Author: Deng Tong, Golden Finance

On May 27, 2025, sports betting operator SharpLink Gaming, Inc. (NASDAQ: SBET) announced the signing of a securities purchase agreement for a $425 million public company private investment (PIPE), planning to issue approximately 69.1 million shares of common stock (or equivalent securities) at a price of $6.15 per share (with company management team members at $6.72 per share). Consensys Software Inc. led the investment as the main investor, with participants including well-known crypto venture capital firms such as ParaFi Capital, Electric Capital, Pantera Capital, and Galaxy Digital.

SharpLink will use the raised funds to purchase Ethereum (ETH) as the company's primary treasury reserve asset. After the transaction is completed, Ethereum co-founder and Consensys founder and CEO Joseph Lubin will serve as the chairman of SharpLink's board and assist the company in developing its core business as a strategic advisor.

From this point on, SharpLink officially became an Ethereum treasury enterprise, known as the "ETH version of MicroStrategy."

Why is SharpLink transforming into an Ethereum treasury enterprise? What are the important milestones on the path of the ETH treasury strategy? What opportunities and challenges does SharpLink face after the transformation?

I. The Predecessor of SharpLink

SharpLink's predecessor was MER Telemanagement Solutions Ltd., founded in 1995, initially focusing on traditional telecommunications areas such as telecom expense management, call billing, and contact center software. In 2019, it was renamed SharpLink Gaming, primarily focusing on gambling. However, in recent years, it has fallen into serious difficulties: in 2024, revenue declined by 26% year-on-year to $3.66 million, with continued operating losses, and it faced delisting risks due to its stock price being below Nasdaq's minimum standards for an extended period.

II. Important Milestones of SharpLink's ETH Treasury Strategy

On May 27, announced a $425 million private placement, with ETH as the treasury reserve asset;

On May 30, submitted Form S-3ASR to the U.S. SEC, intending to raise $1 billion to increase ETH holdings;

On June 2, completed the $425 million private placement financing to increase ETH holdings;

On June 13, acquired 176,271 ETH for $463 million;

From June 18 to 21, purchased an additional 6,744 ETH;

On June 23, announced it had received Nasdaq approval to launch options trading under the standards and regulations set by Nasdaq and OCC, with the stock code "SBET";

On June 24, announced it had increased its total ETH holdings to 188,478;

On June 25, purchased 5,989 ETH ($14.47 million) through Galaxy Digital;

On June 28, purchased 1,989 ETH ($4.82 million) through OTC;

On July 1, increased holdings by 4,951 ETH, approximately $12.4 million;

On July 3, increased holdings by 2,738 ETH through OTC;

On July 10, increased holdings by 5,072 ETH, valued at approximately $13.51 million; directly purchased 10,000 ETH from the Ethereum Foundation for a total of $25.7237 million;

On July 11, increased holdings by 12,648 ETH, valued at $35.31 million;

On July 12, purchased 21,487 ETH, valued at approximately $64.26 million;

On July 14, purchased 16,373 ETH through Galaxy, valued at $48.85 million, bringing total holdings to 270,000 ETH, surpassing the Ethereum Foundation's 242,500 ETH, ranking first.

On July 15, increased holdings by 24,371 ETH, valued at $73.21 million.

On July 16, increased holdings by 5,188 ETH, valued at approximately $15.76 million.

III. What Opportunities Has SharpLink's Transformation Brought?

1. Saving Stock Price

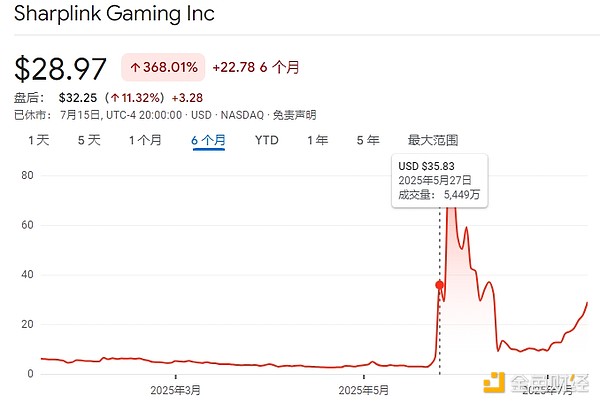

The most direct impact is reflected in the company's stock price. After SharpLink officially announced its transformation into an Ethereum treasury enterprise, its stock price entered a skyrocketing mode.

Affected by the positive news on May 27, SharpLink's stock price surged over 650% on the same day. The company's market value skyrocketed from $2 million to $2.5 billion. SharpLink's stock price was only $2.79 three trading days prior, increasing more than 17.56 times in three days, ending a prolonged downturn, and reaching a peak of $79.21 on May 29. As of the time of writing, SharpLink's stock price is $28.97.

2. Deep Binding with the Ethereum Ecosystem

In May 2025, when SharpLink was financing, it deeply bound itself with the Ethereum ecosystem—led by ConsenSys, with participation from top crypto institutions like ParaFi and Pantera.

Joseph Lubin, founder of ConsenSys and co-founder of Ethereum, stated: "After the transaction is completed, ConsenSys looks forward to collaborating with SharpLink to explore and formulate the Ethereum treasury strategy and serve as a strategic advisor on its core business. This is an exciting moment for the Ethereum community, and I am very pleased to work with Rob and his team to bring Ethereum's potential into the public capital markets."

3. Expanding Business Scope from Traditional Gambling to Crypto Gambling

In early 2025, SharpLink acquired a 10% stake in Armchair Enterprises, the parent company of CryptoCasino.com, for $500,000 in cash. This means SharpLink has begun to venture into the gambling market in the cryptocurrency and blockchain space.

IV. The Future of SharpLink

1. Influenced by the Crypto Market and ETH Trends

In the short term, SharpLink's prospects will be highly tied to the crypto market's performance. Due to SharpLink's substantial ETH holdings, its stock price fluctuations are strongly correlated with ETH prices. In this market cycle, influenced by factors such as net inflows into ETFs, the development of stablecoin ecosystems, and the entry of institutions and whales, ETH prices are experiencing a breakthrough.

Moreover, more companies are holding mainstream cryptocurrencies like BTC and ETH as treasury reserves, which will influence traditional financial markets' favor towards these crypto assets. The price trends of ETH will bring more surprises to investors and will also drive SharpLink's stock price up.

2. How to Truly Achieve Practical Applications Remains to be Explored

SharpLink previously focused on traditional sports betting. After transforming into an Ethereum treasury enterprise, how to achieve real practical applications in the cryptocurrency field is a pressing issue to consider. Although SharpLink acquired a 10% stake in Armchair Enterprises, it does not mean that SharpLink has already secured stable users and liquidity. The leading crypto prediction market Polymarket has gained immense popularity with a series of political prediction events, and how to share in that success remains a challenge for SharpLink to explore.

3. Potential Regulatory Challenges

The U.S. CFTC views prediction markets as binary options, and Polymarket faces compliance pressure due to 25% of its users being from the U.S.

Attorney Shao Shiwei from Mankiw Law Firm has previously stated: "The crypto prediction market platform indeed offers a binary options-like product, where users have two options for the predicted event's outcome: 'yes' or 'no.' This option is the product that users receive. Under the regulatory environment in the U.S., over-the-counter binary options are completely prohibited, allowing only two exchanges, the North American Derivatives Exchange (Nadex) and Cantor Exchange, to provide legal binary options trading. Additionally, U.S. regulations require brokers to only collaborate with domestic payment service providers to regulate the flow of funds."

Whether gambling platforms can ultimately operate within a compliant regulatory framework is not only a test for SharpLink but also a dilemma faced by all gambling platforms.

V. Conclusion

SharpLink's current development momentum is remarkable, but relying solely on ETH treasury reserves and the gambling label is clearly not sustainable in the long run. In the short term, influenced by the crypto market and the treasury reserve boom, SharpLink has captured significant attention. However, in the long run, whether it can achieve real practical applications, how to compete with industry giants, and whether it can develop compliantly within the regulatory framework are all challenges that SharpLink needs to overcome.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。