Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

The cryptocurrency market seems to have entered a phase of accelerated upward movement. Following a significant surge the night before last, the market experienced another round of even more intense increases last night.

According to OKX market data, BTC surged to 117,548.2 USDT last night, and as of 8:30 this morning, it is reported at 115,408 USDT, with a 24-hour increase of 3.75%; even more astonishing is the altcoin benchmark ETH, which, under multiple favorable stimuli, broke through the 3000 mark last night, reaching a high of 3002.99 USDT, and as of this morning at 8:30, it is reported at 2972.21 USDT, with a 24-hour increase of 5.77%; another altcoin leader, SOL, is reported at 162.7 USDT, with a 24-hour increase of 4%.

Due to the overall rise in the market (especially with ETH no longer stagnating), the altcoin market has also seen a strong recovery. As of this morning at 8:30, several cryptocurrencies among the top 100 have recorded double-digit increases, including SUI reported at 3.42 USDT, with a 24-hour increase of 11.7%; ARB reported at 0.3915 USDT, with a 24-hour increase of 11.1%; PEPE reported at 0.00001218 USD, with a 24-hour increase of 11.2%; PENGU reported at 0.0194 USDT, with a 24-hour increase of 26.18%…

Data from CoinGecko shows that the total market capitalization of cryptocurrencies has surpassed 3.669 trillion USD. In terms of market sentiment, the trading enthusiasm among crypto users has also significantly increased, with today's fear and greed index reaching 71, currently reported as "greed."

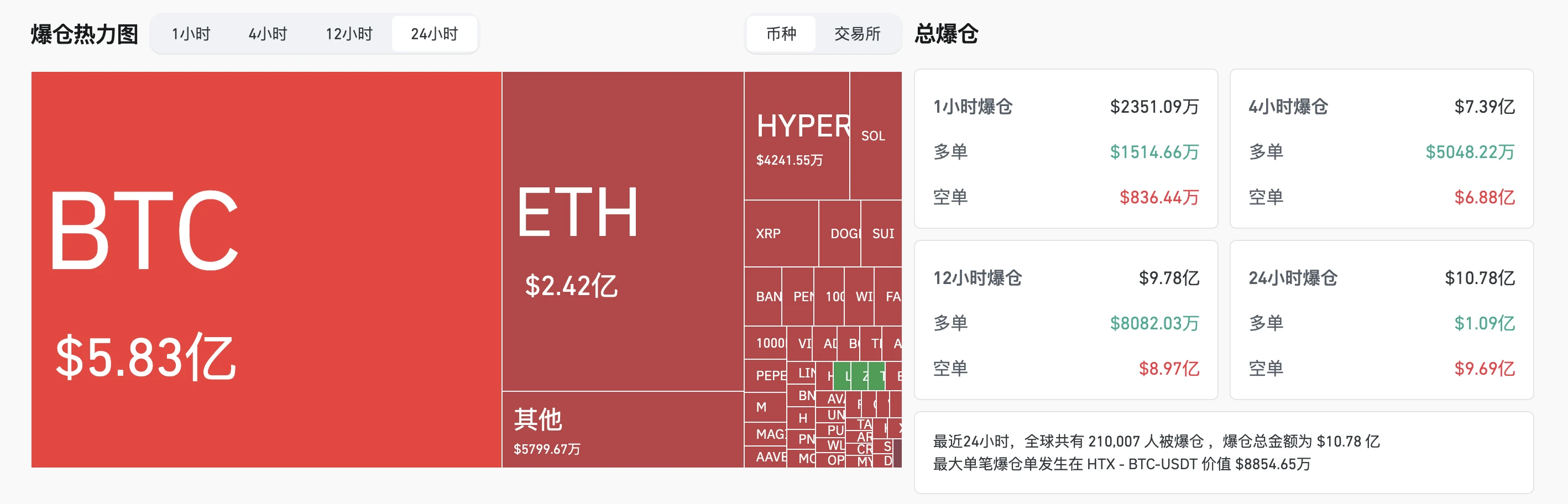

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the total liquidation across the network reached 1.078 billion USD, with the vast majority being short liquidations, amounting to 969 million USD. In terms of cryptocurrencies, BTC saw liquidations of 583 million USD, and ETH saw liquidations of 242 million USD.

Reasons for the Rise: Tariff "Desensitization," Institutional Buying, Interest Rate Cut Expectations

Regarding the reasons for this round of market recovery, we provided some analysis in yesterday's market trend article titled “BTC hits a new high of 112,000 USD, ETH leads with a 7% increase, is the dawn of the altcoin season emerging?.”

On one hand, the market has gradually realized that the collective psychological impact of the recent tariff issues has significantly weakened—just like the story of "The Boy Who Cried Wolf," when a story is told multiple times, its deterrent effect naturally diminishes. The panic impact of the tariff war on the crypto market and even the global economy has greatly decreased.

On the other hand, the buying power from institutions, including ETFs, continues to grow. As of July 10, the spot Bitcoin ETF has maintained positive inflows for five consecutive days. After SOL opened up ETF channels, more altcoin ETFs are also expected to be approved for listing; in addition, beyond established BTC hoarding companies like Strategy, an increasing number of listed companies have shifted their hoarding targets to ETH, SOL, and even altcoins like HYPE.

In addition to the above reasons, the remarks from several Federal Reserve officials last night regarding interest rate cuts also somewhat boosted market sentiment.

San Francisco Fed President Daly stated last night: “I think there may be two interest rate cuts, but there is uncertainty in everyone's expectations, considering implementing cuts in the fall.”

Federal Reserve Governor and potential next chair candidate Waller stated that even with strong employment data in June, the Fed should still consider cutting rates at the July meeting—“I have made my point clear. The current policy interest rate level is too high, and we can discuss lowering the benchmark rate in July… When inflation is declining, we do not need to maintain such a tight policy stance; this is the decision-making logic that a central bank should have.”

ETH Strong Rebound, Can the Momentum Continue?

ETH is undoubtedly the "brightest star" in this round of market increases. Since the market low in April this year, no one expected that ETH, which had the most pessimistic sentiment at the time, would outperform BTC and SOL, achieving a doubling rebound to date.

Regarding the reasons why ETH has been able to outperform the market recently, we provided a detailed analysis in the article “Five Major Rising Logics Becoming Clear, ETH May Welcome Structural Reversal.” In short, supported by five major rising logics—regulatory easing, institutional accumulation, foundation reforms, growth in on-chain activities, and a return of market confidence—ETH, which has undergone a long consolidation period, may welcome a structural reversal, with the potential for further upward momentum in the long term.

Jack Yi, the founder of LD Capital, who previously made high-profile calls for ETH, also posted on X this morning, stating that Ethereum ETH breaking through 3000 USD marks the start of a bull market in the crypto industry… Ethereum is severely undervalued; the previous bull market was driven by ICOs and DeFi, while this round is driven by stablecoins and RWA.

However, from the perspective of short-term trends and order situations, ETH still faces strong selling pressure around the 3000 USD mark, which means that to effectively break through this level, ETH may still need to consolidate further below. An analysis model released by CoinDesk this morning also indicates that ETH faces strong resistance around the 3000 USD mark, with support areas around 2750 USD.

Additionally, the Ethereum Foundation, which was recently praised for its operational reforms, sold 1210 ETH this morning at an average selling price of 2889.5 USD. Considering the foundation's past "top-ticking" record, this may also affect market sentiment to some extent.

Will the "Altcoin Season" Come Again?

ETH has always been regarded as the benchmark for altcoins. Previously, due to ETH's prolonged stagnation, the altcoin market had been sluggish for a long time. However, with ETH finally experiencing a strong rebound, the market has rekindled hopes for the legendary "altcoin season."

Regarding this discussion, trader degentrading posted a different analysis on X last night, believing that under the market consensus of "altcoins are scams," the gradually rising short positions will ultimately become the fuel for the rise of altcoins due to short squeezes, thus driving the arrival of the "altcoin season."

The current market is witnessing an unprecedented phenomenon: the open interest (OI) of several altcoins exceeds their market capitalization, which means there are uncovered naked shorts—because covering shorts requires buying equivalent spot, and when OI > market cap, the market simply does not have enough token supply to accommodate.

The historic turning point is that as Bitcoin is about to break through its previous high, we are observing for the first time: massive funds continuously flowing into ETH; institutions bidding for ETH through treasury companies; the altcoin derivatives market's OI hitting historical records; and a new generation of traders profiting from shorting altcoins (the consensus that "altcoins are all scams" is prevalent).

A short squeeze storm is about to arrive, with the current total market OI around 172 billion USD (BTC 83 billion/ETH 40 billion), with altcoins alone accounting for 50 billion. When these massive short positions established at historical lows begin to collectively cover—this will be the structural source of demand for altcoins. The game is about to begin.

However, differing voices still exist. Andrei Grachev, executive partner at DWF Labs, believes that most altcoins are expected to underperform Bitcoin in the future.

The approval of the "Big and Beautiful Act," seasonal market activity in the fourth quarter, and potential interest rate cuts will drive Bitcoin and crypto-related stocks to new highs. The altcoin market may partially follow the rise, but most mid-cap coins are expected to underperform Bitcoin, and opportunities will arise again.

It has been too long since the last "altcoin season," so long that the term has become a joke, and the market seems to have lost the courage to imagine it again.

Will this time be different?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。