Author: Prathik Desai

Translation: Block unicorn

In 2020, Strategy (then known as MicroStrategy) began converting debt and equity into Bitcoin. By purchasing BTC, it became the largest publicly traded Bitcoin holder.

Five years later, the company is still selling software, but the gross profit from operations continues to decline in its overall contribution to the company. In 2024, the operating gross profit dropped to about 15% compared to 2023. In the first quarter of 2025, this figure decreased by 10% compared to the same period the previous year. By 2025, Strategy's approach had been imitated, improved, and simplified, paving the way for over a hundred publicly traded entities to hold Bitcoin.

The strategy is simple: finance the business with low-cost debt, purchase Bitcoin, wait for its appreciation, and then issue more debt to buy more Bitcoin—creating a self-reinforcing cycle that turns the corporate treasury into a leveraged crypto fund. Maturing debt is settled by issuing new shares, thereby diluting the equity of existing shareholders. However, due to the rising value of the company's Bitcoin holdings, the stock price premium offsets this dilution.

Most companies following in Strategy's footsteps have existing businesses that hope to increase balance sheet returns through Bitcoin as an appreciating asset.

Strategy was entirely about appreciation potential, yet it did not want to bear the burden of building a real business. They had no customers, no profit model, and no operational roadmap. They only needed a balance sheet filled with Bitcoin and a financial shortcut to quickly enter the public market. Thus, Special Purpose Acquisition Companies (SPACs) emerged.

These Bitcoin transactions can negotiate valuations in advance and package them under a shell that complies with SEC regulations while avoiding being labeled as investment funds.

The SPAC route makes it easier for companies to pitch their strategies to stakeholders and investors, as there is nothing else to promote besides Bitcoin.

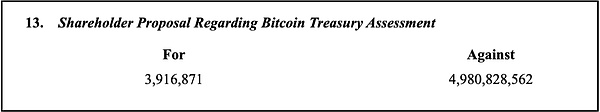

Do you remember what happened when Meta and Microsoft considered adding Bitcoin to their treasury? They faced overwhelming rejection.

For public market investors, SPACs are seen as tools that provide pure Bitcoin exposure without direct contact with cryptocurrencies. It's like buying a gold ETF.

SPACs do face challenges in adoption by retail investors, who tend to prefer more popular avenues for gaining Bitcoin exposure, such as exchange-traded funds (ETFs). A 2025 institutional investor digital asset survey showed that 60% of investors preferred to gain cryptocurrency exposure through registered instruments like ETFs.

Nevertheless, demand still exists. This model fully leverages the potential of leverage.

When Strategy purchased Bitcoin, it did not stop at a one-time purchase. It continuously issued more convertible bonds, which were likely to be redeemed by issuing new shares. This approach transformed a traditional business intelligence platform into a Bitcoin accelerator. During the rise in stock prices, its performance even outpaced Bitcoin itself. This blueprint left a deep impression on investors. SPAC-based Bitcoin companies can also provide the same acceleration effect: buy Bitcoin, then issue more stock or debt to buy more Bitcoin. This cycle continues, forming a closed loop.

When a new Bitcoin company announces it has secured a $1 billion PIPE (Private Investment in Public Equity) backed by institutional support, it showcases to the market that real capital is paying attention. For example, Twenty One Capital gained significant market trust with backing from heavyweight institutions like Cantor Fitzgerald, Tether, and Softbank.

SPACs allow founders to achieve this goal early in the company's lifecycle without first building a revenue-generating product. Early institutional endorsements help attract attention, capital, and momentum, with fewer barriers compared to the investor resistance that publicly traded companies may face.

For many founders, the SPAC route offers flexibility. Unlike IPOs, which have stricter timelines and pricing, SPACs provide more control over narrative, forecasting, and valuation negotiations. Founders can tell a forward-looking story, formulate capital plans, retain equity, and avoid the cumbersome process of traditional VC to IPO financing.

The packaging of SPACs itself is part of the appeal. Going public is a well-known language. Stock codes can be traded by hedge funds, added to retail platforms, and what you are actually buying and how much is still very important.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。