Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

The pandemic in 2020 disrupted many established plans and allowed William Guo to see the limitations of the traditional financial system during the advancement of a real estate project. This sparked the exploration of the integration of Web3 and real assets.

The same "disruptive gene" has now been integrated into the underlying architecture of PlayEstates. When users receive daily USDC profit sharing from on-chain properties through PNFT, and when Southeast Asian students subscribe to high-quality American assets with $10, the William team always shares a smile in front of the electronic screen in their San Francisco office. These moments make the decision made on a near-bankrupt night four years ago seem even more precious.

It is this "turning crisis into opportunity" gene that has attracted over 10,000 users to PlayEstates even before public marketing. Odaily Planet Daily discovered that the record of selling out the first batch of $350,000 in internal test assets in just two and a half weeks is backed by a large number of young users experiencing the shock of "being a landlord on-chain" for the first time—"It turns out that asset accumulation can be visualized like a game task."

In a conversation with founder William Guo, sharp statements such as "compliance is a matter of life and death" and "liquidity is not a technical issue but a human issue" frequently emerged. How does this CEO, who attempts to implant a "Pinduoduo-style experience" into real estate, balance the compliance framework of Delaware Series LLC with the gamified design of SocialFi? Can ToC-type RWA truly break through the high walls of traditional finance?

Below is the transcript of the exclusive interview with Odaily Planet Daily, enjoy~

1. The Path of "Playing" Out: The Evolution from Engineer to RWA Entrepreneur

Odaily Planet Daily: Can you briefly introduce your background? What considerations led you to choose the RWA track after coming from traditional industries and the tech field?

William Guo: I initially worked in engineering and green technology, and later my company was acquired by a large tech firm. Subsequently, my partners and I founded a fund focused on smart and green building, not only investing but also deeply participating in the development of some real estate projects. We have accumulated a wealth of practical experience in real estate from both investor and developer perspectives.

When the pandemic broke out in 2020, we encountered a sudden cash flow interruption while operating multiple projects. The reason was that some overseas investors could not enter the country to sign contracts, exposing the issues of the traditional real estate financing structure's heavy reliance on offline processes and intermediary systems. This structural risk made us start to think: can we use blockchain technology to digitize and fragment assets, allowing users to complete subscriptions and transfers directly on-chain?

This idea naturally aligns with Web3's emphasis on "disintermediation" and "transparency and verifiability." In 2022, we officially launched the PlayEstates project, focusing on the RWA track, hoping to connect high-quality real estate assets in the U.S. with global on-chain users and explore a new path for the digitization of traditional assets.

Odaily Planet Daily: Your background is very diverse, covering hard tech, real estate, and venture capital. How have these experiences influenced you in building PlayEstates? Are there reflections in product design or team operations?

William Guo: The greatest value of this diverse background is that it has allowed me to avoid some detours when judging direction and making important decisions. This has been particularly crucial in compliance and long-term structural design.

PlayEstates essentially involves asset securitization, so compliance requirements are very high. I have always believed that it is extremely dangerous to recklessly "innovate" or attempt to bypass rules during a phase when regulations are not yet fully clear. We want the project to be on the right track from day one, rather than waiting until it grows larger to catch up.

Therefore, when assembling the team, I paid special attention to legal and compliance backgrounds. Many core members of the team, including legal advisors, are long-term partners I have worked with in my previous entrepreneurial or investment experiences, with high mutual trust and aligned philosophies. This tacit understanding allows us to be more efficient and reliable in product structure design, process management, and external connections.

Odaily Planet Daily: The outside world often views PlayEstates as a "real estate NFT platform," but in your opinion, what is the core capability that is most easily overlooked? Will you also open Tokenization-as-a-Service in the future?

William Guo: This is a common misunderstanding. We are currently using the NFT model to put assets on-chain, but this is just one of the technical implementations at this stage. In the future, we may shift to using FT (fungible token) structures based on market feedback and liquidity needs to enhance trading efficiency and flexibility in the secondary market.

From a more fundamental perspective, our true core capability goes beyond "turning real estate into NFTs." Our strength lies in having a complete capability for asset acquisition, management, distribution, and compliance processing, especially with significant advantages in channels for acquiring real estate assets, investment structures, and operational experience. Most of the assets on the platform come from our own fund or projects jointly developed with partner family offices, and these resources are not easily replicable.

Moreover, our goals extend far beyond real estate. While real estate is the most mature and familiar track for us, we are gradually expanding into other high-yield, compliant asset types such as renewable energy, oil fields, and mines. These directions are already in the preparatory process and will be launched on the platform in the future.

In the long run, we hope PlayEstates will become a "multi-asset supported" RWA infrastructure platform rather than just a "real estate NFT marketplace." We also plan to gradually open Tokenization-as-a-Service (TaaS) to serve more institutions and developers with real assets but lacking on-chain tools.

2. Reconstructing Real Assets with Dual Tokens: PlayEstates' Model, Products, and Cross-Chain Ambitions

Odaily Planet Daily: PlayEstates adopts the Delaware Series LLC structure and combines NFT issuance for real estate assets. In your view, what are the core advantages of this structure in terms of compliance and governance?

William Guo: We use the Delaware Series LLC structure, combined with Regulation D and Regulation S compliance paths, to ensure legal compliance while achieving efficient governance and risk isolation. This structure has been validated by early projects like RealT, and our compliance advisory team includes the Resmith law firm, which participated in RealT's compliance design.

Each Series corresponds to an independent asset, legally isolated from one another, meaning that even if a particular project encounters default or liquidity issues, it will not affect other assets, fundamentally avoiding systemic risk. At the same time, each asset can operate, declare, and manage independently, which helps us diversify our layout.

From a regulatory perspective, U.S. domestic users participate through the Reg D path and only need to complete KYC certification; overseas users can access compliance through a Series Fund established in the BVI under Reg S. This "internal-external separation" structural design ensures the legality and transparency of real estate assets during the NFTization process and effectively avoids potential regulatory risks associated with "security-type NFTs."

Odaily Planet Daily: The "PNFT + OWND" dual-token structure launched by PlayEstates is relatively rare in the RWA track. Can you briefly introduce its design logic and advantages?

William Guo: Our design adopts a dual-token structure of NFT and OWND, aiming to maximize user coverage and asset liquidity under compliance.

NFT serves as the digital certificate of the asset, allowing users who complete KYC to receive daily USDC profits through this certificate; while users who have not completed KYC can receive profits in the form of OWND tokens, thus avoiding compliance and tax obstacles in certain regions. OWND can also serve as a circulating utility token within the platform, with the potential to be listed on exchanges, providing a flexible path for more users to participate.

Compared to REITs or RealT models, we have optimized in two aspects: first, higher liquidity, as NFTs can be freely transferred on the platform or other supported NFT markets; second, fewer trading restrictions, avoiding issues like the months-long lock-up required for compliance in RealT projects, allowing users to enter and exit the asset market more conveniently.

This structure was jointly designed by our compliance advisory team from one of the world's top five law firms, aiming to provide a safe and efficient entry point for users with different identity statuses and regions.

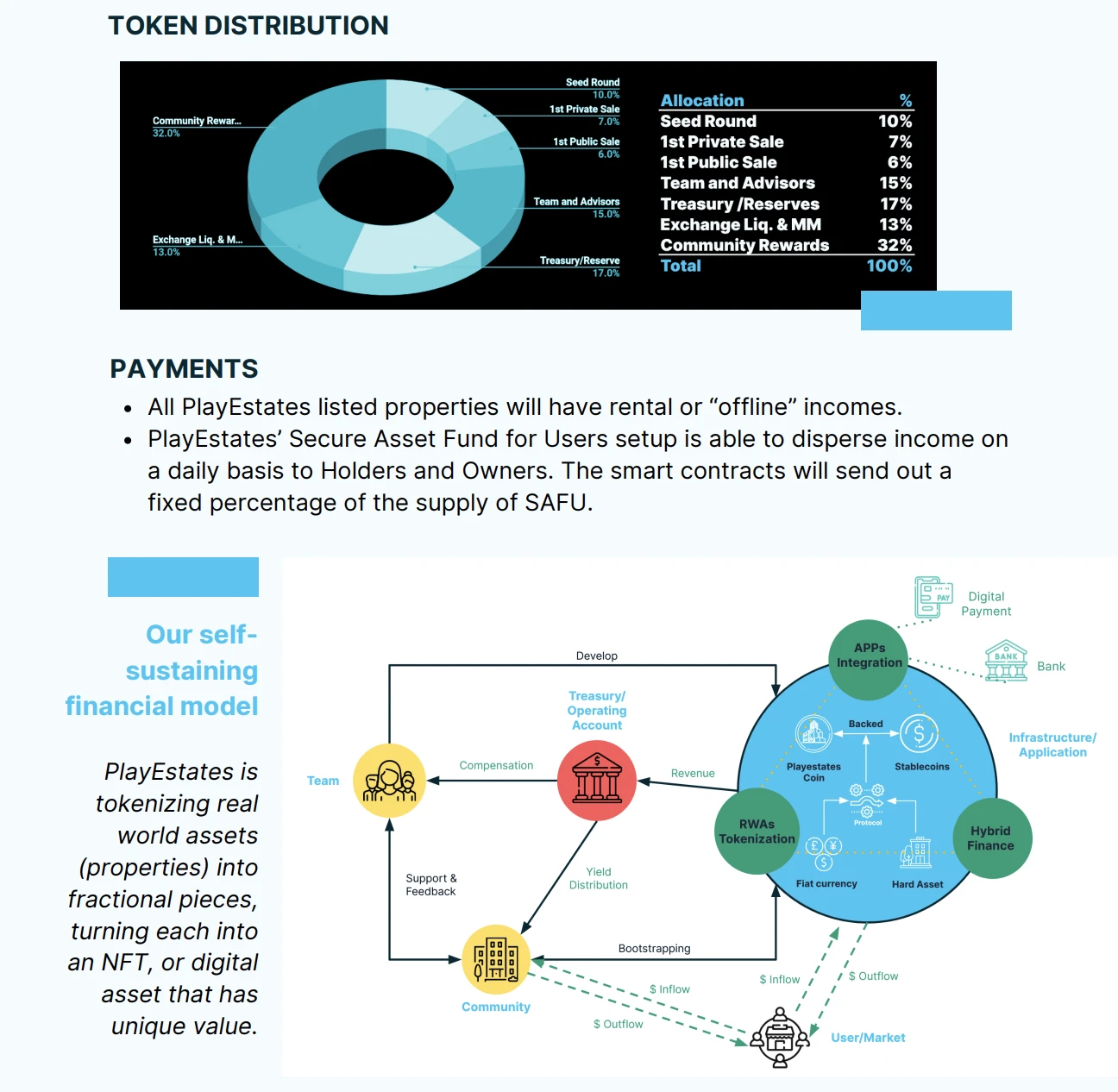

Odaily Planet Daily: Daily dividends and the SAFU fund are highlights of PlayEstates. What is the operational logic of this mechanism? How does it achieve automatic profit distribution?

William Guo: Our profit distribution mechanism essentially involves the on-chainization of asset returns. The returns from the asset side are distributed daily to users holding the relevant assets in the form of USDC. The benefits of this mechanism are twofold: on one hand, it enhances the platform's transparency, as all profit records can be verified on-chain; on the other hand, it facilitates future compliance reporting or tax processing.

We view users holding NFTs as "digital shareholders" of the assets, receiving daily dividends. The entire dividend process is executed automatically, with records publicly verifiable, serving as on-chain proof of our platform's performance capability. As AUM grows, we hope to strengthen user trust, especially in building confidence among traditional Web2 users.

Odaily Planet Daily: Compared to projects like Ondo and RealT, what are the key differences of PlayEstates, especially in terms of ToC participation paths and product experience strategies?

William Guo: I believe the core challenge in the current RWA track is not asset tokenization, but rather insufficient on-chain liquidity. The technology and compliance paths have gradually matured, but many projects lack real user participation after going on-chain, resulting in tokens that "exist in form but lack substance."

PlayEstates' strategy is to address the liquidity issue from the source. We are not simply tokenizing assets; we are introducing mechanisms from SocialFi and GameFi, allowing users to participate in assets through "play," enhancing interaction experience and trading frequency. Similar to how Pinduoduo attracts user participation through entertainment, we also hope to provide a sense of achievement and stickiness in small investments, thereby building user trust.

Compared to traditional RWA projects that focus on ToB investment logic, we have chosen to firmly pursue a ToC route. Because we believe: as long as there are users, there will be liquidity; with liquidity, asset providers will naturally connect. This model not only reduces intermediary links and improves exit efficiency but also aligns more with the decentralized spirit of Web3.

Odaily Planet Daily: Which U.S. real estate institutions, custodians, and payment systems (such as Banxa) has PlayEstates integrated with so far? What has been the most challenging aspect of these integrations?

William Guo: In terms of real estate institutions, we have our own investment institution supporting us, and we also have many cooperative family offices in the U.S. that continuously bring us asset packages and contract resources, which greatly helps the growth of our platform's AUM.

On the payment system side, we have already launched multiple on-chain payment service providers, including Banxa and MoonPay. We are building a complete payment system framework with MoonPay, and in the future, we will gradually integrate various payment methods such as Apple Pay, Google Pay, ACH (Automated Clearing House), and Wire Transfer to meet different user preferences.

At the same time, we are also in discussions for cooperation with a U.S. bank, Customers Bank. This bank took over many payment resources related to virtual currencies after the collapse of Circle's partner bank. It currently supports the exchange of 46 currencies with USDC, and if the cooperation is established, it will significantly enhance our payment efficiency, reduce intermediary steps for users, and help save costs and improve capital utilization.

In these integration processes, the challenge mainly lies not in technical implementation but in how to connect multiple systems and services within a compliant framework, ensuring a balance between security, user experience, and compliance.

3. RWA is More Than Compliance and Returns: The Future Asset Experience PlayEstates Aims to Define

Odaily Planet Daily: Where are PlayEstates' main users currently distributed? What are the key growth markets for the future?

William Guo: Currently, our users are mainly concentrated in two regions: the U.S. and Southeast Asia.

In the U.S., most of our team members, asset providers, and early investors are local, so we have accumulated a group of qualified investors who have a good understanding and resource base, and they are quite familiar with local real estate assets and have a strong willingness to subscribe.

Southeast Asia is another important market for us, especially users from mainland China, Hong Kong, and surrounding areas. These users generally have a willingness to globalize their asset allocation and hope to invest their local cash or assets more efficiently into high-quality assets in countries like the U.S. However, due to limitations in channels, information, or thresholds, such investment opportunities have not been easily accessible in the past.

Our platform can serve as a tool to solve the "information gap," helping them complete asset allocation and achieve indirect holdings in some previously hard-to-reach asset categories.

Looking at future expansion directions, we will continue to focus on the Southeast Asian market and are also paying attention to opportunities in the Middle East, especially as some countries open up to exploring on-chain assets. We hope to promote more practical implementations in these regions in the future.

Odaily Planet Daily: PlayEstates aims to "help young people accumulate assets." In your view, what is the biggest asset dilemma facing Generation Z currently? How will PlayEstates address this?

William Guo: I believe the biggest dilemma facing Generation Z is the "high entry point for assets." Previous generations could save for a down payment to buy a house through hard work, but today's young people face soaring housing prices, high inflation pressure, and continuously rising asset valuations. It is becoming increasingly difficult to rely on personal accumulation to obtain a property or a quality asset.

What we hope to solve is precisely this "entry threshold" issue. PlayEstates allows users to subscribe to real-world asset shares starting from $10—by "fragmenting" the assets, we enable young people to participate at a low cost and gradually complete asset accumulation.

Odaily Planet Daily: What is your view on the current mainstream narrative trend in RWA? Is the entry of traditional institutions a positive thing for the track?

William Guo: I think this is definitely a good thing. When we first entered this track, most traditional institutions were still observing; their decision-making processes were relatively slow, and their reactions were not as quick. At that time, it was mainly entrepreneurs like us who were exploring and paving the way.

But now we can clearly see a shift—these institutions are starting to recognize the direction of RWA and are making arrangements. They are now also trying to put some assets on-chain through blockchain methods, whether as product issuance or as a channel for asset allocation.

I believe this is positive for the entire industry. On one hand, it helps form healthy competition and pushes the entire ecosystem forward; on the other hand, it serves as a kind of endorsement for retail investors—they will realize that this track is credible and is also favored by traditional finance. Ultimately, everyone will choose the platform and asset types that suit them, and PlayEstates is just one option among them.

We are still in the early stages, and there is still a lot of room in the market. The entry of institutions will only accelerate and stabilize the development of this track.

Odaily Planet Daily: What functional iterations will PlayEstates have in the next phase? For example, mobile apps, DAO governance, or asset auctions?

William Guo: We will launch a mobile app in Q4 of this year, with both Android and iOS versions being released simultaneously. This way, users can more conveniently complete subscriptions, view returns, or participate in governance on their mobile devices.

At the same time, we will gradually launch the relevant governance mechanisms for the DAO in Q4. Because for asset holders, they should have the right to participate in asset management, such as whether to sell a certain asset or how to enhance returns; these will be realized through voting in the future.

As for lending and asset portfolio derivatives, we are also advancing the compliance process and are connecting with some suitable partners. This part may still need another two or three quarters to refine.

One point we currently value is: when money is on the platform, we actually have a responsibility. We are not just collecting money and calling it a day; we hope to truly "make money work" through better asset design or derivative products, and then return the profits to users and investors.

Odaily Planet Daily: Finally, do you think the biggest pain point in the current RWA is compliance or liquidity? In your view, what key issues must the next generation of RWA projects address?

William Guo: These two pain points are actually closely related. Compliance is fundamental; if compliance is not done well, asset tokenization lacks legal protection, and it is hard to talk about user trust. Liquidity, on the other hand, determines users' willingness and experience to participate. Many projects, although they have gone on-chain, face complex procedures, difficult exits, or high costs, which ultimately diminish the value of the assets users receive, making it naturally hard to sustain.

In my view, the next generation of RWA projects with real long-term potential must address three things simultaneously: compliance, liquidity, and asset quality.

First is localized compliance. Regulatory requirements vary greatly from country to country; a one-size-fits-all approach cannot work globally. PlayEstates adopts a regional compliance strategy, for example, U.S. users go through Reg D, while overseas users access through the BVI structure, ensuring that users from different regions participate within a controllable range.

Second is liquidity experience. We not only focus on whether assets can be transferred but also on whether the entire path of payment, subscription, and exit is smooth. PlayEstates lowers the threshold through GameFi and SocialFi models while optimizing on-chain interaction processes to enhance participation efficiency.

Third is the quality of the assets themselves. Currently, some projects are putting poorly packaged assets on-chain, essentially "shell financing," which harms both users and the industry. We always insist on only launching real, high-quality assets with clear return structures and granting users the right to enter and exit freely.

These three points are indispensable and truly constitute the moat of the new generation of RWA projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。