In the past year, many global financial giants have quietly entered the cryptocurrency market. Whether it is mainstream financial institutions in the United States or national government platforms in Japan, India, Thailand, and other countries, they have gradually turned their attention to blockchain technology and crypto assets. Behind these seemingly marginal pilot projects and investments lies an increasingly clear trend: the traditional financial system is launching a new round of performance scrutiny on blockchain infrastructure.

Compared to the technological standards of the internet era, the operational efficiency of most existing blockchains remains relatively low. The Ethereum mainnet processes about 15 transactions per second, with confirmation times measured in seconds, while the Visa network can handle up to 65,000 transactions per second at peak, and Nasdaq's matching system boasts a capacity of over 100,000 transactions per second. The Google Ads bidding system requires rapid decision-making among millions of requests per second, all of which constitute the high-pressure demands for blockchain performance in the real world.

Although new-generation chains like Solana, Avalanche, and Optimism theoretically have the capability of tens of thousands of TPS, practical issues such as complex contract calculations, network bandwidth bottlenecks, and consensus delays can significantly reduce actual throughput. Therefore, we see an increasing number of technical paths being proposed to break through the current ceiling of blockchain scalability, such as Layer 2, modular chains, parallel execution, and asynchronous consensus mechanisms… Various scaling solutions are emerging one after another.

Even Solana, known for its high performance, announced a protocol reform plan called Alpenglow at this year's consensus conference, aiming to replace the existing TowerBFT consensus mechanism and historical proof timestamp system by introducing the Votor and Rotor modules to further enhance its throughput and stability. This not only reflects Solana's re-examination of its own architecture but also confirms that a new round of competition for on-chain performance has begun across the industry.

In this competition, Sei is one of the few public chains that has made "high-throughput infrastructure" a core strategy. Compared to Ethereum's incremental scaling route represented by Rollup or Solana's vertical breakthrough with an integrated architecture, Sei attempts to start from the underlying logic, adopting a systematic reconstruction approach to create a truly Web2-level responsive L1 public chain, with the key node of this strategy being the recently launched Giga upgrade.

Why is the Giga Upgrade Needed?

Recently, Sei released the Sei Giga white paper, stating that Sei is a decentralized, permissionless EVM public chain with no block rewards, utilizing a Proof-of-Stake mechanism. It supports smart contracts written in mainstream EVM languages such as Solidity and Vyper. Its compatibility with EVM is essentially equivalent to that of the Ethereum mainnet, with differences only in aspects like EIP-4844, PREVRANDAO, state root, block gas limits, and transaction fee mechanisms.

Sei Giga uses a completely custom-built EVM execution client, a new storage layer, and a state commitment mechanism based on asynchronous accumulators. Thanks to these designs, Sei Giga can scale to Web2-level use cases, such as environments requiring rapid transaction confirmations (like on-chain transactions), while ensuring quick finality on a verifiable and secure public ledger.

We often talk about the TPS of blockchains, but for smart contracts, a more precise measurement is gas/sec. Gas is the unit that measures computational consumption in Ethereum, reflecting the resource consumption of executing a piece of logic. The higher the gas/sec supported by the chain, the more complex contract logic and higher concurrent calls it can handle.

In April last year, Paradigm's CTO published an article titled "Reth's path to 1 gigagas per second, and Beyond," introducing the concept of Gigagas. Giga translates to a common quantity unit, meaning billion or giga; while gas refers to the familiar gas fees.

The combination of the two words means one billion gas, indicating that the performance improvement of the blockchain needs to aim for this target to ultimately achieve a user experience akin to Web2. By this standard, Ethereum currently operates at a level of one million gas/sec, while Sei Giga's target is 5 Gigagas/sec, a 50-fold increase.

Why 5? This is a realistically significant threshold—based on the RPC request volume of Google, the transaction load of Visa, and even the invocation frequency of AI models, 5 Gigagas is already the basic threshold for high-load Web2 applications. The Giga upgrade is essentially a foundational engineering project prepared for future mainstream scenarios.

The Giga upgrade is not a one-size-fits-all solution; rather, it marks a comprehensive reconstruction along the three core paths of execution, consensus, and storage, transforming the chain into a performance foundation close to traditional distributed systems.

Three Pillars of Sei's Technical Reconstruction

Reconstructing the EVM Client to Release Concurrency

In recent years, the blockchain industry has faced an old problem: smart contracts run too slowly. It's like a road designed for bicycles but needing to accommodate the traffic of high-speed trains. The EVM (Ethereum Virtual Machine) is the most universal "operating system" in the crypto world, but its original design did not prioritize speed, processing at most a hundred transactions per second. Today, real-world applications like financial transactions, gaming, and ad bidding often require tens of thousands or even hundreds of thousands of requests per second, which the EVM clearly cannot handle.

The Giga upgrade introduced by Sei aims to solve this performance issue. In simple terms, Sei wants the EVM to function like a highway, allowing thousands of cars to pass simultaneously instead of waiting in line one by one.

Sei has developed a new EVM client optimized for throughput, introducing ahead-of-time compilation, transaction dependency analysis, and a parallel execution framework. By statically analyzing contract bytecode, the system can determine which transactions are independent before execution, enabling true parallel processing.

This is akin to cars on a highway no longer queuing at toll booths but being identified and allowed to pass by AI cameras ahead. This predictive mechanism significantly reduces the likelihood of "traffic jams" on the chain. Additionally, Sei employs a custom binary encoding format to compress block sizes and reduce parsing times, making network transmission and execution scheduling more efficient.

Autobahn Multi-Lane Architecture for Second-Level Confirmation

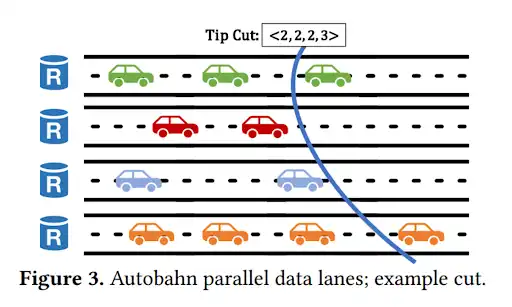

Traditional blockchains rely on a single proposer to submit a block during the consensus process, which limits throughput. The core idea of Autobahn is "multi-lane": each validating node can propose its own block, forming independent proposal lanes, from which a rotating leader periodically selects a snapshot for consensus.

This mechanism separates the propagation of transaction data from final confirmation: data availability is pre-validated by PoA signatures before consensus, requiring only minimal message passing (two rounds of confirmation), compressing final confirmation times to under 700 milliseconds.

In simple terms, most blockchains are like a highway with only one toll booth, allowing only one car to pass at a time. While this method is safe, it is slow and prone to congestion. Tendermint operates on such a "single toll booth" mechanism: each round has a "proposer" who packages transactions, and others must wait for them to finish before they can validate, making the entire process step-by-step and inefficient.

In contrast, Sei's Autobahn consensus mechanism resembles a multi-lane highway, where each lane has its own toll booth, allowing multiple booths to simultaneously let different vehicles through. Multiple participants in the network can propose transaction requests in their own "lanes" without waiting for one person to finish before the next can proceed. This "multi-proposer" architecture significantly enhances transaction processing speed without sacrificing security—Sei Giga's throughput capability is over 50 times that of traditional Tendermint.

Moreover, Sei has implemented a very clever approach: it separates the steps of "consensus" and "data," which are typically tied together. The consensus phase no longer requires downloading all transaction content; it only needs to confirm that "data is being held," retrieving it when needed. This is like a meeting where not everyone needs to read through thick materials in advance; as long as someone confirms that the materials are complete and backed up, the meeting can proceed efficiently.

This mechanism allows Sei to not only meet ordinary transaction needs but also provide a blockchain foundation closer to traditional internet performance for high-frequency trading, on-chain gaming, AI applications, and other scenarios requiring rapid responses.

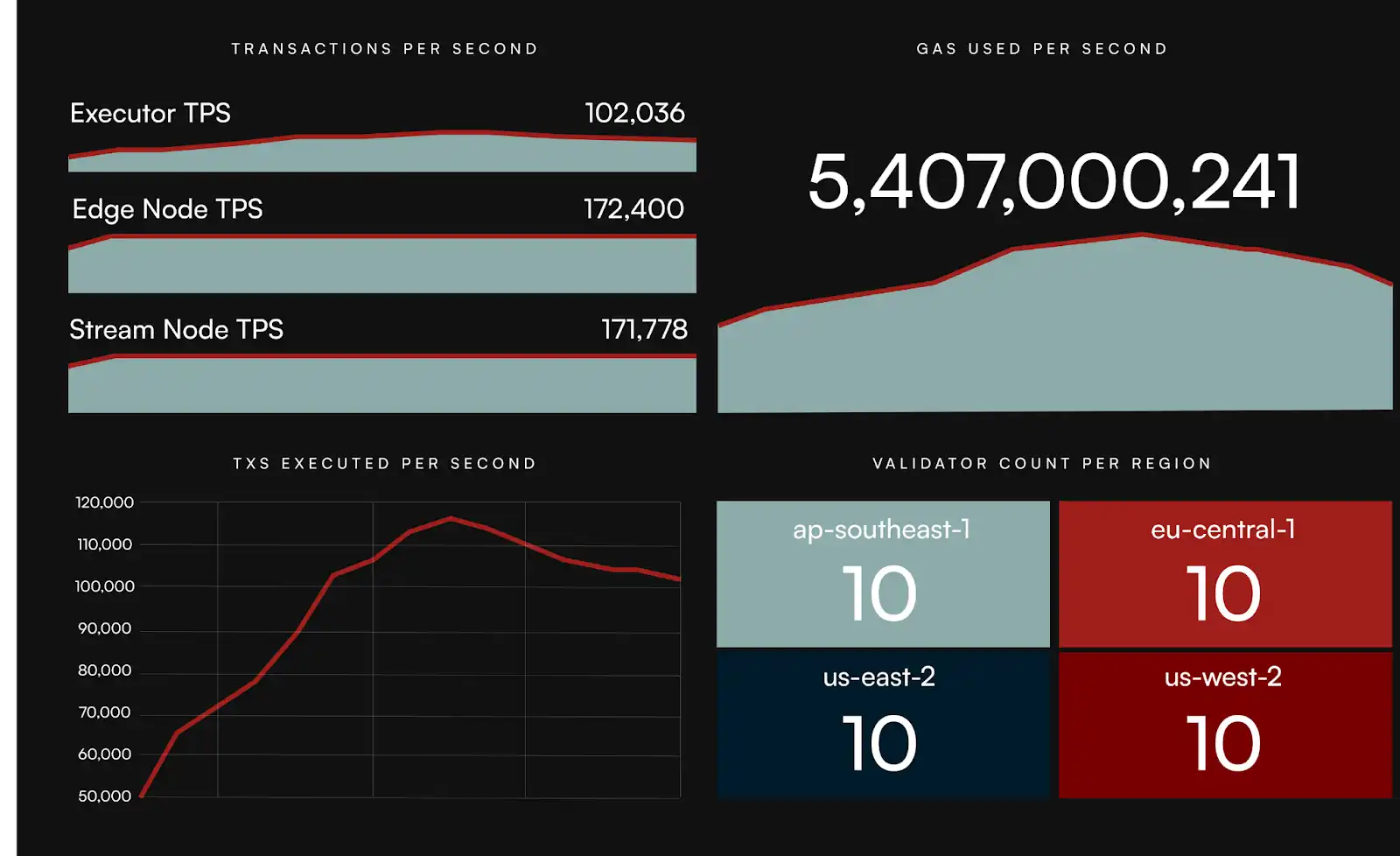

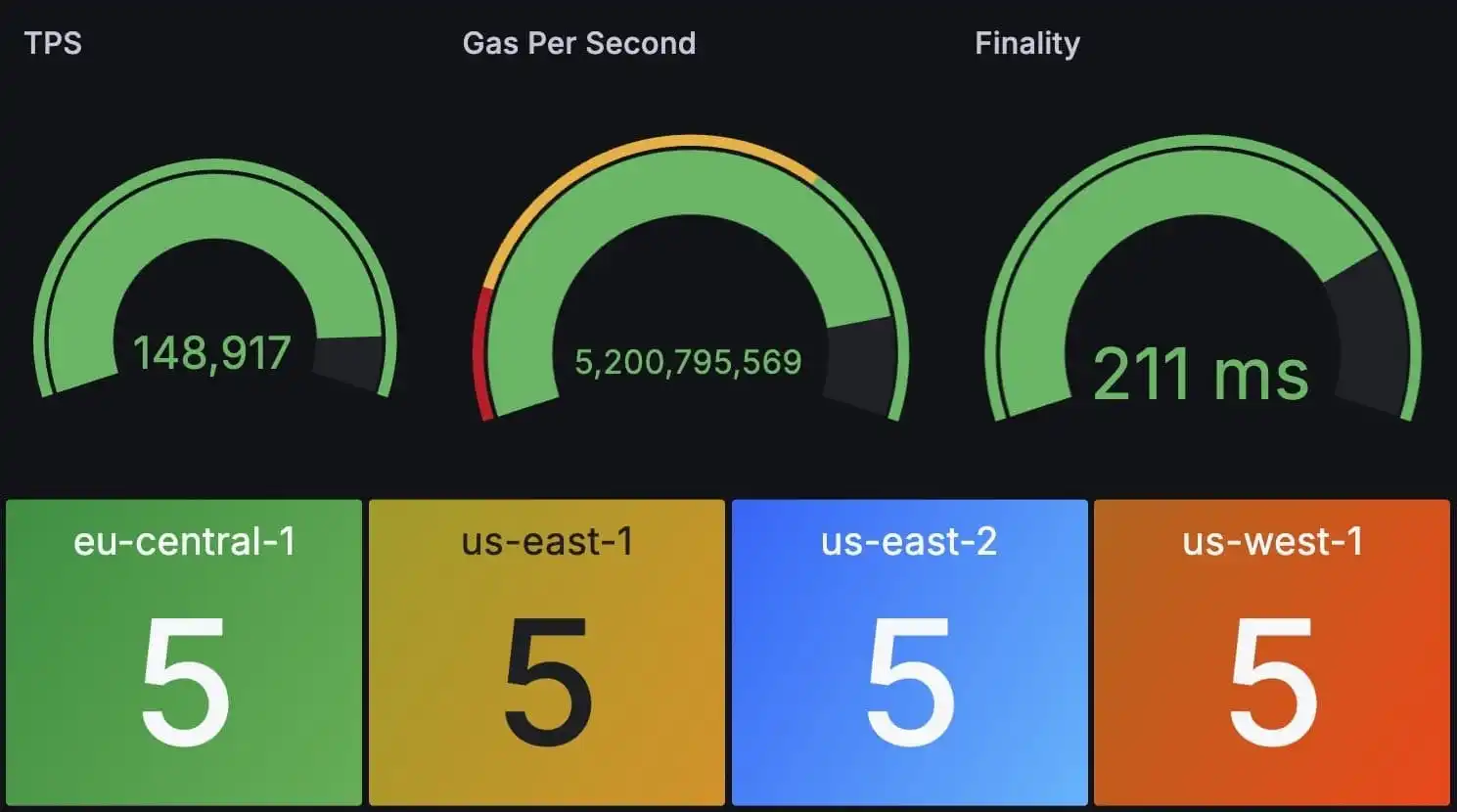

In internal testing, the Sei team deployed a network of 40 validating nodes distributed across Singapore, Germany, Ohio, and Oregon, simulating real-world delays and bandwidth limitations. In this environment, the Giga upgrade achieved a sustained processing capacity of 5 Gigagas per second, with final confirmation times maintained under 700 milliseconds, and the network remained stable across regional deployments.

Asynchronous State Submission and Efficient Data Pathways

In the storage layer, Sei Giga introduces an asynchronous state root generation mechanism, allowing contract state updates to no longer block the main process. After transaction execution is completed, state updates can occur in the background, similar to the write-ahead logging and asynchronous flushing mechanisms used in large databases, ensuring data consistency while significantly reducing latency.

Additionally, Sei has optimized the read path for its KV database structure and improved read and write efficiency through caching, preloading strategies, and batch writing. Overall, the entire storage engine is moving towards an architecture resembling distributed database systems.

Beyond Technology: What About Sei's Ecological Prospects?

Technology is just the first step; institutional design and market pathways are equally important. The current performance competition in the public chain field has already entered deep waters. The competition between Solana and Ethereum goes without saying, and the emerging public chain ecosystems like Sui and Abstract that are catching up should not be underestimated.

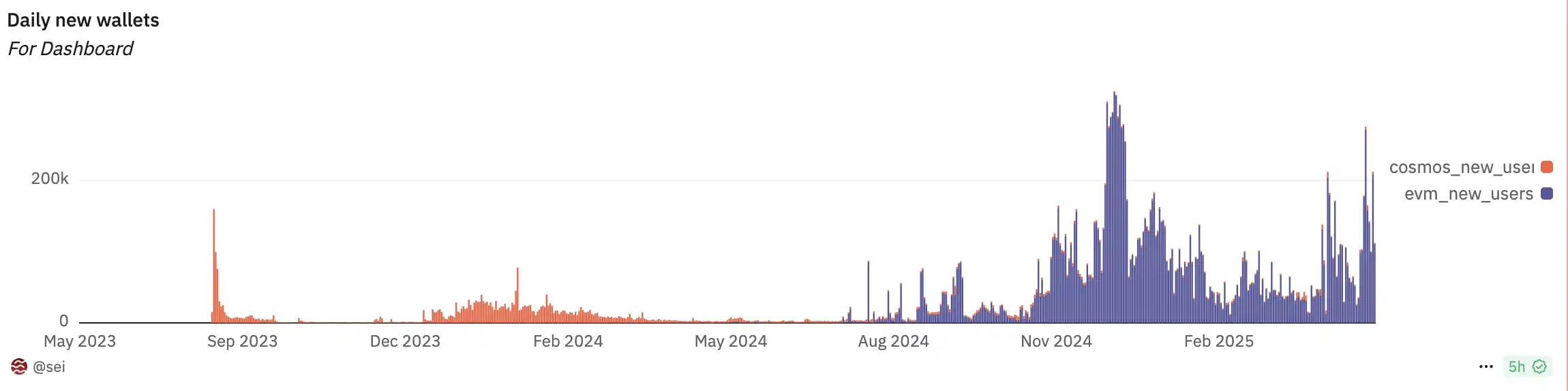

Since the construction of the EVM ecosystem began in mid-last year, the number of wallets in the Sei ecosystem has significantly surpassed the peak during the Cosmos architecture period, indicating that its user base and on-chain activity are gradually aligning with mainstream EVM networks. Therefore, the official announcement of the Sei Giga upgrade can be seen as a key step for this new public chain to clarify its technological advantages and development direction in the face of fierce competition in the high-performance EVM battlefield.

This upgrade not only represents a substantial breakthrough for Sei in terms of throughput and finality but also marks its strategic transformation from a "parallel chain" to "high-frequency trading infrastructure." For developers looking to deploy more complex logic and lower-latency applications in Web3, Sei is attempting to provide a landing platform that is closer to Web2 performance standards.

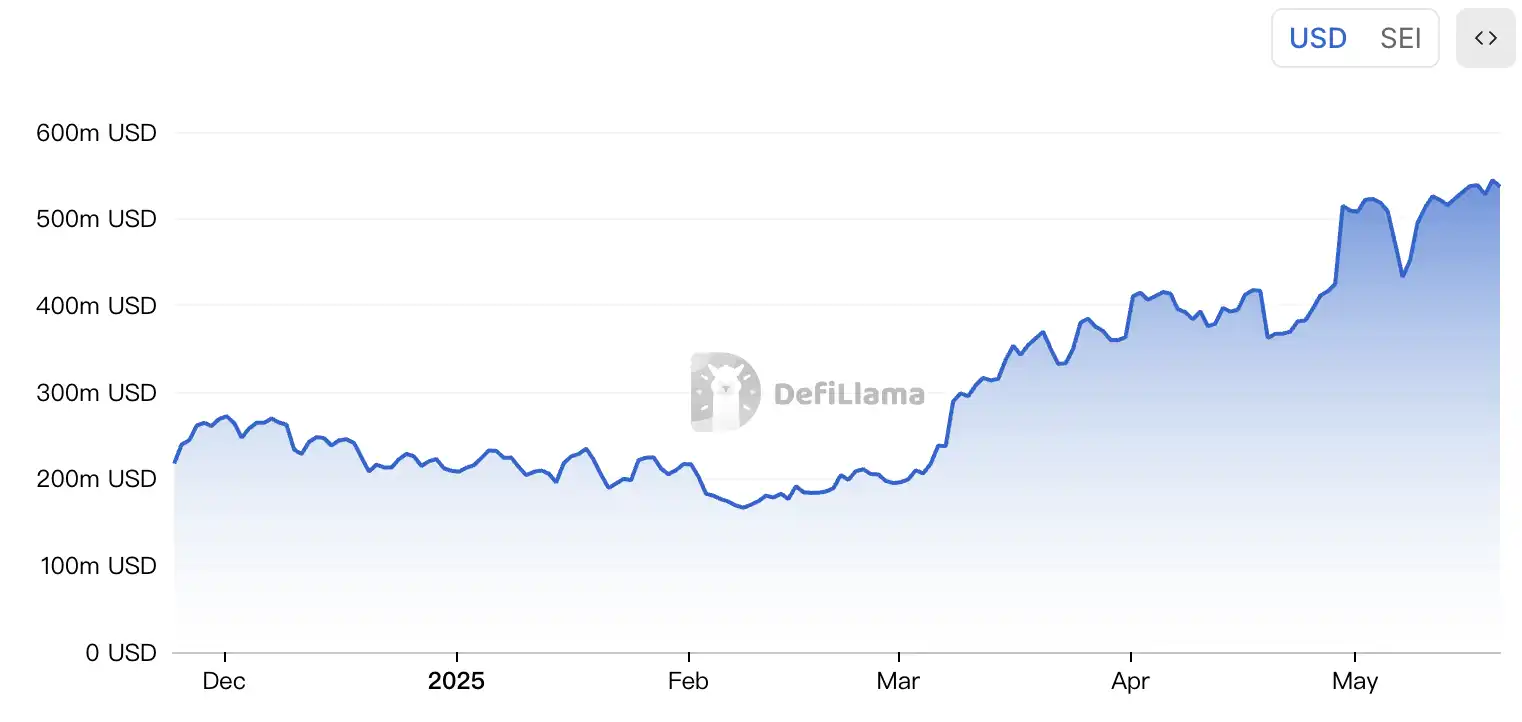

At the same time, the scale of on-chain assets in Sei is also steadily expanding. As of the time of writing, its TVL has reached $1.264 billion. As shown in the chart below, since 2025, the TVL of the Sei ecosystem has been in a continuous growth state, demonstrating the sustained confidence of developers and the capital market in its technological upgrade path.

This growth is reflected not only in on-chain data but is also gradually transmitting into the traditional financial system. In May 2025, Canary Capital submitted the S-1 filing for the Staked SEI ETF, indicating that Sei is expected to become one of the few blockchains that can be included in compliant asset portfolios. The Sei Development Foundation, established in the United States, ensures the robustness of governance, development direction, policy alignment, and compliance advancement.

This positions Sei to potentially become a truly on-chain platform aimed at traditional capital markets. In the context of the emergence of next-generation on-chain assets such as stablecoins, RWA, and DePIN, Sei's characteristics of "high throughput + regulatory compliance + easy access" have secured it a proactive role in ecological evolution.

On July 10, the Sei Development Foundation announced that the native USDC and Circle's Cross-Chain Transfer Protocol (CCTP V2) will soon be launched on the Sei mainnet. This integration marks Sei's further strengthening of its capabilities as a high-throughput, regulatory-compliant on-chain infrastructure, particularly demonstrating significant competitiveness in providing digital dollar functionality and seamless cross-chain asset transfers for enterprises and developers.

According to Justin Barlow, Executive Director of the Sei Development Foundation, this integration will create new digital asset application opportunities for enterprises, combining the stability of native USDC with Sei's performance optimization to provide institutional-level financial support for various on-chain products such as DeFi, DeSci, and blockchain games. He noted that developers are launching new services daily on Sei, and the introduction of native USDC injects critical financial infrastructure into its ecosystem.

The performance competition in the current public chain field has already entered deep waters. Solana has achieved ultra-high TPS with a single-chain architecture but is limited in handling complex contracts; Ethereum bets on Rollup, outsourcing complexity to Layer 2, but the challenges of cross-chain communication continue to emerge.

Sei attempts to take a middle path: achieving underlying performance upgrades through a modular architecture while being compatible with the Ethereum developer ecosystem, creating a "middle-state platform" that balances performance and compatibility.

The Giga upgrade not only signifies that Sei possesses the underlying capabilities to support high-throughput scenarios such as AI, finance, and gaming but also marks the arrival of a new round of performance leaps for public chains. If the previous phase focused on "usability," the next competition will be for "performance sovereignty"—whoever can support a larger scale of assets and users will have the opportunity to define the infrastructure standards of Web3.

From proposing the concept of "Gigagas" to building the Autobahn consensus system, and completing practical testing before the upcoming mainnet launch, Sei has completed the entire performance innovation process in less than a year. This reform is far more than just "a bit faster"; it opens a new dimension of imagination for the entire on-chain world. Performance is no longer an accessory but the starting point of the underlying narrative. As on-chain applications become increasingly complex, data more dense, and users more Web2-like, only public chains with Giga-level throughput capabilities can truly meet the on-chain demands of the next billion users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。