Original: Mason Nystrom, Investor at Pantera Capital

Translation: Zen, PANews

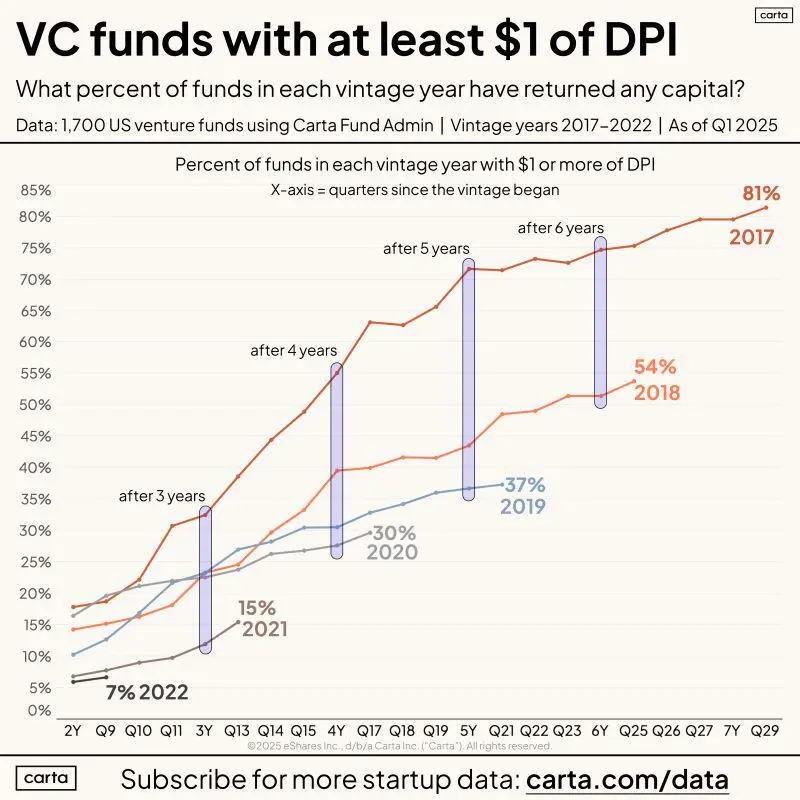

Funding has become difficult nowadays, as upstream DPI (Distributed Capital Return Rate) and LP (Limited Partner) funding face challenges.

In the broader venture capital field, the amount of money returned to LPs by various funds during the same period has decreased compared to previous years. This, in turn, has led to a reduction in the "dry powder" available for existing and newly established VCs to invest, exacerbating the funding difficulties for founders.

What does this mean for crypto venture capital?

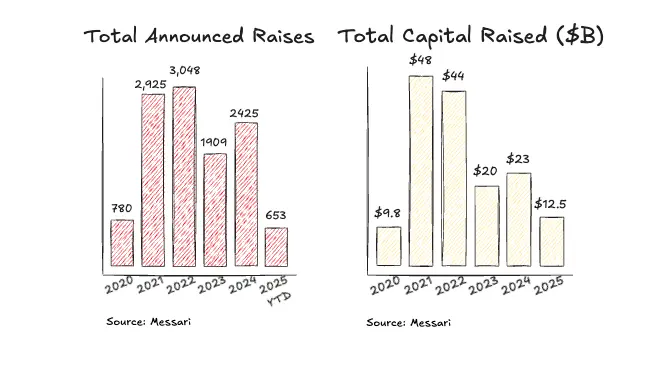

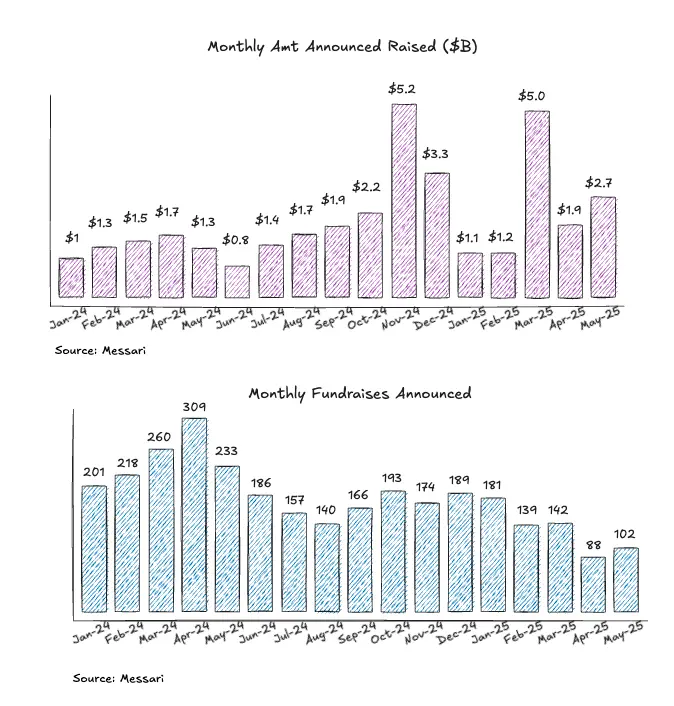

The number of transactions is slowing down in 2025, but the pace of capital deployment remains consistent with 2024. The decrease in transaction volume may be related to many VC funds nearing the end of their lifecycle and a reduction in available "dry powder." However, some large funds are still completing significant transactions, so the pace of capital deployment is consistent with the previous two years.

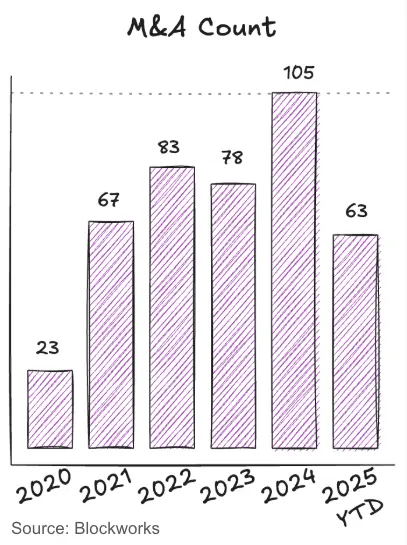

In the past two years, M&A activity in the crypto space has continued to improve, benefiting liquidity and exit opportunities. Recent large M&A cases, including NinjaTrader, Privy, Bridge, Deribit, and HiddenRoad, have provided more assurance for industry consolidation and crypto equity VC exits.

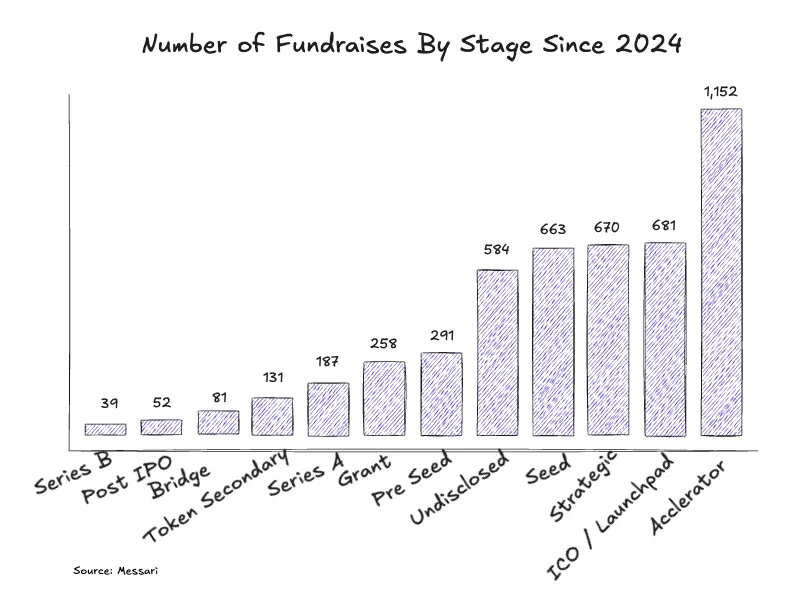

Over the past year, the overall number of transactions has remained stable, with some larger late-stage transactions announced for completion in Q4 2024 and Q1 2025. This is mainly because more transactions are concentrated in the Pre-seed, Seed, and accelerator stages, where capital has remained relatively abundant.

By financing stage, accelerators and launch platforms lead in the number of transactions. Since 2024, a large number of accelerators and launch platforms have emerged in the market, which may reflect a tightening funding environment, leading founders to prefer launching projects by issuing tokens early.

The median size of early financing rounds has rebounded. The scale of Pre-seed financing has continued to grow year-on-year, indicating that funding in the earliest stages remains sufficient. The median financing for Seed, Series A, and Series B rounds has approached or rebounded to 2022 levels.

Crypto VC Prediction 1: Tokens Will Become the Main Investment Mechanism

The market will shift from a "token + equity" dual structure to a model of "single asset carrying value." One asset, one set of value accumulation logic.

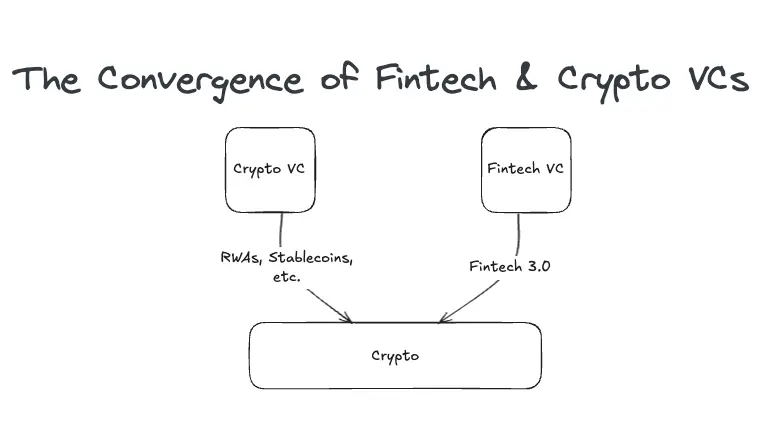

Crypto VC Prediction 2: The Acceleration of Integration Between Fintech VC and Crypto VC

Every fintech investor is becoming a crypto investor, focusing on the next generation of payment networks, new digital banks, and blockchain-based asset tokenization platforms. Crypto VCs face competitive pressure, and those that have not positioned themselves in the stablecoin/payment sector will find it difficult to compete with fintech VCs that have rich payment experience.

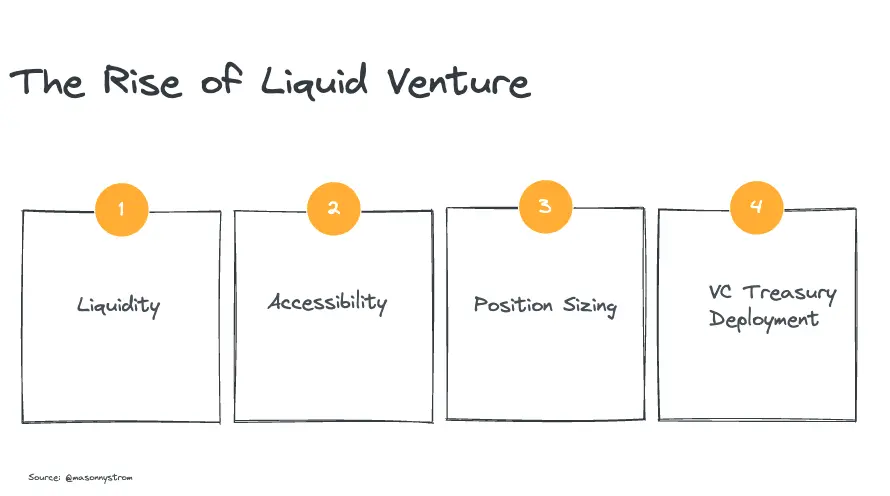

Crypto VC Prediction 3: The Rise of "Liquid Venture Capital"

"Liquid Venture Capital" seeks venture-like opportunities in the tradable token market:

- Liquidity — publicly traded assets/tokens have higher liquidity, meaning faster exit paths.

- Accessibility — private VC investment thresholds are high, while liquid venture capital allows investors to directly purchase tokens without "snatching projects," and also through over-the-counter (OTC) trading.

- Position Management — companies issuing tokens early allow small funds to establish meaningful positions, while large funds can also invest in high market cap tradable tokens.

- Fund Operations — the best-performing crypto VC funds typically allocate reserve assets to mainstream tokens like BTC and ETH, achieving excess returns. I personally expect that during bear market cycles, VC funds will more frequently draw on funds in advance and invest in quality tokens.

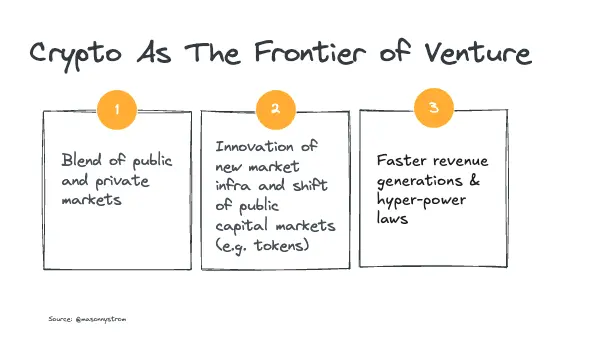

The crypto space will continue to be at the forefront of venture capital. The integration of public and private capital markets is a trend in the development of venture capital, with more traditional VC funds choosing to position themselves in liquid markets (such as post-IPO holding tools) or secondary equity markets, while the crypto space has already been on this path. Crypto continues to lead in innovation in capital markets. As more assets go on-chain, more companies will choose "on-chain first" financing methods.

Finally, the outcomes in the crypto market often exhibit a more "power law distribution" than traditional venture capital — top crypto assets are not only competing to become digital sovereign currencies but also to serve as the foundational layer of the new financial economy. Although the return distribution is more extreme, it is precisely for this reason that crypto venture capital will continue to attract significant capital inflows in pursuit of asymmetric returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。