This week, Washington welcomed a pivotal moment dubbed "Cryptocurrency Week," as the U.S. Congress accelerates the advancement of several pieces of legislation supporting cryptocurrencies, signaling significant changes for the cryptocurrency industry. This not only injects new growth momentum into the industry but also significantly reduces its future risks.

Legislative Highlights of "Cryptocurrency Week"

On July 3, the U.S. House of Representatives passed a low-key yet far-reaching press release, officially declaring June 14 as "Cryptocurrency Week," and committed to advancing three key pieces of cryptocurrency legislation:

The GENIUS Act: Provides a clear regulatory framework for stablecoins. This bill has passed the Senate with a vote of 68 to 30, including support from 18 Democratic lawmakers, making it one of the most bipartisan bills of the 2025 congressional session. If passed unanimously by the House, the bill will be sent to the President for signing, potentially becoming the first significant cryptocurrency legislation in U.S. history.

The CLARITY Act: Establishes a comprehensive regulatory framework for crypto assets, aimed at providing clear compliance guidance for market participants.

The Anti-CBDC Surveillance National Act: Prohibits the creation of a central bank digital currency (CBDC) in the U.S. to protect financial privacy and market freedom.

Although the CLARITY Act and the Anti-CBDC Act still require Senate approval, the passage of any of these bills in the House would mark an important milestone for the cryptocurrency industry.

Why Are These Legislations Crucial for Cryptocurrency?

A clear regulatory framework will bring dual benefits to the cryptocurrency industry:

Driving Growth and Reducing Risk

1. Promoting Growth

Clear cryptocurrency legislation will incentivize large financial institutions to increase their presence in the crypto space, attracting billions of dollars in investment and guiding trillions of dollars in traditional assets into blockchain-based ecosystems. Imagine the prosperity of the cryptocurrency market if JPMorgan, Bank of New York Mellon, or Nasdaq could freely develop in a clear regulatory environment? The answer will soon be revealed during "Cryptocurrency Week."

2. Reducing Risk

The cryptocurrency industry has been repeatedly battered by a lack of regulation, with collapses like FTX, Luna, and Three Arrows Capital not only devastating the market but also undermining investor confidence. These failures largely stem from regulatory gaps:

If there were clear regulations governing exchanges, collapses like that of offshore platforms such as FTX due to a lack of internal controls and audits would be less likely to occur.

If large banks could custody crypto assets, investors would no longer shy away due to custody risks.

If the GENIUS Act were implemented sooner, Ponzi-like stablecoins such as Luna would have no foothold.

While clear rules cannot completely eliminate market scandals—evidenced by Bernie Madoff and Credit Suisse incidents in traditional finance—they can significantly reduce the likelihood of such events. Over the past 15 years, Bitcoin, despite being one of the best-performing assets globally, has experienced seven drops of over 70%. Clear regulation will lower the risk of unexpected collapses caused by unregulated offshore platforms, and the likelihood of significant market volatility will also decrease.

Why Does Cryptocurrency Enjoy Bipartisan Support?

There are concerns that the next government may reverse the achievements of cryptocurrency legislation, but such worries may be unfounded. Cryptocurrency is one of the few policy issues that has garnered broad bipartisan support in the U.S. The passage of the GENIUS Act in the Senate exemplifies this, demonstrating a cross-party support base. Several reasons underpin this bipartisan support:

Enthusiasm from Young Voters: Cryptocurrency is highly popular among younger demographics, making it hard for politicians to ignore this trend.

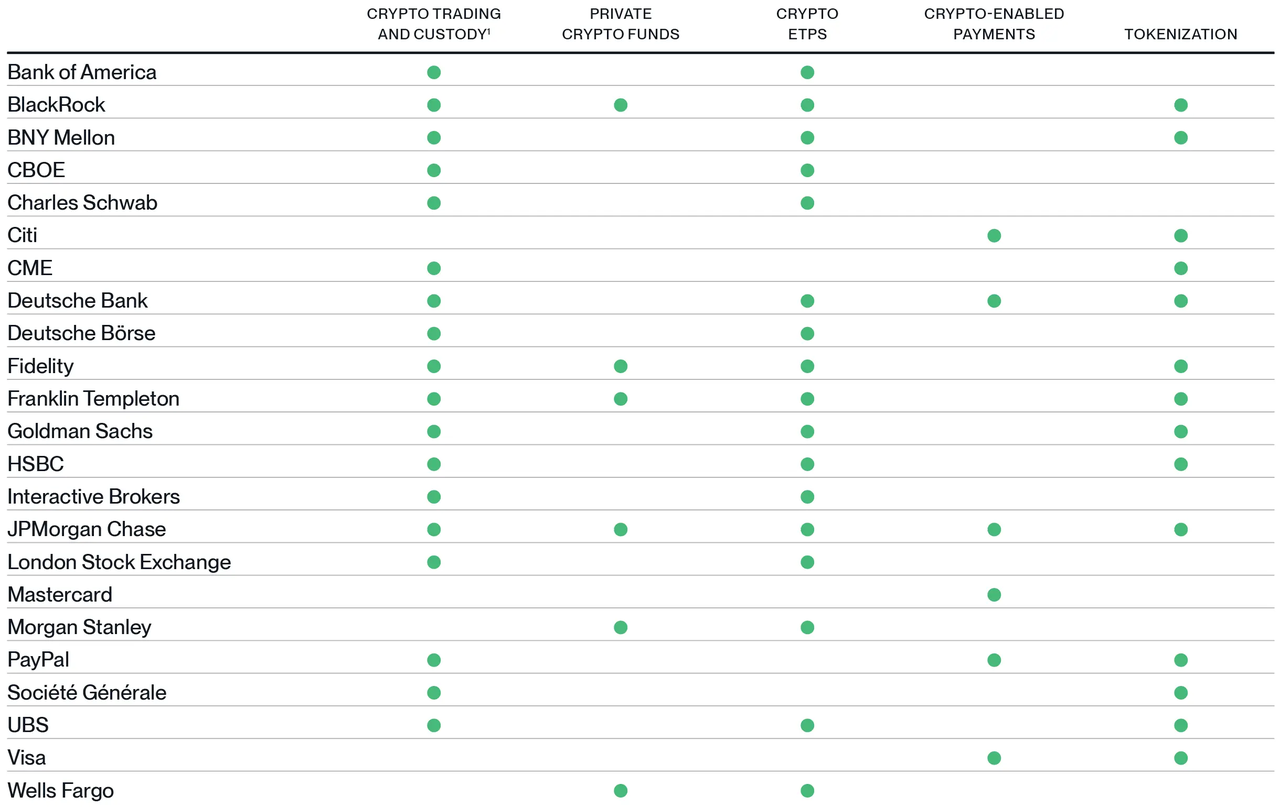

Push from the Financial Industry: The U.S. financial sector—traditionally a significant donor to Democrats—eagerly seeks to seize the growth opportunities presented by cryptocurrency. Major financial institutions like BlackRock, JPMorgan, and Morgan Stanley have varying degrees of involvement in the crypto space, with millions of Americans and thousands of businesses already invested.

This economic motivation ensures the long-term sustainability of cryptocurrency legislation. As a vivid metaphor puts it: "You can't put the genie back in the bottle." Once these bills are passed and signed into law during "Cryptocurrency Week," cryptocurrency will enter a new era of mainstream acceptance.

Trends in Institutional Adoption

Data Source: Bitwise Asset Management, data from company filings and presentations. Data as of June 30, 2025. (1) "Cryptocurrency trading and custody" includes trading of cryptocurrency spot, futures, and derivatives.

According to Bitwise Asset Management, as of June 30, 2025, nearly all major financial institutions in the U.S. have engaged in cryptocurrency trading, custody, or derivatives markets. This wave of institutional adoption further solidifies the position of cryptocurrency and makes policy reversals more difficult.

Conclusion

Washington's "Cryptocurrency Week" is not just a legislative event but a turning point for the maturation of the cryptocurrency industry. Through legislation such as the GENIUS Act, the CLARITY Act, and the Anti-CBDC Act, the cryptocurrency market will welcome clearer rules, lower investment risks, and stronger growth momentum. This not only opens new opportunities for investors and institutions but also lays the foundation for building an open, transparent, and efficient financial ecosystem. Cryptocurrency is becoming mainstream, and the legislative progress made this week will write a new chapter for the industry's future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。