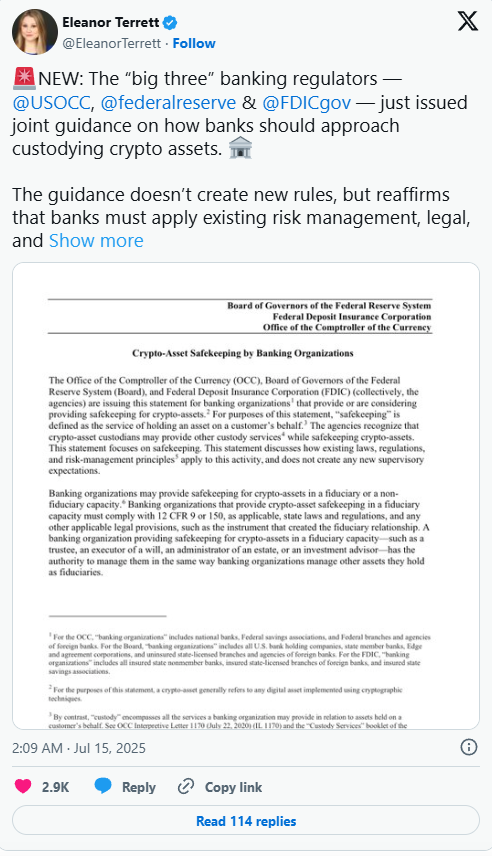

The Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve today issued a joint statement explicitly allowing banks to custody customers' cryptocurrencies. Previously, several regulatory agencies attempted to independently formulate this policy, and now the rule is clearer.

However, due to the repeated emphasis by regulators on consumer protection, this also brings some restrictions. Most importantly, banks are explicitly prohibited from allowing customers to hold the keys to these custody mechanisms.

A New Era for Cryptocurrency in the U.S. Banking Industry

A comprehensive and entirely new supportive attitude towards cryptocurrency has permeated federal regulatory agencies, bringing about widespread changes.

However, the lingering state of confusion may still delay significant victories, and institutions may sometimes even lose battles. Today, three federal financial regulatory agencies jointly issued a statement confirming that banks can custody cryptocurrencies:

These three agencies, namely the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve, have taken several measures in recent months to clarify the relationship between banks and cryptocurrencies.

For example, the Office of the Comptroller of the Currency (OCC) attempted to explicitly confirm these custody rules in May. Prior to this, the Federal Deposit Insurance Corporation (FDIC) published documents related to the banking of cryptocurrencies and amended rules to prevent future abuses.

Even the Federal Reserve, which recently clashed with Trump, is committed to bridging the gap between banks and cryptocurrencies. It has removed the reputational risk guidelines that strongly deterred traditional financial institutions from entering the industry.

In short, many of the largest regulatory agencies want to change this rule. The Securities and Exchange Commission (SEC) did not sign today's statement, but it also approved similar wording in January. However, today, these three agencies have come together to more clearly state their positions:

“Banking institutions may provide custody for crypto assets either as a trustee or non-trustee. Banking institutions… have the authority to manage [crypto assets] in the same manner as they manage other assets held in trust,” the statement from the agencies reads.

So, what does this actually mean? In short, these regulatory agencies are doing their utmost to assure banks that they can freely participate in cryptocurrency custody.

The statement provides some general guidelines to ensure maximum consumer protection, such as conducting audits, maintaining regulatory compliance, and deploying appropriate cybersecurity measures.

However, these agencies are firm on one point, which may frustrate some community members. If your cryptocurrency is held by a bank, then it is the primary custodian.

These agencies assume full responsibility when holding assets. In other words, banks cannot allow customers direct access to the private keys of their accounts under any circumstances.

That said, this is just a small workaround. Many cryptocurrency enthusiasts especially want to safeguard their own assets, but these individuals may not initially hand over their tokens to banks. Most customers will retrieve their assets immediately after the bank processes transfer requests.

That is to say, these regulatory agencies are not entirely adopting a laissez-faire policy. They repeatedly emphasize in their statements that banks need to maintain compliance and security, even going so far as to impose new rules.

The federal government is willing to try bank custody of cryptocurrencies but maintains strict standards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。