Written by: KarenZ, Foresight News

On June 30, BitMine Immersion Technologies (hereinafter referred to as BitMine), a company focused on Bitcoin mining and infrastructure, announced the completion of a $250 million private placement financing and plans to launch an Ethereum treasury strategy, aiming to become one of the largest publicly listed companies holding ETH globally.

This move has sparked industry discussions—why would a company that has long focused on Bitcoin suddenly initiate an Ethereum treasury strategy? Is it merely a simple asset allocation adjustment, or a deeper bet on the cryptocurrency ecosystem?

Who is BitMine?

BitMine's predecessor was registered in Nevada on August 16, 1995, originally named Interactive Lighting Showrooms, Inc. It underwent several name changes, having been known as Am/Tex Oil and Gas, Inc., Critical Point Resources, Inc., Renewable Energy Solution Systems, Inc., and RES Systems, Inc., before reverting to Renewable Energy Solution Systems, Inc. in 2013.

On April 6, 2020, BitMine's predecessor merged with Delaware subsidiary RESS Merger Corp. and relocated to Delaware. Subsequently, RESS Merger Corp. became a subsidiary of Sandy Springs Holdings, Inc. In July 2021, a new management team joined, and the company began entering the Bitcoin mining business, creating hosting centers using immersion cooling technology for self-mining Bitcoin and providing equipment hosting services for third parties. In 2022, to better reflect the company's new focus on Bitcoin mining and hosting, it was renamed Bitmine Immersion Technologies Inc., and the stock code was also changed accordingly.

BitMine's multiple name changes reflect its transformation and development. Currently, the company's core business includes Bitcoin mining, computing power trading, Bitcoin reserve management, and enterprise-level consulting services, aiming to provide comprehensive Bitcoin solutions for institutional and individual investors.

- Bitcoin Mining: Operating its own immersion cooling data centers and collaborating with air-cooled data centers, with mining machines distributed across Texas, USA, and Trinidad and Tobago.

- Financialization of Computing Power: Trading computing power as a financial asset, providing contract-based computing power trading services, helping investors participate in mining profits without directly holding hardware.

- Mining as a Service (MaaS): Offering one-stop mining solutions for publicly listed companies and institutions, including machine leasing, operational management, and financial support, lowering the entry barrier for clients.

At the same time, BitMine is accumulating Bitcoin as a long-term reserve, directly integrating Bitcoin into its treasury system to enhance shareholder value and strengthen its balance sheet. Additionally, BitMine provides Bitcoin treasury management consulting for corporate clients, including custody, compliance, and hedging strategies. According to BitMine's official website, its custody partners include BitGo and Fidelity Digital Assets.

Previously, BitMine was publicly traded on the OTC Pink market of OTC Markets Group Inc., which has lenient requirements for companies and minimal disclosure obligations. In September 2023, BitMine upgraded from the Pink market to the OTCQX market, the highest tier of OTC stock trading.

On May 16, 2025, BitMine implemented a 1:20 reverse stock split to pave the way for listing on a national securities exchange. The following month, BitMine announced its public listing on NYSE American (terminating trading of its common stock on OTCQX), with the stock code BMNR. It also raised $18 million through the issuance of common stock and subsequently used all net proceeds ($16.34 million) to purchase Bitcoin, specifically spending $16.347 million to acquire 154,167 Bitcoins at an average price of $106,033. BitMine CEO Jonathan Bates stated, "We have established a Bitcoin treasury and fulfilled our commitment to invest 100% of trading profits into Bitcoin."

Why Bet on Ethereum?

BitMine plans to use the latest $250 million private placement financing to initiate its Ethereum treasury strategy, aiming to become one of the largest publicly listed companies holding ETH globally. This transaction was led by MOZAYYX, with participation from investors such as Founders Fund, Pantera, FalconX, Republic Digital, Kraken, Galaxy Digital, DCG, Diametric Capital, Occam Crest Management, and Thomas Lee.

According to BitMine's statement, "The funds from the private placement enable the company to adopt ETH as its primary reserve asset while continuing to focus on core business operations. ETH is the native layer of the Ethereum blockchain. One of Ethereum's key features is its support for smart contracts, with most stablecoin payments, tokenized asset transactions, and decentralized finance applications occurring on Ethereum. By directly holding ETH, the company can participate in native protocol layer activities on the Ethereum network, such as staking and DeFi mechanisms." BitMine plans to collaborate with FalconX, Kraken, and Galaxy Digital, alongside its existing custody partners BitGo and Fidelity Digital, to advance its Ethereum treasury strategy.

Notably, renowned Wall Street strategist and co-founder of Fundstrat Global Advisors, Thomas Lee, will also join BitMine's board as chairman. Thomas Lee stated on CNBC's Squawk Box that "(most) of the stablecoin industry is built on Ethereum, which is essentially the backbone and architecture of stablecoins, making it crucial to create a project that accumulates Ethereum."

Thomas Lee is one of Wall Street's most optimistic strategists and has previously indicated that the utility of Bitcoin and Ethereum will continue to grow by 2025, with Bitcoin expected to surpass $150,000 by the end of the year. His involvement undoubtedly lends credibility to this strategy and reflects the increasing importance of Ethereum to traditional financial forces.

BitMine's strategic move is not coincidental; it implies a threefold judgment on industry trends:

1. Ethereum as the Infrastructure for Stablecoins and DeFi: Ethereum supports smart contracts and is the core platform for most stablecoin (such as USDT, USDC) payments, tokenized asset trading, and DeFi applications globally. Thomas Lee likened stablecoins to "ChatGPT in the cryptocurrency space," and Ethereum, as its underlying blockchain, will directly benefit from the proliferation of stablecoins. By holding ETH, the company can participate in staking, DeFi, and other native protocol layer activities to gain additional returns.

2. Replicating the Bitcoin Strategy Model: BitMine plans to emulate MicroStrategy's Bitcoin strategy by monitoring the "per share ETH value" metric (similar to MicroStrategy's "BTC Yield" metric) and aims to achieve continuous growth in ETH holdings through cash flow reinvestment and capital market activities.

3. Underestimation of Ethereum's Value and Wall Street Capital Layout: By 2025, Ethereum has become a key allocation target for a small number of institutional investors, with its staking annualized yield and compliance gradually gaining recognition from traditional finance. SharpLink Gaming disclosed on July 1 that it has accumulated 198,167 ETH and has fully deployed its ETH reserves into staking protocols.

Market Capitalization and Fundamental Discrepancy: Capital Frenzy Behind a 30-Fold Increase in a Week

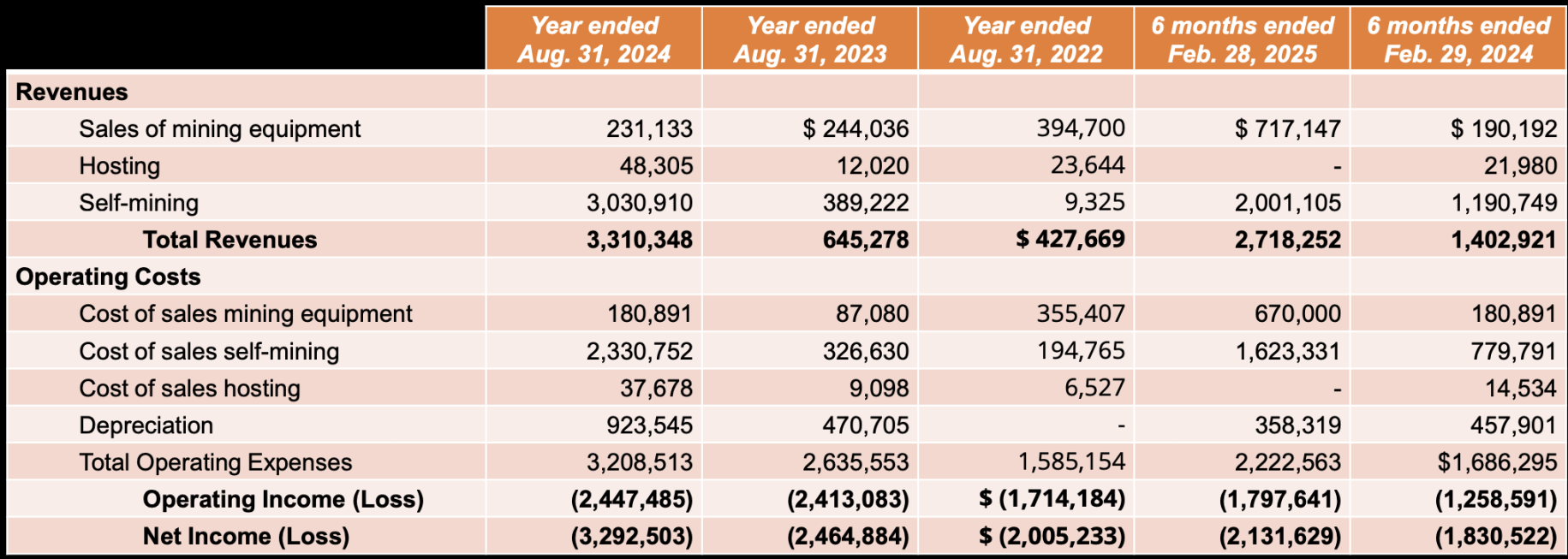

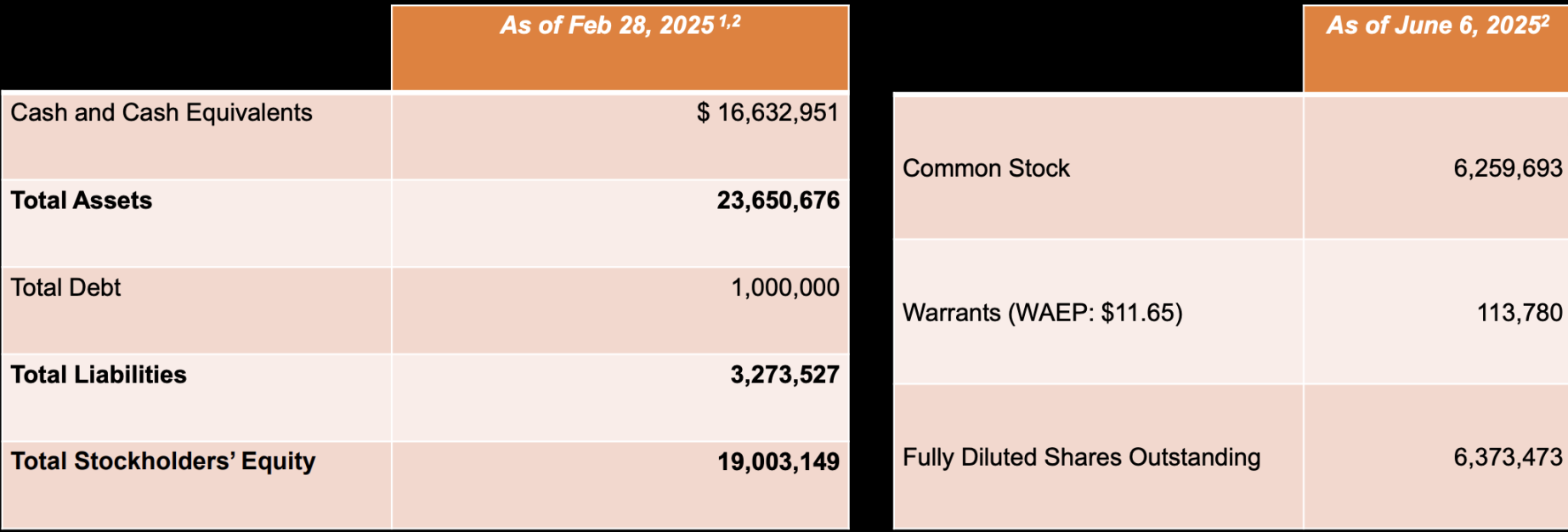

In terms of financial performance, BitMine's revenue, while not high, has been steadily increasing year by year, with 2024 annual revenue at $3.31 million, a 674% increase compared to 2022. As of February 28, 2025, BitMine's balance sheet shows cash and cash equivalents worth over $16.63 million, total assets of approximately $23.65 million, and shareholder equity of $19 million after deducting liabilities.

Source: BitMine

In the past week, BitMine's stock price surged from $4.26 to $135, increasing over 30 times, bringing its market capitalization to $800 million. However, compared to the annual revenue of $3.31 million, the market cannot help but question: has this company's valuation detached from reality? And is the initiation of the Ethereum strategy intended to leverage market trends to further boost its valuation?

Nasdaq-listed company SharpLink began a bold bet on Ethereum in May, with its stock price soaring from $3 in May to nearly $80, only to plummet to around $12 due to sell-off concerns and a crisis of trust. This case highlights the high risks associated with betting on crypto assets. The volatility of the cryptocurrency market, changes in the regulatory environment, the development of the Ethereum ecosystem, issues of transparency in corporate strategy execution, and the bubble risks of market premiums detaching from fundamentals can all impact the company.

BitMine's strategic layout reflects the binary pattern of the crypto industry, "Bitcoin - Ethereum": while Bitcoin is viewed as "digital gold," Ethereum is positioning itself as "the infrastructure carrier for stablecoins and DeFi," seizing the high ground of application ecology. BitMine attempts to bet on both, but how to balance its Bitcoin core business with the new Ethereum strategy remains unclear. For investors, in the current environment of market capitalization frenzy and fundamental dislocation, it is essential to maintain a rational perspective.

References:

https://bitminetech.io/wp-content/uploads/2025/06/BitMine-Corporate-Presentation-6-10-25.pdf

https://www.prnewswire.com/news-releases/bitmine-immersion-technologies-announces-250-million-private-placement-to-initiate-ethereum-treasury-strategy-expected-to-become-one-of-the-largest-publicly-traded-eth-holders-302494355.html

https://www.cnbc.com/2025/06/30/wall-street-strategist-tom-lee-is-aiming-to-create-the-microstrategy-of-ethereum.html

https://www.sec.gov/Archives/edgar/data/1829311/000168316821006222/bitmine10k.htm_

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。