Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.68 trillion, with BTC accounting for 63.9%, which is $2.35 trillion. The market cap of stablecoins is $257 billion, with a recent 7-day increase of 0.83%, of which USDT accounts for 62.25%. Circle (USDC) has applied for a national trust bank license in the U.S. to strengthen compliance.

The Trump family's USD1 trading volume has reached a new high, with a 24-hour transaction volume of $1.25 billion, second only to USDT and USDC.

This week, BTC prices have shown a volatile upward trend, currently priced at $118,003; ETH has also shown a volatile upward trend, currently priced at $3,011.

BTC Key Price Milestones (July 7-11)

Date

Price

Key Drivers

July 7

107,945

Trump's tariff policy triggered market volatility

July 10

112,000

Capital inflow from Brazil seeking safe haven

July 11

118,000 (new high)

ETF capital inflow + short covering

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: BONK with a 7-day increase of 37.59%, SPX with a 7-day increase of 32.7%, PENGU with a 7-day increase of 32%, MGO with a 7-day increase of 56%, and 1INCH with a 7-day increase of 42%.

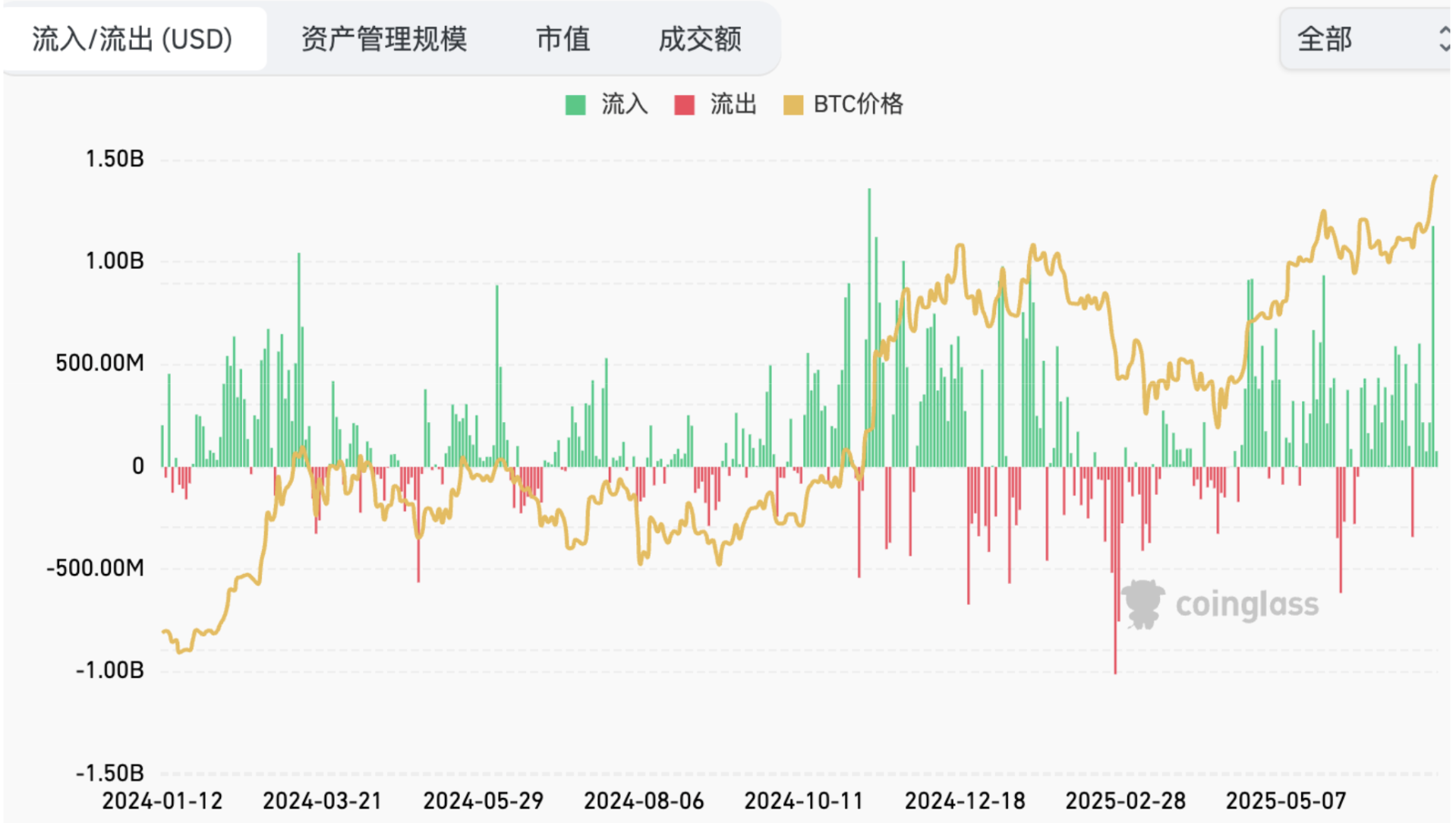

This week, the net inflow for U.S. Bitcoin spot ETFs was $2.7143 billion; the net inflow for U.S. Ethereum spot ETFs was $907.8 million.

Market Forecast:

This week, stablecoins continue to be issued, with significant net inflows into U.S. Bitcoin and Ethereum spot ETFs. Both BTC and ETH are showing a volatile upward trend. The RSI index is at 62.87, indicating strength. The Fear and Greed Index is at 72 (higher than last week), remaining stable for two consecutive days, reflecting market optimism but not reaching extremes.

This week, the U.S. introduced Tariff 2.0, imposing tariffs of 20-50% on multiple countries, but the impact on the crypto market is minimal. The probability of a Federal Reserve rate cut in September is 72.3%, but there was no action in July.

Key attention should be paid to the "Cryptocurrency Week" in the U.S. from July 14-18, which will review three major bills: "GENIUS," "CLARITY," and others. If passed, BTC may challenge $120,000. If regulatory uncertainty increases, it may pull back to the support level of $108,000-$110,000.

Understanding Now

Review of Major Events of the Week

- Bitcoin reached a historical high of $118,000, with short covering of $318 million;

- Trump announced a 50% tariff on Brazil (effective August 1), triggering capital inflow into BTC;

- The U.S. "Cryptocurrency Week" is scheduled for July 14-18, which will review the "GENIUS," "CLARITY," and other major bills;

- BTC spot ETF saw a net inflow of $203 million in a single day, with BlackRock's holdings exceeding $78 billion;

- ETH ETF capital inflow reached a quarterly high, with Fundstrat raising $250 million to increase ETH holdings;

- GMX suffered a hack resulting in a loss of $42 million, with the team offering a 10% bounty to recover funds;

- XBIT decentralized exchange saw a 300% surge in trading volume, becoming a new safe haven amid the tariff crisis;

- The Federal Reserve's June meeting minutes showed internal divisions, cooling rate cut expectations;

- Data from 85 core stocks in Hong Kong went on-chain, with Pyth Network promoting RWA development;

- The Trump family's crypto project has made over $600 million in profits, raising controversy over policy and business interests.

Macroeconomics

United States

- Fiscal Policy: The "Big Beautiful Plan" (tax cuts + infrastructure) passed the House, potentially raising long-term inflation;

- Monetary Policy: The probability of a Federal Reserve rate cut in September is 72.3%, but there was no action in July.

Europe and Asia

Region

Policy Trends

Market Impact

Eurozone

ECB maintains interest rates, hints at delaying rate cuts

Euro under pressure

Japan

Sticks to ultra-loose policy

Yen depreciation accelerates

China

May cut the reserve requirement ratio by 0.5% in the second half of the year

Liquidity expectations improve

ETF

According to statistics, from July 7 to July 11, the net inflow of U.S. Bitcoin spot ETFs was $2.7143 billion; as of July 11, GBTC (Grayscale) had a total outflow of $23.338 billion, currently holding $21.724 billion, while IBIT (BlackRock) currently holds $83.085 billion. The total market value of U.S. Bitcoin spot ETFs is $150.643 billion.

The net inflow of U.S. Ethereum spot ETFs was $907.8 million.

Envisioning the Future

Upcoming Events

- Polkadot will hold the Web3 Summit 2025 in Berlin from July 16 to 18;

- Bitcoin Asia 2025 will be held at the Hong Kong Convention and Exhibition Centre from August 28 to 29;

- WebX Asia 2025 will take place in Tokyo, Japan, from August 25 to 26, 2025;

- TOKEN2049 Singapore 2025 will be held in Singapore from October 1 to 2, 2025.

Project Progress

- The trial of Tornado Cash co-founder Roman Storm will take place on July 14, with the prosecution dropping some charges but still pursuing money laundering, some unauthorized fund transfer, and violations of the International Emergency Economic Powers Act;

- The U.S. Congress will begin voting on three important crypto-related legislations on July 14: the "Genius Act," the "Clarity Act," and the "Anti-CBDC Surveillance State Act";

- The first phase of the Wormhole staking program rewards must be claimed by July 15; any unclaimed rewards will be returned to the SRP pool for future reward cycles;

- Sonic Labs will randomly open the first phase of S token airdrop claims from July 15 to 22;

- Tuttle submitted an amendment to change the effective date of a batch of 2x leveraged cryptocurrency ETFs to July 16. This does not mean they will definitely launch, but generally, the effective date is the launch date for ETFs, and given that SSK has successfully listed, it is likely that others (similar products) will follow.

Important Events

- On July 15 at 20:30, the U.S. will release the unadjusted CPI year-on-year for June, affecting Federal Reserve policy expectations;

- On July 17 at 2:00, the Federal Reserve will release the Beige Book on economic conditions.

Token Unlocking

- Starknet (STRK) will unlock 127 million tokens on July 15, valued at approximately $18.54 million, accounting for 3.53% of the circulating supply;

- Sei (SEI) will unlock 55.56 million tokens on July 15, valued at approximately $17.87 million, accounting for 1% of the circulating supply;

- Arbitrum (ARB) will unlock 92.65 million tokens on July 16, valued at approximately $38.51 million, accounting for 1.87% of the circulating supply;

- ZKsync (ZK) will unlock 173 million tokens on July 17, valued at approximately $10.12 million, accounting for 2.42% of the circulating supply;

- ApeCoin (APE) will unlock 15.58 million tokens on July 17, valued at approximately $10.46 million, accounting for 1.95% of the circulating supply;

- Fasttoken (FTN) will unlock 20 million tokens on July 18, valued at approximately $89 million, accounting for 4.64% of the circulating supply;

- OFFICIAL TRUMP (TRUMP) will unlock 906 million tokens on July 18, valued at approximately $913 million, accounting for 9% of the circulating supply.

About Us

Hotcoin Research, as the core research and investment center of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We build a "trend judgment + value excavation + real-time tracking" integrated service system, providing precise market interpretation and practical strategies for investors at different levels through in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluation of potential projects, and all-day market volatility monitoring, combined with weekly live broadcasts of "Hotcoin Selected" strategy and daily news briefings of "Blockchain Today." Relying on cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, jointly seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors invest based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。