Before the rise of the crypto industry, few could have imagined how profoundly "on-chain" would integrate into our daily lives. Crypto technology has fundamentally transformed the way people manage their finances, returning financial control to users rather than relying on traditional institutions. Today, DeFi has taken another significant step forward—tokenized stocks are officially launched.

Solana is a widely popular public chain in the crypto world, known for its high-speed transaction processing capabilities and smooth user experience. Now, Solana is bringing a crucial pillar of traditional finance into the DeFi world through the innovation of "tokenized stocks." These blockchain tokens issued by Backed (such as AAPLx, TSLAx) are each backed 1:1 by real U.S. stocks. This article will guide you through the basic concepts of tokenized stocks, their applications on Solana, advantages and risks, and teach you how to buy and trade stocks step by step on Solana.

What are Tokenized Stocks?

Tokenized stocks are blockchain representations of tradable stocks in the real world, such as those of well-known companies like Apple, Tesla, and Nvidia. On Solana, these stocks are referred to as xStocks, with each token backed 1:1 by real stocks. This product is launched by Backed and is leading the on-chain future of finance.

For example, AAPLx is the on-chain representation of Apple Inc.'s stock AAPL, with the corresponding real stock held by a trusted custodian. xStocks are linked to the real stock market prices and can be traded like crypto assets around the clock, unaffected by traditional market hours. More importantly, they can be used as collateral in DeFi applications for lending, trading, and various operations.

Note: The availability of tokenized stocks may be subject to local securities laws, and users should ensure compliance with local regulatory requirements before proceeding.

Why Trade Tokenized Stocks on Solana?

Solana is a high-performance blockchain known for its ultra-fast transaction speeds and low fees. Its core advantages include:

Second-level transaction confirmation: Settlements completed in less than a second;

Ultra-low fees: Trading without pressure, no worries about high gas fees;

Excellent wallet experience: Good support from wallets like Phantom and Solflare;

High DeFi integration: xStocks can be used as collateral or LP tokens in various DeFi scenarios.

With a strong developer community, a rich ecosystem of DeFi protocols, and institutional support, Solana is an ideal trading platform for tokenized stocks.

Platforms for Trading Tokenized Stocks on Solana

Several platforms have launched or integrated tokenized stocks, mainly including:

Backed Finance: A leading tokenized issuer, with over 60 stocks and ETFs (such as AAPLx, SPYx, NVDAx) available for trading on Solana DEXs like Jupiter and Raydium.

Solflare Wallet: A popular Solana wallet that allows users to purchase stock tokens directly with SOL or USDC. Click "Market Stocks" on mobile or go to the "Stocks" page on the web to trade.

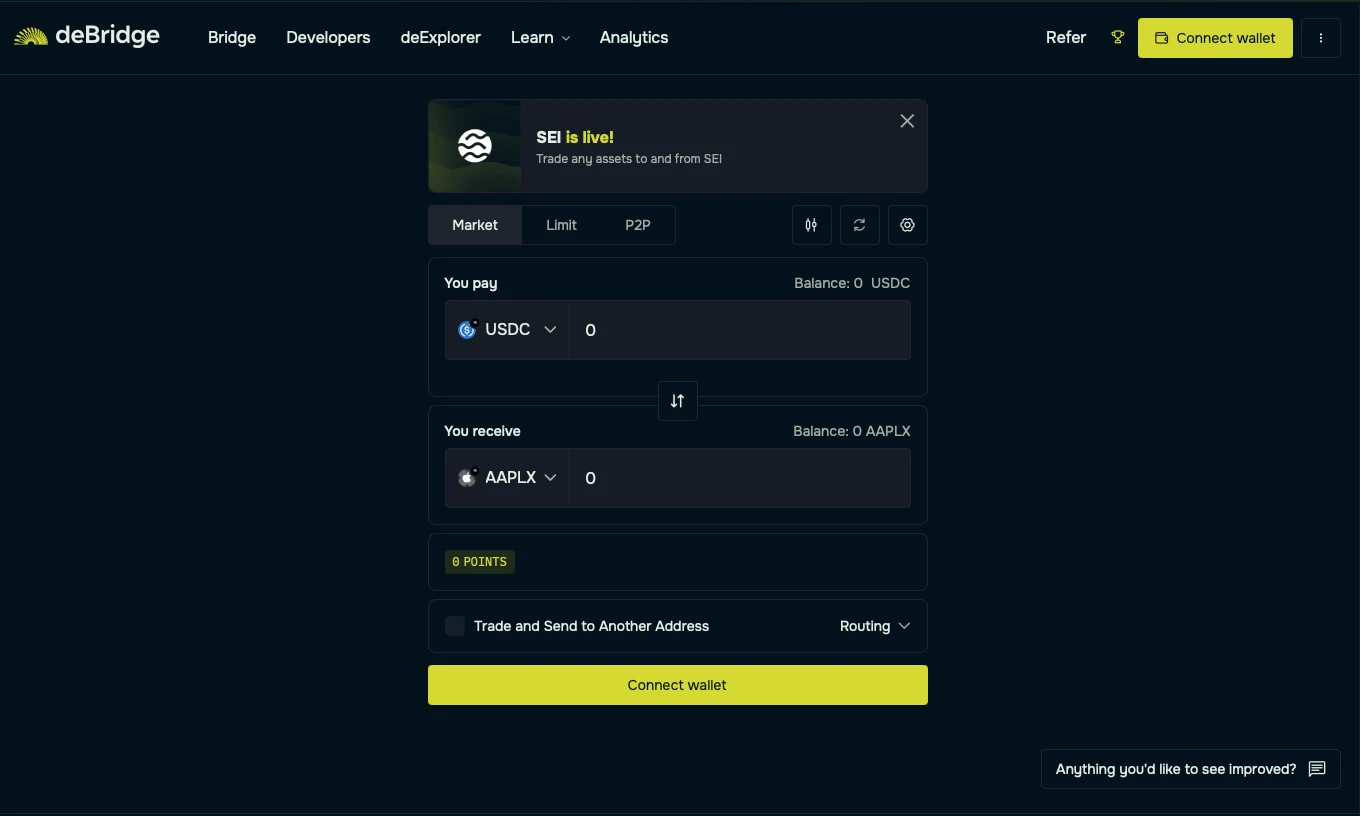

deBridge: A cross-chain protocol with extremely fast speeds, allowing you to enter xStocks trading from anywhere in the DeFi world in seconds.

How to Purchase Tokenized Stocks on Solana via deBridge?

As an extremely efficient cross-chain protocol, deBridge eliminates the risks and bottlenecks of traditional liquidity pools, allowing funds and information to flow between chains at lightning speed. Here are the steps to use deBridge:

If You Don't Have Solana Assets

Visit app.debridge.finance;

Select the source chain and asset you want to cross-chain, for example, choose the Ethereum network and ETH;

For the target chain, select Solana, and for the target asset, select SOL;

Connect your EVM wallet and Solana wallet;

Enter the amount, check the fees, and confirm the transaction details;

After signing the transaction, you will receive SOL in your Solana wallet;

Then, you can exchange SOL for any tokenized stocks on deBridge, such as AAPLx, NVDAx, etc.

If You Have Solana Assets

Visit app.debridge.finance;

Select Solana for both the source and target chains, choose SOL, and then select the tokenized stock you want to exchange.

This process allows you to exchange tokens for tokenized stocks (xStocks) at market prices.

Disclaimer: deBridge does not issue, custody, or broker tokenized stocks; all related assets are issued and provided by third-party platforms.

Advantages of Tokenized Stocks on Solana

24/7 Trading: xStocks can be traded around the clock, unaffected by weekdays;

Instant Settlement: Unlike traditional stocks that rely on clearinghouses, xStocks go directly into your wallet;

Deep DeFi Integration: Can be used for on-chain lending, smart contract operations, collateral, etc.;

Low Cost, High Efficiency: Ultra-low fees and high-speed transactions provide a better trading experience.

Risk Warning

While tokenized stocks are highly attractive, any investment carries risks, and users should make decisions based on their own risk preferences:

Regulatory Risk: Strict U.S. securities regulations may limit users in certain regions;

Custodial Risk: xStocks rely on the issuer to hold the real stocks;

Liquidity Risk: Not all tokenized stocks have good trading depth;

Smart Contract Risk: There may still be technical vulnerabilities;

Market Risk: Stock prices may fluctuate significantly due to global events or market sentiment.

The Future of Stock Trading on Solana

Tokenized stocks bridge traditional finance and the on-chain world. With platforms like Solana, deBridge, and Solflare, anyone can easily access xStocks, making traditional stock trading as flexible and free as DeFi.

Whether you are a seasoned crypto user or a newcomer to stock investing, tokenized assets on Solana open a door to the financial future for you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。