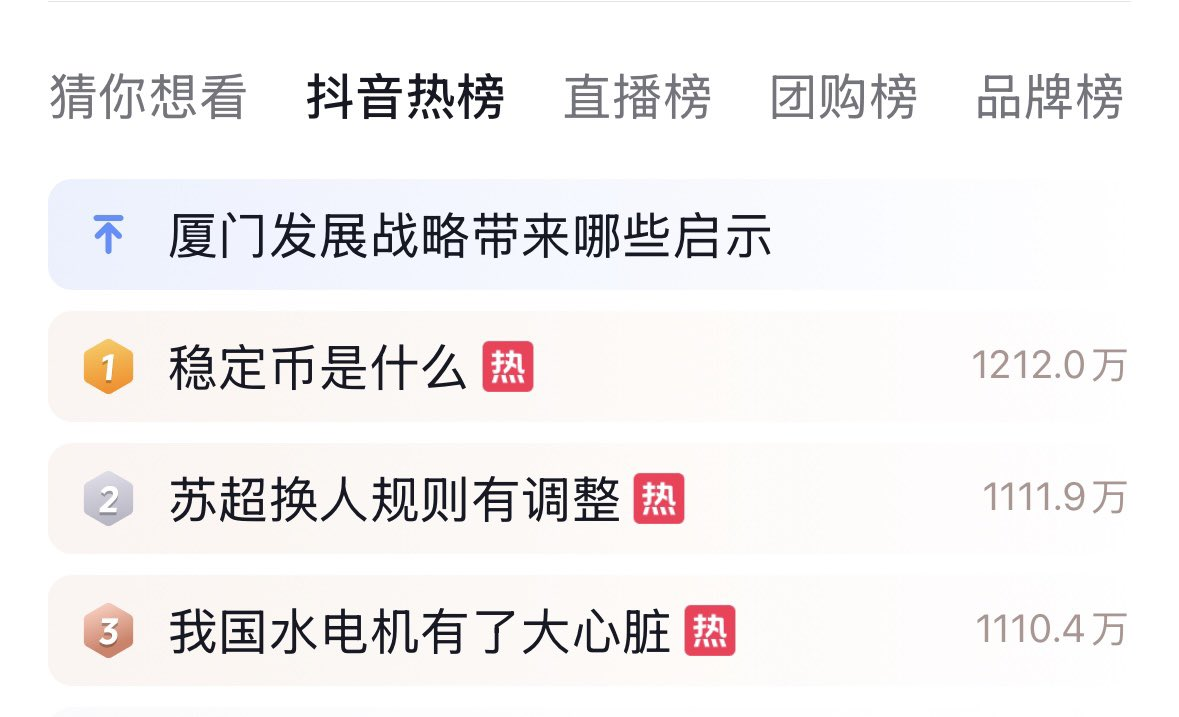

The topic of "What is a Stablecoin" has skyrocketed to the top of Douyin's trending list, with a heat value of 12.13 million, reflecting the public's strong interest in this emerging financial tool. With Hong Kong's "Stablecoin Regulation" set to take effect on August 1, 2025, and tech giants like JD.com and Ant Group actively laying out their strategies for stablecoins, stablecoins are becoming the focus of the global fintech landscape. This article will delve into the definition, advantages of stablecoins, and the impact of Hong Kong's new regulations and corporate strategies on their development.

What is a Stablecoin?

A stablecoin is a type of cryptocurrency that is pegged to a specific asset, typically linked to fiat currencies like the US dollar or Hong Kong dollar, or commodities like gold, aiming to maintain price stability. Unlike more volatile cryptocurrencies like Bitcoin, stablecoins ensure their value stability through 1:1 asset reserves (such as cash or government bonds) or algorithmic mechanisms. For example, USDC, issued by Circle, consistently maintains a trading price of 1 USD, with a market capitalization of $62,235,323,495 as of July 6, 2025, and a 24-hour trading volume of $4,296,896,247, showing minimal price fluctuation over the past 90 days.

The main advantages of stablecoins are:

Low Volatility: Provides investors and traders with a stable store of value and medium of exchange.

Efficient Payments: Especially in cross-border payments, stablecoins can significantly reduce transaction costs and time. For instance, JD.com plans to reduce cross-border payment costs by 90% using stablecoins, with processing times cut to under 10 seconds.

Financial Inclusion: Offers a pathway for unbanked populations to access the digital financial system.

Blockchain Integration: Acts as a bridge between traditional finance and blockchain technology, widely used in decentralized finance (DeFi) and cross-border trade.

Hong Kong's "Stablecoin Regulation": Setting a New Global Regulatory Benchmark

On May 21, 2025, the Hong Kong Legislative Council passed the "Stablecoin Regulation," which will officially take effect on August 1, aiming to establish a comprehensive licensing system for fiat-referenced stablecoins (FRS). The regulation requires issuers to obtain a license from the Hong Kong Monetary Authority (HKMA) and meet strict requirements for reserve asset management, redemption guarantees, and anti-money laundering compliance. Specific requirements include:

- 100% Reserve Requirement: Stablecoins must be fully backed by cash or highly liquid government bonds to ensure price stability and user trust.

- Transparency and Auditing: Issuers must undergo regular independent audits and publicly disclose information to mitigate risks.

- Open Model: Allows issuers to create stablecoins pegged to multiple fiat currencies, such as the Hong Kong dollar, US dollar, and potentially offshore renminbi in the future.

Hong Kong's Financial Secretary, Paul Chan, stated that stablecoins have broad application potential in scenarios like cross-border payments, addressing the pain points of "slow speed and high costs" in traditional finance. The new regulations not only provide legal certainty for the stablecoin market but also enhance investor confidence through strict oversight, attracting more institutional participation. This move by Hong Kong is seen as a benchmark for global stablecoin regulation, leading the way ahead of the US, EU, and other regions.

JD.com and Ant Group: Strategic Embrace of Stablecoins

The implementation of Hong Kong's new regulations has attracted active participation from tech giants, with JD.com and Ant Group being prominent players. Both companies have joined the HKMA's "Stablecoin Issuer Sandbox" program to test stablecoins based on the Hong Kong dollar and US dollar, and explore the possibility of offshore renminbi stablecoins.

JD.com: Innovating Cross-Border Payments and E-commerce Scenarios

JD.com's blockchain subsidiary, JD CoinChain Technology, plans to launch a Hong Kong dollar-pegged stablecoin (JD-HKD) by the end of 2025, supporting payments in US dollar and renminbi stablecoins. JD.com founder Liu Qiangdong stated that stablecoins will significantly reduce cross-border payment costs (by up to 90%) and time (from several days to under 10 seconds), with plans to apply stablecoins in e-commerce retail, supply chain finance, and global trade settlement. JD.com CEO Liu Peng emphasized that stablecoins will gradually expand from enterprise payments to consumer payments, aiming for a global instant payment experience.

Ant Group: A Global Vision for Fintech

Ant Group is applying for stablecoin issuance licenses in Hong Kong and Singapore through its international business unit, Ant International, aiming to leverage its advantages on the Alipay platform (serving 1.3 billion users globally) to drive the digital transformation of cross-border payments and treasury management. Ant Group Vice President Bian Zhuoqun stated that stablecoins will enhance the efficiency of cross-border payments, providing more convenient financial services for global merchants and consumers. If approved by the People's Bank of China, Ant Group also plans to launch an offshore renminbi-pegged stablecoin, further promoting the internationalization of the renminbi.

Public Curiosity and Market Prospects Behind the Stablecoin Boom

The 12.13 million heat value of the topic "What is a Stablecoin" on Douyin reflects the public's strong curiosity about stablecoins, closely linked to the strengthening of global regulations and corporate strategies. As of May 2025, the total market capitalization of global stablecoins has reached $223 billion, accounting for 6.5% of the cryptocurrency market. Citibank predicts that by 2030, the stablecoin market size could reach between $1.6 trillion and $3.7 trillion.

The new regulations in Hong Kong and the participation of tech giants pave the way for the widespread adoption of stablecoins. Stablecoins not only provide users with low-cost, high-efficiency payment tools but also enhance market trust through a compliant framework. The implementation of Hong Kong's "Stablecoin Regulation" marks a new chapter in global digital finance, while the strategies of companies like JD.com and Ant Group will further drive the application of stablecoins in cross-border trade, retail payments, and financial innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。