Written by: Matthew Nay, Messari

Translated by: Glendon, Techub News

Key Points:

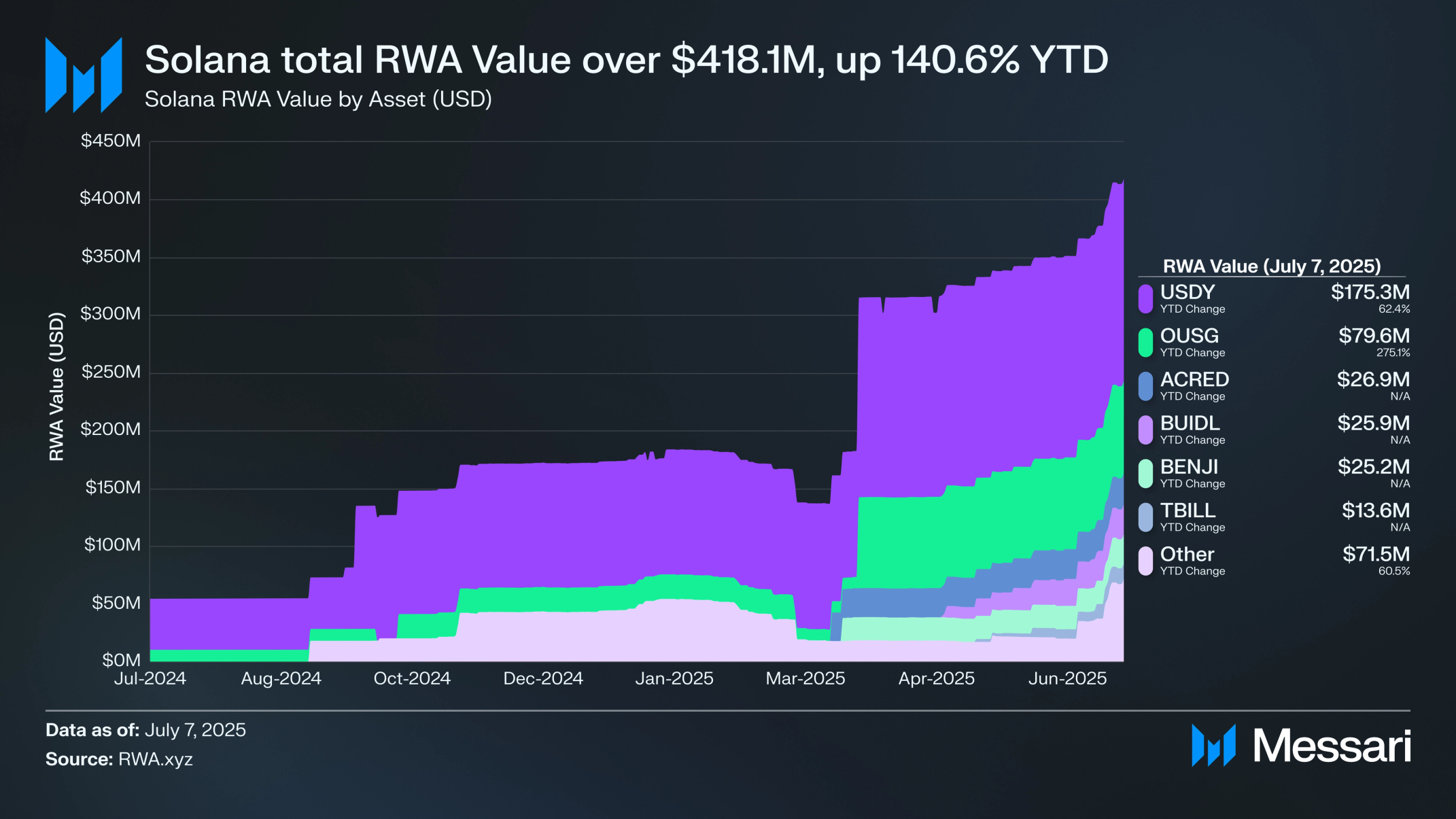

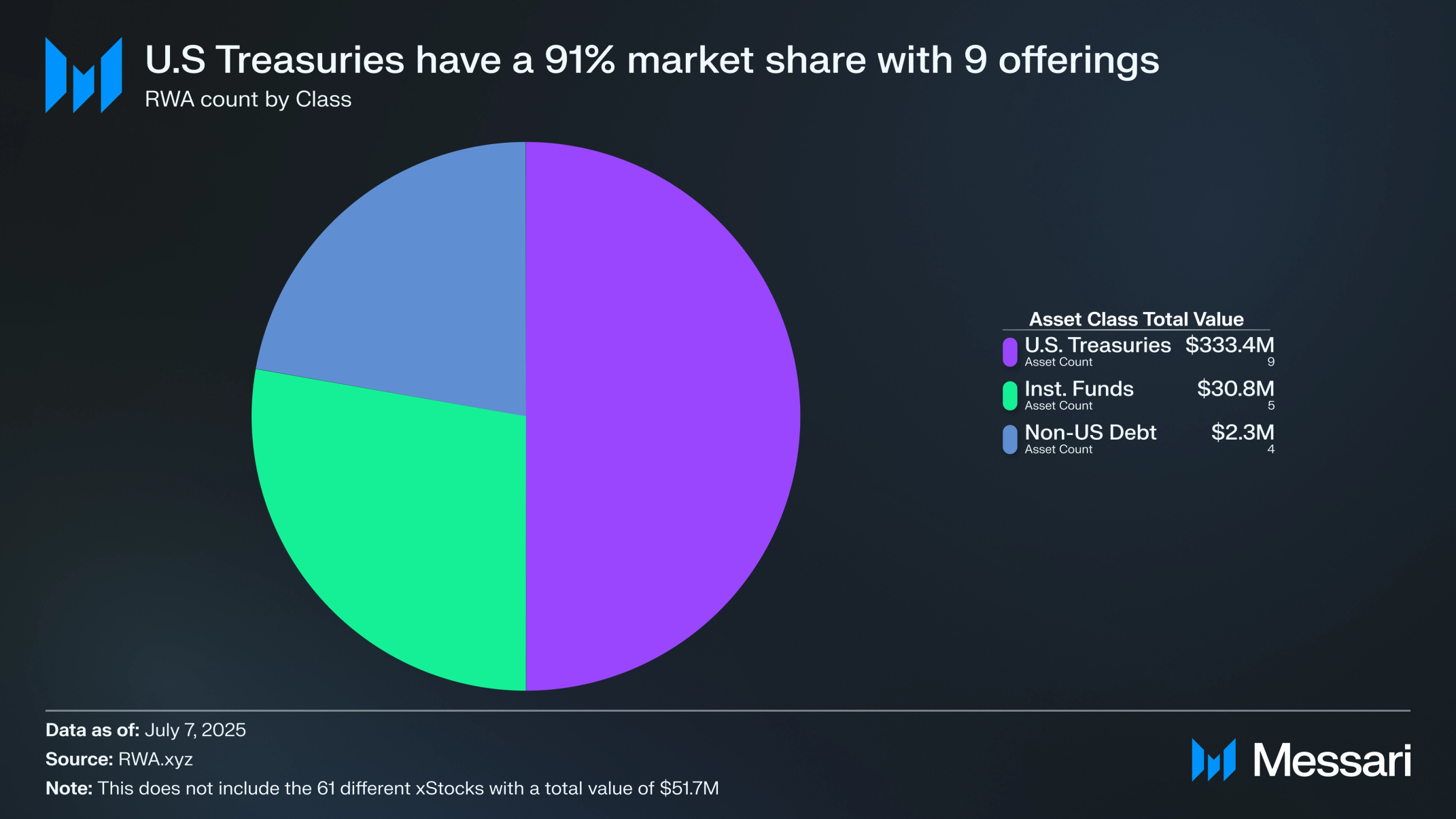

The value of real-world assets (RWAs) on Solana exceeds $418.1 million, growing 140.6% year-to-date. Ondo's USDY leads this category with $175.3 million (41.9% market share), followed by other assets like OUSG, ACRED, and BUIDL.

Backed has partnered with Kraken to introduce tokenized stocks to Solana via xStocks by June 30, 2025, allowing over 40,000 wallets to hold xStock within a week. Superstate, Ondo, and Step Finance plan to launch tokenized stocks later this year.

R3 plans to transfer over $10 billion in tokenized assets from its permissioned distributed ledger technology (DLT) platform Corda to Solana. R3 provides support for the issuance and transfer of tokenized assets for regulated financial institutions.

The market capitalization of Maple Finance's yield-bearing stablecoin syrupUSDC has rapidly climbed to $60.1 million.

Solana is also a hub for alternative real-world assets (RWAs), such as tokenized funds from Blackrock and Apollo, tokenized real estate, unique physical goods, and collectibles.

Real-world assets represent a paradigm shift in decentralized finance (DeFi), connecting traditional finance (TradFi) with blockchain infrastructure by tokenizing off-chain assets such as government bonds, private credit, public equities, real estate, and even physical goods.

This shift brings new levels of liquidity, programmability, and global accessibility to financial instruments, especially for those that have historically lacked liquidity, faced restrictions, or suffered from inefficient distribution. Over the past year, Solana has emerged as a strong competitor in this space, establishing itself as a viable platform for institutional and retail users to access and interact with on-chain real-world assets.

The appeal of Solana lies in its high throughput, near-zero transaction costs, and robust developer ecosystem. Technical innovations such as the Token-2022 standard and rapid block finality have enabled seamless compliance tools, yield distribution, and composable DeFi integrations. From tokenized treasury bonds to on-chain stocks and tokenized commodities, these features make Solana particularly well-suited for hosting a wide range of real-world assets. Furthermore, its infrastructure increasingly meets the needs of asset issuers, regulators, and users, paving the way for the adoption of tokenized real-world assets at both the institutional and community levels.

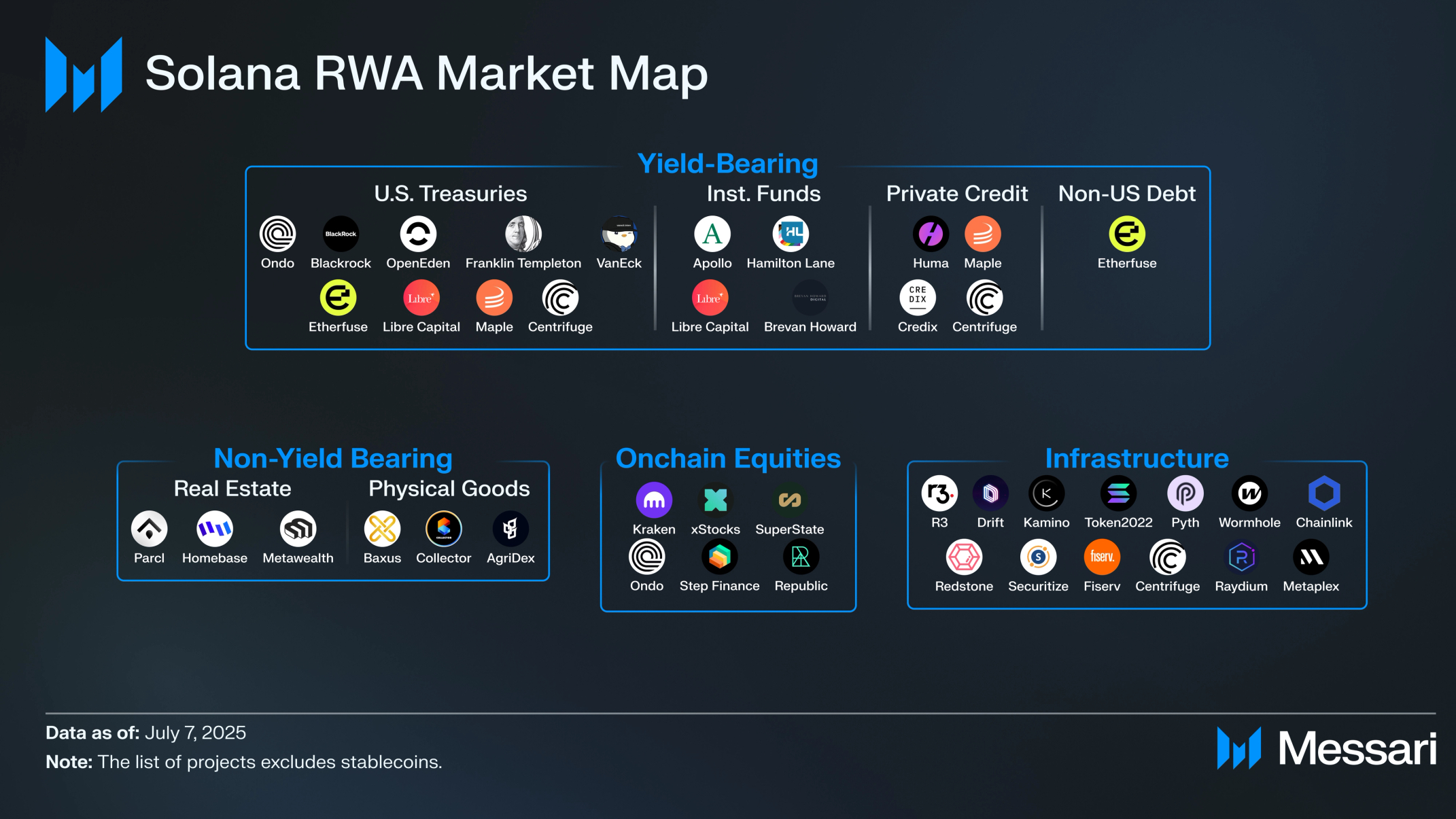

Real-world assets (RWAs) on Solana primarily encompass four core categories: 1. Yield-Bearing Assets, including tokenized U.S. Treasuries, institutional funds, and private credit protocols (such as Ondo Finance, Franklin Templeton, and Maple); 2. Tokenized public equities, set to be launched by Superstate, Kraken, and Ondo Global Markets; 3. Non-yield-bearing assets, such as tokenized real estate and collectibles from platforms like Parcl and BAXUS; 4. Emerging infrastructure providers (like R3 and Securitize) that support compliance and interoperability.

Through these lenses, the article will explore the development trajectory of Solana as an emerging hub for on-chain real-world assets and what this means for the future of global capital markets.

Yield-Bearing Assets

Yield-bearing real-world assets (also known as yield-generating real-world assets) are the most significant and fastest-growing segment within Solana's real-world asset ecosystem, accounting for the vast majority of non-stablecoin real-world asset value (in USD). These assets, ranging from tokenized U.S. Treasuries to institutional funds and private credit, provide on-chain investors with direct access to off-chain income streams, and they typically offer greater composability and 24/7 accessibility compared to traditional financial counterparts. (Note: All data in this report is as of July 7, 2025.)

Tokenized U.S. Treasuries

Tokenized Treasuries provide a digital wrapper for the world's most liquid and trusted yield instruments and have become foundational pillars for on-chain asset management, stablecoin collateralization, and DAO treasury operations. Solana's tokenized treasury market has evolved from a small-scale start to encompass a range of products from native and cross-chain asset issuers.

Ondo Finance: OUSG & USDY (Treasury and Yield Tokens)

OUSG and USDY represent Ondo Finance's dual approach to tokenized U.S. Treasuries. OUSG was launched in January 2023 as a tokenized fund initially built around BlackRock's BUIDL fund, primarily targeting accredited investors. As of July 2025, OUSG has become the second-largest yield-bearing asset on Solana by market capitalization, valued at $79.6 million.

USDY, launched in August 2023, is a token backed by Treasuries and bank deposits, designed to function as a yield-generating stablecoin with broad accessibility. The price of USDY appreciates as interest accumulates. The token can be transferred across chains via LayerZero, making it highly composable within DeFi applications. As of July 2025, USDY is the largest yield-bearing real-world asset on Solana by market capitalization, with 6,978 holders and a market cap of $175.3 million.

BlackRock: BUIDL (U.S. Dollar Institutional Digital Liquidity Fund)

BUIDL is a tokenized U.S. dollar money market fund developed by BlackRock, holding cash and short-term U.S. Treasuries. It was initially launched on Ethereum in March 2024 and expanded to Solana in March 2025, marking one of the first significant institutional real-world asset deployments on the network. The fund has a AAA rating and maintains a stable $1 value while distributing dividends daily. Access is limited to accredited investors verified through KYC (Know Your Customer), and Solana's 24/7 settlement capabilities and low transaction costs have made it attractive for the fund.

BUIDL transforms a traditionally static financial instrument into a highly accessible and interoperable asset. BlackRock's entry into the tokenized real-world asset space on Solana affirms the growing credibility and interoperability of public chain infrastructure in institutional finance. As of July 2025, BUIDL is the fourth-largest yield-bearing real-world asset (RWA) on Solana by market capitalization, valued at $25.23 million.

Franklin Templeton: BENJI (On-Chain U.S. Government Money Fund FOBXX)

BENJI represents shares of Franklin Templeton's FOBXX money market fund, which invests in U.S. government securities, cash, and repurchase agreements. BENJI was initially launched in 2021 and expanded to Solana in February 2025 as part of its multi-chain rollout, becoming the eighth network supported by the fund. It maintains a stable $1 value and offers a yield-generating alternative to traditional stablecoins, with interest accumulating daily.

What sets BENJI apart is that it is one of the first registered mutual funds with the SEC that is open to retail investors on-chain, accessible via the Benji mobile app.

OpenEden: TBILL (Tokenized Short-Term Treasury Bill Vault)

TBILL is a fully collateralized token backed by short-term U.S. Treasury bills, issued through a regulated trust structure. Since its launch in 2023, TBILL has enabled users to mint and redeem tokens 24/7 using stablecoins like USDC, with the token price appreciating as interest accumulates. OpenEden is one of the first platforms to offer Treasury bill products accessible to DeFi, primarily targeting non-U.S. investors.

The product's low entry barrier, real-time redemption, and high transparency have contributed to its success, with adoption accelerating in Asia and Europe. TBILL has gained attention for receiving a "A" rating from Moody's and is used as yield-bearing collateral for other tokens, such as Velo's USDV stablecoin. As of July 2025, TBILL is the seventh-largest yield-bearing real-world asset on Solana by market capitalization, valued at $11.7 million.

VanEck: VBILL (Tokenized U.S. Treasury Fund)

VBILL is the tokenized version of VanEck's short-term U.S. Treasury strategy, launched on Solana in May 2025 in collaboration with Securitize. Unlike yield tokens like OUSG and USDY that appreciate in value, VBILL maintains a stable $1 price and distributes earnings through daily token dividends. Its asset custody is provided by State Street, with real-time pricing maintained through Redstone oracles.

A standout feature of VBILL is its atomic redemption (instant settlement) through Agora's AUSD stablecoin, allowing investors to seamlessly switch between yield and liquidity by leveraging AUSD's integration with Solana DeFi protocols like Kamino. Its structure combines traditional fund management practices with on-chain efficiency, serving institutional cash managers. As of July 2025, VBILL is the sixth-largest yield-bearing real-world asset on Solana by market capitalization, valued at $13.6 million.

Centrifuge: deRWA and deJTRSY (On-Chain Treasury Bills)

Centrifuge is known for its early work in tokenizing real-world loans on Ethereum and Polkadot, expanding to Solana in May 2025 and launching its deRWA token standard. The first token to be deployed under this framework on Solana is deJTRSY, which represents shares of a $400 million short-term U.S. Treasury fund managed by Anemoy. Unlike traditional security tokens, deRWA assets will be freely transferable and immediately usable within Solana's DeFi ecosystem, including on platforms like Raydium, Kamino, and Lulo.

The deJTRSY token will enable Solana users to earn yields from U.S. Treasuries in a fully composable manner, enhancing the on-chain utility of traditional financial instruments. Additionally, Centrifuge's approach eliminates long-standing frictions in the liquidity of tokenized real-world assets and embodies its strategy of connecting institutional-grade funds with high-speed DeFi infrastructure. In addition to Treasuries, Centrifuge also supports private credit pools on Solana, allowing asset management firms to underwrite real-world loans and provide tokenized tranches to on-chain investors. These pools diversify sources of yield and enhance credit channels for emerging market borrowers.

Tokenized Institutional Funds

Institutional funds on Solana represent a new wave of RWA tokenization, extending beyond simple debt instruments to encompass diversified private credit, real estate, and alternative asset strategies. These products are designed to meet the requirements of compliance, transparency, and DeFi composability, while also offering more diverse and higher-yielding products than tokenized Treasuries.

Apollo: ACRED (Apollo Diversified Credit Fund)

ACRED is the tokenized version of Apollo Global Management's diversified private credit fund, created in collaboration with Securitize and launched on Solana in May 2025. The token represents an investment interest in a corporate loan portfolio and other private credit instruments, issued as a regulated security token (sToken) under Securitize's compliance framework.

ACRED is open to accredited investors and integrates with Solana's native DeFi platforms, such as Kamino and Drift Institutional. These integrations allow users to borrow stablecoins using their ACRED holdings as collateral and implement leverage strategies, effectively transforming a traditionally illiquid asset into composable DeFi collateral. The fund brings institutional-grade credit exposure and capital efficiency to Solana. As of July 2025, ACRED is the third-largest yield-bearing real-world asset on Solana by market capitalization, valued at $26.9 million.

Libre Capital: Tokenized Alternative Funds

Libre Capital is a platform supported by Hamilton Lane and Brevan Howard, providing institutional investors with exposure to tokenized alternative assets. In July 2024, Libre launched its Solana integration, becoming the first platform to introduce private market credit funds to the network. Currently available tokenized funds include Hamilton Lane's senior credit opportunity fund (SCOPE) with a target yield of 9%, Brevan Howard's main fund (BHM), and a short-term dollar fund managed by BlackRock ICS.

Libre acts as a "tokenized gateway" for top fund managers, aggregating a range of private credit, hedge fund, and liquidity alternative strategies. The platform emphasizes permissioned access for accredited investors and aims to unlock secondary trading capabilities on Solana to achieve real-time liquidity in these traditionally illiquid markets.

Tokenized Private Credit

Solana's private credit protocols expand the boundaries of real-world assets by enabling direct lending to fintech companies, SMEs, and emerging market borrowers, all supported by on-chain transparency and risk management.

Maple Finance: syrupUSDC (Yield-Bearing Stablecoin)

syrupUSDC is Maple Finance's on-chain yield-bearing stablecoin, launched on Solana in June 2025. The token represents funds deposited into Maple's credit pools, which provide loans to trading firms, market makers, and fintech companies. syrupUSDC has a target annual percentage yield (APY) of 6-7%, positioning it as a higher-yielding alternative to traditional yield-bearing stablecoins.

The product is designed for use in DeFi applications and benefits from composability within the Solana ecosystem, including on DEXs like Orca and lending platforms like Kamino. Maple's approach combines transparency, rigorous underwriting standards, and real-time liquidity, transforming institutional credit into a stablecoin form that can circulate in a broader DeFi landscape. As of July 2025, over 63.6 million tokens have been issued, with a market capitalization of $70.7 million, of which $47 million has been deposited into Kamino.

Credix Finance: Private Credit Market

Credix Finance operates a Solana-native private credit market, enabling institutional investors to fund loans initiated by fintech companies in emerging markets like Brazil and Colombia. Since its launch in 2023, Credix has facilitated the tokenization of receivables, asset-backed loans, and revenue-sharing agreements. Its funding pools are typically structured into senior and junior tranches to accommodate different risk-return profiles and include features such as insurance provided by export credit agencies and bankruptcy-remote trusts. As of July 2024, the platform has facilitated financing for hundreds of SMEs in Brazil. Credix's uniqueness lies in its focus on real-world impact and localized deal flow, offering higher yields and diversified opportunities beyond the U.S. market.

Huma Institutional: PayFi Private Credit

Huma Institutional functions similarly to the private permissioned lending of Centrifuge, Maple, and Credix. Huma currently supports 12 active lending pools across four different PayFi protocols, with six active on Solana and operated by Arf. Through these six pools, the Huma platform has issued over $97 million in credit.

Arf is a global liquidity platform providing USDC-based short-term financing for cross-border payments without the need for pre-funded accounts. By leveraging on-chain liquidity, Arf enables fast, low-cost settlements while reducing counterparty risk. In April 2024, Arf merged with Huma to expand its liquidity solutions.

Other Debt-Based Protocols

Etherfuse: Stablebonds (Sovereign Bonds on Solana)

Etherfuse focuses on bringing emerging market sovereign debt and currencies on-chain. Through products like MXNe and Tesouro, the platform tokenizes Mexican and Brazilian government bonds, offering stablecoin-like assets on Solana and other networks. For example, MXNe is a stablecoin denominated in Mexican pesos, fully backed by short-term government CETES bonds. This structure allows users to earn yields from sovereign debt while transacting on-chain in local currencies.

Etherfuse launched its stable bond product in 2024, targeting remittance markets and domestic financial institutions seeking foreign currency-denominated digital tools. By combining bond-backed stability with DeFi liquidity, Etherfuse introduces a new category of low-volatility, yield-bearing assets, expanding access to real-world assets beyond dollar-centric tools.

On-Chain Stocks

Tokenized stocks on Solana represent the next phase of evolution in capital markets, supporting 24/7 trading, fractional ownership, and seamless integration with DeFi protocols. Although still in its early stages, this space is rapidly maturing thanks to advancements in compliance technology, transfer agent mechanisms, and cross-chain infrastructure.

Superstate: Opening Bell (On-Chain Equity Platform)

Opening Bell is an equity tokenization platform developed by Superstate, an asset management company founded by Robert Leshner. In May 2025, the platform announced a partnership with Securitize to enable companies registered with the SEC to issue and trade equity directly on public chains like Solana. These stocks will be recorded through compliant digital transfer agents and are expected to become fully regulated securities under U.S. law. In May of the same year, the team submitted a proposal to the SEC for "Project Open" in collaboration with the Solana Policy Institute and Orca, outlining how to issue and trade securities on public chain infrastructure for more efficient, transparent, and effective capital market operations.

The first company to land on the platform is SOL Strategies (ticker CYFRF), a $280.6 million Solana fund management tool that participates in the network ecosystem by operating its own validator nodes. On-chain trading for Opening Bell is expected to launch in the second half of 2025, aiming to shorten the traditional T+2 settlement cycle to near-instant execution and enable full programmability and composability of equity in DeFi.

Backed and Kraken: xStocks (Tokenized Stocks and ETFs)

xStocks is a portfolio of tokenized U.S. stocks and ETFs launched in collaboration between the Swiss-regulated issuer Backed and the exchange Kraken. The product was announced in May 2025 and officially launched on June 30. The initial offering includes over 60 products, covering individual stocks like Apple and Tesla, as well as broad-based index funds, and is open to non-U.S. customers. These tokens will be issued in a fully collateralized manner on Solana, with the underlying shares held in compliant custodians. Kraken users can trade on the exchange or withdraw to on-chain for DeFi protocol operations.

xStocks' core advantage lies in its "compliance-first" architecture (supported by the European prospectus) and the seamless integration with the Kraken exchange and Solana DeFi ecosystem. The platform is dedicated to popularizing U.S. stock investment channels, particularly serving users in regions with insufficient coverage from traditional brokerages. As of July 7, 2025, there are over 45,700 xStocks holders, with a total market capitalization of $51.7 million. Among them, the S&P 500 index token SPYx leads with 9,692 holders and a market value of $6.8 million, while the Tesla token TSLAx ranks second with 9,914 holders and a market value of $6.2 million.

Ondo: Global Market Platform

Ondo Global Markets is a product suite soon to be launched by Ondo Finance, aimed at providing non-U.S. investors with direct access to tokenized public equity and ETFs. The platform does not issue synthetic assets or ETFs but operates as an on-chain brokerage interface: actual shares are held by custodians and linked to tokens in wallets (such as onTSLA). These tokens will serve as programmable ownership representations, transferable among whitelisted users or acting as collateral.

Ondo's architecture supports trade orders executed off-chain on traditional exchanges while enabling on-chain instant settlement. The platform is currently in development and is scheduled to launch by the end of 2025. Its innovation lies in treating tokens as information transmission infrastructure rather than a new asset class, achieving compliance and liquidity while ensuring on-chain programmability. Once officially launched, it is expected to introduce thousands of traditional equity assets to the Solana ecosystem.

Republic: Mirror Tokens (Pre-IPO Equity Exposure)

In June 2025, the investment platform Republic announced the launch of a new asset class called "Mirror Tokens," with the first product rSpaceX minted on Solana. These tokens provide economic exposure by simulating the performance of stocks from private companies like SpaceX during liquidity events such as IPOs or mergers, without granting direct equity or ownership. rSpaceX opens up Pre-IPO investment opportunities to global non-accredited investors, with a minimum subscription threshold of just $50 and a maximum limit of $5,000 per account. This initiative leverages Solana's high-performance infrastructure to democratize traditional illiquid private equity assets. Republic plans to expand "Mirror Tokens" to other leading private companies.

Step Finance: Remora Markets (Tokenized Stock Trading)

Remora Markets was acquired by Step Finance in December 2024, with plans to allow users to trade fractional equity shares on Solana. Remora will be embedded within Step Finance's broader portfolio management interface, prioritizing user-friendly design, small trade volumes, and minimal fees. All revenue generated by Remora will be used to repurchase STEP tokens, aligning protocol incentives with the interests of token holders. The platform will operate under regulatory licenses obtained through the acquisition, supporting 24/7 trading and instant settlement.

Remora adopts a retail-first strategy in the tokenized equity market, positioning itself as a more accessible alternative to institutional-oriented platforms like Opening Bell and xStocks. The platform is still under development, aiming for a full launch in the second half of 2025.

Non-Yielding Assets

While yield-bearing assets dominate the total locked value (TVL) of real-world assets on Solana, non-yielding products (non-income-generating products) play a crucial role in expanding asset classes and showcasing the flexibility of Solana's infrastructure. These assets include tokenized real estate, unique physical goods, and collectibles.

Tokenized Real Estate

Parcl: Users can invest in the price fluctuations of real estate markets in specific geographic areas (such as major U.S. cities) through Parcl, without actually owning the properties. The platform provides a liquid, low-threshold, and low-cost channel for exposure to real estate trends by tracking price indices (price per square foot) and creating a tradable market.

Homebase: Homebase issues tokenized NFTs representing fractional ownership of U.S. rental properties, strictly adhering to compliance requirements such as KYC, third-party custody, and lock-up. Investors can buy and sell shares directly on its platform, lowering entry barriers and enhancing market liquidity while ensuring legal enforceability.

MetaWealth: MetaWealth is a Solana-based investment platform focused on fractional real estate ownership in the European market. Since its launch, the platform has facilitated over $36 million in tokenized real estate investments, listing assets in countries like Romania, Spain, Greece, and Italy, with over 50,000 investor accounts and 138 tokenized assets.

Tokenized Physical Goods and Collectibles

BAXUS: BAXUS operates a peer-to-peer trading platform for premium rare spirits, storing bottles in a vault after authenticity verification and tokenizing them as NFTs on Solana. Users can trade, store, and insure their collections, with NFTs serving as both proof of ownership and a redemption mechanism for physical assets.

CollectorCrypt: CollectorCrypt brings physical collectibles (such as Pokémon trading cards) to Solana, allowing users to deposit items for authentication, tokenization, and integration with DeFi functionalities. This model expands the application scenarios of NFTs as carriers of physical value.

AgriDex: AgriDex tokenizes agricultural products on Solana, supporting the buying and selling of crops in the form of NFTs that encapsulate key transaction details. By collaborating with agricultural organizations and utilizing DeFi tools, the platform aims to enhance transparency and efficiency in the commodities market.

RWA Infrastructure

Solana's RWA ecosystem is built on a rapidly evolving set of technical standards, data oracles, compliance tools, and market infrastructure.

R3

R3 is a UK-based fintech company that provides enterprise-level distributed ledger solutions for regulated financial institutions. While R3 is not a direct issuer or investor in RWA, it acts as a technology enabler. It offers middleware and compliance tools to support the issuance of tokenized assets and their transfer from permissioned environments to high-performance public networks like Solana.

Its flagship product, Corda, is a permissioned distributed ledger technology (DLT) platform applied in capital markets, payments, and central bank digital currencies (CBDCs). Corda is designed for regulated environments, focusing on privacy and compliance, and supports direct trading between institutions. R3's clients include top financial institutions such as HSBC, Bank of America, and the Bank of Italy. As of June 2025, R3 has supported over $10 billion in tokenized assets across asset classes.

Drift Institutional

In May 2025, Drift announced the launch of Drift Institutional, aimed at assisting institutions in bringing RWA to Solana. This service simplifies the tokenization process for traditional assets such as credit, real estate, and commodities through native DeFi tools, granting assets leverage and composability for more efficient capital utilization, automated yield strategies, and transparent risk management.

The first case for Drift Institutional is a collaboration with Securitize to connect Apollo's $1 billion diversified credit fund (ACRED) to Solana. This integration allows accredited institutional investors to deposit sACRED into institutional liquidity pools (ACRED-USDC/ACRED-USDT) and borrow stablecoins against their positions.

Kamino Finance

Kamino Finance is a Solana-based lending protocol that provides users with automated strategies for participating in lending and providing liquidity. As a key platform for RWA integration, Kamino allows investors to use tokenized real-world assets as on-chain collateral. A notable use case is that investors holding shares of the Apollo tokenized credit fund (ACRED) can deposit them into Kamino to borrow stablecoins like USDC against their holdings. This functionality unlocks the liquidity of traditionally illiquid assets and deepens their integration with the Solana DeFi ecosystem.

Fiserv

In June 2025, payment and fintech company Fiserv announced a strategic partnership with Circle to enhance stablecoin payment capabilities for its clients. This collaboration integrates Circle's USDC infrastructure with Fiserv's extensive network covering thousands of financial institutions and millions of merchant nodes worldwide. This move will enable Fiserv to leverage the Solana blockchain for fast, low-cost USDC payment settlements, connecting traditional commerce and banking systems with the modern internet-native financial layer.

Other Infrastructure

Token Standards: SPL tokens and the Token-2022 standard lay the foundation for fungible and non-fungible assets on Solana. Token-2022 introduces extended functionalities designed specifically for real-world assets, including confidential transfers, interest accumulation, programmable transfer restrictions, and compliance execution hooks.

Oracles: Pyth Network provides high-frequency decentralized price feeds for various assets within the Solana ecosystem, covering a range from Parcl's real estate index to yield-bearing government bonds. Switchboard and Redstone offer supplementary oracle solutions to enhance data redundancy and reduce manipulation risks.

Cross-Chain Bridges: Wormhole and Chainlink's CCIP (Cross-Chain Interoperability Protocol) enable seamless cross-chain transfer and settlement of real-world assets, allowing interaction with ecosystems like Ethereum, Polygon, and Avalanche. Projects like Centrifuge and Backed utilize Wormhole to bring institutional-grade assets into Solana's DeFi ecosystem.

Compliance and Identity Solutions: Securitize provides Know Your Customer (KYC)/Anti-Money Laundering (AML) enforcement, investor onboarding, and transfer agent services to ensure the compliance of tokenized funds and equity products.

Conclusion

The real-world asset ecosystem on Solana has seen significant expansion, evolving from a handful of experimental projects to a robust, diverse, and institutionally credible niche market. Yield-bearing products, particularly tokenized government bonds and institutional funds, form the cornerstone of this ecosystem, while composable DeFi integration and programmable compliance set Solana apart. The simultaneous rise of tokenized stocks, real estate derivatives, and physical goods underscores the network's flexibility and innovative capacity, supported by cutting-edge infrastructure and growing institutional partnerships.

Looking ahead, Solana, with its unique advantages of speed, composability, and developer-driven innovation, is poised to become a core platform in the next wave of real-world asset adoption. As new asset classes launch and partnerships deepen, Solana is expected to compete with Ethereum in the institutional RWA market and define a new standard for programmable, global, and democratized finance in the blockchain era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。