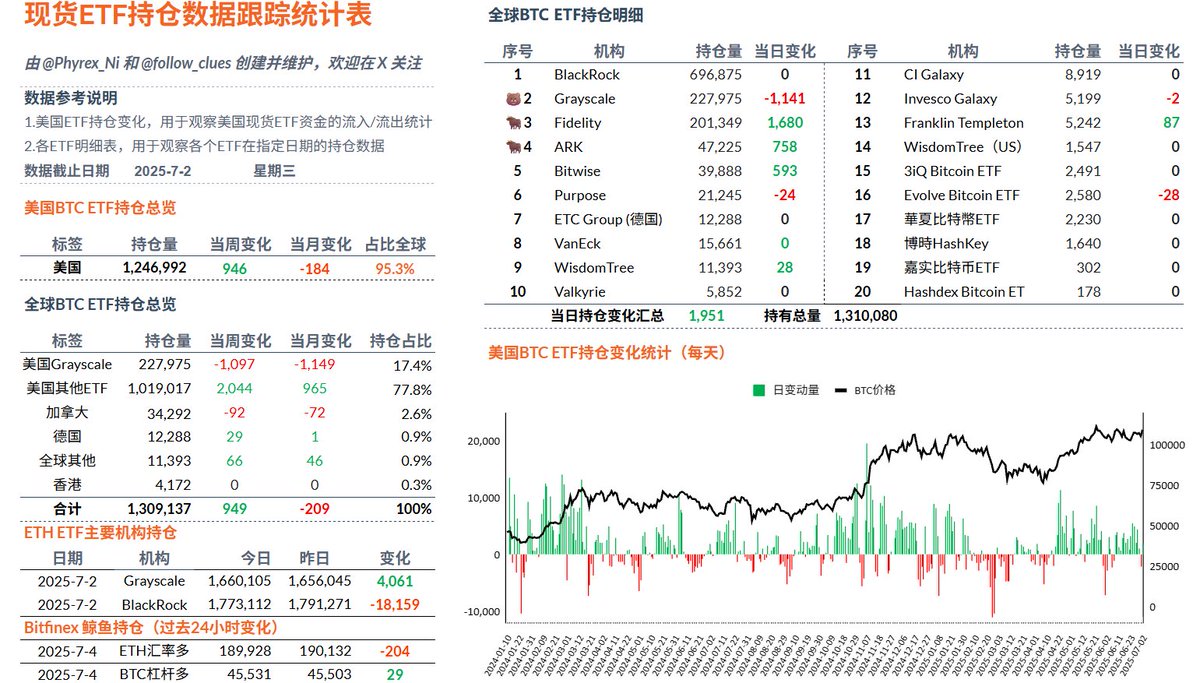

Chasing highs and cutting losses is vividly displayed in the spot ETF. Yesterday, the sentiment warmed up, the quarrel over the "Chuanma" came to a pause, and the passage of the "Big Beautiful" bill brought about a rise in the risk market. With the increase in the price of $BTC, spot ETF investors regained their purchasing power. On Tuesday, Fidelity sold the most, but on Wednesday, they bought everything back, and ARK and Bitwise also doubled their purchases.

Only Grayscale suddenly experienced a four-digit outflow, while other data remained quite normal. BlackRock's investors have not changed their positions for two consecutive days. Traditional spot ETF investors are not the main driving force behind the current price increase; the reduction in selling is the primary reason for maintaining the price.

Data address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?gid=1695479590#gid=1695479590

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。