Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

The Bitcoin ETF ignited last spring, and the "Crypto ETF Summer" is expected to arrive in the second half of this year.

With altcoin ETFs for SOL, XRP, DOGE, and others waiting for approval from the U.S. SEC, the number of submitted crypto spot ETFs has surpassed 70. Currently, the Solana staking ETF has successfully launched, a group under Trump is promoting a "crypto blue-chip portfolio" ETF, and the SEC is planning to establish unified listing rules, possibly preparing for a concentrated approval.

Unlike the on-chain experiment of DeFi Summer in 2020, this "ETF Summer" is driven by Wall Street and Congress.

Three Catalysts for "ETF Summer": Trump, Universal Standards, Staking ETFs

The wave of Bitcoin spot ETFs that surged last year is far from over.

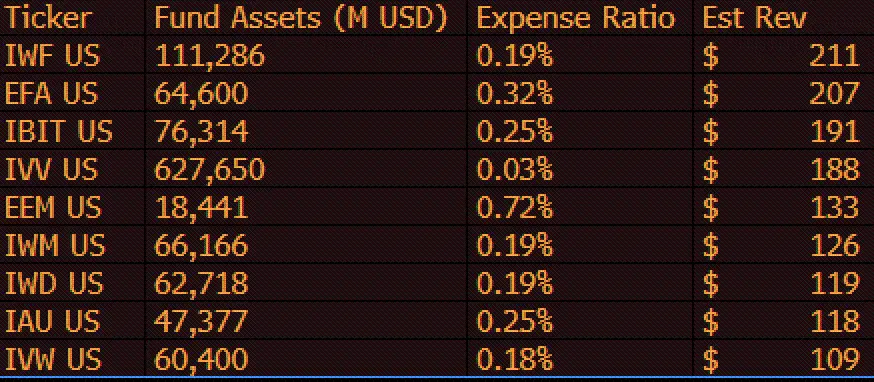

Among the 2,000 funds managed by the world's largest asset management giant BlackRock, the Bitcoin spot ETF $IBIT, set to launch in early 2024, has surprisingly jumped to the third position in expected annual returns, only behind the IWF, which tracks the largest 1,000 growth companies in the U.S., and the EFA, which covers developed market stocks outside of the U.S. and Canada.

Image Source: Eric Balchunas

The success of the Bitcoin ETF has sounded a huge gong, and the battlefield for crypto ETFs has shifted from single-point breakthroughs to a comprehensive rollout.

Bloomberg ETF analyst James Seyffart recently predicted that a new wave of ETF approvals will arrive in the second half of 2025: among them, the approval probabilities for LTC, SOL, and XRP are 95%, while DOGE, HBAR, Cardano, Polkadot, and Avalanche are expected to have a 90% approval probability.

Image Source: James Seyffart

It is worth noting that the review deadlines for these altcoin ETFs are mostly concentrated in the fourth quarter of this year. Once approved in bulk, the crypto market will welcome "ETF Summer." Currently, the three major catalysts driving this wave are beginning to take shape.

First Catalyst: Trump's Involvement, Political Capital Boosting Crypto ETFs

Trump has written "crypto" into his political script, launching a "crypto combination punch," attacking from all angles with crypto projects WLFI, meme coins, stablecoins, and crypto ETFs.

In March, Trump's media technology group signed a binding cooperation agreement with crypto trading platform Crypto.com and asset management company Yorkville America Digital, planning to launch a series of crypto ETFs under its brand Truth.Fi.

In the following months, Trump's camp made intensive moves:

- On June 3, Truth Social submitted a Bitcoin ETF application;

- On June 16, Truth Social submitted applications for Bitcoin and Ethereum ETFs, with a holding structure of 75% Bitcoin and 25% Ethereum;

- On July 8, Truth Social applied for a "blue-chip crypto ETF," including Bitcoin (70%), Ethereum (15%), Solana (8%), Cronos (5%), and XRP (2%).

Such a high frequency of ETF applications undoubtedly ignited the first fire for crypto ETFs.

Second Catalyst: SEC Establishing Universal Listing Standards, Potentially Accelerating Approvals

With the surge in crypto ETF applications, the U.S. SEC is considering a faster approval framework. Crypto journalist Eleanor Terrett disclosed last week that the SEC is working on establishing universal listing standards for cryptocurrency ETFs, aiming to significantly speed up the listing process for these funds.

According to the preliminary plan, if tokens meet the standards, issuers will not need to go through the lengthy 19b-4 approval process but only need to submit an S-1 document and wait 75 days. The discussed selection criteria may include market capitalization, degree of decentralization, and wallet distribution.

Bloomberg senior ETF analyst Eric Balchunas stated, "It makes complete sense for the SEC to establish universal listing standards, which is also why we are optimistic about the high approval probability of most mainstream coins reaching 95%. We expect these rules to be lenient enough that most of the top 50 coins can successfully issue ETFs."

Another Bloomberg analyst, James Seyffart, predicted that this framework draft could be released as early as this month, with formal implementation expected in September or October.

If this framework is successfully introduced, it is highly likely to open the floodgates for crypto ETF approvals, marking a key step for the SEC in regulating crypto assets.

Third Catalyst: Staking ETFs Breaking the Ice, Bridging On-Chain Yields with Traditional Markets

Ethereum staking ETFs have always been a focal point of market attention. Since February of this year, several institutions, including 21Shares, Grayscale, Fidelity, Bitwise, and Franklin, have successively submitted applications to the SEC to include spot Ethereum ETFs in staking mechanisms. However, as of now, the related proposals have not yet been approved.

While waiting, an "unexpected player" broke the deadlock first: on July 2, the first U.S. Solana staking ETF (REX-Osprey Solana + Staking ETF, trading code $SSK) officially launched for trading. This ETF aims to track the performance of Solana while generating yields through on-chain staking.

It operates in the form of a Class C company, circumventing regulatory challenges related to staking, providing investors with a compliant way to earn staking yields. On its first day of trading, SSK achieved a trading volume of $33.914 million, significantly outperforming Solana futures ETFs, XRP futures ETFs, and the average performance of regular ETFs, but falling short of the trading volume levels of Bitcoin and Ethereum spot ETFs.

The launch of this ETF marks a dual breakthrough in regulation and product structure, potentially triggering a wave of applications for PoS staking ETFs.

The three major catalysts intertwine, and the crypto "ETF Summer" is gradually revealing its initial state. Along with the wave of coin-stock linkage, more innovative plays may emerge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。