On July 15, the well-known financial science popularization YouTuber "Xiao Lin Says" released a video titled "Understanding Stablecoins in One Breath" on mainstream platforms such as YouTube, Bilibili, Douyin, and Toutiao. Within 24 hours, the video garnered over five million views. This marks the first time that content from the cryptocurrency space has entered the public eye in a professional and neutral manner, unfolding the background, significance, and related legislation of stablecoins, allowing more users to understand the intricacies through a science popularization format.

Xiao Lin Says' breakout moment has turned the "crypto industry" into a "mainstream topic."

First, let's review the key points summarized from Xiao Lin Says' video content.

- US dollar stablecoins still dominate, but value is concentrated at the "reach" end

In 2024, the trading volume of stablecoins surpassed the annual payment totals of Visa and Mastercard for the first time. Current mainstream US dollar-pegged stablecoins (such as USDT and USDC) use US dollars or US Treasury bonds as reserve assets, but their actual commercial value is primarily concentrated in the distribution phase. In 2024, Circle's channel distribution fees paid to Coinbase reached as high as $900 million, accounting for 54% of its total revenue. This data clearly illustrates the distribution characteristics of the industry's value chain: true commercial dominance lies in the hands of platforms that have user reach capabilities.

- Compliance has become a watershed in the industry, bringing a "trust premium"

The video points out that the early negative impressions of cryptocurrencies associated with money laundering and excessive speculation are becoming key obstacles to mainstream acceptance. In this regard, Circle's compliance practices provide a successful model—successfully penetrating the mainstream financial market in the United States. With the advancement of the Genius Act, Hong Kong's stablecoin regulations, and the Mica EU legislation, this "compliance premium" is reshaping the competitive landscape of the industry.

- Stablecoins represent geopolitical financial games behind the scenes

The video indicates that the US regulatory attitude towards stablecoins is essentially an extension of dollar hegemony in the digital age. This competitive situation has led traditional financial institutions to enter the fray: banks are concerned about their payment and settlement businesses being eroded, while tech giants covet the benefits of financial infrastructure. Notably, regulatory agencies still strictly limit stablecoins to the payment sector, maintaining a high level of vigilance over their derivative financial services. This policy direction will continue to influence the industry's evolution.

The significance of this breakout video lies in providing us with a rare "external perspective"—through the feedback of 5 million ordinary viewers and the high-frequency keywords in the comment section, we can see the mainstream market's true understanding and expectations of the crypto industry—compliance anxiety and practical skepticism.

1. Crypto compliance and user asset security

In Xiao Lin Says' video, exchange compliance and user asset security occupy an important portion, with a particular emphasis on OKX. For ordinary users, the core concern regarding cryptocurrencies is not "can I profit?" but rather "are my funds safe?" The comments section of the video reflects numerous non-crypto users' concerns about regulatory compliance, fund security, and the potential risk of "Ponzi schemes." These concerns represent the threshold the industry must cross to gain widespread acceptance.

After all, the lessons of history are clear: in 2014, Japan's Mt. Gox lost 850,000 bitcoins due to hacking and mismanagement; in 2022, FTX collapsed due to the misappropriation of user funds, with a market value of tens of billions reduced to zero overnight. These events not only severely damaged industry confidence but also had a significant impact on the market:

- At the beginning of 2023, the total market value of cryptocurrencies was approximately $800 billion, far below the peak in 2021 ($3 trillion).

- The total amount of crypto financing in 2023 was only $9.5 billion (according to Messari data), a 69% decrease from 2022 ($30.7 billion), marking a new low since 2020.

- The 2023 banking crisis (closure of Silvergate and Signature) severed fiat currency channels: crypto companies faced increased difficulty in dollar inflows and outflows, leading to decreased liquidity, reduced financing, and retail investors exiting the market. The dark moment of the market entering a "crypto winter" is a painful price the entire industry pays for regulatory gaps. Embracing crypto compliance proactively is a more challenging path, as it entails high costs.

The video particularly emphasizes the concept of "Proof of Reserves (PoR)." Compared to the reserve models of traditional financial institutions and the layered intermediary models of institutional custody, clear proof of reserves (PoR) is akin to the balance sheet of a publicly listed company, and is more real-time and transparent. There is much hidden yet valuable information within, such as the proportion of mainstream assets, which can be equated to the proportion of core assets; the asset reserve ratio can be equated to an effective indicator of solvency.

Monthly proof of reserves disclosures have now become standard for mainstream trading platforms. Observing OKX's practices over the past two years reveals that, in addition to meeting basic disclosure requirements, they have also established an on-chain monitoring system capable of real-time tracking of suspicious addresses and risk warning capabilities. From OKX's "CEX + Wallet + Pay" integrated strategy, it is evident that this is their commitment to global user safety and product experience. Similarly, we can see that Circle has gained recognition in the US market through its adherence to compliance, which is a long-term credit certification and a response to investors, users, and regulators.

2. Global payment with stablecoins is just the starting point; application is the ultimate goal

When discussing the "global payment system of stablecoins," Xiao Lin Says raised a key point in the current development of stablecoins: although regulatory agencies in various countries still focus on the payment attributes of stablecoins, their future potential goes far beyond that. With the acceleration of stablecoin legislation, global giants are making moves:

- PayPal launched PYUSD in August 2023, becoming the first payment giant to issue a stablecoin;

- Ant Group, JD.com, and other internet companies are actively applying for stablecoin licenses in Hong Kong;

- Traditional financial institutions such as Standard Chartered Hong Kong and China Merchants Bank International are also exploring stablecoin business through joint ventures or sandbox testing.

Currently, over 40 companies have applied for stablecoin licenses in Hong Kong, and JPMorgan CEO Jamie Dimon has stated that he does not understand the appeal of stablecoins, but he will not stand idly by. The industry is currently in a critical transition period: while major institutions are competing for stablecoin issuance rights, the entire market has yet to form a unified understanding of the true value and development path of stablecoins.

As the barriers to issuance lower, true differentiation will be reflected in the ability to construct commercial scenarios. For example, in cross-border payments and e-commerce collaborations, using stablecoins to replace traditional bank remittances (saving 3-5% in fees); promoting merchant access: facilitating the implementation of stablecoins in tourism, gaming, e-commerce, etc.; expanding DeFi participation and lowering barriers; and crucially, establishing compliant channels: enabling fiat currency exchanges through licenses, allowing stablecoins to be truly "usable."

This is why Meta plans to embed payment functions in WhatsApp to create stablecoin applications in social scenarios; Coinbase focuses on building digital wallets with social and gaming attributes; and OKX starts from user demand scenarios, emphasizing digital currency payments and on-chain integration.

OKX establishes a compliant channel for real-time 1:1 exchange between the US dollar and USDC through cooperation with Circle, while also collaborating with banks to optimize fiat currency inflow and outflow processes. At the same time, users can complete stablecoin transfers or make payments at POS terminals through the OKX Pay app. When users can use stablecoins for various scenario payments and conveniently complete exchanges with fiat currencies, the commercial value of stablecoins can truly be fully realized.

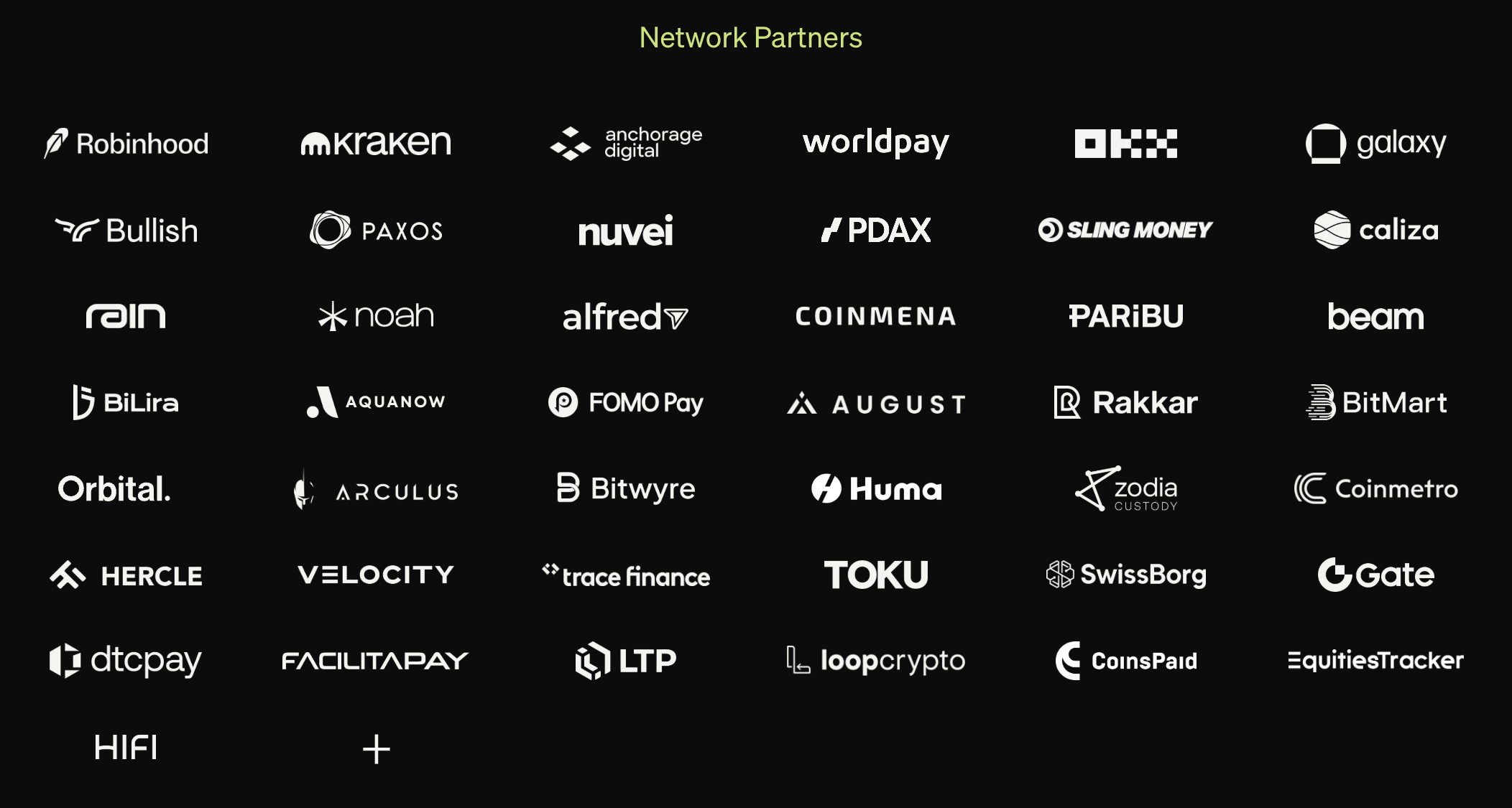

It is evident that companies related to stablecoins are accelerating their collaboration to build an ecosystem, forming a multi-cooperative body in issuance technology, ecological applications, and distribution channels, engaging in fierce competition. For example, Circle and Coinbase's collaboration established the issuance and distribution system for USDC; the Global Dollar Network collaborates with over 30 top companies in the industry, including the mainstream US trading platform Robinhood, cryptocurrency exchange Kraken, and crypto financial services company Galaxy Digital.

Recently, the Global Dollar Network (GDN) announced the issuance of the USDG stablecoin in the EU and announced OKX as a core partner. This is currently the "only" stablecoin that has received regulatory recognition in both Singapore and the EU after USDC, covering over 3 billion users in 450 countries/regions.

Conclusion: The long-termism behind the breakout

Compliance is becoming the ticket to entry, and application scenarios determine the ceiling: when ordinary users can easily use stablecoins for cross-border payments and daily consumption as demonstrated in the video, cryptocurrencies can truly integrate into real life.

Every milestone in the industry's development is hard-earned. Each breakout moment for the crypto industry, every individual or brand that steps into the mainstream spotlight, embodies long-term persistence and effort. Every step they take is a careful layout, a bold attempt, and a steadfast belief, which is why they have reached this point and come before us. Only in this way can they represent the builders of crypto.

Xiao Lin Says' breakout video is not only the beginning of a financial industry innovation revolution for stablecoins but also a reflection of the long-term efforts of crypto industry builders. I believe this is not just a simple instance of being "seen."

Event link: https://www.ouxyi.io/ul/QKb93L?urlSlug=okx-btc-campaign&channelId=aicoin20

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。