Author: Foxi_xyz

Translation: Baihua Blockchain

Recently, on-chain trading of U.S. stocks has become the latest hotspot, with mainstream trading platforms like Kraken and Robinhood launching on-chain stock trading services that allow investors to buy and sell tokens representing real stocks. These services enable investors to trade popular U.S. stocks such as Apple, Tesla, and Nvidia 24/7.

So, what is the mechanism behind on-chain trading of U.S. stocks, and do the tokens purchased by users really equate to stocks? What opportunities are there in this?

01 Basic Overview

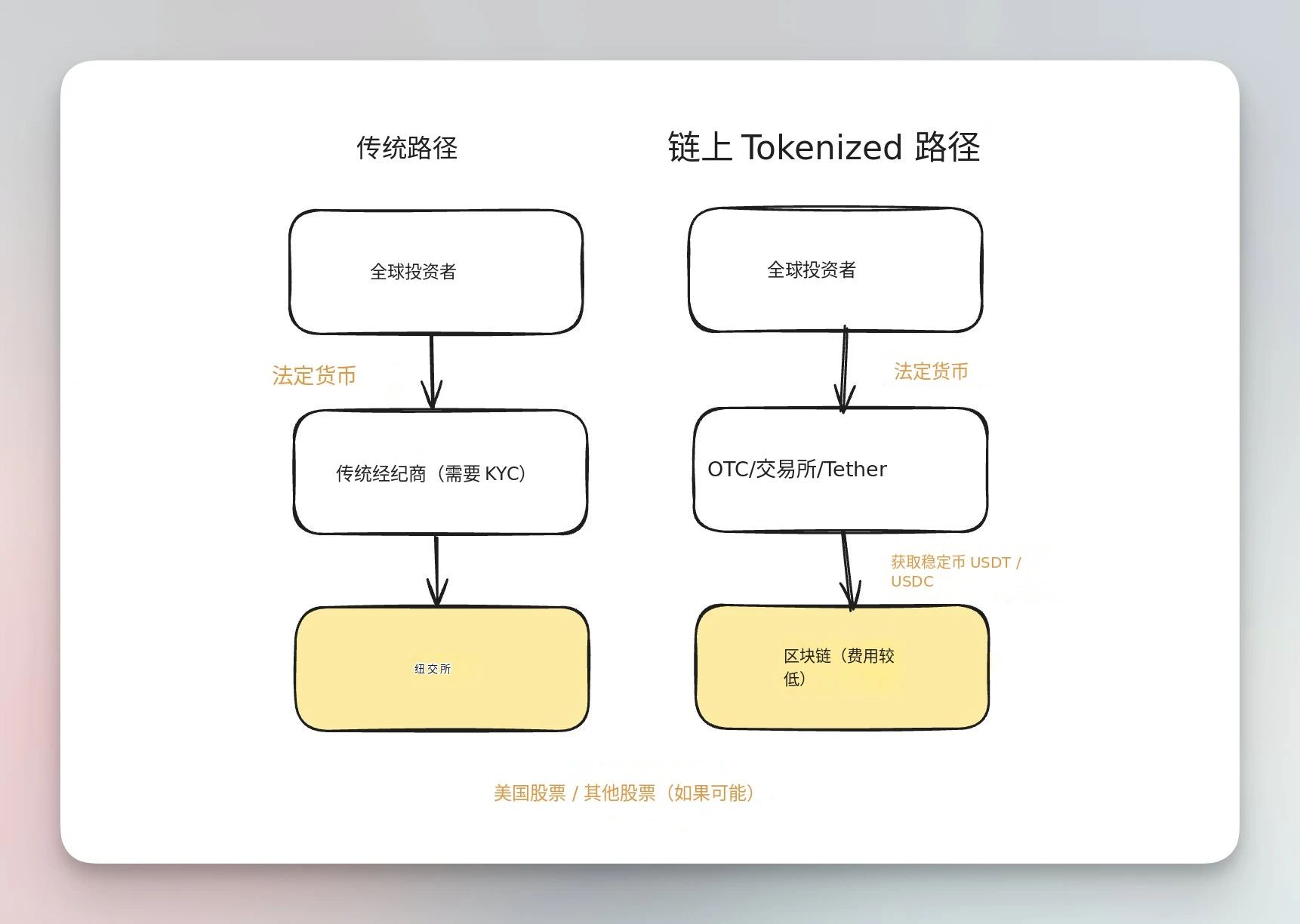

The image above describes the basic operational principles of stock tokenization, highlighting a few key pieces of information:

When you purchase tokenized Apple stocks through Kraken's xStocks, you are not buying derivatives or futures contracts. Instead, Kraken's partner, Backed Finance, buys and holds actual Apple stocks at a regulated custodian. Then, a corresponding token is issued on the Solana blockchain, creating a digital representation of that actual stock.

Stock ≠ Cryptocurrency. On-chain stocks introduce interesting arbitrage opportunities. During off-market hours, when the New York Stock Exchange is closed but blockchain trading continues, token prices may slightly deviate from the last known stock price due to trading activity and market sentiment. Arbitrageurs can profit by buying and selling tokens and redeeming them through the issuer, realigning the prices. Caution is advised when purchasing on-chain stocks during off-market hours.

This structure means that token holders cannot obtain traditional shareholder rights, such as voting rights—these rights are retained by the custodian. What you are purchasing is economic exposure to stock performance, not actual shareholder status. This is a trade-off that enables blockchain-based trading while maintaining regulatory compliance.

02 24/7 Trading?

The most obvious advantage of tokenized stocks is continuous trading. Unlike traditional exchanges that operate for about 6.5 hours a day and only on business days, blockchain-based tokens can trade continuously. Kraken's xStocks offers 24/7 trading, while Robinhood currently provides 24/5 trading and plans to expand to round-the-clock trading after launching its Layer 2 based on Arbitrum.

This continuous availability creates interesting market dynamics. When significant news is released outside traditional trading hours—such as earnings announcements, geopolitical events, or company-specific developments—your tokenized stocks can react immediately. Token prices become real-time indicators of market sentiment, potentially providing price discovery that traditional markets cannot match during off-hours.

03 Traditional vs. Tokenized?

This image shows the differences between traditional U.S. stock trading methods and on-chain U.S. stock trading via platforms like Kraken and Robinhood. However, like traditional U.S. stock trading methods, KYC is still required, but there are essential differences in the custody model.

1. KYC (Know Your Customer)

In fact, any compliant platform offering stock exposure requires KYC and must adhere to regulations—completely anonymous stock trading is nearly impossible legally unless the platform wants to operate illegally. There have been past attempts at decentralized non-KYC stock tokens, but they encountered legal troubles. A notable case is Terra's Mirror Protocol, which allowed anyone to mint and trade synthetic "mAssets" of U.S. stocks (like Tesla and Google) using only a crypto wallet without KYC from 2020 to 2022. The U.S. SEC later deemed Mirror's stock tokens as unregistered securities and took legal action against Terraform Labs and its founder Do Kwon.

Entry paths differ

This time is different; even large exchanges like Kraken and Bybit support trading stocks on their platforms. You can simply view these "stock coins" as MeMe coins, with the third party promising that each coin is backed by stocks. I think Trump might really like this approach. It provides retail investors with a more convenient way to enter the U.S. stock market through stablecoins. As long as the final settlement is in USD, I believe regulatory pressure will not be too great.

2. Custody Model Related

Tokenized platforms prioritize accessibility and flexibility. Kraken and Robinhood offer zero-commission trading on their stock tokens, earning revenue through spreads and other services. They natively support fractional ownership, allow 24/7 trading, and may integrate with decentralized finance protocols.

But the trade-offs are also clear. Traditional brokers provide regulatory protection, established customer service, and direct shareholder rights. Tokenized platforms offer greater accessibility and innovative features but have lower regulatory clarity and newer operational infrastructure.

There are fundamental differences in the custody model. Traditional brokers hold stocks in "street name" through central depositories, and your ownership records are in their systems. Tokenized platforms issue blockchain tokens, allowing you to choose self-custody, giving you direct control over your holdings, but also requiring you to manage private keys and security.

04 Why I Think This Is a Bull Market

1. Capital Magnet Effect

Consider the structural advantages of tokenized stocks compared to traditional stock markets. Retail investors in Nigeria can now purchase Apple stocks without navigating complex international brokerage relationships or currency conversion fees. This is not just convenience; it is a fundamental expansion of market access that could drive unprecedented capital inflows into crypto infrastructure.

The mechanism here is more complex than simple user acquisition. When someone buys tokenized Tesla stocks, they are not only entering the crypto market—they are also creating sustained demand for stablecoins, generating transaction fees for Layer 2 networks, and validating the entire crypto tech stack as legitimate financial infrastructure.

2. Compound Effect

Ethereum and its Layer 2s (like Robinhood) will gain sustained trading volume from stock trading, creating real economic value for ETH holders through fee burn and network effects. Solana (Kraken and Bybit) with its high throughput architecture may capture market share in high-frequency stock trading, driving demand for SOL transaction fees.

Tokenized stocks can address the "ghost town" problem in the crypto market during bear markets. Historically, when crypto prices crash, trading volumes evaporate, and users flee to traditional assets. With on-chain stocks, capital may be more likely to stay within the crypto ecosystem, maintaining liquidity and platform engagement even when altcoins struggle.

3. Invisible Adoption

Tokenized stocks may achieve a goal that years of crypto evangelism have failed to realize: seamless mass adoption. Users trading stock tokens on Arbitrum via Robinhood in the EU are not consciously deciding to enter the crypto market—they are simply using better financial services. This invisible adoption model could attract millions of users who would never actively choose to buy cryptocurrencies, but would be happy to use them when crypto infrastructure is abstracted away.

05 Conclusion

In the long run, most stocks (and even other assets) may be traded on the blockchain, greatly benefiting from low transaction costs and efficiency on-chain. Of course, this largely depends on the acceptance of on-chain asset trading and the evolution of regulations in the future.

Optimistically, on-chain stock trading could become a killer application, enabling exponential growth of the crypto user base and bringing millions of real-world assets onto the chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。