Original Source: Primitive Ventures

Written by: Yetta (Investment Partner at Primitive Ventures) & Sean (Liquidity Partner at Primitive Ventures)

We are very pleased to announce our participation in the $425 million PIPE (Private Investment in Public Equity) transaction for SharpLink Gaming, Inc. (NASDAQ: SBET). This transaction provides us with a differentiated exposure, participating in an enterprise treasury management solution based on the Ethereum protocol, with a structure that combines options flexibility and long-term capital appreciation potential. This investment reflects our strong confidence in Ethereum's important role in the U.S. capital markets and further supports our view that crypto assets will be integrated into the mainstream financial system.

Why We Invest

ETH vs. BTC: The Divide of Productive Value

ETH possesses natural yield capabilities in staking and the DeFi ecosystem, making it a true productive asset, while Bitcoin lacks such mechanisms. The BTC model, represented by MicroStrategy, relies more on debt financing to acquire coins, with its underlying asset yielding no returns, thus carrying higher leverage risks. SBET is expected to directly utilize ETH's on-chain mechanisms for compound growth, delivering real and quantifiable returns to shareholders.

Currently, regulators have not approved any ETH staking ETFs, making it difficult for traditional markets to access the yield layer of ETH directly. We believe that SBET is an innovative way to achieve this pathway, and with the cooperation of Consensys, it is expected to operate protocol-based strategies that bring substantial on-chain returns, potentially surpassing future ETH staking ETFs.

Additionally, the implied volatility of ETH (69) is significantly higher than that of BTC (43), creating greater option value for convertible arbitrage and structured derivatives, making volatility a tradable asset rather than pure risk.

Strategic Participation of Consensys

We are honored to collaborate with Consensys in this $425 million PIPE investment. Consensys is the strongest force driving the commercialization of Ethereum, and its technical strength, product ecosystem, and operational scale are key drivers for SBET to become a native enterprise vehicle for Ethereum.

Founded in 2014 by Ethereum co-founder Joe Lubin, Consensys has been dedicated to transforming Ethereum's open-source foundation into scalable real-world applications—from the Ethereum Virtual Machine (EVM) and zkEVM (Linea) to helping tens of millions of users access Web3 through MetaMask. To date, Consensys has raised over $700 million from top investment firms like ParaFi and Pantera, and has an excellent execution record in strategic acquisitions, making it the most deeply embedded operational entity in the current Ethereum ecosystem.

Joe Lubin's role as chairman is not merely symbolic. As one of the architects of Ethereum's core design and a key leader of the ecosystem's most critical infrastructure companies, Joe possesses comprehensive insights into Ethereum's product roadmap and asset mechanisms. His early experience on Wall Street also equips him with the capital market literacy needed to guide SBET into an institutional-level financial framework.

In SBET, we see a unique combination of an asset and the most capable investors. This synergy is forming a powerful positive flywheel: a protocol-native treasury strategy driven by protocol-native leadership. Under Consensys' guidance, we believe SBET is poised to become a flagship demonstration of how productive capital from Ethereum can be institutionalized and scaled in traditional capital markets.

Market Valuation Comparison and Analysis

To further understand the opportunities presented by SBET, we attempt to analyze the valuation dynamics of different crypto treasury strategies.

MicroStrategy: The Pioneer of Crypto Asset Strategies

MicroStrategy has set the industry benchmark for crypto treasury strategies, having accumulated 580,250 Bitcoins worth approximately $63.7 billion as of May 2025. MSTR's strategy is to increase its BTC holdings through low-cost debt and equity financing, a model that has inspired many companies to follow suit, validating the feasibility of crypto assets as reserve assets.

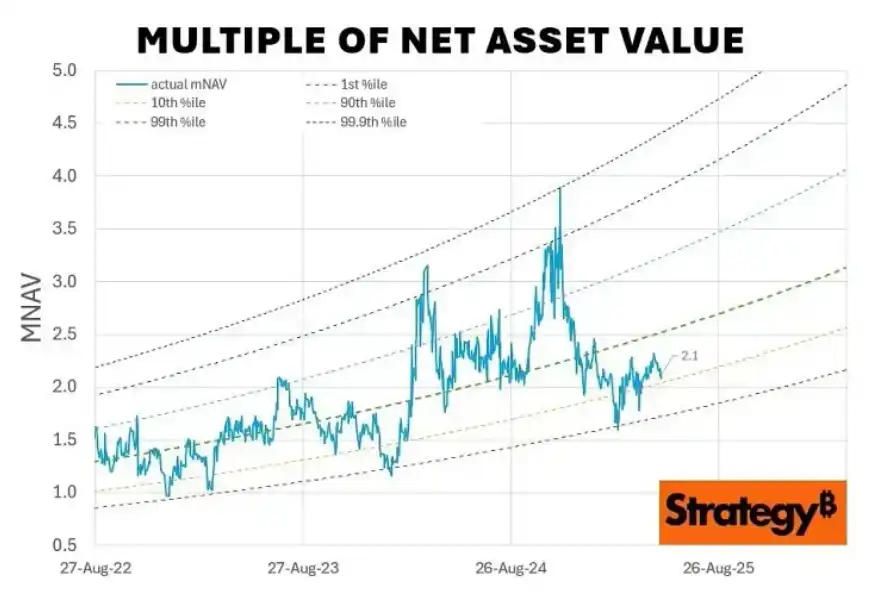

As of May 2025, MSTR's market capitalization is approximately 1.78 times its Bitcoin net asset value (mNAV), highlighting strong investor demand for leveraged exposure to crypto assets through publicly traded stock. This premium arises from the combination of three factors: leverage-driven upside potential, eligibility for index inclusion, and a more convenient investment path compared to direct coin holdings.

Historically, MSTR's mNAV multiple has fluctuated between 1x and 4.5x from August 2022 to August 2025, reflecting how market sentiment drives valuation. Its peak (such as 4.5x) typically occurs during BTC bull market cycles and periods of significant MSTR accumulation, demonstrating strong investor enthusiasm; conversely, the drop to a low of 1x corresponds to market consolidation periods, revealing the cyclical nature of investor confidence.

Peer Comparison Analysis

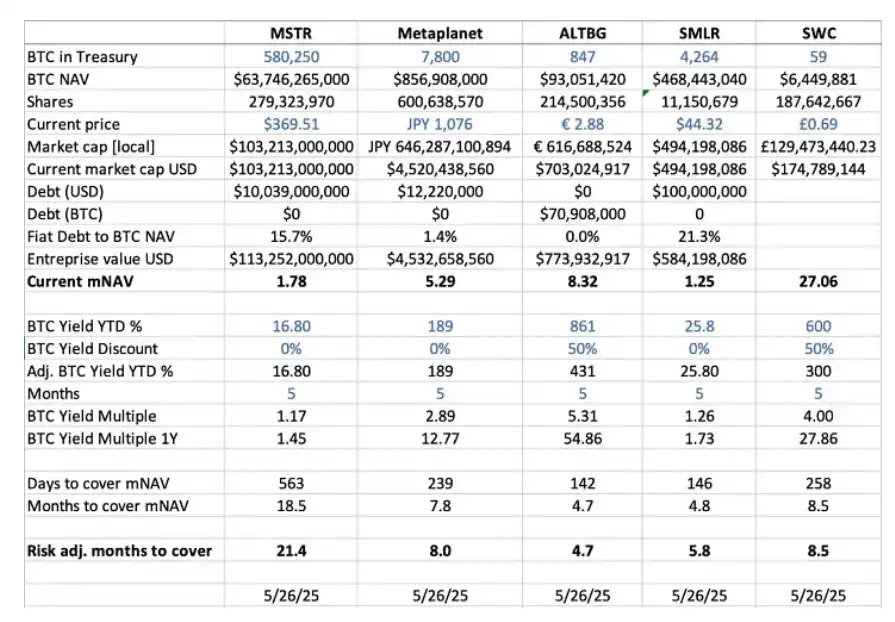

We conducted a horizontal comparison analysis of several publicly listed companies employing crypto treasury strategies:

BTC Net Asset Value (NAV): The total dollar value of the Bitcoin assets held by the company. MicroStrategy ranks first with 580,250 BTC (approximately $63.7 billion); followed by Metaplanet (7,800 BTC, $857 million), SMLR (4,264 BTC, $468 million), ALTBG (847 BTC, $9.3 million), and SWC (59 BTC, $6.4 million).

mNAV Multiple (Market Cap / BTC NAV): The multiple between the company's market capitalization and its BTC net assets, reflecting its trading premium. SWC has the highest premium at 27.06x, primarily driven by limited BTC holdings and market sentiment; ALTBG (8.32x) and Metaplanet (5.29x) also maintain high premiums; while MSTR (1.78x) and SMLR (1.25x) have relatively moderate premiums due to larger scale and higher leverage.

BTC Year-to-Date Return (YTD%): The growth rate of BTC per share, adjusted for dilution. Smaller companies often exhibit higher unit output efficiency due to more aggressive BTC accumulation actions, such as ALTBG at 431% and SWC at 300%. These data provide investors with important insights into capital efficiency and compounding ability.

Time Required for mNAV Convergence (Months): The time required for the company to accumulate enough Bitcoin to reach the NAV level implied by its current market capitalization, based on the current BTC growth rate. Estimating based on BTC's annual return, ALTBG and SMLR could theoretically achieve valuation convergence within 5 months, providing arbitrage opportunities for NAV compression trades and relative pricing discrepancies.

Risk Factors: The debt-to-NAV ratios for MSTR and SMLR are 15.7% and 21.3%, respectively, making them more susceptible to shocks when BTC prices decline. In contrast, ALTBG and SWC are unleveraged, providing stronger risk resilience.

The Metaplanet Case in Japan: A Valuation Observation from a Macro Market Perspective

Valuation differences often stem from variations in asset reserve sizes and capital allocation structures, but regional capital market dynamics are also crucial, directly influencing asset market pricing. The case of Metaplanet is particularly representative—it is often referred to as the "Japanese version of MicroStrategy."

The high valuation premium of Metaplanet arises not only from its Bitcoin assets but also from the structural advantages brought by the design of Japan's domestic market:

NISA System Benefits: Japanese retail investors are aggressively buying Metaplanet stock through NISA (Nippon Individual Savings Account). This system allows individuals to enjoy a capital gains tax exemption of up to approximately $25,000, significantly enhancing the tax attractiveness of stock allocation compared to the up to 55% capital gains tax on direct BTC holdings. According to data from Japan's SBI Securities, Metaplanet was the most purchased stock in NISA accounts in the week leading up to May 26, 2025, with its stock price soaring 224% over the past month.

Structural Misalignment in Japan's Bond Market: Japan's debt level has reached 235% of GDP, and the yield on 30-year Japanese government bonds has risen to 3.20%, creating significant structural pressure in the bond market. In this context, investors increasingly view the 7,800 BTC held by Metaplanet as a hedging tool against yen depreciation and domestic inflation risks.

SBET: Moving Towards Cross-Market Dominance

In the public market, regional capital flows, tax structures, investor psychology, and macroeconomic conditions are often as important as the underlying assets themselves. To uncover asymmetric investment opportunities at the intersection of crypto assets and traditional markets, it is essential to deeply understand the institutional details and market behaviors of different jurisdictions.

As the first publicly listed vehicle built around Ethereum capital, SBET is in a unique position to amplify its first-mover advantage through "jurisdictional arbitrage" strategies. We believe that SBET can further solidify its leadership position, for example, by achieving dual listings on the Hong Kong Stock Exchange (HKEX) or Japan's Tokyo Stock Exchange (Nikkei), to unlock regional liquidity in the Asian market while mitigating valuation dilution caused by narrative shifts.

Through this cross-market layout, SBET has the potential to become a truly global Ethereum-native (ETH-native) listed entity, not only possessing industry symbolic significance but also ensuring institutional compliance and accessibility, thus becoming a representative new type of crypto financial instrument in the global capital markets.

The Institutionalization Process of Crypto Capital Structure

The integration of CeFi (Centralized Finance) and DeFi (Decentralized Finance) marks the maturation of the crypto market, indicating that this emerging asset class is accelerating its embedding into a broader financial system. In a sense, this trend is driving the transition from "crypto finance" to "institutional finance."

On one hand, protocols like Ethena and Bouncebit represent a new paradigm of CeDeFi: organically integrating centralized components with on-chain mechanisms, expanding the applicability and accessibility of crypto assets, and providing a more user-friendly pathway for institutional participants.

On the other hand, the linkage between crypto and traditional capital markets reflects a deeper evolution of macro financial structures: crypto assets are gradually transitioning from marginal assets to "institutionalizable asset classes." This institutionalization path mainly undergoes three stages, each representing a leap in structure and financial engineering:

· GBTC: The Original Institutional Entry but Structurally Rigid

As one of the earliest compliant exposures to BTC, GBTC provides market access within a regulatory framework, but due to the lack of a redemption mechanism, its price has long deviated from its net asset value. This stage reveals the structural limitations of traditional financial instruments in the crypto era.

· Spot Bitcoin ETF: A Liquidity Revolution but Still Passive

Since receiving SEC approval in January 2024, the spot BTC ETF has introduced a daily subscription/redemption mechanism, tightly anchoring NAV and significantly raising the threshold for institutional participation and market efficiency. However, its passive management nature prevents it from capturing on-chain yields and actively creating value from crypto assets, which is also its inherent yield ceiling.

· Corporate Treasury Strategies: The Rise of Active Yield Paradigms

MicroStrategy, Metaplanet, and today's SharpLink are incorporating crypto assets into corporate treasury systems, moving beyond mere "holding" to reconstructing capital efficiency and shareholder return models through on-chain staking, yield compounding, tokenized financing, and on-chain cash flow design. This stage is a critical juncture for institutionalizing and sustaining "crypto-native capital."

From the one-way structure of GBTC to the liquidity upgrade of ETFs, and then to the "yield-optimized corporate treasury model" represented by companies like SBET, this evolutionary path demonstrates how crypto capital structures are gradually being absorbed into the modern financial system, providing higher liquidity, stronger structural design capabilities, and richer value creation pathways.

We Maintain a Cautiously Optimistic Stance

While we are confident in the long-term prospects of SBET, we also remain acutely aware of potential risks:

Premium Compression Risk: If SBET's stock price remains below net asset value for an extended period, its mechanism for financing through issuing new shares may lead to dilution effects. This situation has precedent from GBTC's long-term discount phase before transitioning to an ETF.

ETF Cannibalization Risk: If a spot Ethereum ETF is granted permission for staking yields in the future and its management scale continues to expand, investors may shift towards the ETF due to its "simpler, compliant" pathway, even if its yield capabilities are limited. This "convenience-first" market preference could divert funds away from SBET.

Nevertheless, we firmly believe that the ETH-native yield strategy employed by SBET is likely to outperform ETH ETFs in the long run, providing investors with a growth-oriented and yield-generating allocation opportunity.

Final Thoughts

Our participation in the $425 million PIPE investment in SharpLink Gaming is based on our profound understanding of Ethereum's transformative potential in the corporate treasury space. With the technical depth of Consensys and the visionary leadership of Joe Lubin, SBET possesses all the elements to lead a "new cycle of crypto value creation."

As CeFi and DeFi accelerate their integration, crypto assets will play a more central role in a broader market system. We are proud to participate in and support SBET's vision, and we will continue to steadfastly seek high-potential opportunities that can stand out in this structural transformation.

This article is contributed and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。