Author: Lawyer Liu Zhengyao

Introduction

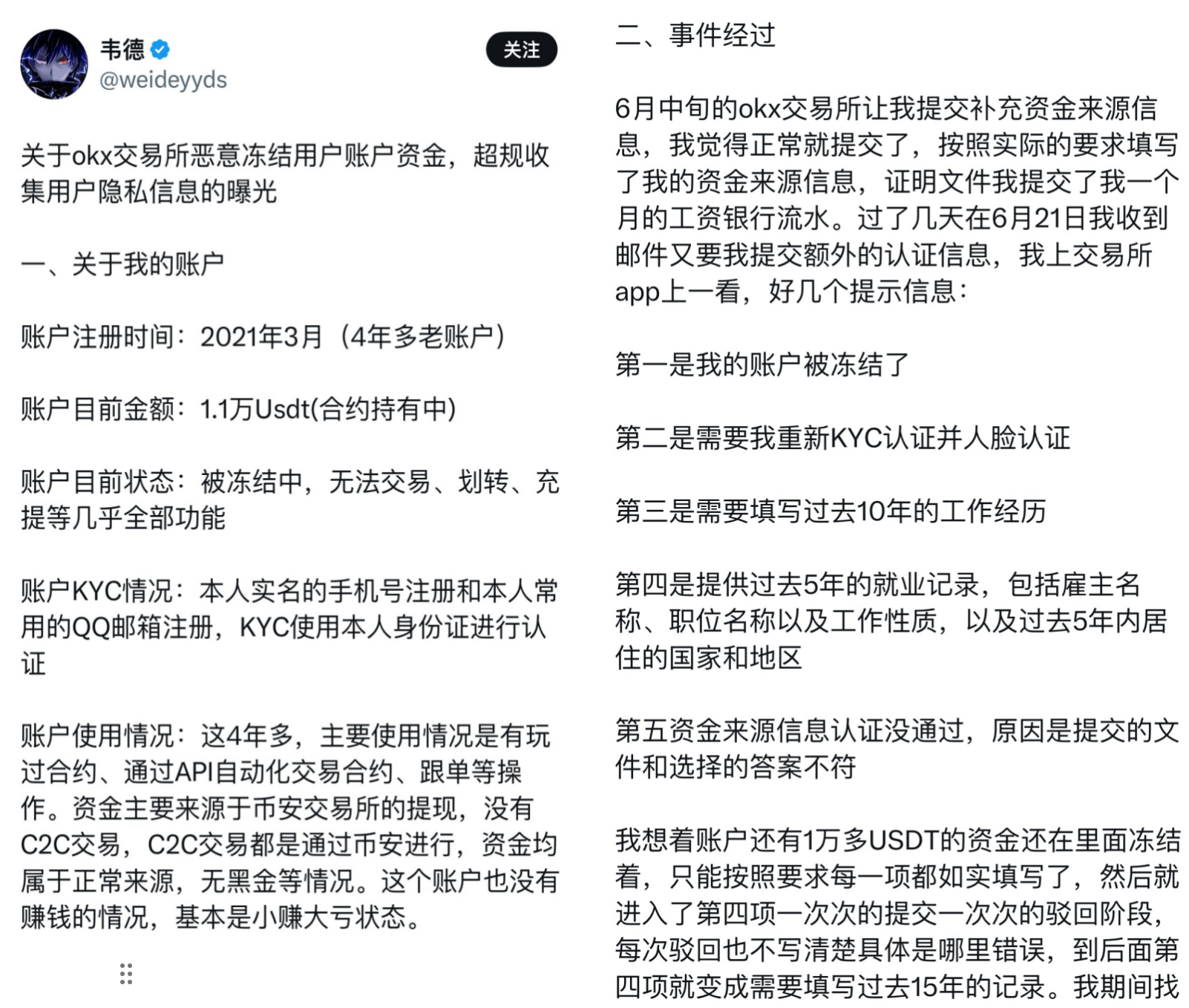

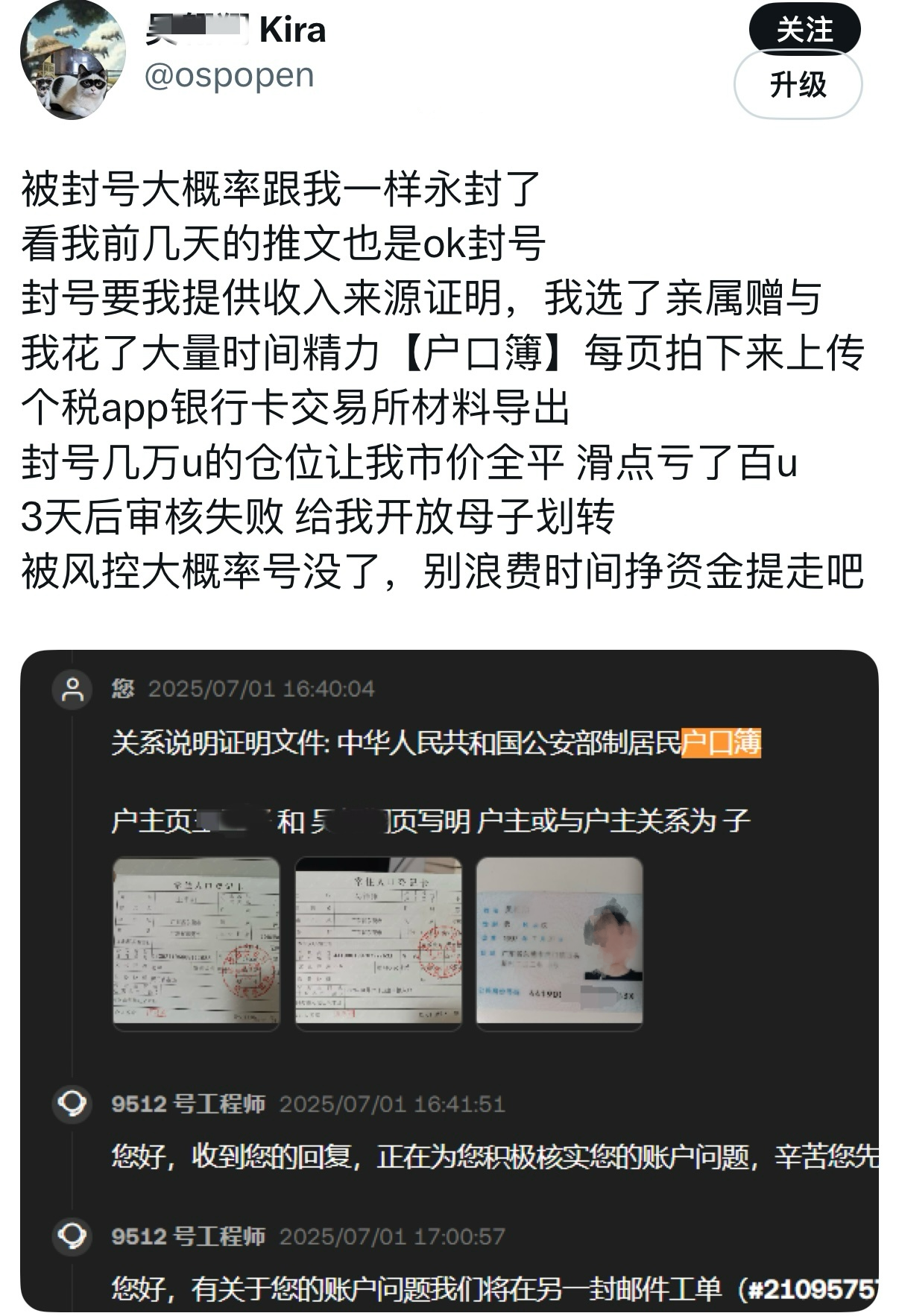

Recently, some users have posted on social media, stating that their accounts on OKEx have been frozen, with restrictions on withdrawals, and even account bans. When users apply for unfreezing, the exchange requires them to provide "proof of income" and other documentation.

Some users have also shared their experiences with OKEx in the comments, speculating that the blogger may have been permanently banned, and expressed that they have spent a lot of effort trying to resolve their account unfreezing issues, ultimately failing the review.

As a web3 lawyer, Lawyer Liu aims to provide a legal analysis of this incident from an objective and neutral perspective, as well as the financial security issues faced by mainland residents when using all centralized exchanges, deeply interpreting the real risks for mainland residents in the virtual currency field.

1. How does the exchange respond?

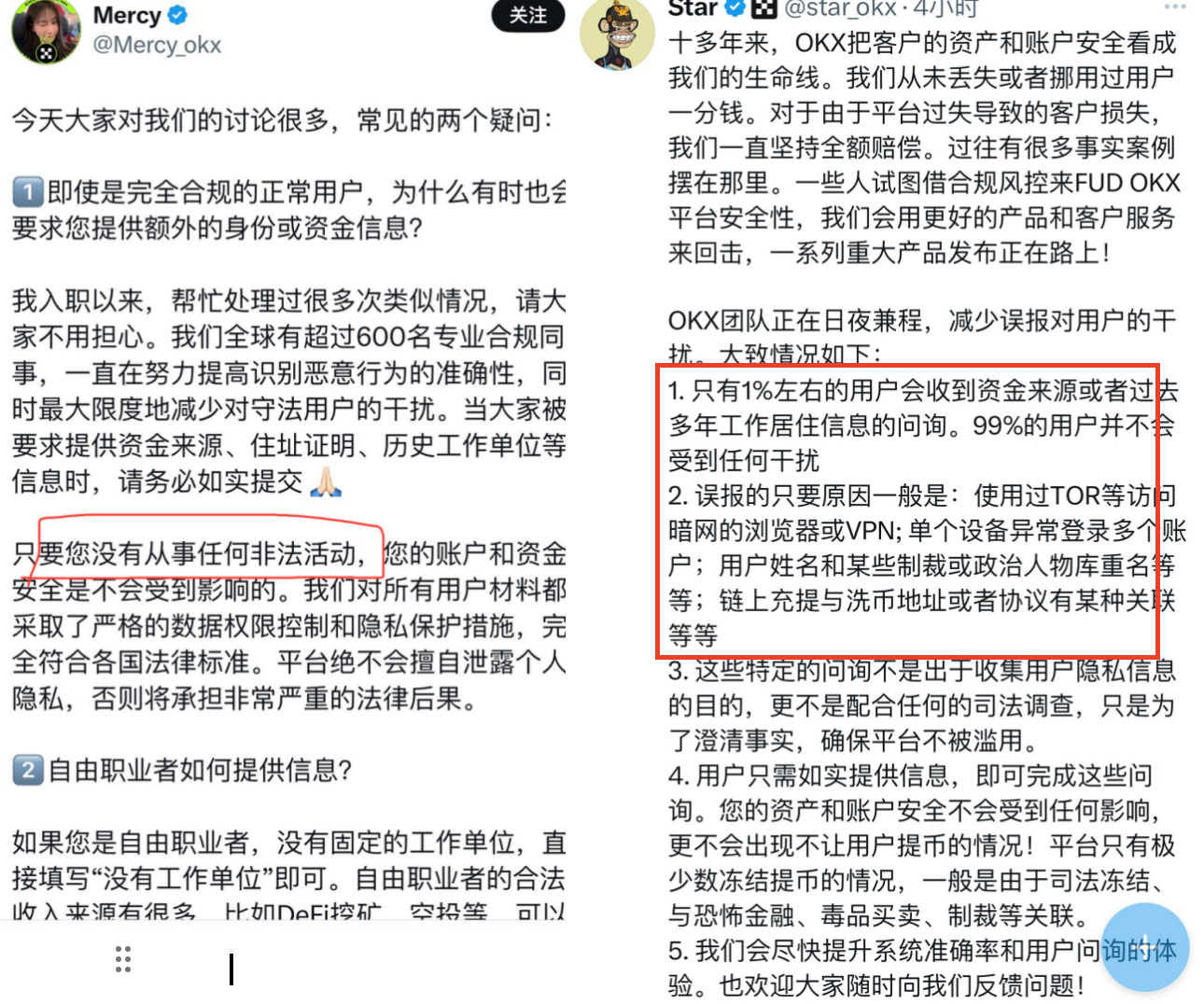

OKEx has promptly responded to the public sentiment online. For example, OKEx employee Mercy stated that completely compliant and normal users may also be mistakenly affected when the system identifies "malicious behavior," and thus OKEx is working to improve the accuracy of identifying malicious behavior. The employee also stated, "As long as you are not engaged in any illegal activities, your account and funds will not be affected."

OKEx's CEO Xu Mingxing also posted, indicating that due to false positives, about 1% of users may receive inquiries about "source of funds or past work and residence information." The main reasons for false positives include users accessing the platform via VPN, using TOR to access the dark web, logging into multiple accounts from a single device, and users having the same name as certain sanctioned or political figures.

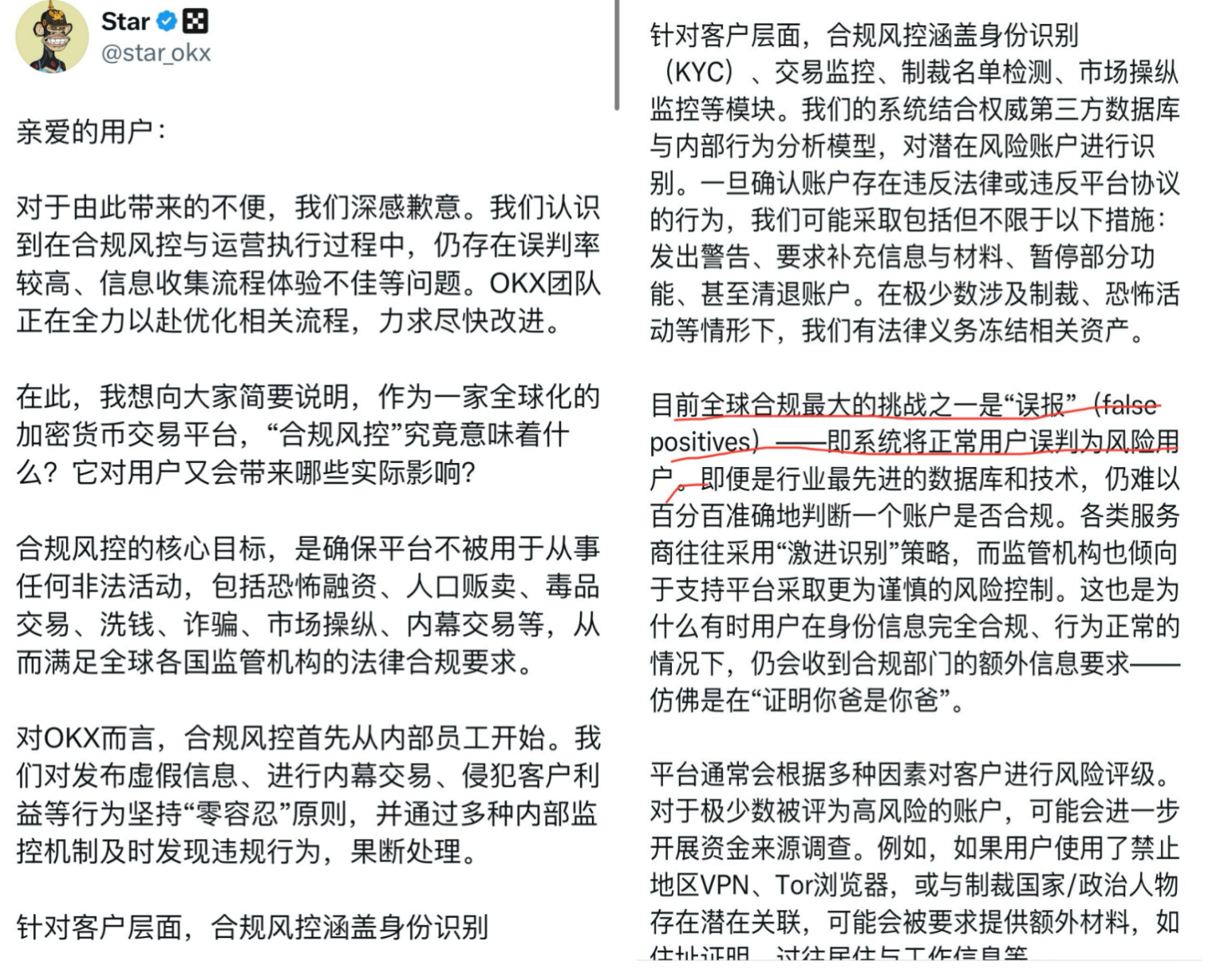

Later, the CEO of OKEx issued another statement apologizing to users and explaining the significance and impact of "compliance risk control" in virtual currency exchanges, while also clarifying the following:

"Once it is confirmed that an account has violated laws or platform agreements, we (OKEx) may take measures including but not limited to the following:

Issuing warnings, requesting additional information and materials, suspending certain functions, or even closing accounts. In very rare cases involving sanctions, terrorist activities, etc., we have a legal obligation to freeze related assets."

Additionally, the reasons for "false positives" were explained.

2. Legal Risks for Chinese Residents Using Overseas Virtual Currency Exchanges

Some time ago, there were rumors that OKEx was planning an IPO in the US, although it is still uncertain whether this news is true. If it is true, then it seems easy to understand why OKEx is implementing strict KYC policies.

Of course, it could also be false news about the IPO. Therefore, we need to interpret and analyze the legal risks for mainland Chinese users registering on virtual currency exchanges, especially those engaging in trading activities, from a higher perspective.

Currently, there are many regulatory policies applicable to virtual currencies in mainland China (see: "Summary of Regulatory Documents for the Web 3.0 Industry in Mainland China"). Among them, the "9.4 Announcement" in 2017 drove mainland virtual currency exchanges "overseas," and the most powerful current regulation is the "9.24 Notice" ("Notice on Further Preventing and Handling Risks of Virtual Currency Trading Speculation").

The "9.24 Notice" systematically and comprehensively regulates the business activities of overseas virtual currency exchanges:

(1) Providing services to residents in mainland China through the internet by overseas virtual currency exchanges constitutes illegal financial activities;

(2) Domestic staff of overseas virtual currency exchanges, as well as legal entities, non-legal entities, and individuals who knowingly or should know that they are engaged in virtual currency-related businesses and still provide marketing, payment settlement, technical support, etc., will be held legally accountable.

In other words, from the perspective of regulators in mainland China, the services provided by overseas virtual currency exchanges to mainland residents are considered illegal financial activities. However, since law enforcement agencies in mainland China do not have extraterritorial enforcement power, they cannot force overseas virtual currency exchanges to shut down their servers or stop providing services to mainland residents via the internet.

From the perspective of mainland residents, there are currently no regulations prohibiting them from using overseas virtual currency exchanges. The "9.24 Notice" only prohibits exchanges from operating in mainland China but does not prohibit mainland residents from using exchanges.

Therefore, the current situation is that even if exchanges know that operating in mainland China is prohibited, they are unlikely to give up this large market. Thus, exchanges will continue to provide services to mainland users. Users registered in mainland China can still pass KYC even if they register using a "+86" phone number or a mainland resident ID or Chinese passport.

Of course, licensed exchanges in Hong Kong (such as OSL, HashKey, etc.) and exchanges in other countries (such as Coinbase in the US, and even Kraken) still do not support account openings for individuals with mainland identities, residences, or work according to Chinese regulatory policies.

Thus, the risk for mainland Chinese residents is that even if you can normally use exchanges like Binance and OKEx, you need to understand that according to Chinese regulatory regulations, the services provided by exchanges to mainland residents are considered illegal financial activities. Some friends may wonder, if that's the case, why haven't I "run into trouble"? Hold on, and let's look at Lawyer Liu's analysis below.

3. Insights from the FTX Bankruptcy Case to the OKEx Incident

On July 4, regarding the bankruptcy plan of the FTX exchange, one opinion was that if users belong to restricted foreign jurisdictions, their compensation funds may be confiscated. Among all the involved funds from "restricted countries," 82% came from China.

This means that if your own country does not protect virtual currency investment activities, expecting other countries or exchanges to provide protection is somewhat wishful thinking. Therefore, mainland China's web3 nomads, especially those involved in trading, are truly "orphans in the crypto world."

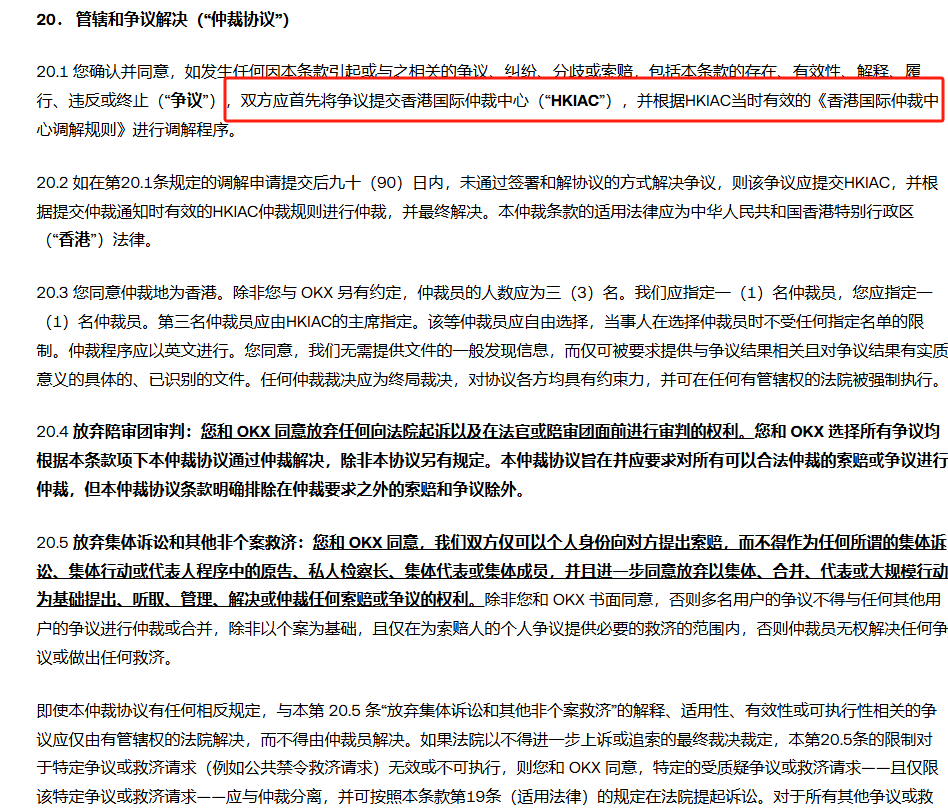

Finally, Lawyer Liu wants to say that for users in mainland China using centralized exchanges, if they encounter frozen accounts, apart from cooperating with the exchange to unfreeze the account as required, it is difficult to have other "hardline" means. According to the legal jurisdiction stipulated on OKEx's official website, if one wants to "sue" OKEx, they need to go to the Hong Kong International Arbitration Centre, which is prohibitively expensive for many ordinary users (travel, lost work, lawyer fees, etc.).

(Source: OKEx official website)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。