Original author: Bright, Foresight News

On the evening of July 8, Bloomberg reported that Tether CEO Paolo Ardoino stated in an interview that Tether has its own vault in Switzerland, currently holding gold worth $8 billion (approximately 80 tons). The vault is located in Switzerland, but for security reasons, the company refused to disclose its exact location or the date it was established.

The vast majority of the gold is held directly by Tether. Paolo Ardoino mentioned that Tether decided to establish its own vault due to cost issues. Paying fees to vault operators commonly used in the precious metals industry is a very luxurious expense.

Tether has become one of the largest holders of gold globally, aside from banks and nation-states, with gold in the vault valued at approximately $8 billion, roughly equivalent to the total value of precious metals and other commodities held by UBS Group. Previously, during his speech at the Bitcoin 2025 conference in Las Vegas, Paolo Ardoino revealed that Tether's gold reserves amount to 50 tons.

Gold currently accounts for nearly 5% of Tether's total reserves, primarily used to support its gold token XAUT and as collateral for its stablecoin.

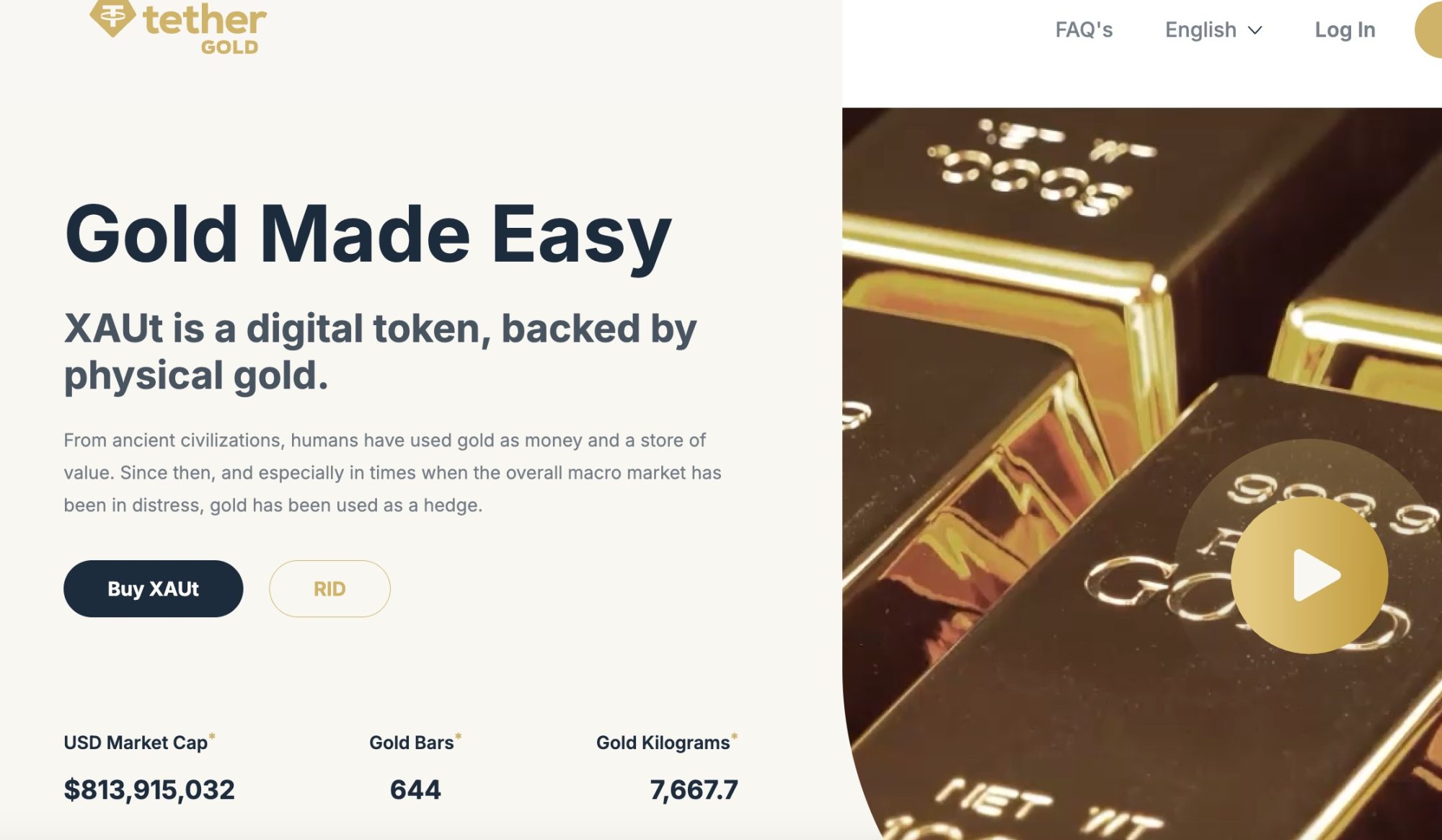

Tether Gold (XAUT) is a stablecoin issued by Tether's subsidiary TG Commodities Limited, pegged to physical gold, with each XAUT token representing 1 ounce of gold certified by the London Bullion Market Association (LBMA). Currently, XAUT supports both the Ethereum and Tron networks.

Additionally, Tether has launched its own Alloy by Tether platform, allowing users to use XAUT as collateral to mint new synthetic dollar stablecoins aUSDT.

According to data from Tether's official website, the current circulating market value of XAUT is approximately 813 million yuan, corresponding to 7.66 tons of gold, equivalent to 644 standard "London Good Delivery" gold bars.

According to Tether's official website, compared to traditional gold, XAUT has the inherent advantages of cryptocurrency:

Easy to transport. Transporting XAUT tokens is no different from other crypto assets.

Easy to divide. XAUT tokens can be minimally divided into 0.000001 troy ounces of gold.

Easy trading 24/7. Trading can be conducted around the clock, 365 days a year on exchanges that support XAUT.

Easy redemption. Tether can deliver physical gold bars to any address within Switzerland.

Easy storage. Storing XAUT is no different from other crypto assets.

Easy verification. All physical gold supporting XAUT tokens can be tracked on Tether's website for quick verification of gold holdings.

At the same time, holding XAUT incurs no custody fees, and holders can redeem XAUT for physical gold at any time, but must meet certain minimum redemption amounts and related fees. Below are the specific fees for purchasing and redeeming on Tether's official website.

Purchase fee: When purchasing XAUT through Tether's official platform, a one-time fee of 0.25% is required. Additionally, users must complete identity verification and pay a non-refundable verification deposit of 150 USDT, with a minimum purchase amount of 50 XAUT.

Redemption fee: When redeeming XAUT for physical gold, a one-time fee of 0.25% is required. Currently, the minimum redemption amount is 430 XAUT, approximately equivalent to one standard "London Good Delivery" gold bar. Additional shipping fees may also apply.

Currently, mainstream exchanges such as Bybit and Okx support spot and leveraged trading of XAUT, while Tether's operating entity Bitfinex directly supports 100x perpetual contract trading.

However, Tether is not the first to venture into the on-chain gold space.

PAX Gold (PAXG) is a digital asset linked to physical gold issued by the American fintech company Paxos Trust Company. Each PAXG token represents 1 ounce of gold certified by the London Bullion Market Association (LBMA), with the physical gold held and stored in professional vaults in London by Paxos. PAXG was officially issued on the Ethereum network in 2019 and is regulated by the New York State Department of Financial Services (NYDFS), making it the world's first fully regulated gold-backed stablecoin.

Currently, PAXG has a market value of approximately $843 million but is primarily targeted at U.S. customers, thus also supported by mainstream U.S. exchanges like Coinbase.

Overall, as Tether gradually exits the U.S. market amid the compliance process of the U.S. "GENUIS" Act, it is increasingly focusing on emerging markets. Tether's long-established reputation, strong asset reserves, and accessible storage methods are all contributing to the globalization of XAUT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。