The homework written in the past couple of days has been a bit lackluster, not because the prices have continuously broken new highs, but rather because there hasn't been much movement in the market. Although the prices have risen well, there has been no actual progress in either the macro market or Trump's tariff policies. Even the so-called development of stablecoins and RWA in China has not shown any signs of life, so the market lacks sustained positive news to stimulate it. We analyzed the reasons for the price increase yesterday.

It's not because purchasing power has significantly improved, but rather because there are too few investors willing to sell. Most investors are in a state of reluctance to sell, and the actual turnover of $BTC remains very low. Most investors choose to hold their coins, as can be seen from the data of long-term holders who have held for over 155 days. Even though Bitcoin's price has repeatedly reached new highs, long-term holders are still at high levels.

Combined with the exchange data we saw yesterday, it is clear that long-term holders are unwilling to sell, and the inventory on exchanges continues to decline, indicating that most investors are either buying or waiting. This is the main reason for the rise in Bitcoin prices. Of course, the purchase volume of the spot ETF also reached a peak yesterday, but it's uncertain how long this will last.

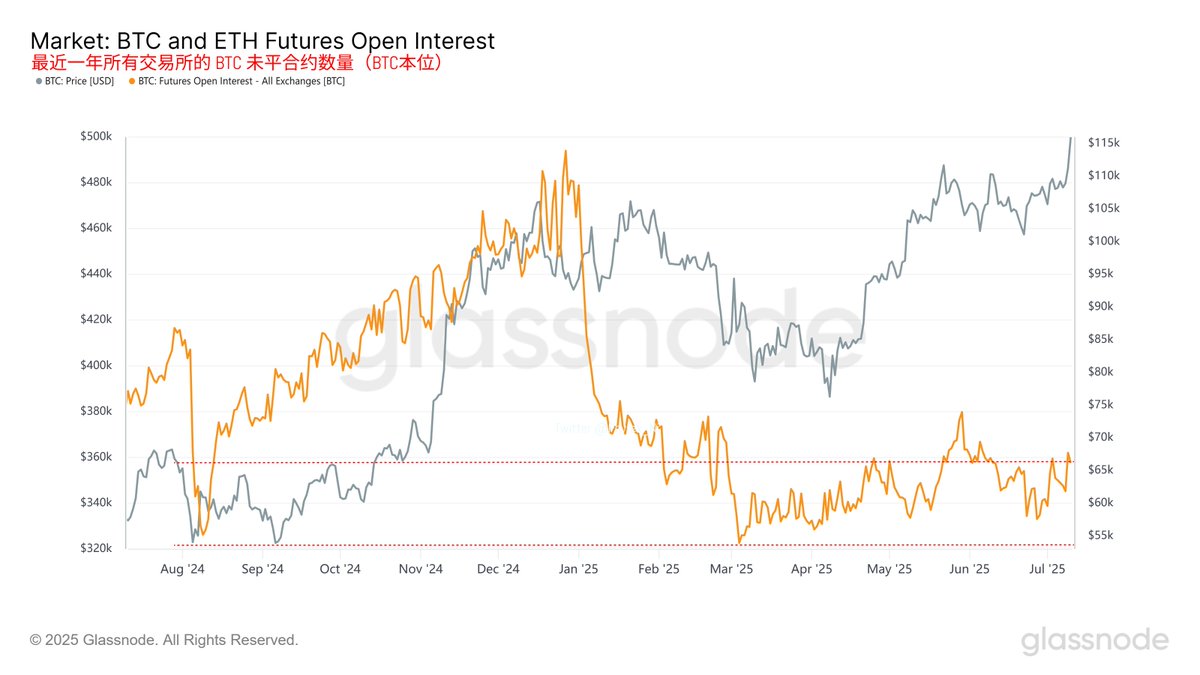

Not only in the spot market, but BTC's perpetual contracts are the same. From the data, although BTC's price has reached new highs, the open contract volume has not significantly increased; instead, it is still fluctuating at a low level. Comparing this to the end of 2024, it is clear that as BTC's price rises, the open contract volume continues to increase, indicating a strong market sentiment for speculation.

Now, with prices at new highs, the open contracts are at a low level, suggesting that the number of investors willing to speculate on BTC contracts is still low. In simpler terms, most investors do not have a clear directional choice.

Today, prices continue to reach new highs, so we still need to wait for the URPD data, which will depend on the weekend. However, I took a look at the support levels, and they have not been broken. Let's continue to monitor Trump's tariff policies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。