hold these real-world assets. Instead, it collaborates with professional RWA platforms to achieve access. For example, platforms like Hashnote, Ondo, and Backed hold real short-term U.S. Treasury bonds and tokenize them. Usual collaborates with these platforms to bring their issued on-chain T-Bills assets into the protocol as collateral backing for the USD0 stablecoin. To simplify user experience, Usual packages T-Bills assets from different platforms into a universal collateral asset—USYC. When users actually use it, they do not need to worry about which institution the specific assets come from; they only need to interact with USYC.

There are two ways for users to participate. The first is for users holding tokenized RWA. These users typically obtain tokenized T-Bills through third-party platforms (such as Hashnote) and collateralize these qualifying assets to the protocol via Usual's daoCollateral contract, which will automatically mint USD0 stablecoin at a 1:1 ratio. Upon redemption, users can also use this contract to exchange USD0 back for the original collateral assets. The second way is for users who do not have RWA assets but wish to obtain USD0. These users can choose an indirect participation method: they only need to deposit USDC, and the Usual protocol will call upon USYC assets that have already been pre-collateralized by other providers (Collateral Providers) in the system to mint an equivalent amount of USD0 for the user. Meanwhile, the USDC paid by the user will be transferred to the Collateral Provider as their liquidity income source, and the provider will also receive incentives in USUAL tokens.

Through the above mechanisms, users can smoothly participate in Usual's stablecoin system, whether or not they own tokenized RWA. The design of USYC helps the protocol integrate various sources of real-world assets behind the scenes, ensuring stability and compliance while providing users with a simple, safe, and efficient experience.

At the same time, Usual has also launched a derivative product of USD0 called USD0++, which is essentially a yield-bearing USD0. Users can deposit their USD0 into Usual's yield pool, receiving an equivalent amount of USD0++, representing the principal (USD0) they deposited and the interest that continues to accumulate in the pool. The protocol uses these USD0 deposited by users to collateralize and mint more USYC or execute other low-risk RWA strategies, and the generated yield will be proportionally distributed to USD0++ holders, with USD0++ itself continuously appreciating. When users redeem, they can exchange USD0++ for a larger quantity of USD0, thus obtaining yield. The incentives for USD0++ are released linearly, with the longest release period being four years. If users exit midway or withdraw assets, the unvested incentives will be partially deducted or unavailable for claim, encouraging users to participate long-term and enhancing the protocol's capital stability and liquidity safety.

USD0 currently has a market capitalization of approximately $619 million. According to official data from Usual, the collateral assets for USD0 are about $620 million (mainly USYC), with a collateralization rate of 100.81%, indicating sufficient capital reserves.

Figure 5. USD0 reverse data. Source: https://usual.money/

In terms of compliance, Usual does not directly custody real-world assets (such as government bonds) but obtains tokenized versions of these assets (like T-bills tokens) through compliant RWA platforms, which are mostly already in line with relevant financial and securities regulatory standards. The tokenized T-bills issued by these platforms are conducted within a legal framework, providing Usual with a foundation for compliant asset sourcing. At the same time, the Usual protocol itself is decentralized, with all processes of collateralization, minting, and redemption completed through on-chain smart contracts, without custody of user assets or involvement of centralized clearing agents, thus achieving bankruptcy isolation and security transparency. The overall design avoids the reliance on traditional stablecoins on bank custody, reducing compliance risks, but attention must still be paid to potential regulatory policy changes that partner platforms may face in the future.

2.6 Native Stablecoins of Public Chains/Exchanges

An increasing number of public chains and exchanges are choosing to launch their own native stablecoins. This type of stablecoin is issued by the public chain team or its core ecosystem, specifically designed for the ecosystem of that chain, deeply integrated into core modules such as trading, lending, and governance, aiming to reduce reliance on external stablecoins like USDT and USDC, and enhance the stability and autonomy of the on-chain financial system.

2.6.1 BUSD (Binance USD)

BUSD was initially issued in collaboration between Binance and Paxos Trust Company and is an asset-backed stablecoin. Each BUSD is backed by a real reserve asset of $1, which includes bank deposits or short-term U.S. Treasury bonds, held by the regulated U.S. financial institution Paxos, and is subject to regular third-party audits to ensure that the number of BUSD on-chain corresponds exactly to the off-chain dollar reserves.

BUSD adopts a model of off-chain custody and on-chain issuance, with reserve assets stored in the traditional financial system (such as bank accounts and money market instruments), while the on-chain BUSD (ERC-20 token) is minted and distributed by Paxos, which users can exchange for dollars. Through the Paxos website, users can submit redemption requests to convert BUSD back to off-chain dollars.

In February 2023, the New York Department of Financial Services (NYDFS) required Paxos to stop issuing BUSD, primarily due to a review of its regulatory compliance. Although there were no explicit allegations of wrongdoing against Paxos, regulatory concerns about its compliance risks were raised. Consequently, the official announcement was made to cease the minting of new coins, while existing BUSD could still be redeemed for dollars and continued to be protected by custody. Subsequently, Binance gradually halted new lending activities related to BUSD, canceled trading pairs, closed withdrawal channels, and began converting users' BUSD balances into new coins like FDUSD. Currently, it is no longer possible to mint new BUSD through any official or legal channels. Over time, the circulation of BUSD will gradually decrease, ultimately exiting the market. As of now, the market capitalization of BUSD is approximately $310 million.

The BUSD incident highlights the importance of compliance regulation for stablecoins, as compliant stablecoins are more secure for long-term operation. At the same time, this incident also reflects the regulatory risks faced by centralized stablecoins and the strong demand for transparency; third-party audits and asset disclosures are key to gaining user trust.

In addition to BUSD, major public chains have also begun exploring and planning their own native stablecoins in recent years to enrich their ecosystems and enhance user experience. For example, Berachain has issued the collateralized stablecoin Honey, which achieves price anchoring through its multi-asset collateral mechanism; Base plans to launch USDb, aiming to create a native stablecoin pegged to the dollar to support a wider range of DeFi applications; Layer 2 solutions like Arbitrum and Optimism are also actively exploring the launch of their own stablecoins to address cross-chain and scalability needs. These stablecoins typically adopt models of over-collateralization or asset reserves, balancing security and liquidity, thereby promoting ecosystem prosperity and efficient capital circulation.

2.7 Comparison of Advantages and Disadvantages of Different Types of Stablecoins

The types of stablecoins mentioned above include: asset-backed, crypto-collateralized, algorithmic, RWA-supported, and yield-bearing, among others. Different types of stablecoins have their own strengths and weaknesses in terms of stability, security, decentralization, and compliance.

Fiat-backed stablecoins (such as USDC, USDT, FDUSD) are currently the most widely used and most supported by regulation. These stablecoins are typically backed by 1:1 dollar or short-term U.S. Treasury bonds, held by centralized institutions. This gives them excellent performance in price stability and user acceptance, but they also face issues of centralization and varying transparency, with some projects (like USDT) being questioned due to insufficient information disclosure.

Crypto-collateralized stablecoins (such as DAI, USDS) use on-chain crypto assets like ETH and stETH as collateral, generating stablecoins through over-collateralization. This mechanism has a high degree of decentralization and self-custody of funds, but due to the volatility of underlying assets, it may trigger liquidation risks. Additionally, low collateral efficiency limits its large-scale use.

Algorithmic stablecoins (such as the now-collapsed TerraUST) attempted to maintain their peg through system algorithms adjusting supply and demand, but they are prone to collapse when market confidence is low, leading to their gradual elimination in recent years. Some projects (like the original FRAX) adopted partial algorithmic mechanisms but have now transitioned to 100% collateralization to meet stricter regulatory requirements.

RWA-supported stablecoins (such as USD1, Frax V3, sDAI) combine blockchain and traditional financial assets, using real assets like short-term U.S. Treasury bonds and money market funds as collateral. These stablecoins have clear advantages in security and compliance and are increasingly favored by policies, but they also face issues of centralized custody and audit dependency.

Yield-bearing stablecoins (such as USDe, USDY) embed yield functions into the stablecoin mechanism, allowing users to automatically earn interest by depositing into the protocol. These stablecoins not only meet basic pegging requirements but also incentivize users to hold and lock up their assets, increasing stability and usage rates. However, if the sources of interest (such as protocol income, RWA returns, etc.) are unsustainable, it may create redemption pressure and risks, especially under extreme market conditions that could affect redemption capabilities.

In summary, the future development trend of stablecoins is moving towards greater transparency, compliance, and security. Asset-backed and RWA-supported stablecoins may gain a larger market share under policy promotion, while crypto-collateralized stablecoins will continue to play their role in decentralized ecosystems. Each type has its own application scenarios and risks, and users and developers need to make reasonable choices based on their needs.

2.8 Programmable Stablecoins

In addition to the traditional types of stablecoins mentioned above, the concept of programmable stablecoins has gradually emerged in the public eye in recent years.

2.8.1 Programmable Money

With the development of blockchain technology, the role of digital currency has evolved beyond just being electronic cash; it is gradually acquiring the ability to operate with built-in rules, meaning that the currency itself can automatically execute and make payments based on preset conditions. This concept is known as programmable money, which essentially combines currency with program code, allowing for more flexible, secure, and intelligent use of funds.

The idea of programmable money first emerged in the early days of Bitcoin, where some technical communities wanted to ensure that funds could only be transferred under certain conditions. However, due to Bitcoin's very limited scripting capabilities, this idea remained theoretical.

In 2015, Ethereum introduced smart contracts, giving digital currency true programmable capabilities for the first time, allowing money to automatically transfer, freeze, or destroy under specific conditions. For example, users can set payments to occur only after a certain task is completed or funds to automatically unlock at a specific time. Since then, money can not only circulate but also automatically adhere to rules. The subsequent rise of DeFi protocols further propelled this trend, managing and executing programmable assets through smart contracts, with increasingly complex usage logic for digital assets and a growing demand for money to operate automatically.

At the same time, central banks around the world are also placing greater emphasis on the value brought by programmable capabilities as they advance digital currencies (CBDCs). For example, China's digital yuan already supports designated use and expiration in certain scenarios; the European Central Bank's digital euro is also testing functionality for restricted use. These developments indicate that programmable money is becoming a new trend.

2.8.2 The Trend of Programmability in Stablecoins

Against the backdrop of the gradual realization of programmable money concepts, stablecoins, as one of the most widely used types of digital assets today, are also evolving towards being smarter and more controllable. The core advantage of stablecoins is their price peg to fiat currencies, such as the U.S. dollar or the euro, making them key tools for hedging volatility, payment settlement, and asset pricing in the crypto ecosystem. Whether users are buying and selling assets on exchanges or engaging in lending and staking within DeFi protocols, stablecoins play the foundational role of on-chain dollars.

However, despite stablecoins operating on public and transparent blockchains, their functions remain relatively simple; most stablecoins are merely transferable and tradable tokens, lacking deeper control capabilities. For instance, while we can trace on-chain funds from one address to another, we cannot know whether they are used for a specified purpose, nor can we prevent them from being used in non-compliant scenarios. For governments, enterprises, or financial institutions, simple address tracking is far from sufficient for regulatory audits or fund usage management.

Moreover, most mainstream stablecoins (like USDT and USDC) adopt a basic account model of "you transfer, I receive," without any built-in usage restrictions or automated rules. For example, you cannot set conditions that the funds can only be used for payroll, automatically disbursed at the end of the month, or only transferred to certified suppliers. Once the funds arrive, the sender loses control. This presents clear limitations in scenarios requiring detailed fund management.

For this reason, the market demand for stablecoins is extending from price stability to rule control and automatic execution. More and more enterprises, institutions, and even public sectors hope that stablecoins can not only preserve value but also automate task execution. They wish to use a stablecoin with settable conditions, allowing for flexible management of fund usage, timing, and recipients, and automatically executing on-chain to enhance efficiency, reduce risks, and meet compliance requirements.

This is the backdrop against which "programmable stablecoins" have emerged.

2.8.3 Definition and Advantages of Programmable Stablecoins

In the summary above, we mentioned the growing call for the intelligence of stablecoins in the market. Against this backdrop, programmable stablecoins have entered the public eye. Simply put, programmable stablecoins build upon the traditional stablecoin's asset price anchoring by further introducing executable rules and conditional logic, making them not only price-stable but also self-managing and rule-compliant.

Traditional stablecoins are like cash in dollars on-chain, freely transferable and usable, but once issued, how the funds are used, who they are used for, and when they arrive is entirely controlled by humans. In contrast, programmable stablecoins resemble a smart check with instructions and a timer, allowing pre-setting of who can receive, when to issue, and where to use, with automatic execution on-chain, reducing human intervention while enhancing fund security and compliance.

These stablecoins are particularly suitable for scenarios that require fine control. For example, on the enterprise side, programmable stablecoins can be used to set up automated salary disbursements, contract-based payment logic for funds released upon completion of deliveries, and so on. In government scenarios, they can be used to restrict education subsidies to designated schools or medical assistance to specific hospitals.

From a financial compliance perspective, the most significant feature of programmable stablecoins is their ability to embed regulatory rules into code, enabling automatic control of funds during their usage. For instance, through on-chain identity systems, it can be set that only users who have passed KYC verification can receive or use such stablecoins, effectively establishing a whitelist system on-chain. Additionally, if an abnormal transaction is detected, smart contracts can automatically freeze the funds, waiting for review or authorization before unlocking, thereby enhancing risk control capabilities. Furthermore, each transaction can be tagged and recorded, facilitating the tracking of fund usage to meet audit and anti-money laundering (AML) regulatory requirements. Compared to traditional stablecoins, which cannot be controlled once issued, programmable stablecoins possess self-regulatory capabilities, making them more applicable in scenarios with high compliance requirements, such as corporate finance, government subsidies, and cross-border settlements.

From a technical implementation perspective, programmable stablecoins are typically hosted and controlled by on-chain smart contract systems, working in conjunction with identity systems (such as DID) and compliance interfaces (such as on-chain KYC and AML modules) to construct a new digital currency system that is automated, controllable, and compliant. Specifically, the DID (Decentralized Identity) system can assign a user an on-chain identity identifier, binding their real-name information, credit status, or qualification certification. Smart contracts can then determine who has the right to use the funds, automatically executing whitelist verification, permission allocation, and other logic. Compliance interfaces provide on-chain KYC (user identity verification) and AML (anti-money laundering) functions to check whether users are compliant, whether addresses pose risks, and whether funds are used for designated purposes. When abnormal situations are detected, it can also trigger automatic freezing or audit alerts.

Because of these capabilities, programmable stablecoins are no longer merely payment tools; they are compliant digital assets that can identify users, understand rules, and execute automatically. This gives them a clear advantage in scenarios with high regulatory requirements, such as corporate financial management, government subsidy distribution, and cross-border payments. Many countries and institutions have already begun related pilot projects and explorations, which will be discussed in the next subsection.

2.8.4 Typical Cases

As the concept of programmable stablecoins gradually transitions from technical ideas to real-world applications, central banks, financial institutions, and Web3 projects around the world are actively exploring related initiatives, attempting to integrate functions such as rule-based payments, usage restrictions, and compliance controls into the stablecoin system to adapt to diverse scenarios like cross-border payments, public fund management, and institutional settlements. Here are a few representative practical cases.

mBridge: A Model for CBDC Cross-Border Programmable Payments

The mBridge project, initiated by the Hong Kong Monetary Authority, the Bank of Thailand, the Central Bank of the UAE, and the Digital Currency Research Institute of the People's Bank of China, is currently one of the most influential cross-border central bank digital currency (CBDC) experiments globally. The goal of mBridge is to build a multilateral digital currency platform specifically for cross-border settlement and payments, addressing the pain points of low efficiency, high costs, and slow transaction times in the current cross-border payment system.

It is noteworthy that mBridge does not issue stablecoins. Instead, it uses the CBDCs issued by the central banks of the participating countries, which are state-backed digital currencies with legal tender status. In simple terms, CBDCs are electronic currencies like digital renminbi or digital baht issued by the state that can circulate on the blockchain, differing from stablecoins like USDC and USDT, which are issued by companies and pegged to the dollar, representing a digital form of sovereign currency.

The innovation of the mBridge platform lies not only in establishing settlement channels between multiple CBDCs but also in introducing preliminary programmable payment capabilities. Users can set conditions for transactions, such as automatic execution only after identity verification, compliance with trade content, and the arrival of a specified time. This mechanism not only enhances the security and compliance of cross-border clearing but also endows CBDCs with flexible rule control capabilities similar to programmable stablecoins.

As an official cross-border collaboration experiment, mBridge provides a clear template for the future digitalization and intelligence of cross-border payments and reflects the trend of global sovereign digital currencies evolving towards automation and rule-based payments.

Circle and Tether: Stablecoin Enterprises Exploring Permission Control

Current mainstream stablecoin issuers are also actively exploring technical implementations for controllable stablecoins. Although these mechanisms cannot yet be fully termed programmable stablecoins, they have already begun to take shape, especially in terms of permission management and risk control.

Taking Circle, the issuer of USDC, as an example, its stablecoin contract includes built-in functions for freezing and recovering funds. In simple terms, Circle has the ability to freeze USDC on a specific address, making it temporarily unable to transfer, and even recover these funds when necessary. These mechanisms are typically used to handle judicial inquiries, freeze stolen assets, or manage sanction lists. While this capability raises questions about centralized control, from a technical perspective, it has taken the first step towards formalizing and controlling fund rules.

Similarly, Tether (the issuer of USDT) also possesses similar capabilities. Tether has repeatedly frozen wallet addresses suspected of criminal activity at the request of law enforcement agencies. This indicates that the smart contracts behind its stablecoin also embed on-chain permission interfaces, possessing a certain degree of dynamic management capability.

However, these functions are currently primarily used for risk control and security purposes, remaining passive controls rather than proactive programmable logic. In other words, they do not automatically execute complex conditional logic on-chain but rather involve platform intervention and manual operations, thus not achieving full programmability.

So, is it possible for stablecoins like USDT and USDC to truly evolve into fully programmable forms in the future?

From the current perspective, achieving flexible programmability for them is quite challenging. First, these stablecoins are widely used in exchanges, DeFi, and daily payments, where users value the characteristics of no barriers and free transfers. Adding rule restrictions and usage bindings could negatively impact liquidity and acceptance. Second, programmability implies setting rules, binding identities, and authorization conditions, which significantly raises the operational costs and understanding thresholds for ordinary users. If the process becomes too complex, it may affect users' willingness to use it and even reduce system efficiency. Finding the right balance between controllability and usability is an important prerequisite for promoting its adoption.

Third, different countries and regions have varying attitudes towards the controllability of funds. For example, in Europe, the digital euro is testing restricted use payments, while in some countries that emphasize free financial markets, imposing restrictions on fund usage may face more legal and political resistance. This difference in compliance perception may lead to fragmentation in cross-border usage, hindering the establishment of a globally unified programmable payment network.

Potential

Programmable stablecoins are ideal tools for enterprise and government payments. Compared to the free transfer model of traditional stablecoins, programmable stablecoins can provide enterprises, institutions, and governments with more refined payment control capabilities. For example, enterprises can set project funding to be released based on progress, and employee salaries can be adjusted based on performance, while governments can restrict subsidies to public expenditure scenarios such as healthcare and education, thereby improving fund efficiency and reducing the risk of misuse.

At the same time, as on-chain smart contracts become increasingly complex, transactions are no longer just about transferring funds; they involve multiple triggering factors such as time, permissions, conditions, and identities. Programmable stablecoins serve as value-bearing tools for these on-chain financial contracts, enhancing execution security and flexibility.

Finally, when programmable stablecoins interact with on-chain identities (DID), on-chain audits, and real assets (RWA), they can achieve more trustworthy and transparent fund flows and asset mappings. For instance, in supply chain finance, payments can be automatically linked to product delivery milestones. In RWA investments, stable returns can be distributed to qualified investors according to contract rules. This combination is expected to truly bridge the gap between on-chain and real economies, promoting deep integration between Web3 and the real economy.

Overall, the future of programmable stablecoins is not just as a smarter payment tool, but as a digital infrastructure that links identity, assets, contracts, and compliance. It is both an extension of real-world compliance and regulatory logic onto the blockchain and a key pivot for the institutionalization and standardization of the on-chain economy. Although it is still in the exploratory phase, its evolutionary path is becoming clearer, with long-term value and potential in areas such as enterprise-level finance, public fund management, and RWA clearing and settlement.

3. Core Application Scenarios of Stablecoins

As an important component of the cryptocurrency market, stablecoins are price-stable and widely used in various scenarios such as payments, cross-border settlements, DeFi, trading, storage, and hedging.

3.1 Medium of Exchange

The three main functions of money include a medium of exchange, a measure of value, and a store of value. The medium of exchange refers to a widely accepted medium used for the exchange of goods or assets. Stablecoins can serve as a medium of exchange for on-chain transaction matching and settlement, especially in centralized exchanges (CEX) and decentralized exchanges (DEX), for pricing and settlement. Stablecoins act as on-chain digital dollars, widely accepted in the crypto market as an intermediary for asset exchanges and a universal tool for on-chain value transfer. Due to their price pegged to the dollar and low volatility, users frequently use them in cryptocurrency trading. For example, most trading pairs on exchanges like Binance, OKX, and Coinbase are priced in USDT or USDC, with stablecoins typically appearing on the right side of trading pairs.

Figure 6. Stablecoins as a medium of exchange. Source: https://www.binance.com/en/trade/BTC_USDT?type=spot

In DEXs like Uniswap, Curve, and Balancer, stablecoins also play a crucial role as important components of liquidity pairs, primarily serving as intermediary bridges for various asset trades. Users can more intuitively assess the prices and values of other crypto assets through stablecoins, avoiding trading losses caused by market volatility. Additionally, many DEX asset exchanges are not matched through order books but are completed through liquidity pools, each consisting of two assets, referred to as a liquidity pair, such as ETH/USDT or BTC/USDC. Liquidity providers (LPs) deposit these two assets in pairs into the pool for others to trade. This helps users buy and sell crypto assets more smoothly, enhancing the overall trading experience. Stablecoins can also circulate quickly between different protocols, becoming the most commonly used and important medium for on-chain value transfer.

3.2 Multiple Roles of Stablecoins in DeFi

Stablecoins play a core role in the DeFi ecosystem, widely used in lending, trading, liquidity provision, and restaking scenarios.

In lending scenarios, stablecoins can serve as both borrowing assets and collateral assets. For example, in mainstream lending protocols like Aave and Compound, users can collateralize crypto assets to borrow stablecoins equivalent to a certain percentage of the collateral value to meet liquidity needs. For instance, if a user holds 10 ETH but does not want to sell it, they can choose to collateralize their ETH in a lending protocol like Aave to borrow stablecoins such as USDC or DAI, equivalent to 60%-75% of the collateral value. Stablecoins are stable in price and have good liquidity, allowing users to invest elsewhere, participate in other projects, or purchase goods. This way, users retain long-term ownership of ETH while obtaining stablecoins that can be flexibly used. If market fluctuations cause the value of the collateralized asset to drop below a certain threshold, the protocol will automatically liquidate the collateral to prevent bad debts.

At the same time, for users with lower risk tolerance, stablecoins can also be used as collateral to borrow other tokens. For example, a user with 10,000 USDC can collateralize it in a lending protocol to borrow tokens like ETH for liquidity mining, leverage operations, or simply to earn deposit interest. This method carries relatively lower risk, as stablecoins have low price volatility and are easy to redeem, making them suitable for conservative investors.

According to CoinLaw data (https://coinlaw.io/stablecoin-statistics/), the total value locked (TVL) in the entire DeFi system reached $120 billion in 2024, with stablecoins contributing 40%, highlighting their important position in lending, trading, and liquidity pools.

Additionally, in liquidity restaking (LRT) and restaking protocols, stablecoins also play a key role. Represented by EigenLayer, these protocols view stablecoins as low-risk, highly liquid underlying assets. On one hand, stablecoins are often used to establish risk buffer pools to help users cope with staking losses or slashing events; on the other hand, many protocols use stablecoins as a means of profit distribution to avoid uncertainties caused by platform token volatility. Some protocols also support using stablecoins alongside other assets as composite collateral to improve capital utilization efficiency. For institutional users with lower risk tolerance, the participation of stablecoins also enhances their trust and willingness to engage in the restaking ecosystem.

Overall, stablecoins have become an indispensable value anchor and liquidity engine in the DeFi system, enhancing protocol security and capital efficiency while providing users with a more stable way to participate.

3.3 Payments and Settlements

Stablecoins are gradually being used for payments and cross-border settlements worldwide, with their greatest advantages being fast transfers, low fees, and global usability, serving as a replacement for the slow and costly transfer processes of traditional banking systems. For example, using stablecoins for cross-border remittances incurs fees of less than half of those charged by traditional banks, and funds can arrive within minutes. According to CoinLaw data, the adoption rate of stablecoins globally increased by 22% in 2024, particularly favored by users in emerging markets, as they effectively combat local currency inflation. Additionally, 50% of cross-border digital transactions utilized stablecoins, demonstrating their significant role in global payments. In terms of remittances, using stablecoins can save an average of about 4.5% in fees compared to traditional bank channels, greatly reducing the cost of cross-border transfers.

On the retail side, consumer usage of stablecoins is also rapidly growing. By 2024, over 25,000 merchants globally accepted stablecoin payments, with approximately 15% of e-commerce transactions using stablecoins. When using stablecoins for payments in physical stores or online, users enjoy real-time checkout and low-cost experiences, avoiding intermediary clearing methods.

Figure 7. Stablecoins gain traction in retail e-commerce transactions in 2024. Source: https://coinlaw.io/stablecoin-statistics/

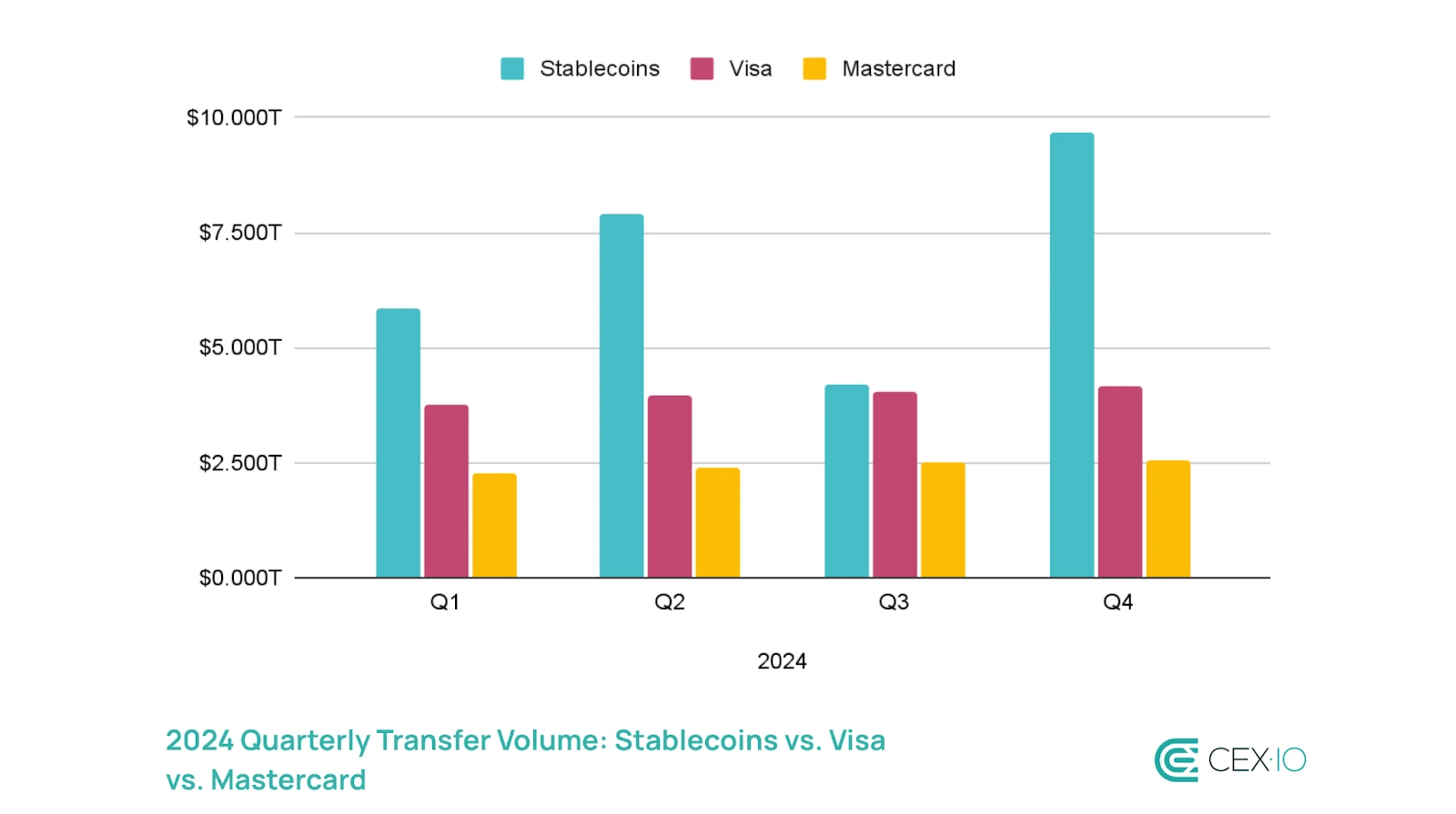

Moreover, in business payment scenarios, stablecoins are gradually becoming the preferred choice for corporate salaries and vendor settlements. According to Rise Works' 2024 Annual Report, 65% of salaries in the crypto sector are paid in stablecoins like USDT and USDC. Major payment companies like Visa and Stripe have also integrated stablecoins (such as USDC) into their settlement networks. According to CEX.IO data, the total transaction volume of stablecoins in 2024 reached between $27 trillion and $35 trillion, surpassing that of Visa and Mastercard. The application of stablecoins in 2024 has expanded into the tokenized asset space, supporting over $250 billion in on-chain securities trading, showcasing their new role in financial asset issuance and settlement.

Figure 8. 2024 Quarterly Transfer Volume: Stablecoins vs. Visa vs. Mastercard. Source: https://blog.cex.io/ecosystem/stablecoin-landscape-34864

It is evident that stablecoins are changing traditional payment systems, playing an increasingly significant role, especially in international payments, corporate settlements, and the digital economy.

3.4 Store of Value and Hedging Asset

Due to their peg to the dollar and stable value, stablecoins are becoming an important store of value and hedging asset for users worldwide.

A store of value refers to an asset that can maintain its value over the long term and is not easily depreciated, suitable for saving for future use, such as gold or the dollar, which are typical store of value tools. For many users living in high-inflation countries, stablecoins are equivalent to digital dollars, providing a convenient and secure means of preserving value. In countries like Argentina, Nigeria, and Venezuela, where local currencies continue to depreciate, many residents find it difficult to easily obtain dollar accounts or physical cash. Stablecoins, however, can be held, transferred, and stored with just a crypto wallet, bypassing banks and foreign exchange restrictions, without relying on any intermediaries, allowing users to control their wealth simply by remembering their private keys.

Stablecoins also serve as a hedging asset. During periods of economic turmoil, local currency depreciation, or war conflicts, users can hedge risks and avoid wealth shrinkage by converting their assets into USDT or USDC. For example, in 2023, Argentina's annual inflation rate reached about 140%, while USDT, pegged to the dollar, maintained a stable 1:1 ratio, making it very popular locally. In countries like Ukraine and Lebanon, which are affected by war or financial control, stablecoins have also become important tools for users to safeguard their assets by circumventing the banking system. Additionally, an increasing number of users in Latin America and Africa are choosing to convert their salaries or savings into stablecoins for long-term holding. Cross-border e-commerce and freelancers often use stablecoins for payments to avoid exchange rate losses; crypto investors also convert their assets into stablecoins after cashing out during bull markets to hedge risks and wait for the next opportunity.

A large amount of data also verifies this trend. According to Chainalysis' 2024 Annual Report (https://www.chainalysis.com/blog/subsaharan-africa-crypto-adoption-2024/), stablecoin trading volume on non-U.S. platforms accounts for over 60% of the global total, primarily concentrated in emerging markets. The latest report released by Chainalysis in 2025 indicates (https://www.chainalysis.com/blog/stablecoin-innovation-in-2025-ep-159/) that in Sub-Saharan Africa, over 30% of on-chain transactions involve stablecoins, with a significant amount used for remittances, savings, and daily payments; stablecoins (especially USDT and USDC) have become key means for users in these regions to cope with local currency depreciation and achieve digital savings.

These data and scenarios indicate that stablecoins are not only financial innovation tools but are also becoming widely applicable digital savings and hedging solutions in the real world.

3.5 The Role of Stablecoins in GameFi and the Metaverse

In the Web3 gaming and metaverse economy, stablecoins are gradually becoming "hard currency," widely used for in-game purchases, NFT transactions, and reward payments. Taking the well-known blockchain game Axie Infinity as an example, it supports players to recharge and withdraw using USDC on the Ronin network, and even directly distribute player earnings in USDC, significantly simplifying the settlement process.

According to the Stablecoin Insider 2025 report (https://stablecoininsider.com/2025/01/01/2025-stablecoin-adoption/), it is expected that by 2025, 65% of blockchain games will integrate stablecoins to simplify payment processes, enhance settlement efficiency, and potentially reduce transaction costs by up to 80%. In the metaverse, stablecoins serve as a value unit linked to the real world, addressing issues of high price volatility of native tokens and inconvenience in cross-platform transactions. Users can use the same stablecoin across multiple metaverse platforms to purchase virtual real estate, artworks, equipment, and other assets without frequently exchanging different game currencies.