Today's homework can't be discussed much. Trump continues to release tariffs on some small countries, which does not significantly harm the overall situation. After the announcement of TACO yesterday, market sentiment has improved noticeably. The final tariff implementation will be on August 1. Before that, we are mainly waiting for the tariff issues between the United States, China, and the European Union, as well as the Federal Reserve's interest rate meeting in July.

The Federal Reserve's meeting minutes were also released in the early morning. Overall, most committee members remain neutral (cautious) and slightly dovish, believing that there is still a window for one or more rate cuts in 2025, either to meet declining inflation or to address economic downturns, which would open the door for rate cuts. The hawkish and dovish stances are roughly balanced, so as long as inflation can be controlled, the probability of a rate cut in September is quite high.

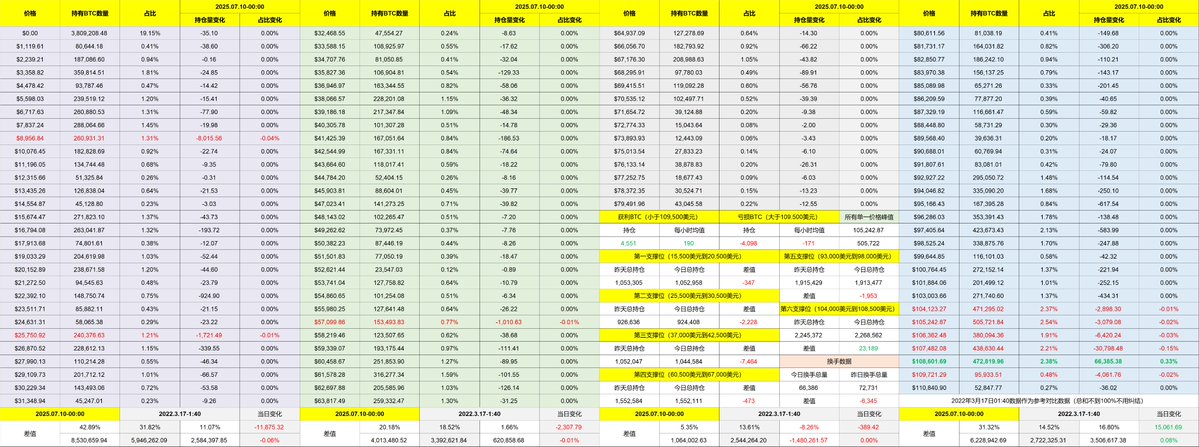

Looking back at Bitcoin's data, today's turnover is even lower than yesterday's, and market activity continues to decline. This is completely inconsistent with the price's upward trend. A year ago, I couldn't have imagined this situation: on one hand, prices are rising, while on the other hand, trading volume is shrinking and turnover is declining. In simple terms, there are too few investors trading, which leads to this situation.

Last week, we expressed through various data that the current price increase is not supported by much purchasing power, but rather by a large number of investors unwilling to sell. The mismatch in supply and demand has caused the price to rise, while the actual amount of funds and purchasing power has not significantly increased, which is true for both spot and ETFs.

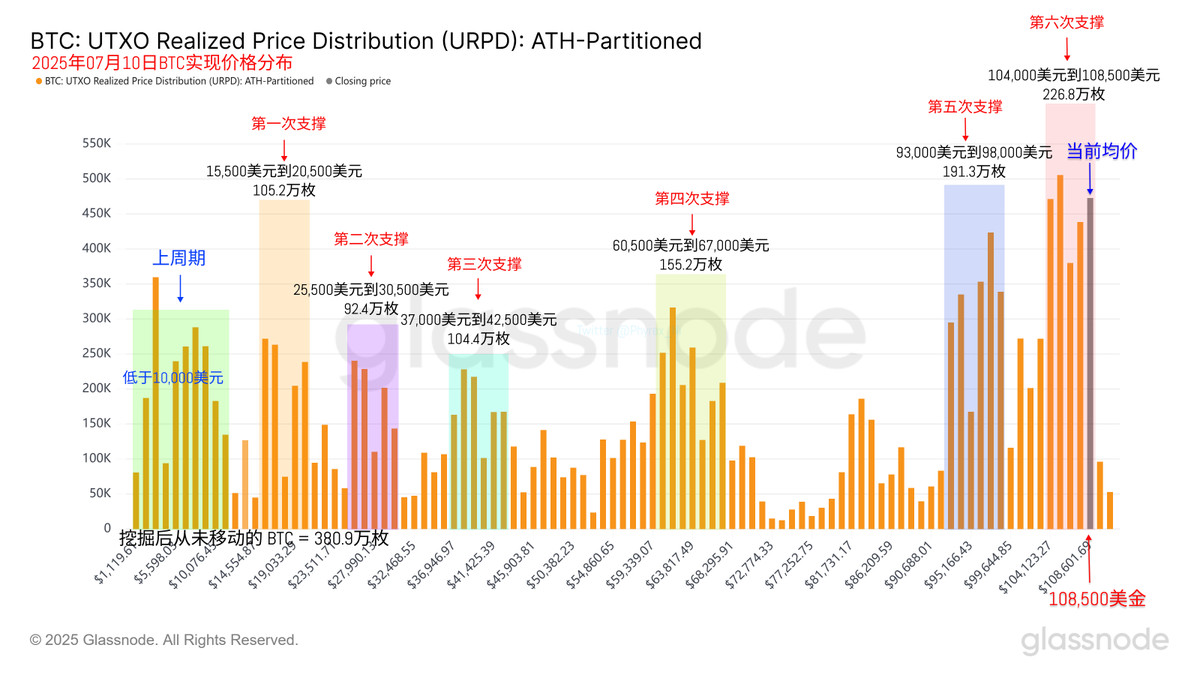

There isn't much to say about support either; the price increase has made the support more solid. More investors are concentrated between $104,000 and $108,500, and the market is still waiting for a directional choice. However, as long as there are no systemic risks, it should remain relatively stable.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。