Original Title: "BTC New High Comes as Expected, Main Uptrend Still Ahead"

Original Source: Bitpush

With the surge of listed companies accumulating coins, the new high for BTC has "arrived as expected." As the financial market pays close attention to the direction of the Federal Reserve's monetary policy, on July 9, during the late trading hours of the U.S. stock market, Bitcoin broke through the previous high of May 22, setting a new historical high of nearly $112,000 per coin (CMC data shows $111,925.38), with an intraday increase of nearly 3%.

Federal Reserve's June Minutes Signal Rate Cut

The June meeting minutes released by the Federal Reserve that day brought complex but suggestive information to the market.

The minutes show that there are significant divisions within the Federal Reserve regarding the outlook for monetary policy, which can be divided into three main camps:

· Mainstream Camp: Most participants assessed that it may be appropriate to lower the federal funds rate target range this year, but ruled out the possibility of an immediate rate cut in July. They generally believe that the committee "is fully capable of waiting for a clearer outlook on inflation and economic activity." The minutes pointed out that the upward pressure on inflation from tariffs may be temporary or moderate, that medium- to long-term inflation expectations remain stable, and that economic activity and the labor market may show some weakening.

· Hawkish Camp: A minority of participants believe that the federal funds rate target range should not be lowered this year, pointing out that "recent inflation data continues to exceed the committee's 2% target."

· Dovish Camp: A minority of participants (with "Federal Reserve mouthpiece" Nick Timiraos suggesting it may include Fed governors Waller and Bowman) indicated that if the data develops as they expect, they would be willing to consider lowering the policy rate target range at the next meeting.

Despite the internal divisions, the signal that "most participants assessed that a rate cut may be appropriate this year" undoubtedly enhances the market's expectations for future liquidity easing, which is a positive macro catalyst for risk assets like Bitcoin.

Bitcoin Long-Term Holders' Holdings Reach 15-Year High

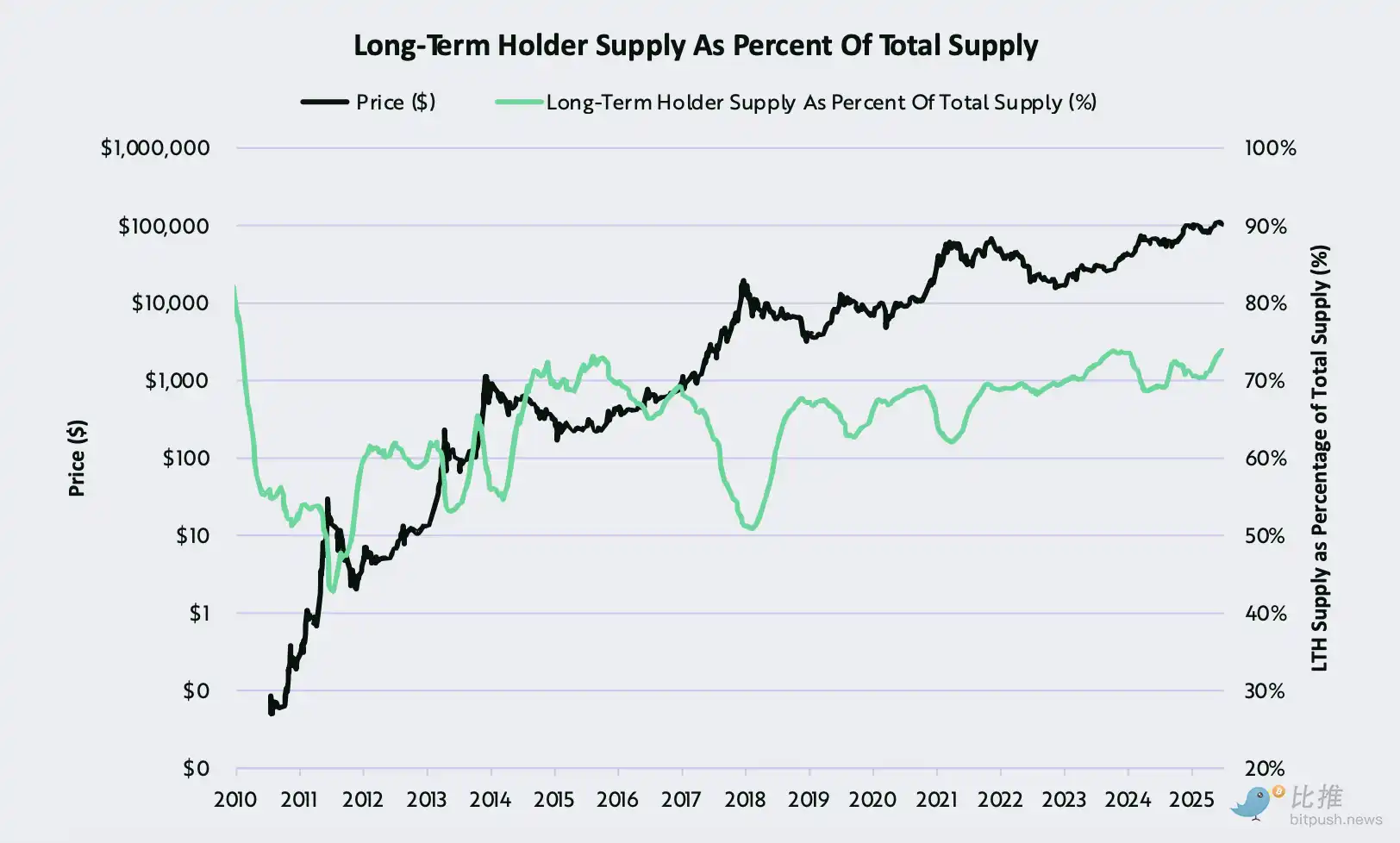

Bitcoin's recent breakthrough is not without foundation. Latest on-chain data from ARK Invest and Glassnode shows a strong "ballast" force in the Bitcoin market—long-term holders (LTHs).

ARK Invest's latest "Bitcoin Monthly Report" indicates that the total amount of Bitcoin held by long-term holders has reached 74% of the total supply, marking a new high in the past 15 years. This strongly suggests that experienced investors have a firm belief in the market and a strong bullish outlook, choosing to accumulate Bitcoin rather than sell as prices rise, providing strong support for the market.

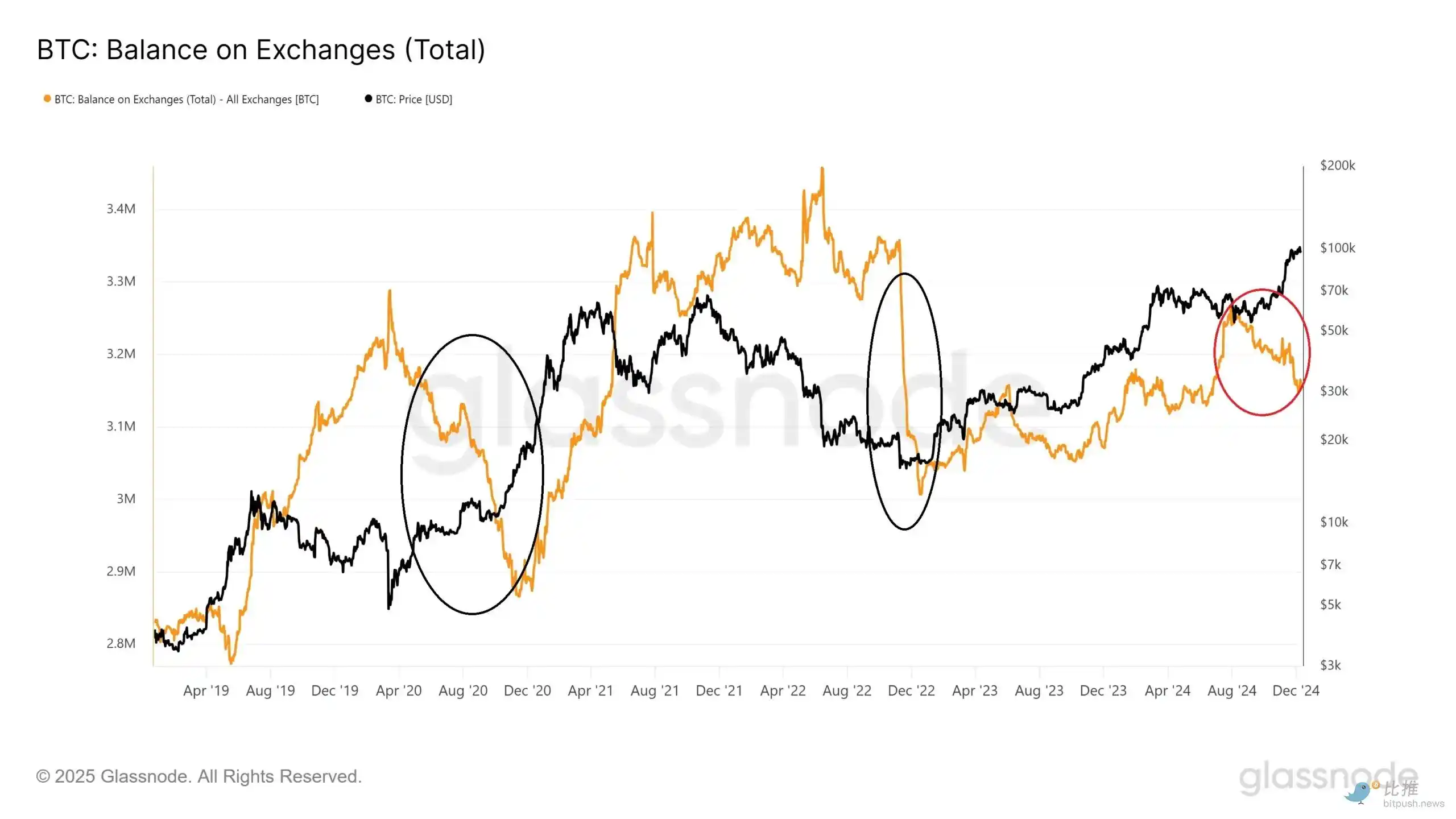

Glassnode's data also confirms this trend. Over the past five years, Bitcoin balances on trading platforms have seen sharp declines twice, and each decline was followed by a significant increase in Bitcoin prices. Notably, since July 2024, Bitcoin balances on trading platforms have been steadily declining. This indicates that investors are withdrawing Bitcoin from trading platforms to private wallets for long-term holding, reducing market selling pressure. If history repeats itself, there is further room for Bitcoin's bull market to run.

Although the ARK Invest report also mentioned that the MVRV momentum indicator measuring market sentiment showed a decline in on-chain capital flow in the second quarter, which may indicate a cooling of short-term market enthusiasm, the firm stance of long-term holders provides a solid foundation for Bitcoin prices, making them more resilient in the face of short-term fluctuations.

Bitcoin "Bull Flag" Breakthrough Aiming for Higher Targets

Several well-known analysts have also expressed optimism about Bitcoin's upward potential from a technical perspective.

According to TradingShot analysts, since hitting the bottom in November 2022, Bitcoin's price has been in a clear upward channel, which closely aligns with the Fibonacci channel that has tracked Bitcoin's price movements since 2013. Analysts believe that Bitcoin has converted the previous "bull flag" top into a support level, which is a "strong bullish signal," and the price continues to stay above the 50-day simple moving average (SMA) of $106,750.

TradingShot further predicts that the technical breakout from this "bull flag" points to the 2.0 Fibonacci extension line, with a target price potentially reaching $168,500.

Additionally, well-known trader Zerohedge pointed out on the X platform that if Bitcoin can follow its fractal pattern with the M2 money supply, then once the current consolidation period ends, Bitcoin's price will enter a parabolic rise. This potential correlation between macro liquidity and Bitcoin prices adds more optimistic tones to the current market.

Glassnode's comparison of historical cycle data found that the current cycle shares similarities with the bull markets of 2017 and 2021—during both cycles, Bitcoin prices began a parabolic rise at similar points in time and continued for nearly a year. This suggests that if historical patterns repeat, Bitcoin still has significant upside potential.

Crypto analyst Rekt Capital also noted that if Bitcoin follows the historical pattern of 2020, the price expansion of this cycle may only have a few months left, with prices potentially peaking in October, about 550 days before the Bitcoin halving event in April 2024.

Bitcoin's recent historical high is the result of a resonance of multiple factors, including macroeconomic benefits, institutional adoption, and listed companies accumulating coins. The Federal Reserve's expectations for rate cuts have injected ample liquidity into the market, and the firm holdings of long-term holders have built a solid price floor. From the current market momentum, its upward trend is far from over, and the second half of the year may see a stronger acceleration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。