Stablecoin startup Agora has announced the completion of a $50 million Series A funding round, led by Paradigm, with participation from Dragonfly. The funds will be used to drive the global expansion and compliance layout of its core product, AUSD.

This is not the first time Agora has attracted capital. Back in April 2024, the company completed a $12 million seed round led by Dragonfly. The two rounds of financing total $62 million, making Agora one of the few platform projects in the current stablecoin space to receive continuous backing from top institutions.

Who is Agora? What’s its background?

Agora is a stablecoin startup founded in 2023 by co-founders Nick van Eck, Drake Evans, and Joe McGrady, dedicated to creating a new platform-based stablecoin architecture, also known as "white-label stablecoins."

Nick van Eck comes from a traditional finance background and is the son of Jan van Eck, the founder of the well-known asset management company VanEck. Co-founder Drake Evans previously served as a core engineer at MakerDAO, while Joe McGrady has engineering and operational experience in Bridgewater-style institutions.

To date, Agora has completed two rounds of financing. In April 2024, Agora completed a $12 million seed round led by Dragonfly Capital to develop its core product AUSD and build a white-label issuance platform. In July 2025, Agora announced the completion of a $50 million Series A funding round, led by Paradigm with Dragonfly participating, with the funds aimed at accelerating global expansion and compliance layout. So far, Agora has raised a total of $62 million, becoming one of the few platform projects in the stablecoin space to receive continuous investment from top venture capital firms.

White-label stablecoin AUSD: a new story or old packaging?

Tether and Circle have long dominated the stablecoin market, one relying on volume to dominate exchanges, and the other focusing on compliance to bridge traditional finance. However, Agora does not intend to become "another USDT or USDC."

Beneath the surface, this landscape is being disrupted by a startup called Agora.

Founded by Nick van Eck, the son of the VanEck investment group founder, along with two engineers from the crypto industry, Agora positions itself differently from Tether and Circle. It does not attempt to create a "more compliant USDT" or a "more decentralized USDC," but instead chooses a new platform-based path: to create an infrastructure that everyone can use to issue their own stablecoins.

The AUSD it launched is a stablecoin pegged to the US dollar, supported by an asset pool managed by State Street Bank and VanEck. Unlike the single-coin distribution of Tether and Circle, Agora uses AUSD as the underlying unified settlement asset and opens up white-label issuance services on this basis—any enterprise, whether a Web3 project or an overseas payment company, can quickly issue its own branded stablecoin, such as "GameUSD" or "ABC Pay Dollar," all of which share AUSD's on-chain liquidity and interchangeability.

This approach is somewhat reminiscent of the early model when Paxos collaborated with PayPal to issue PYUSD. However, unlike Paxos, which built independent stablecoin systems for its partners, Agora's partners must build directly on top of AUSD. This unified underlying design makes it easier for the entire system to aggregate liquidity and facilitates network effects.

This platform-based issuance logic not only lowers the threshold for enterprises to issue stablecoins but also establishes stronger ecological stickiness and a competitive moat for Agora.

From the perspectives of compliance and technical construction, Agora is not a startup. It maintains a high degree of binding with traditional finance: asset custody is entrusted to State Street, asset management is handled by VanEck, and custody technology has also incorporated Copper's MPC solution. At the same time, Agora is in the process of obtaining money transmission licenses (MTL) from various states in the U.S. to prepare for future entry into the U.S. market.

In terms of ecological cooperation, Agora has partnered with Polygon Labs to promote customized stablecoin issuance projects based on AUSD and has completed its first over-the-counter transaction with crypto asset management firm Galaxy. AUSD is currently live on LBank with USDT trading pairs and has received support from projects such as Injective, Flowdesk, Conduit, and Plume Network. On-chain, AUSD has achieved multi-chain deployment on Ethereum, Sui, Avalanche, etc., through Wormhole; Agora has also collaborated with Polygon's cross-chain aggregation protocol Agglayer, aiming to make AUSD its native stablecoin.

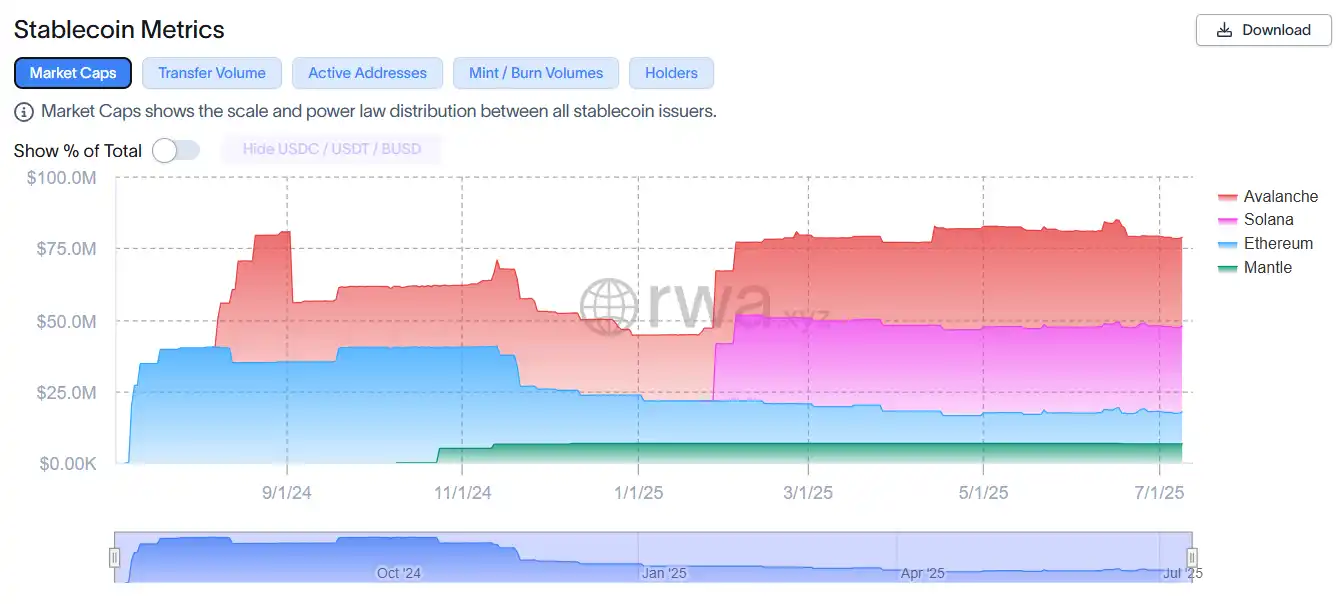

Data source: rwa.xyz

Of course, AUSD's total market capitalization is still less than $200 million, a significant gap from USDT's $159.1 billion and USDC's $62 billion. However, for top institutions like Paradigm and Dragonfly, Agora's platform logic may signify a structural reconstruction of the stablecoin market: stablecoins are no longer just products but can become platforms, allowing every institution to have its own on-chain dollar.

If the past logic of stablecoins was "I issue one for you to use," Agora's logic is "I build a system for you to issue." Tether and Circle are the "products" of stablecoins, while Agora is more like the "AWS" of stablecoin issuance.

Data source: coingecko.com

What does applying for multi-state money transmission licenses (MTL) mean for capturing the U.S. market?

Applying for multi-state money transmission licenses (MTL) is not only a "pass" for stablecoin issuers to operate compliantly but also a key to unlocking the vast U.S. market. MTL not only grants enterprises the legal qualification to conduct money transmission and stablecoin issuance in multiple states but also significantly enhances the trust of banks, exchanges, and institutional investors, serving as a foundational guarantee for cooperation. At the same time, MTL requires enterprises to strictly adhere to multiple compliance obligations such as anti-money laundering (AML), customer identity verification (KYC), and regulatory reporting, ensuring transparency and security in operations, and laying a solid foundation for the future launch of innovative products and services. For this reason, MTL is not only a solid barrier against legal and regulatory risks but also a strategic capital for stablecoin enterprises to establish themselves and continue to develop in the U.S. market.

Currently, mainstream stablecoin issuers such as Circle, Paxos, Gemini, and TrustToken have all obtained money transmission licenses in multiple states.

Circle, as the issuer of USDC, has extensive MTL coverage, providing a solid guarantee for its recognition by mainstream financial institutions and banks.

Paxos is also actively laying out compliance, holding multi-state MTL, and promoting stablecoin issuance through partnerships with PayPal, Binance, and others.

Gemini's GUSD is one of the first stablecoins to obtain a license from the New York Department of Financial Services, and its issuing company also holds multi-state money transmission licenses.

TrustToken has obtained MTL in multiple states to support the legal issuance and circulation of its various asset-backed stablecoins.

In addition to these stablecoin issuers, some digital asset custodians and trading platforms such as Anchorage Digital, BitPay, and Kraken have also applied for and obtained multi-state MTL. Typically, licensed institutions prioritize covering states with strict regulations and active crypto businesses, such as New York, California, Texas, and Florida. Obtaining MTL requires meeting strict capital adequacy, anti-money laundering (AML), customer identity verification (KYC), and compliance reporting requirements. Overall, holding multi-state MTL has become a key compliance threshold for stablecoin products to gain market recognition and institutional cooperation. Agora is applying for multi-state MTL, aiming to enter this compliant camp and unlock the U.S. market.

As a rising star, Agora is actively applying for multi-state MTL, which is an important step for it to achieve legal and compliant operations, integrate into the mainstream financial system in the U.S., and move towards market expansion. Through this initiative, Agora not only demonstrates a high level of commitment to compliance but also sends a strong signal: it aims to become a new force in the stablecoin field that cannot be ignored, gaining recognition from the market and institutions, and opening a new chapter in global layout.

Betting on Agora, Paradigm is not following the trend

Paradigm's investment logic has never been about following trends but rather betting on projects that can reconstruct infrastructure logic. Agora precisely aligns with several directions that Paradigm focuses on:

The integration path of traditional finance and blockchain: Agora leverages State Street and VanEck to embed compliance trust into on-chain products, building an issuance network friendly to institutions.

Reshaping the distribution logic of stablecoins: shifting from "I issue coins for you to use" to "I build a system for you to issue," no longer just creating a stablecoin but providing the capability to issue stablecoins, enhancing network effects and capital efficiency.

Product design that adapts to regulatory trends: proactively applying for MTL and integrating into financial regulatory frameworks, giving Agora a first-mover advantage in the upcoming U.S. regulatory cycle.

Paradigm partner Charlie Noyes stated in an interview: "Agora's product is a stablecoin system with 'built-in batteries,' allowing enterprises to immediately launch stablecoin businesses without needing to hire ten engineers."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。