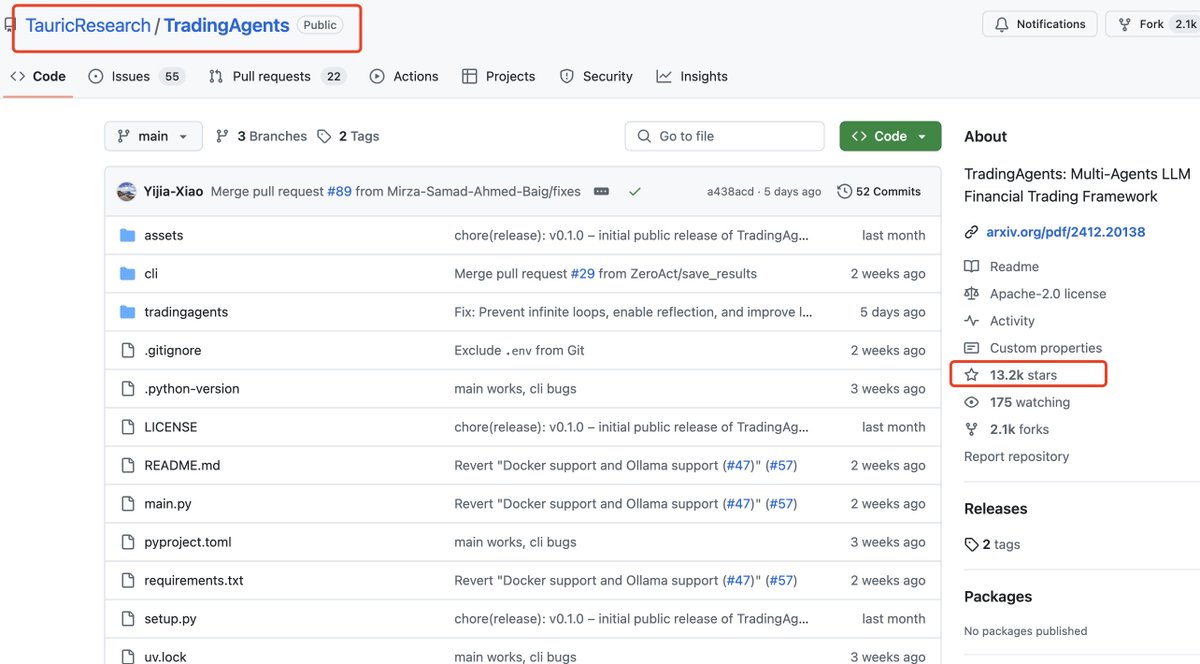

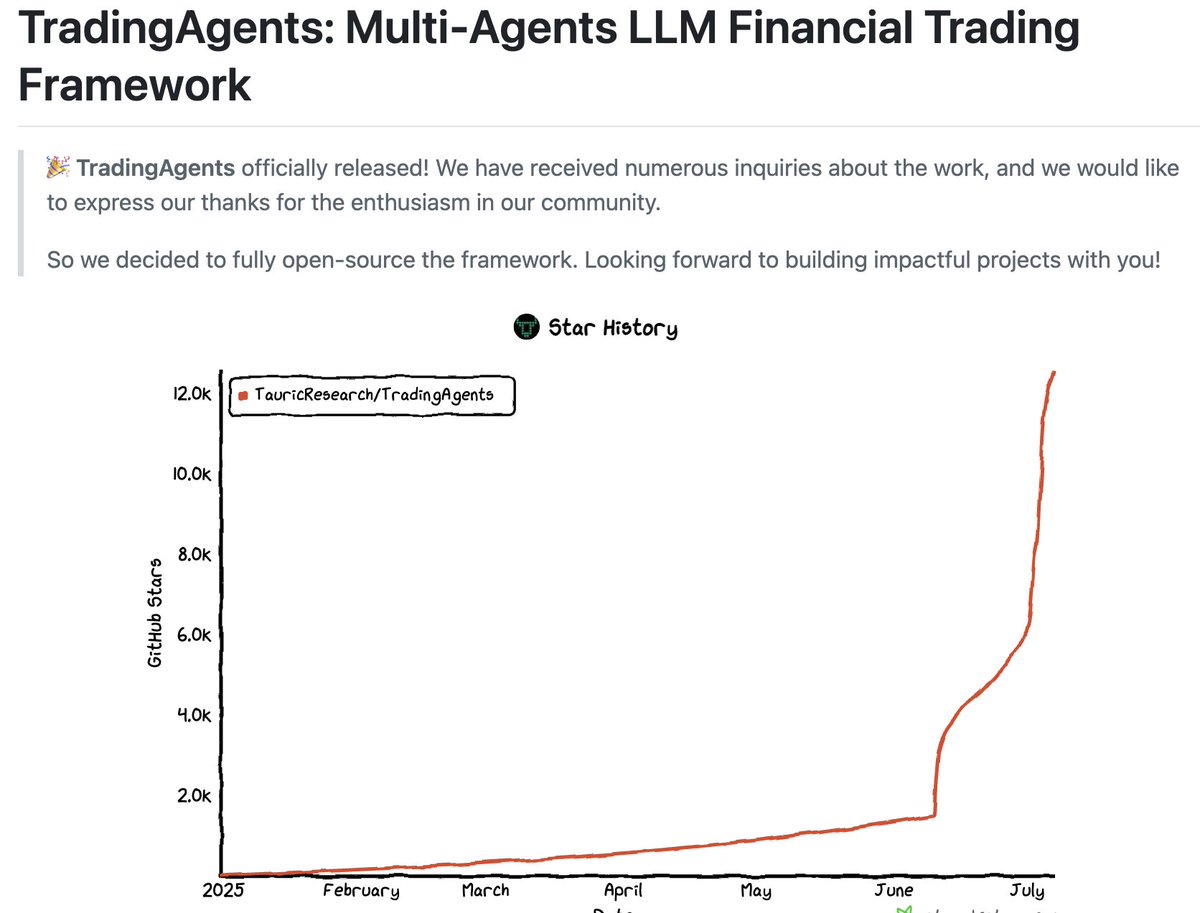

This is the most impressive open-source investment #AI Agent we have seen so far. In just a few months since its launch, it has garnered 13,200 stars. Developed collaboratively by two top institutions, the University of California and the Massachusetts Institute of Technology, this open-source financial #AI system supports localized deployment, addressing privacy concerns.

The #AI financial tools we used in the past generally operated in a "lone wolf" mode—one model was responsible for making decisions from start to finish, at most conducting some backtesting.

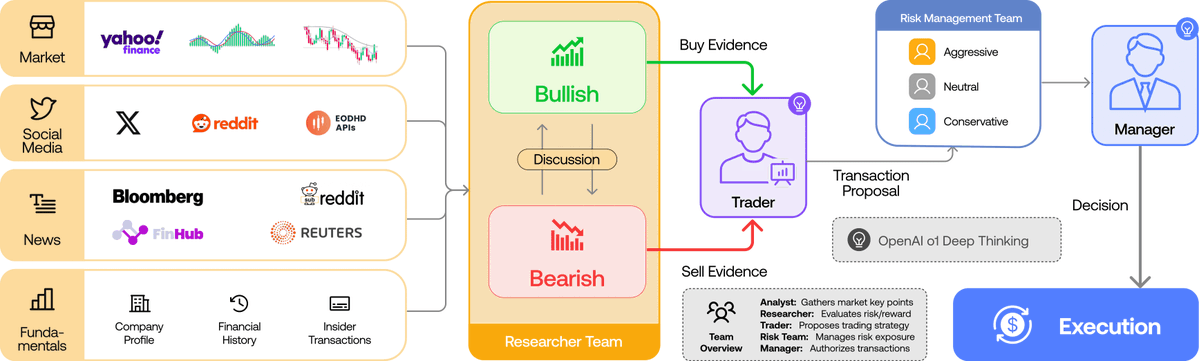

However, this system is different; it employs a "team-based agent" architecture, mimicking the real trading division of labor on Wall Street:

- Analyst Agent: Studies macro and fundamental factors

- Researcher Agent: Interprets sentiment and market dynamics

- Trader Agent: Executes trades and implements strategies

These three agents not only perform their respective roles but can also engage in "structured debates" with each other, similar to investment research meetings, offering suggestions, rebuttals, and corrections, ultimately agreeing on an executable trading strategy.

📈 How does it perform in practice?

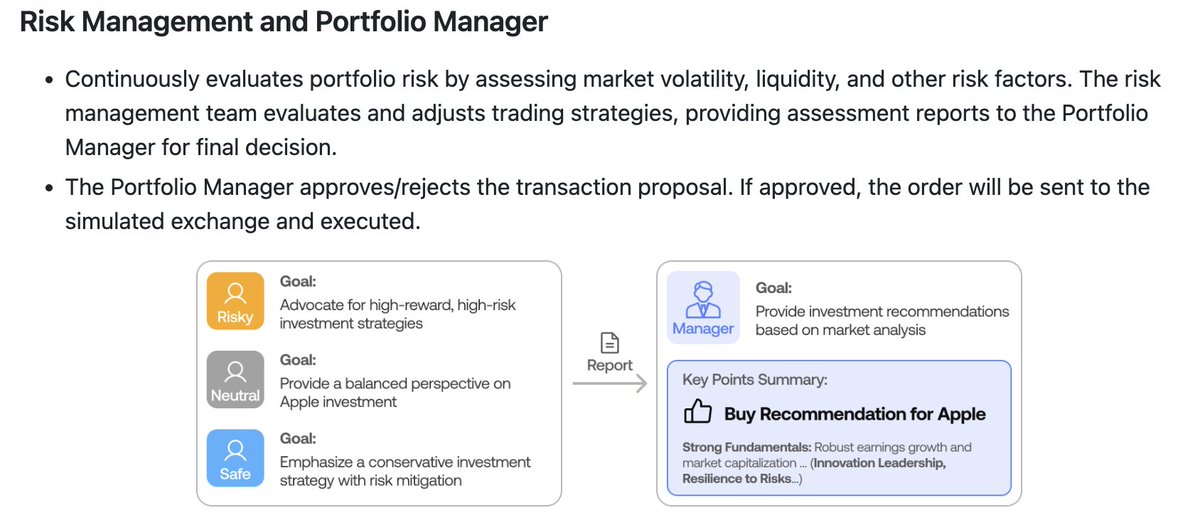

In a simulated trading round of Apple (#AAPL) stock, it achieved a 26.6% return rate, with a maximum drawdown of less than 3%—this is not some random high-frequency strategy; it is a robust model with risk control logic that effectively manages losses.

Moreover, it comes with three selectable risk control modes:

- Aggressive: High volatility, high returns

- Neutral: Moderate balance

- Conservative: Very low risk, suitable for retirement

The most crucial point is that it is open-source! It can be deployed locally! This means you can run it on your own computer or server without worrying about data being uploaded to the cloud and potentially leaked. For investors like me, who are very sensitive to privacy and security, this is an absolute necessity.

Even more importantly, it is completely free, with no licensing fees. Want to integrate it into your own trading system? You can absolutely do that.

In simple terms, this project is about "embedding the investment research team into AI." It is not a mystical tool that helps you get rich with one click; rather, it provides you with a structured, logical, risk-controlled, and verifiable AI investment research system.

We have already forked it and are conducting tests. Our initial feeling is that the strategies are transparent and explainable, and the risk control is indeed more reliable than most black-box models; the architectural design is advanced, and team-based intelligent agents may be the trend for the future. For small to medium-sized funds or individual investors, this is an opportunity to obtain an institutional-level trading system at a low cost. Whether fund managers' jobs are at risk, I cannot say, but it is certain that in the future, fund managers will need to learn to work with #AI; otherwise, they may easily be replaced.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。