Written by: Bright, Foresight News

On the morning of July 17, the secondary cryptocurrency market experienced a good upward trend. After BTC reached a new high of $123,300, it briefly retraced to $115,678 due to the transfer of BTC by an ancient whale to Galaxy Digital, but BTC has now rebounded to $119,000, reducing volatility.

ETH followed BTC's upward trend, rising 10.32% in a single day, reaching a high of $3,423.27, refreshing its price high in nearly 180 days, and has increased over 140% from the cycle low of $1,384.

Sol reached $176, with a daily increase of 8.84%, showing strong upward momentum. Additionally, established meme coins like Floki and Bonk surged over 30% in a single day. As of the time of writing, BTC is trading sideways at $117,910, ETH is temporarily at $3,327, and Sol is at $170.

The total market capitalization of cryptocurrencies has surpassed $3.85 trillion. As altcoins collectively surged, Bitcoin's market share has dropped to 61.2%, and the altcoin season index has risen to 20, with the fear and greed index climbing to 71, indicating greed. During the same period, U.S. stocks initially fell before rising, with the Nasdaq reaching a new high. The S&P 500 rose by 0.32%, closing at 6,263.70 points. The Dow Jones increased by 0.53%, closing at 44,254.78 points. The Nasdaq rose by 0.26%, closing at 20,730.49 points, continuing to set a record closing high.

Meanwhile, U.S. cryptocurrency stocks surged, with Circle rising 19.39% in a single day, closing at $233.20. Coinbase briefly broke the $400 mark during trading but closed down to $398.20, an increase of 2.62%. MicroStrategy rose over 3.07%, closing at $455.90. SharpLink Gaming, which has accumulated over 300,000 ETH, surged 29% in a single day.

In terms of liquidation data, according to Coinglass, over 117,600 people were liquidated in the last 24 hours, with a total liquidation amount of $414 million, including $301 million in short liquidations and $114 million in long liquidations, primarily from short positions. Among these, $174 million in ETH short positions were liquidated within 24 hours. The largest single liquidation on CEX was ETH-USDT, occurring on Binance, valued at $2.9719 million.

After reaching a new high, BTC has been trading sideways, while ETH, Sol, and various altcoins are catching up, suggesting that the secondary market is showing signs of a typical altcoin season. Previously, ETH was somewhat rejected by the market due to its significant drop and small rise, with ancient ICO whales continuously selling off, causing it to drop to $1,384 in the first half of the year. However, it has now strongly rebounded to $3,400, up over 147% from its low. This impressive rise can be attributed to the increased buying power of bulls, indicating that the so-called "change of hands" has indeed been completed.

Full Support from Ethereum Treasury Company

SharpLink Gaming (SBET), supported by ETH co-founders, is the first company to use ETH as a strategic reserve, having accumulated over 320,000 ETH, surpassing the Ethereum Foundation and becoming the largest ETH holder among corporate entities. SharpLink Gaming raised approximately $413 million in net proceeds through its ATM program from July 7 to 11. Of this, about $156 million has been used to purchase ETH, with the remaining approximately $257 million available for future ETH acquisitions.

BitMine Immersion Technologies (BMNR), which has transitioned from a BTC mining company to an ETH treasury company, disclosed on July 14 that it holds 163,142 ETH, valued at over $500 million. Recently, BitMine announced the pricing and signing of a private placement agreement to purchase and sell 55,555,556 shares of common stock or equivalents at a price of $4.50 per share, with expected total proceeds of approximately $250 million to implement its Ethereum financial strategy. Recently, PayPal co-founder and Silicon Valley venture capital pioneer Peter Thiel acquired 9.1% of BitMine's shares, joining the arms race to accumulate ETH.

Ethereum treasury company BTCS Inc (BTCS) was officially included in the Russell Microcap Index on July 16. Previously, BTCS Inc (BTCS) rose over 18.6% in pre-market trading, with a total ETH holding of 31,855, valued at over $100 million.

Institutional Investors Remain Bullish

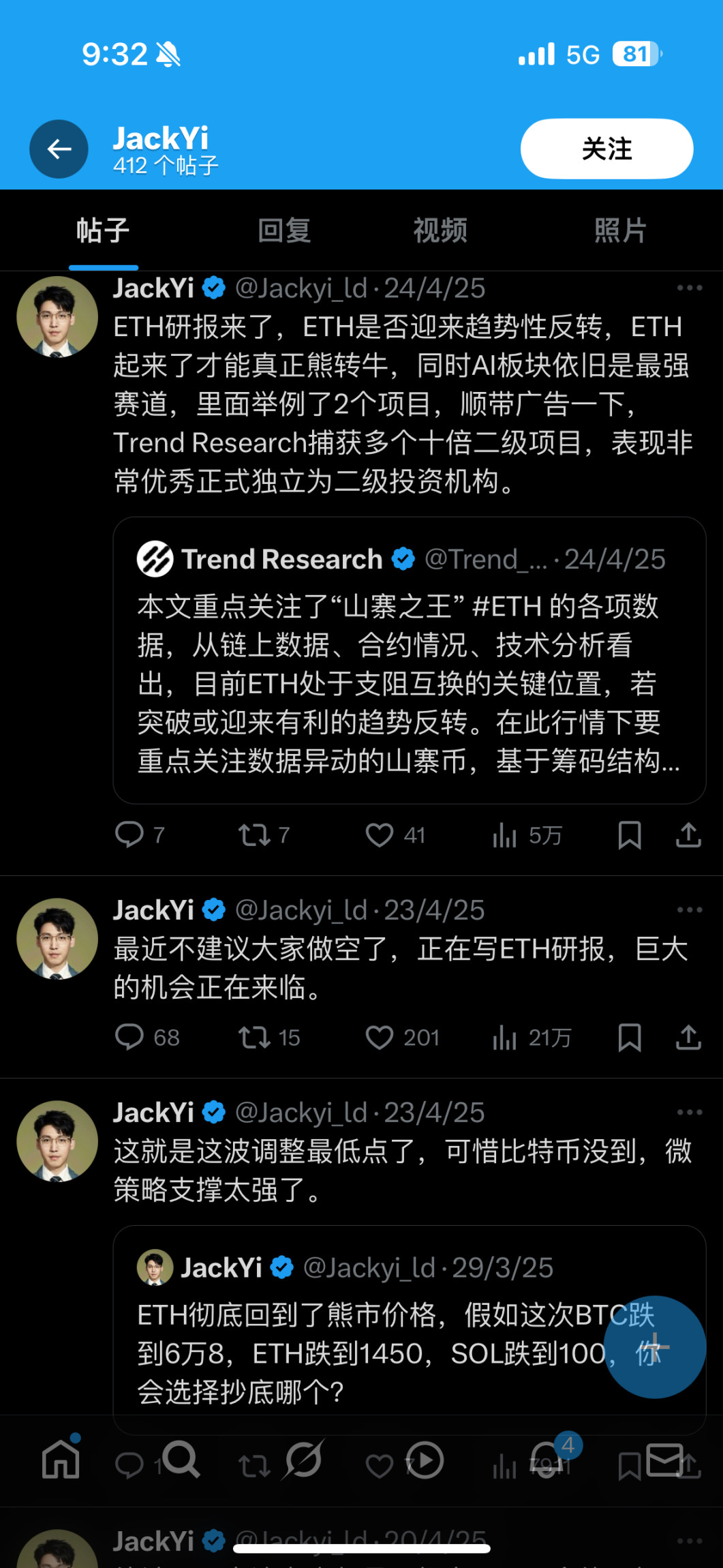

Aside from the reserves of publicly listed companies, institutional investor Jack Yi, leading Trend Research, has played a steadfast bullish role in this round of ETH's upward trend, starting from $1,450 and posting on X that "the entire network is bullish," profiting over $200 million through actual ETH purchases and bullish ETH options.

Recently, Jack Yi stated: "Ethereum at $3,000 is the beginning of the industry's bull market." He emphasized three core reasons for being bullish on ETH:

First, the trend of a major industry bull market, with cryptocurrency policies and expectations of interest rate cuts being core factors for U.S. companies.

Second, Ethereum is severely undervalued; the bull markets in 2017 and 2020 were driven by ICOs and DeFi, while this time it is due to stablecoins and RWA, among others.

Third, consistency in words and actions, patient investment, ignoring all FUD and black swans, with pullbacks being opportunities to increase positions; all upward movements cannot be a straight line.

Additionally, Evgeny Gaevoy, founder and CEO of Wintermute, posted on X that there is almost no ETH available for sale on Wintermute's OTC trading platform, indicating a glimpse of FOMO sentiment.

After the Feast, When to Exit?

However, although ETH has surpassed the $3,400 mark and the altcoin season seems imminent, early investors have already begun to take profits.

Jack Yi has once again taken the lead, stating that U.S. stocks are approaching a local top and are considering taking profits. According to on-chain data monitoring, Trend Research sold 48,946 ETH on July 16, valued at approximately $151 million, to repay its Aave loan. Today, Trend Research transferred a total of 79,471 ETH to Binance, valued at approximately $250 million, for reduction. However, Trend Research's on-chain address still holds 108,000 ETH, valued at approximately $367 million.

The "silent 14-year 80,000 BTC whale" remains an unstable factor in the market, having transferred 9,999 BTC, valued at $1.19 billion, to a new address three hours ago. Any potential sell-off could significantly impact the market.

Overall, while the secondary market is performing well, early profit-takers are already cashing out in bulk. Whether the buying power of new entrants can support the selling pressure from profit-takers remains to be closely monitored.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。