Author: 1912212.eth, Foresight News

In the cryptocurrency world, the days of making huge profits from small investments are long gone. If you missed the wealth-making opportunities in crypto during 2017 and 2021, trying to turn a small amount of capital into a fortune now is akin to chasing a dream. Of course, there are countless stories on Twitter of individuals turning tens of thousands into millions through contracts, and some who became famous by seizing a particular MEME. However, those are the success stories of a few, while the majority who either lost money or didn't make any remain silent and unnoticed. The consensus among some traders is to borrow money to invest in cryptocurrencies if their capital is insufficient.

Recently, the wave of account freezes at OKX has brought the topic of borrowing money to trade cryptocurrencies into the spotlight. Reports indicate that some user accounts were frozen due to issues related to the source of funds, with OKX requiring users to provide detailed proof of funds, including records of income sources for the past ten years, and explicitly stating that funds obtained through online loans are not supported for cryptocurrency trading. This incident has not only raised questions about OKX's compliance policies but has also sparked intense debate within the cryptocurrency community regarding the phenomenon of "borrowing to trade."

Open-minded Individuals: Yield Farming, Arbitrage, Buying Mainstream Spot Coins

Hong Hao, Chief Economist at Foresight Group, once said, "When your capital is too small, multiplying it several times won't have a significant impact on your life." It seems that many aspiring traders share this view.

Twitter user 0x悟道 expressed a complex sentiment towards online loans, stating, "Last July, I borrowed 200,000 from Jiebei, mainly because the interest rate was favorable, only around 3%. I used 200,000 with interest first and principal later for a year, and the total interest was just over 10,000. The risk of this low-leverage is too low to pass up."

According to him, he ultimately doubled his return. However, he has since repaid the 200,000 loan.

Trader Crypto Monkey revealed that after the 94 incident in 2017, he borrowed 180,000 from a general fund, 100,000 from an online business loan, 70,000 from WeChat loans, and 20,000 from Zhaolian's good loan, totaling about 600,000 RMB to buy the dip.

"The hardest time in life came after I finished borrowing. During that period, the market was very volatile, fluctuating by tens of thousands. The most painful part was having to repay tens of thousands every month. The pressure turned into anxiety, and days felt like years. I thought countless times about the consequences of losing my bets in the future."

In the end, he finally saw substantial returns during the bull market.

Smart individuals use borrowed funds as chips to buy the dip during the grueling bear market and downturns, ultimately reaping rewards during the bull market cycle. Alternatively, they use borrowed funds for yield farming, participating in new projects, and other arbitrage opportunities. They do not engage in high-leverage trading with borrowed funds, which may be a significant reason for avoiding pitfalls.

Crypto trader Xiao Su (pseudonym) told Foresight News, "As long as your borrowing cost is low, even buying a Bitcoin spot can make some money, mainly depending on personal risk tolerance. I personally use borrowed funds to buy mainstream spot coins and hold them, planning to sell and repay when the market picks up in the second half of the year. But I only borrow what I can repay; even if I lose that money, it won't be the end of the world."

Opponents: Essentially Adding Leverage

While there are open-minded individuals regarding borrowing to trade cryptocurrencies, there are also many strong opponents. Well-known KOL Bitcoin bluntly stated, "Borrowing to trade cryptocurrencies is essentially adding leverage, and the leverage game is designed for a very small number of people. Most people who want to change their fate end up accelerating their downfall. The so-called 'I can win' is self-deception! True fate changers are never 'gambling with borrowed money,' but rather time, patience, and continuous value accumulation."

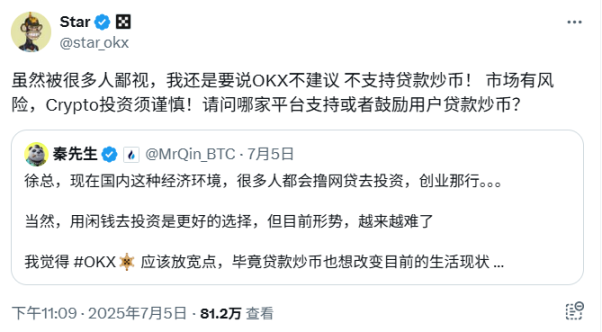

As the topic of borrowing to trade cryptocurrencies intensifies, OKX founder Star has explicitly stated that he does not recommend or support borrowing to trade and questioned which platforms support or encourage users to borrow for trading.

Trader Paulwei also explained on Twitter why he does not recommend players borrow to trade, especially in contracts.

He explained that even when funds are low, he firmly refuses to borrow money for trading. Because a liquidation to zero means that his current method is wrong, his skills are insufficient, and he is "unworthy" of using the amount of capital before liquidation. Immediately using more money to trade is likely to lead to repeating the same mistakes and falling into a deeper abyss. The key to getting through the low points is to make an extremely counterintuitive decision: with less principal, dare to explore slowly with lower leverage.

Conclusion

Some Web3 professionals may choose online loans due to high bank lending thresholds caused by issues with provident funds and social security, coupled with a mindset of making quick money, ultimately leading them to online loans. However, the market is unpredictable, and leverage is a devil; dancing with risk can easily lead to total loss. Controlling risk and not leaving the table may be the key to survival in the cryptocurrency world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。