Can Ripple Banking License Approval Push RLUSD Ahead Of USDT And USDC?

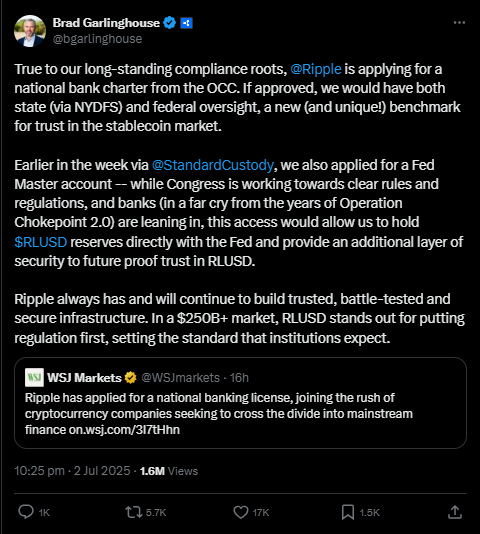

Brad Garlinghouse, the ceo, has just kicked off a bold plan. It has applied for a Ripple banking license with real banking muscle behind it. The CEO dropped the news himself on X, and The Wall Street Journal dug deeper into this and stated that they have filed for a National Bank permit from the U.S. Office of the Comptroller of the Currency to bring its stablecoin RLUSD under federal oversight.

If it gets the green light, the stablecoin RLUSD might stand on stronger legs than Tether or USDC ever did.

This RLUSD's subsidiary, standard custody, and trust have also applied for a Federal Reserve account, which would give them off-hours issuance and redemption of the stablecoin if it gets approved.

Source: Wu Blockchain

By joining this rush of cryptocurrency companies to cross the divide into mainstream finance. which manages the cross-border transactions and dollar-backed RLUSD stablecoins, completed the application with the U.S. office for a Ripple banking license.

Source: Brad Garlinghouse

This is a new benchmark for trust in the market of stablecoin market. Brad Garlinghouse also shed light on RLUSD Strategy in his post on X, stating that the application for the Master account was made under the same Ripple banking license push.

Meanwhile, the congress is working with clear rules and regulations. He also shared his strategy, how this access would allow them to hold $RLUSD reserves directly with the Fed, as an additional layer of security for the future-proof trust in RLUSD. The Ripple banking license could make this possible.

Reassuring the investors' trust , that they have always built trusted, battle-tested, and secure infrastructures and will continue to do so. By setting the standards that institutions expect, with $250B+ market, RLUSD stands out for putting regulation first and pushing ahead with the Ripple banking license.

Their Stablecoin Competitive Edge

With this, the Competitive Edge also arises. Let's talk about some of the top stablecoins with which they are is competing, such as Tether's USDT and Circle's USDC. The ripple banking license could position RLUSD strongly against these rivals.

The preference mostly depends on the transaction speed of the preferred stablecoin, how secure the stablecoin is, and its market value with the total supply.

-

USDT: With a current market cap- $158.33 billion, it is the largest stablecoin. It was designed to maintain a 1:1 value with the dollar. While holding 159.82 billion as the total supply.

-

USDC: The second-largest stablecoin with a current market cap of $61.68 billion, pegged to the US dollar and issued by Circle.While holding 61.69 billion as the USDC of the total supply.

-

RLUSD: It is ranked lower than USDC and USDT in terms of market capitalization, with a current market cap of $469.21 million. Also pegged to the US dollar. While holding a 469.24 million total supply.

As RLUSD holds the maximum supply as infinite, with 469.24 million as the total supply.

Moreover, its market capitalization is positive and expanding into the crypto space; it can be considered that sooner enough RLUSD might come under the top stablecoins. With good security and fast transactions, and with the strength of a Ripple banking license.

Regulatory Signals and Ripple’s Ambitions

After Circle applied for its allowance, Ripple also applied for the same. Also, after the Circle’s stablecoin launch and announced their stablecoin as well. And the question for the investors arises is whether they are following Circle’s path for its growth by securing a Ripple banking license?

If this gets approved, other crypto companies could line up next. That could open a door for more crypto banks.

They always wanted to make crypto feel normal, now if they get a US bank permit, their goal would get real. Also, instead of fighting old might, they can connect.

Will this License Boost Their Native Token?

People holding XRP hope that this could push the token's value higher. More trust can be built. Banks, big companies even everyday users might feel safer working with them. If the Ripple banking license is secured.

But a permit alone won't make XRP shoot up overnight. The approval can even take months or longer.

They also have other challenges, such as staying on the right side of the US regulators, and if it becomes a trusted bank for crypto and cash, it could keep XRP strong as a bridge for payments.

If it were a crypto company that gets a licensed bank, it can make money transfers faster and cheaper. Businesses move dollars and crypto side by side, and also could keep the regulators happy, while staying true to crypto’s speed

For long-term XRP holders, the trust made could matter more than a quick price jump, especially with a secured Ripple banking license.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。