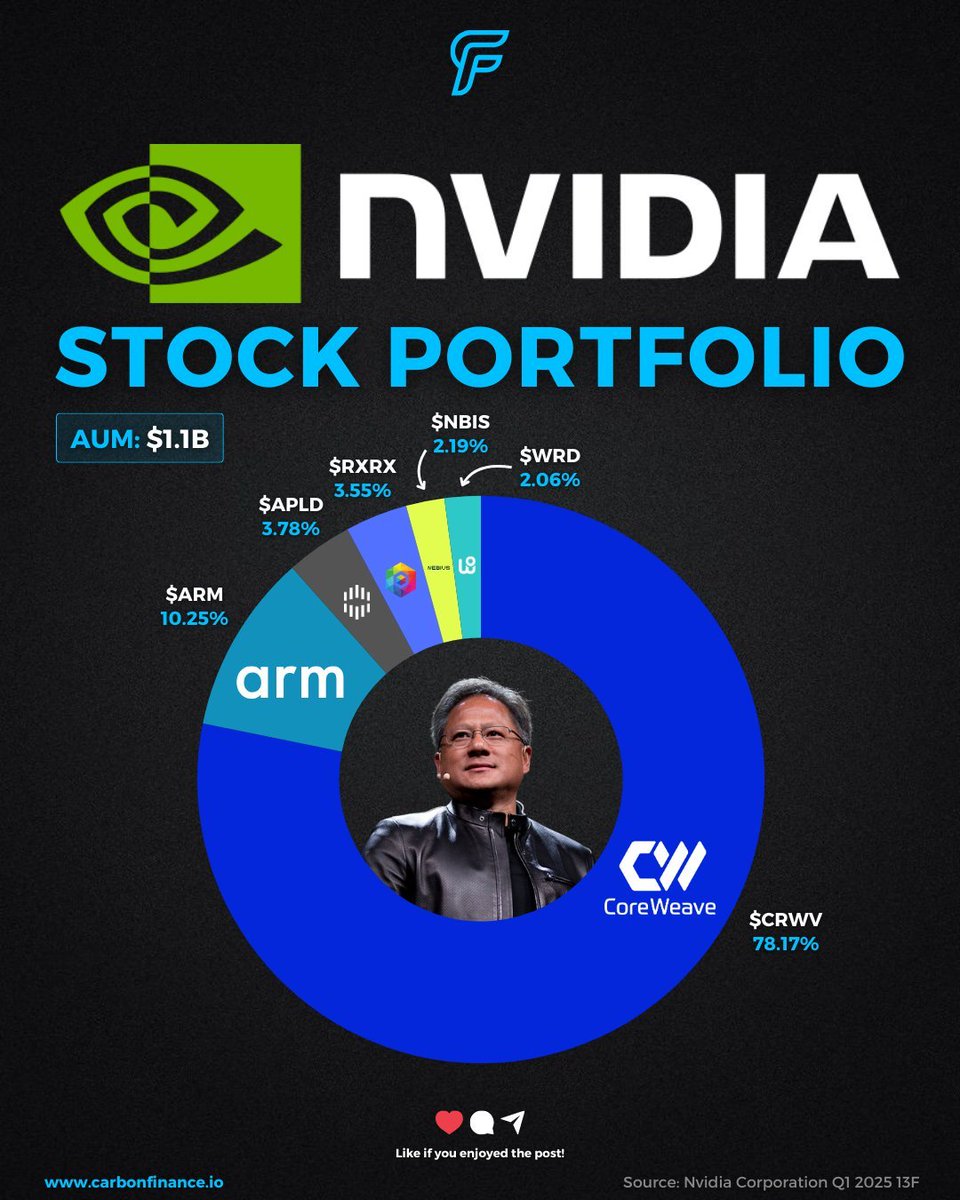

Boss Huang's investment in Nvidia should be worth deep consideration for every partner in the US stock #AI investment field. If we calculate from the first quarter of 2025, Boss Huang has invested 1.1 billion USD, and if the position remains unchanged, its current value would reach 3.38 billion USD. This is more than a threefold increase, especially with a heavy bet of 78.17% on #CoreWeave, which has seen an astonishing increase of 195%!

Among the companies he has bet on related to #AI, we should think deeply (as shown in Figure 2).

First, #Nvidia's bet on #CoreWeave is not a small amount; a 78% position in one company is not speculation, it is a deep binding.

CoreWeave is involved in AI cloud GPUs, simply put, it is like opening an AI "internet café"—many AI companies cannot afford Nvidia graphics cards, so they rent from CoreWeave. Nvidia not only sells cards to it but also invested in it, indicating that Nvidia considers it an "insider."

This is like selling weapons to you while also buying stock in your arms company, completely binding your future development, making this company worthy of deep attention.

Additionally, the stake in #ARM, which accounts for 10.25%, is a bet on the technological lifeline. #ARM is the leader in low-power chip architecture, used in mobile chips and now in #AI edge devices, almost all utilize the #ARM instruction set.

Nvidia previously attempted to acquire ARM but was blocked by antitrust issues; however, now they continue to participate through equity investment, which is very smart. This shows that Nvidia has not given up on the "underlying hard technology" track of ARM.

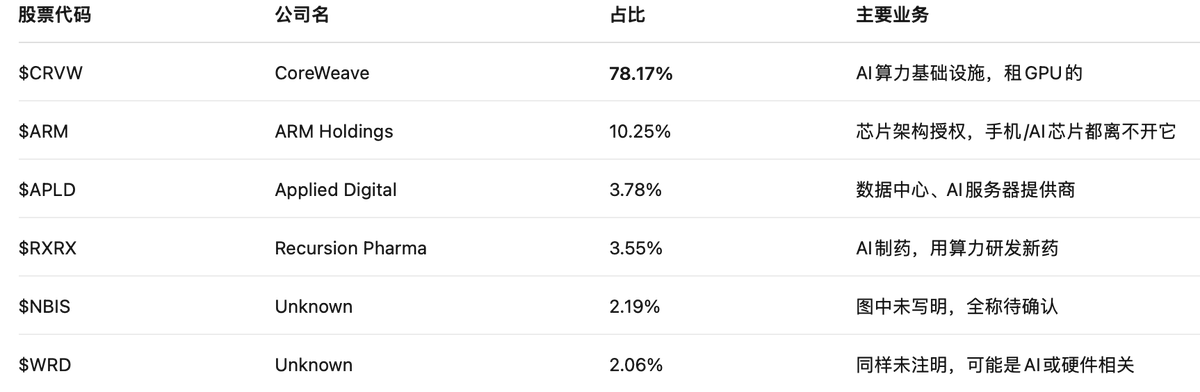

Finally, there are small position layouts, betting on future potential. Companies like #APLD and #RXRX may not be familiar to you, but they represent:

• Infrastructure (#APLD)

• AI + Biotechnology (#RXRX)

This is Nvidia's rhythm in laying out technology trends for the next 5-10 years. Like venture capital, not every investment needs to yield returns, but if one hits, it’s worth it.

If you also want to deeply learn about US stocks, I think following the giants is more reliable than betting on news. For example, following Boss Huang's Nvidia or OpenAI founder Altman's giants is generally a safe bet. They are not emotional retail investors; they often have more reliable information and know whether these #AI companies are worth it. Additionally, pay attention to the infrastructure of #AI and understand "who is building the entire AI stage," such as #CoreWeave and #ARM; these are not "actors," but "stage builders," earning more long-term and stable money, which is more suitable for long-term investment.

Most of the aforementioned US companies (as shown in Figure 3) can be found on @MyStonks_Org, allowing you to participate in US stock investments directly with USDT through tokenization, which is convenient and quick. 🧐

One-click investment in US stocks: https://mystonks.org/?code=Vu2v44

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。