Today's homework is much simpler than yesterday's. The retail data released today, following the CPI and PPI, remains very strong. Although this may be due to expectations around tariffs driving robust consumer spending, data is data. At least for now, the U.S. economy appears to be healthy. It seems we will have to wait until after September to see any signs of a slowdown.

Aside from the retail data, Trump hasn't attacked the Federal Reserve and Powell much today. However, Federal Reserve official Mary Daly's speech today again indicated that it's not just Powell who is at odds with Trump. Although she believes there should be two rate cuts in 2025, she still opposes early rate cuts, which reflects the stance of most Federal Reserve officials.

The voting on the cryptocurrency bill is still ongoing, so I won't dwell on it. There shouldn't be any major issues; it's just a matter of time. Additionally, today BlackRock and Nasdaq finally submitted their application for a $ETH spot ETF to the SEC, with the final approval date set for April 2026. However, the market generally expects approval by the fourth quarter of 2025, which has led to ETH's price nearly touching $3,500.

Although it seems that both investors and the market are in good shape right now, the focus still needs to be on the trends in tariffs and monetary policy, especially regarding Trump's selection of Powell's successor, which is currently of greater concern to investors.

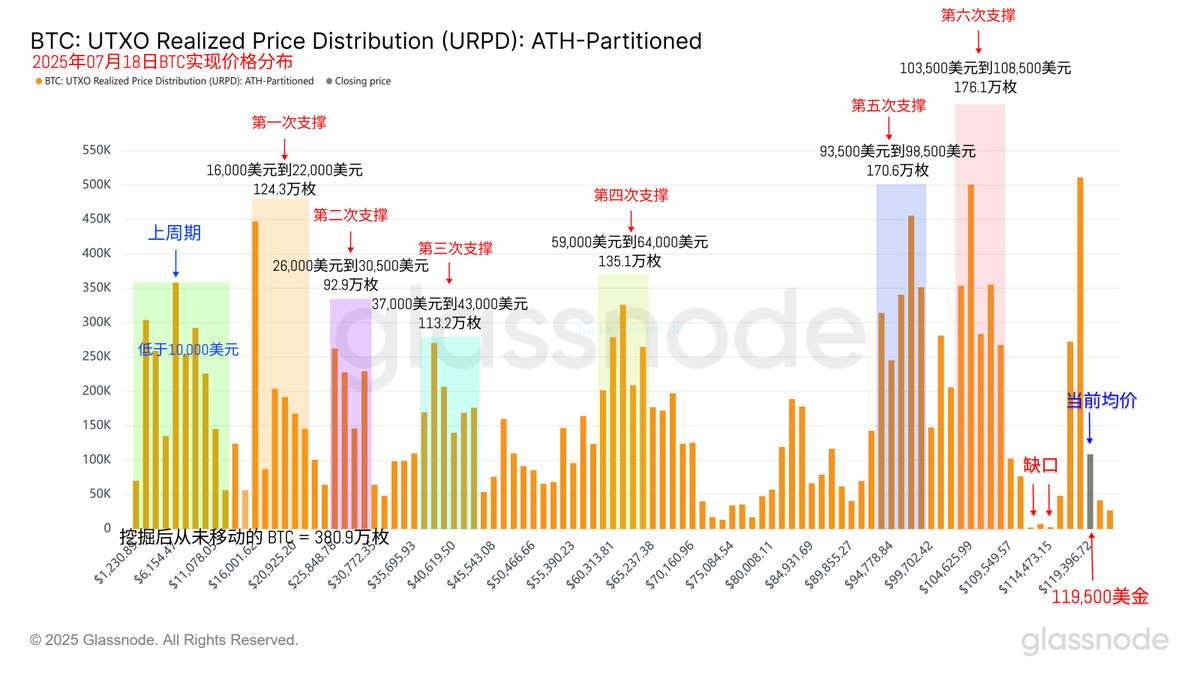

Looking back at Bitcoin's data, although the turnover rate has decreased, it remains at a high level, indicating that investors are still quite speculative. The main sellers are still short-term investors, particularly those with a holding cost exceeding $100,000. The increase in turnover also raises the resistance to $BTC's price upward movement.

The increase in turnover puts significant pressure on support levels, but data shows that the support between $103,500 and $108,500 remains the first stage of support, while the support between $93,500 and $98,500 is even more solid. Overall, as long as there is no systemic risk, the first support level is still quite good.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。