I will increase my investment in publicly listed energy and power companies in the United States. If the U.S. wants to gain a leading position in the #AI field, then power investment is a must. 🧐

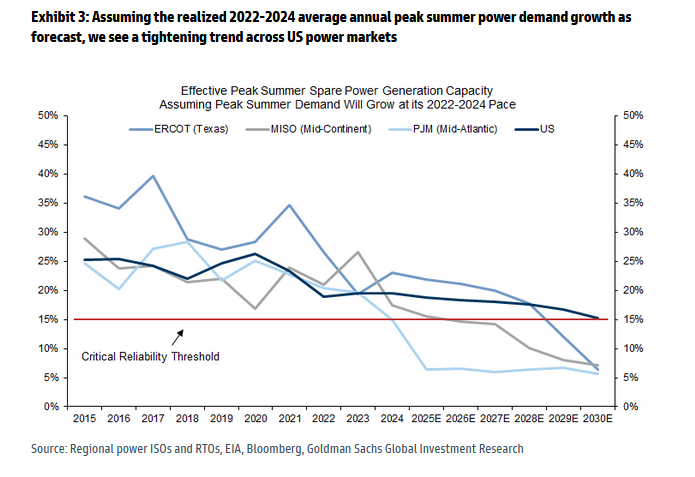

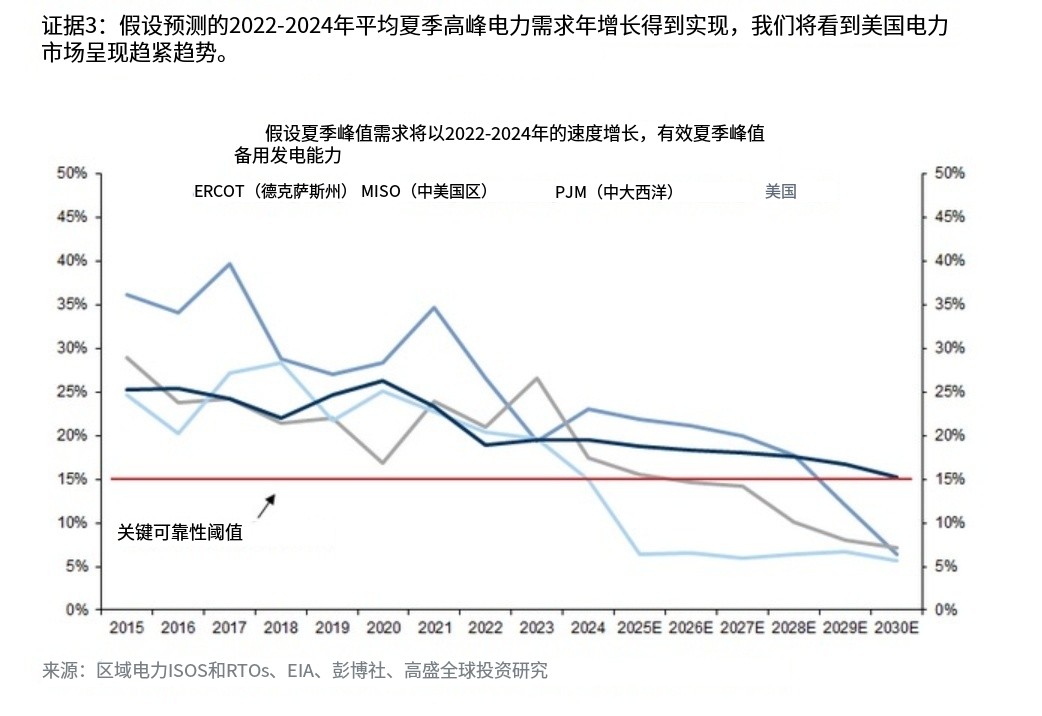

As shown in the chart below, the research report displays data 📊 on the trend of "spare generation capacity" during peak summer electricity demand periods in major U.S. power markets (including ERCOT, MISO, PJM) from 2015 to 2030E.

Here’s a little knowledge nugget — "spare capacity" represents how much additional power the grid can generate during peak periods and is generally considered an important indicator of whether the grid can "hold up."

The red line in the chart below represents the "Critical Reliability Threshold," which is usually around 15% — falling below this number could trigger risks such as power shortages and rolling blackouts. This is absolutely unacceptable for the development of #AI. As a key indicator of national power security, it indicates that while electricity demand in the U.S. is strong, supply is far from sufficient.

According to the data report, the national spare capacity has been continuously declining from its high in 2017 (about 30%), and it is projected to approach around 10-12% by 2030, potentially falling below the critical red line. Texas's ERCOT is particularly severe, expected to remain at extremely low levels (<10%) from 2025 to 2030, which is highly correlated with several recent grid failures in Texas, as well as the surge in demand for #AI data centers and electric vehicles in recent years, leading to a critical energy shortage. Overall, the U.S. (blue thick line) is also declining, indicating that "power tension" will become a structural issue nationwide in the coming years. This has become the number one killer pain point for the future development of #AI in the U.S.

In general, my personal investment strategy is: a combination of green energy equipment manufacturers + energy storage system providers + power infrastructure engineering companies, positioning for the golden expansion period of U.S. power from 2025 to 2030.

We are particularly focused on the following two directions and related companies:

1️⃣ Modernization of the power grid and infrastructure investment

To avoid large-scale blackouts, it is essential to upgrade the transmission and distribution network, deploy smart meters, and implement distributed energy scheduling systems.

During the Trump era, with the advancement of the Great American Rescue Plan, subsequent energy legislation is likely to be smoothly promoted, and there will be significant subsidy and tax reduction opportunities in the next five years.

The targets I am focusing on:

🏗️ Quanta Services (#PWR): The largest power infrastructure engineering company in the U.S.

🌐 Itron (#ITRI): Provider of smart grid technology and energy efficiency solutions.

2️⃣ Power shortages = Explosive demand for clean energy, energy storage, and microgrids

The targets I am focusing on:

☀️ Enphase Energy (#ENPH): Leader in residential solar + energy storage.

⚡ Fluence Energy (#FLNC): A global leader in large-scale grid-level energy storage solutions.

🔋 Tesla (#TSLA): Its Megapack energy storage system is becoming the new standard for grid infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。