Original Title: "From MyStonks to Backed, Why is the US Stock Market in a Hurry to Tokenize?"

Original Source: Nomos Labs

From MyStonks to Backed, Why is the US Stock Market in a Hurry to Tokenize?

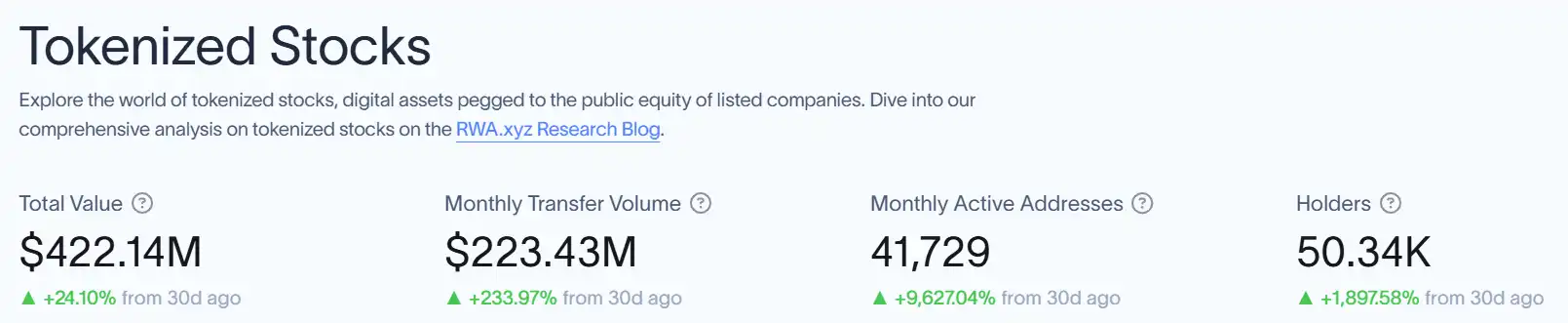

The tokenization of US stocks is unexpectedly becoming the focus of the global blockchain market in 2025. According to data from RWA.xyz, the current market value of tokenized stocks is $422 million, with 50,000 addresses holding tokenized stocks, an increase of nearly 2000% compared to 30 days ago.

If you have recently followed platforms like MyStonks, Backed, and Kraken, or even Web3 trading platforms like Gate.io and Bybit, you may have noticed that traditional US stock stars like Apple, Tesla, and Nvidia are being rapidly brought onto the blockchain, no longer limited to Wall Street trading windows, but circulating among global investors 24/7. This rush to tokenize is not only a technological breakthrough but also an inevitable result of market demand and regulatory easing, accelerating the change in the global investment landscape.

I. The Sudden Acceleration in 2025: Why is the US Stock Market Moving On-Chain?

The concept of blockchain is not new in conjunction with traditional finance, but why is US stock tokenization entering a period of explosion in 2025? Technological advancements, market demand, regulatory relaxation, and capital logic together form the underlying driving forces of this trend.

Firstly, technological bottlenecks have been gradually resolved. After years of development, mainstream public chains like Ethereum and Solana now have the capability to support large-scale asset tokenization. Ethereum provides the ERC-20 standard to ensure on-chain compatibility, while Solana has become a popular choice for trading platforms like Kraken and Bybit due to its high throughput and low costs. Meanwhile, the gradual maturity of cross-chain bridges (like Wormhole) and decentralized identity verification (DID) mechanisms has lowered the barriers for traditional assets to enter the blockchain.

More importantly, in 2025, global market investors, especially in emerging economies, are showing unprecedented enthusiasm for investing in US stocks. However, traditional trading channels for US stocks have very high barriers for overseas investors: complex account opening procedures, high fees, and limited trading hours significantly suppress foreign capital inflow. On-chain US stocks completely bypass traditional account opening and trading processes, allowing global users to easily participate in US asset investment transactions using stablecoins. This 24-hour, low-barrier, low-cost investment channel quickly meets the long-standing global market demand.

A deeper driving force comes from the global strategy of the US dollar. The stablecoin market created a trading volume of $27.6 trillion in 2024, even surpassing Visa and Mastercard. US stock tokenization provides a new value flow path for US dollar stablecoins, becoming another hidden channel for the global return of US capital. The on-chain nature of US stocks appears to be financial innovation, but it is deeply tied to the internationalization strategy of the US dollar. Using stablecoins and on-chain US stocks as tools, US financial institutions and regulators are attracting global capital to gather around dollar assets in a more flexible manner.

Image Source: Zhongguancun Internet Finance Research Institute

From technological feasibility to global capital flow, and to the strategy of US dollar financial hegemony, the acceleration of US stock tokenization is not a coincidence but a carefully planned financial ecosystem reconstruction. The on-chain "Apple" and "Tesla" are not merely digital copies of traditional stocks but represent a structural change in the global capital game rules.

However, the explosion of on-chain US stocks is just the surface. Behind this rush to tokenize, the real players are the strategic games between trading platforms and tokenization platforms.

II. The Real Driving Force Behind the Rise of On-Chain US Stocks: Trading Platforms

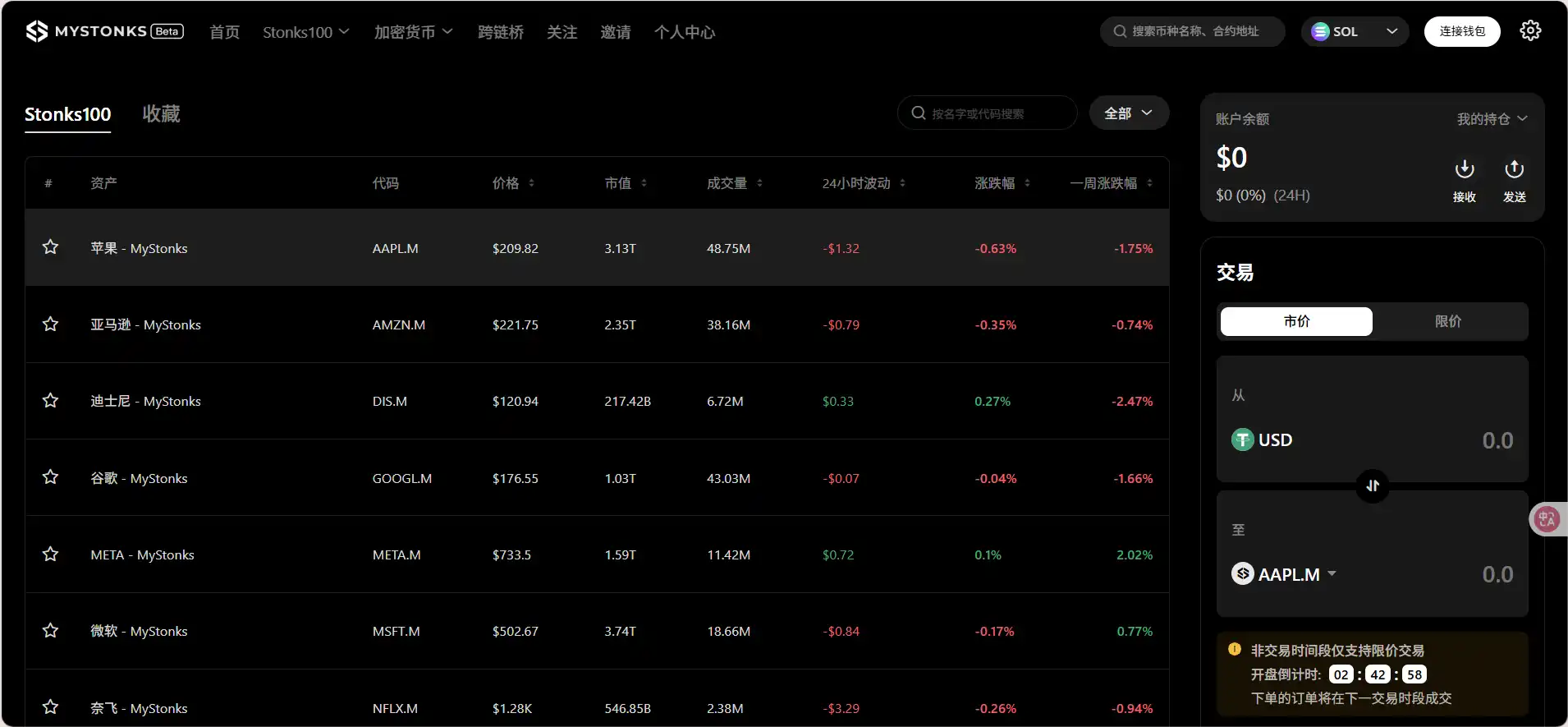

The rapid development of on-chain US stocks is not an active choice of the US stock market itself but a result of the strategic push from on-chain asset platforms and trading platforms. From MyStonks to Backed to Kraken, the rise of these platforms highlights the different demands and games of various market players.

For professional asset tokenization platforms (like Backed and MyStonks), on-chain US stocks represent a new business model and regulatory arbitrage space. Taking Backed as an example, by collaborating with Interactive Brokers and the European custodian Clearstream, they can navigate the ambiguous regulatory landscape of the US Securities and Exchange Commission (SEC) and compliantly custody actual US stock assets in Europe in token form, selling them globally through their on-chain platform. This model not only reduces regulatory compliance costs but also opens up more flexible investment channels for global users.

MyStonks, on the other hand, has chosen a more decentralized path, developing an on-chain asset model based on ERC-20 and NFT standards, combined with Fidelity's asset custody, emphasizing DID identity verification and transparency, attempting to build a new bridge between decentralized finance (DeFi) and the traditional securities market.

The participation of trading platforms like Kraken seems more like capturing the next narrative trend: by introducing US stock tokens to expand trading categories, enhance user stickiness, and reduce the risk of user assets flowing to traditional financial institutions. This participation strategy is not only a natural extension of business expansion but also reflects the high expectations of on-chain trading platforms for "real asset access to Web3."

The combined effect of these multiple driving forces ultimately forms an accelerated competition for "on-chain US stocks." The mutual cooperation and competition between trading platforms and asset tokenization platforms shape the phenomenon of US stock tokenization in 2025 and lay the groundwork for the evolution of the US stock tokenization ecosystem.

III. Explorers of Different Paths Attempting to Answer How US Stocks Should Go On-Chain

MyStonks' approach is the most "native." It turns stocks into NFTs and ERC-20 tokens, circulating on the blockchain through the Ethereum network. It also integrates the DID identity system, attempting to meet compliance requirements while protecting privacy. On MyStonks, users can not only trade stock tokens but also "own" them, just like having a USDC in their wallet. However, this model also brings an old problem: the liquidity and composability of NFTs are always limited, and the efficiency of on-chain trading and user experience are still in the early stages.

Backed takes a completely different route. It is more like an extension of a compliant financial institution, holding real US stocks in a regulated securities system in Europe and then issuing 1:1 pegged tokens. These tokens can be traded on-chain, but the core assets belong more to the platform than to the users. Backed's value lies in lowering the barriers for traditional institutions to participate in Web3, but under this model, users' control over assets remains limited, and the essential issue of "trusting intermediaries" cannot be avoided.

Kraken positions itself as an "interface platform," not building its own token model but directly integrating existing token products like Backed, providing traditional users with a familiar interface and convenient trading experience while maintaining basic compatibility with on-chain assets. Although this approach lowers the user barrier, it also means that its on-chain attributes are weaker and still rely more on the platform's credibility.

These three models emphasize different aspects: MyStonks emphasizes "assets belong to users," Backed emphasizes "assets are truly trustworthy," and Kraken emphasizes "trading is convenient enough." They represent three paths, all answering a common question: can the core assets of traditional finance have their own "universal expression" on-chain, just like USDT?

Behind this is not a technical route dispute but a design question of "who trusts whom": do users trust the code? Trust the platform? Or trust the brokers and custodians behind it? These three are participating in an experiment of future standards with different answers.

IV. Trend Significance and Impact: What Financial Landscapes are Being Reshaped by On-Chain US Stocks?

On-chain US stocks are changing more than just trading methods.

The most intuitive change is that stocks, which could only be traded during US stock market hours, have become assets that can be bought and sold 24/7. Whether in the early morning in New York or late at night in East Asia, users can place orders, match trades, and complete transactions. US stocks no longer belong only to "American daytime" but have become global assets operating around the clock.

A more significant change is that it allows ordinary users worldwide to "directly buy US stocks" for the first time. In the past, to invest in stocks like Tesla and Apple, one had to open a US stock account, exchange currency, and pass compliance hurdles. Now, as long as one has stablecoins, they can participate in one step. Cross-border investment has transformed from a complex process into a simple wallet operation.

For DeFi, the introduction of on-chain US stocks brings not just a new asset class but also the first real entry of real financial assets into the blockchain. These tokens are backed by real enterprises and cash flows, allowing direct participation in liquidity pools, lending, and even derivatives design, thus providing DeFi with a credit foundation linked to real assets.

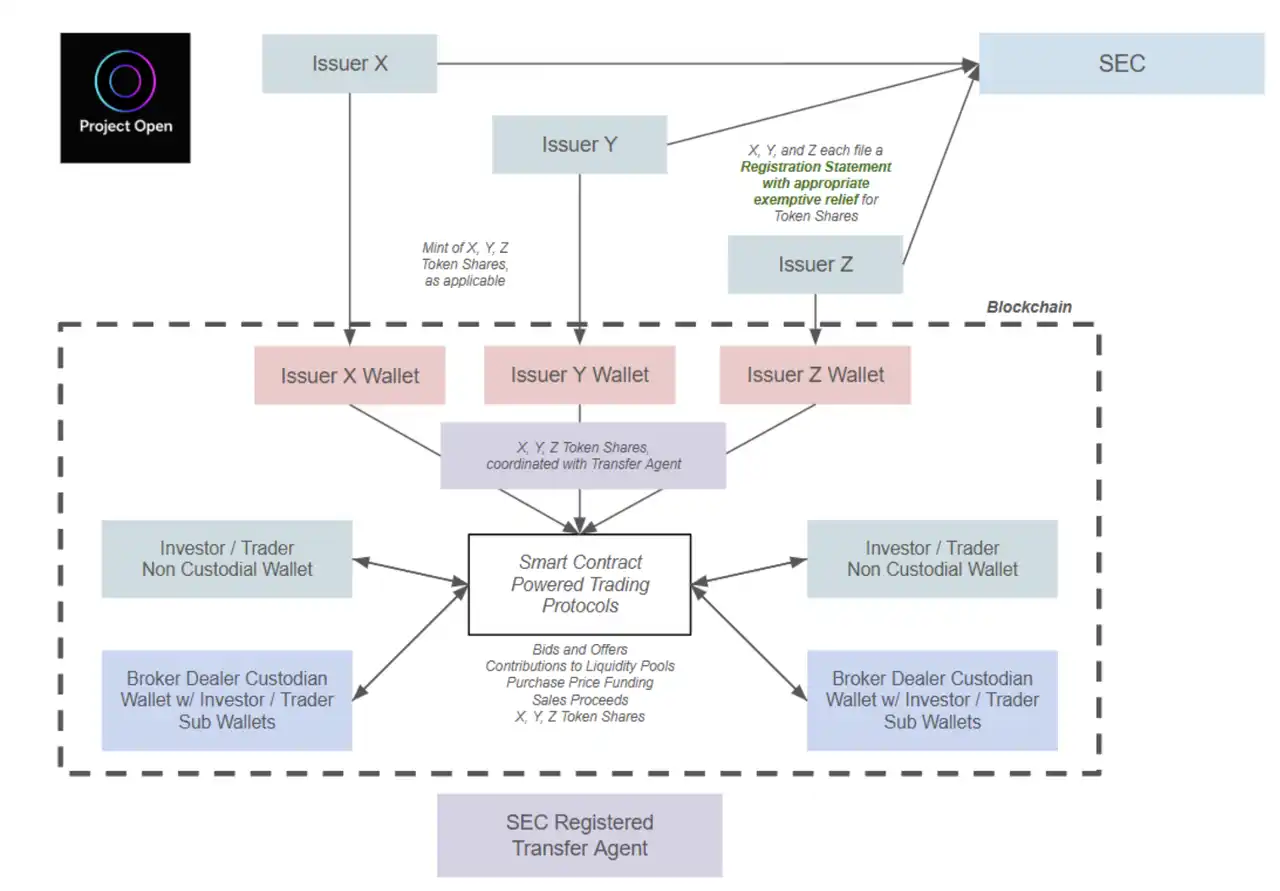

Image Source: The tokenization process for US stock issuance and trading advocated by Project Open

The entry of such assets into DeFi is no longer an abstract notion of "digital currency," but rather operational financial tools with stable valuation anchors and regulatory backing. They can be combined, collateralized, split, and repackaged, gradually building a more mature on-chain financial ecosystem.

So when we ask, "Why is the US stock market in a hurry to tokenize?" what we may see is a trend, a wave. But looking deeper, it is the re-dominance of US dollar assets over global liquidity, the proactive alignment of crypto platforms with real credit systems, and another milestone in breaking the dimensional wall by blockchain.

Conclusion

From MyStonks to Backed and Kraken, what seems to be three different product solutions actually reflects the strong desire of blockchain for real assets. In the past few years, we have witnessed how stablecoins have become a new vehicle for the US dollar. Now, US stock tokenization is following the same path—not to replicate traditional finance but to introduce a more trustworthy, familiar, and liquid asset anchor to the on-chain market. Thus, we say that the urgency of US stock tokenization is not due to the anxiety of the US stock market itself, but rather because the on-chain market desperately needs a more stable, genuine, and easily understood physical asset.

This wave of tokenization appears to be the "tokenization of traditional assets," but in reality, it is Web3 actively seeking an asset logic that can support trading, liquidity, and user trust. Especially in the current context of severe volatility in crypto-native assets and slowing growth in DeFi TVL, US stocks, as "high-quality targets in the real world," are rapidly being introduced into the Web3 ecosystem, becoming a traffic tool for trading platforms to compete for, and also the starting point for a new narrative. From 24/7 uninterrupted trading to bypassing brokers for cross-border investment, to stablecoins as settlement channels, the changes brought by US stock tokenization have long surpassed the products themselves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。