On July 9, 2025, during the closing hours of the U.S. stock market, the price of Bitcoin (BTC) broke through the historical high of $111,963 set on May 22, reaching $112,000, with an intraday increase of nearly 3%, sparking global market discussions. This round of price increase coincided with the ongoing trend of listed companies "stockpiling" Bitcoin and the interest rate cut signals released in the Federal Reserve's June meeting minutes. This breakthrough may be attributed to a surge in institutional demand and a warming risk appetite. However, the future direction of the Federal Reserve's monetary policy, global economic uncertainty, and regulatory risks in the crypto market remain key variables for Bitcoin's continued rise.

Bitcoin's New High: Corporate Stockpiling and Market Frenzy

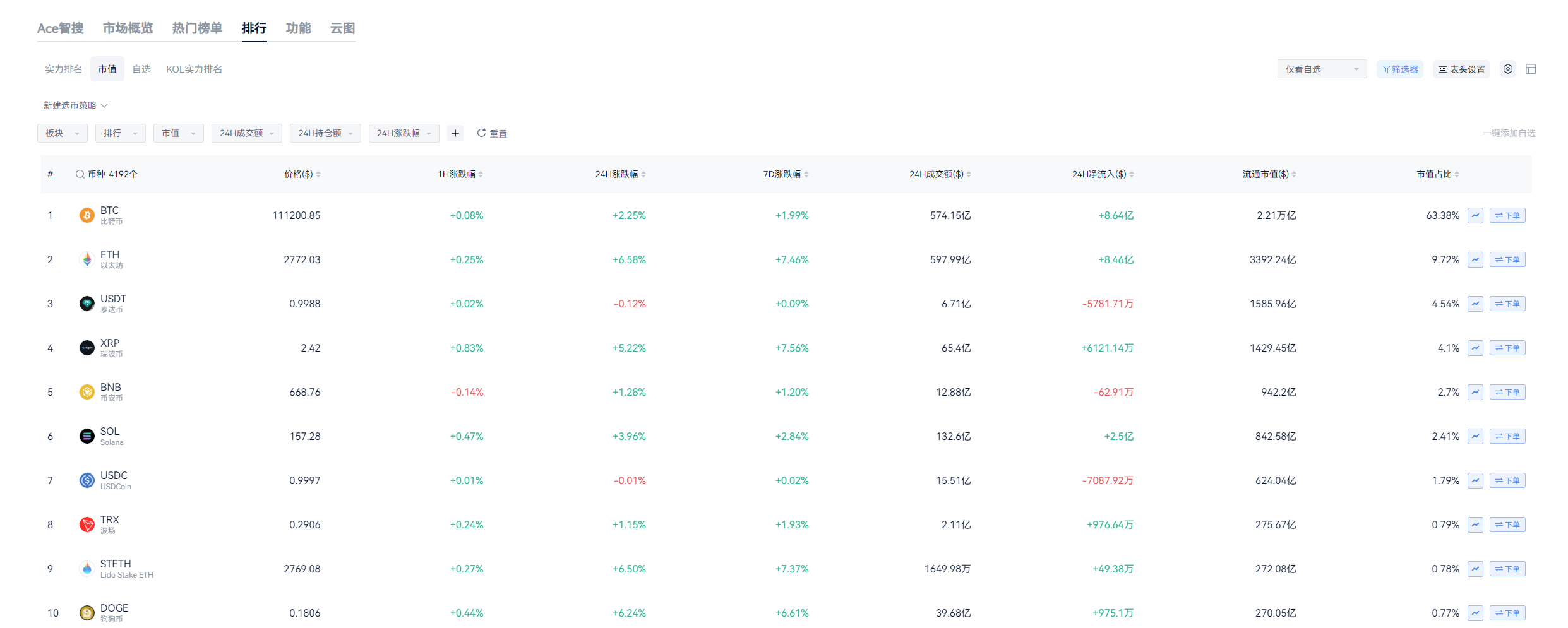

On July 9, 2025, Bitcoin's price reached a historic high of $112,000 before pulling back. According to AiCoin data, Bitcoin's total market capitalization has exceeded $2.2 trillion, accounting for 63.38% of the total cryptocurrency market capitalization.

Candlestick Patterns:

- The daily chart shows a long upper shadow bullish candlestick formed on July 9, with the high of $111,999.79 failing to break through and subsequently retreating, indicating heavy selling pressure above.

- The hourly chart has recently shown a consolidating trend, with the price encountering resistance around $111,500, making multiple unsuccessful attempts.

Technical Indicators:

- MACD: The hourly line shows both the DIF and DEA averages trending upwards, but the histogram is gradually shortening, indicating weakening momentum; the daily line still shows a bullish trend, but high levels may face adjustment pressure.

- RSI: The hourly RSI is in the 64-66 range, close to the overbought area but not yet in a strong unilateral position; the daily RSI remains below 70, indicating limited upward space.

- EMA: The hourly EMA7 (110,945) provides support for the current price, while EMA30 (109,824) and EMA120 (108,873) maintain a bullish arrangement, with an overall upward trend.

Trading Volume:

- The daily trading volume on July 9 was massive (17,282), accompanied by a significant price surge, indicating clear capital-driven momentum, but the subsequent volume contraction shows a lack of enthusiasm for chasing prices.

- The hourly trading volume has gradually decreased, with market sentiment becoming cautious.

The corporate "stockpiling" trend is the core driving force behind Bitcoin's price increase. Since 2025, companies like MicroStrategy, Tesla, and Block have continued to increase their Bitcoin holdings, with BlackRock holding over 690,000 BTC and MicroStrategy's BTC reserves nearing 600,000. The entry of these companies not only boosts demand but also endows Bitcoin with the safe-haven attribute of "digital gold."

The inflow of funds into spot Bitcoin ETFs provides direct support for the price increase. Data shows that in June 2025, net inflows into U.S. spot Bitcoin ETFs exceeded $3 billion, setting a new historical high. BlackRock's IBIT fund has reached a management scale of $45 billion, accounting for 40% of global crypto ETFs, indicating that institutional investors' confidence in BTC remains strong.

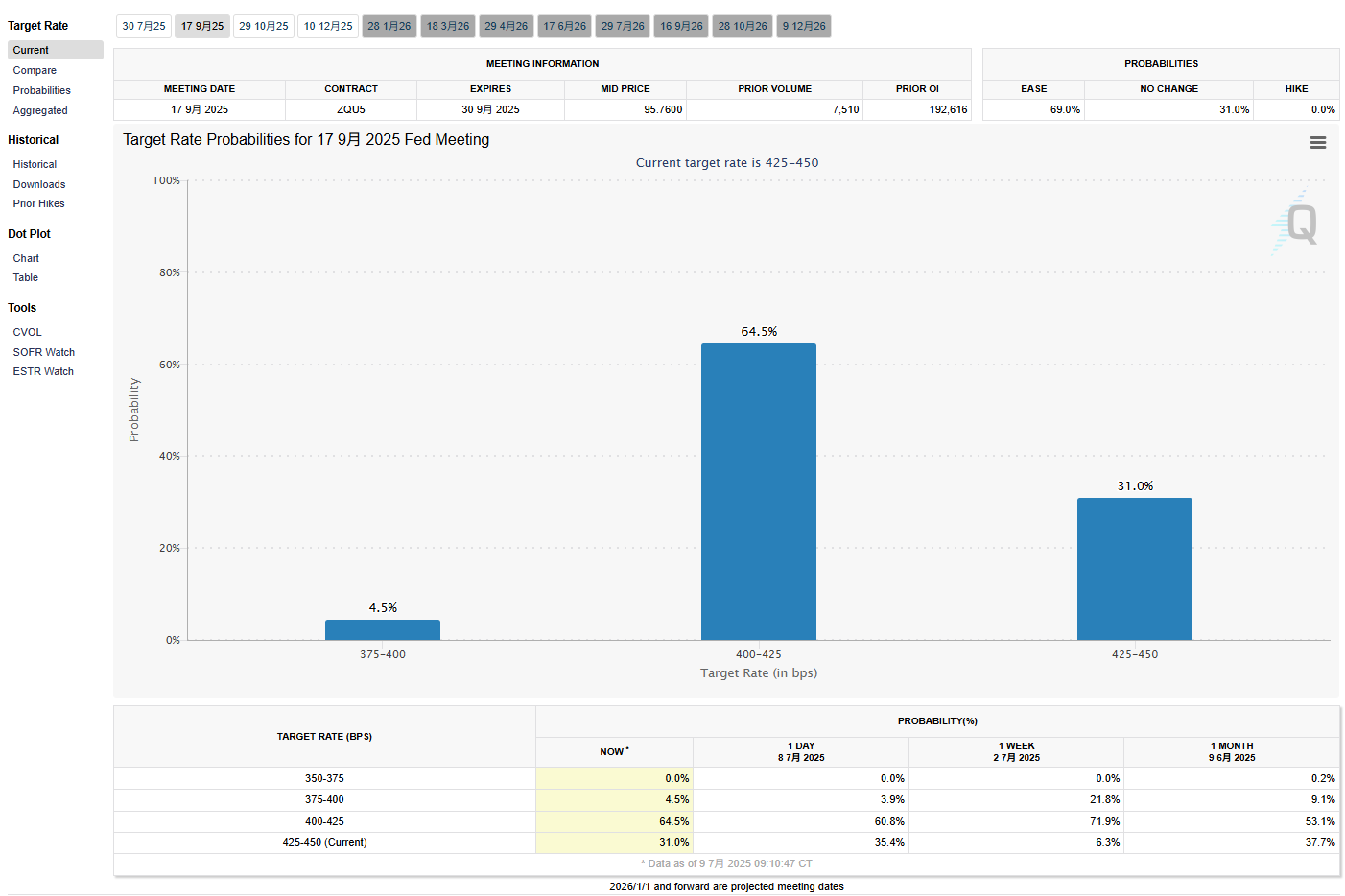

Federal Reserve's Rate Cut Signals: A Catalyst for Monetary Policy

The Federal Reserve's minutes indicate that the Federal Open Market Committee (FOMC) is concerned about slowing inflation and a weak job market, suggesting a possible rate cut in the second half of 2025. Although the June 18 decision maintained the federal funds rate at 4.25%-4.5%, the CME FedWatch tool shows that the market expects a 64.5% probability of a 25 basis point rate cut in September. CMC Markets analyst Carlo Pruscino predicted in June during an interview with Cointelegraph that if the Federal Reserve cuts rates early, Bitcoin's upward target would be set at $112,000, and this price breakthrough seems to confirm that judgment. The warming expectations of rate cuts are favorable for risk assets. Bitcoin, as a highly volatile asset, typically performs strongly in a loose monetary environment. However, the Federal Reserve's cautious stance also adds uncertainty to the market.

Global Context: Tariffs and Economic Uncertainty

The rise of Bitcoin is not an isolated phenomenon; the global economic environment provides a complex backdrop. On July 8, Trump postponed the tariffs originally set to take effect on July 9 until August 1, but the threat of up to 70% tariffs on 14 countries, including Japan and South Korea, remains unresolved. Tariffs could raise import costs, exacerbating the risk of "stagflation" in the U.S., thereby increasing the safe-haven demand for Bitcoin.

At the same time, central banks in BRICS countries continue to increase their gold holdings, with 20% of global gold reserves concentrated in this group. Tether CEO Paolo Ardoino revealed that its Swiss vault holds 80 tons of gold, valued at $8 billion, highlighting the common safe-haven characteristics of precious metals and crypto assets. Bitcoin, as "digital gold," attracts more capital inflows amid expectations of fiat currency depreciation.

Future Outlook: Direction After $112,000

Bitcoin's breakthrough of $112,000 marks its entry into a new price range, but whether it can sustain its rise depends on multiple factors. In the short term, CPI and the Federal Reserve's interest rate decisions are crucial. If rate cut expectations strengthen further, Bitcoin may challenge the $120,000 mark. In the long term, corporate stockpiling and ETF fund inflows will continue to support demand, but tightening regulations and macroeconomic fluctuations may limit price increases.

The crypto market in 2025 stands at a crossroads of opportunities and challenges, and Bitcoin's next destination is worth global attention.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。