Recently, Crypto Cards have become very popular, and the leader in ETH Restaking, Ether.fi, has also launched its U Card Cash. We have tested this card from five perspectives: cashback, earning interest, payment, security, and enterprise use.

Cashback Mechanism

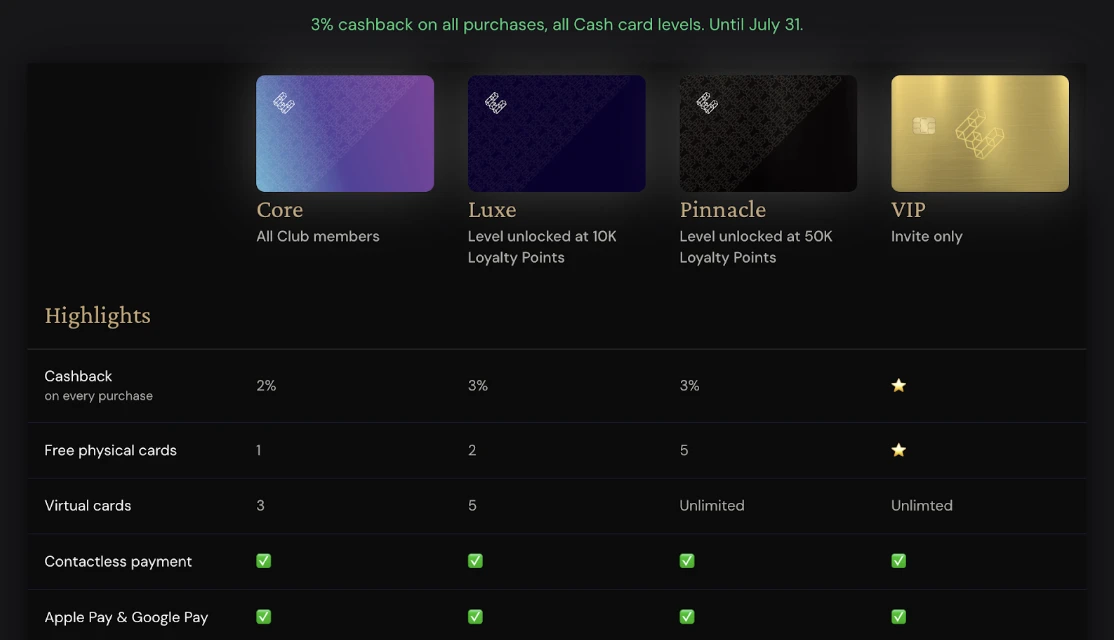

The Ether.fi Cash card offers a cashback mechanism, with the cashback rate depending on the card level: Core users receive 2%, while Luxe and Pinnacle users receive 3%. In the current promotional campaign, users can earn up to 5% total cashback — of which 3% will be returned after spending, and an additional 2% will be issued in ETHFI tokens.

Currently, all instant cashback is settled in SCR tokens (the native token of the Scroll network), and the system will automatically credit the amount after each transaction, with no monthly spending threshold or activation of specific categories required. Additionally, users can earn an extra 1% cashback by inviting friends to use the Cash card for spending.

The Cash card supports Apple Pay and Google Pay, allowing users to use it directly for mobile payments in both online and offline spending scenarios.

Earning Interest Function

A major feature of the Ether.fi Cash card is its integration with Ether.fi's Liquid Vaults, allowing users to deposit assets directly into the vault on the platform and start earning interest without needing to transfer funds to other platforms for additional returns.

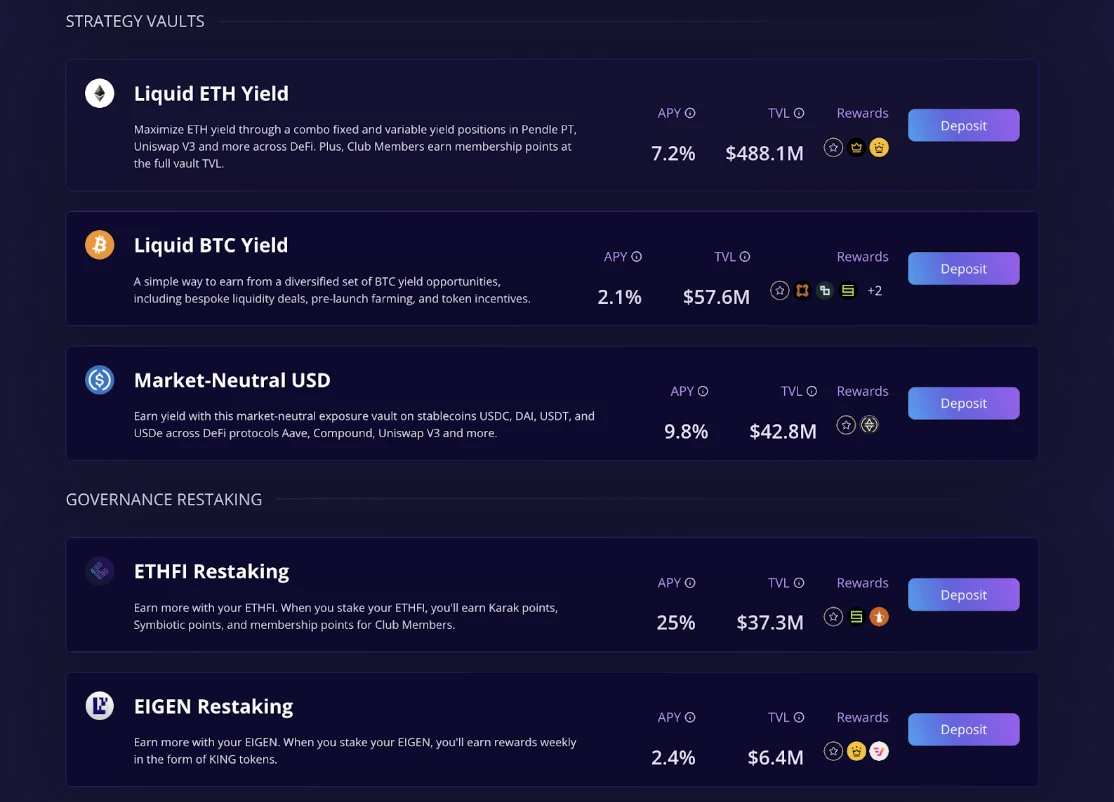

The current basic annual percentage rates (APR) for several main Vaults are as follows:

Liquid USD: approximately 9.8%

Liquid ETH: approximately 7.2%

Liquid BTC: approximately 2.1%

Additionally, there is about a 7% ETHFI incentive layered on top of the basic returns.

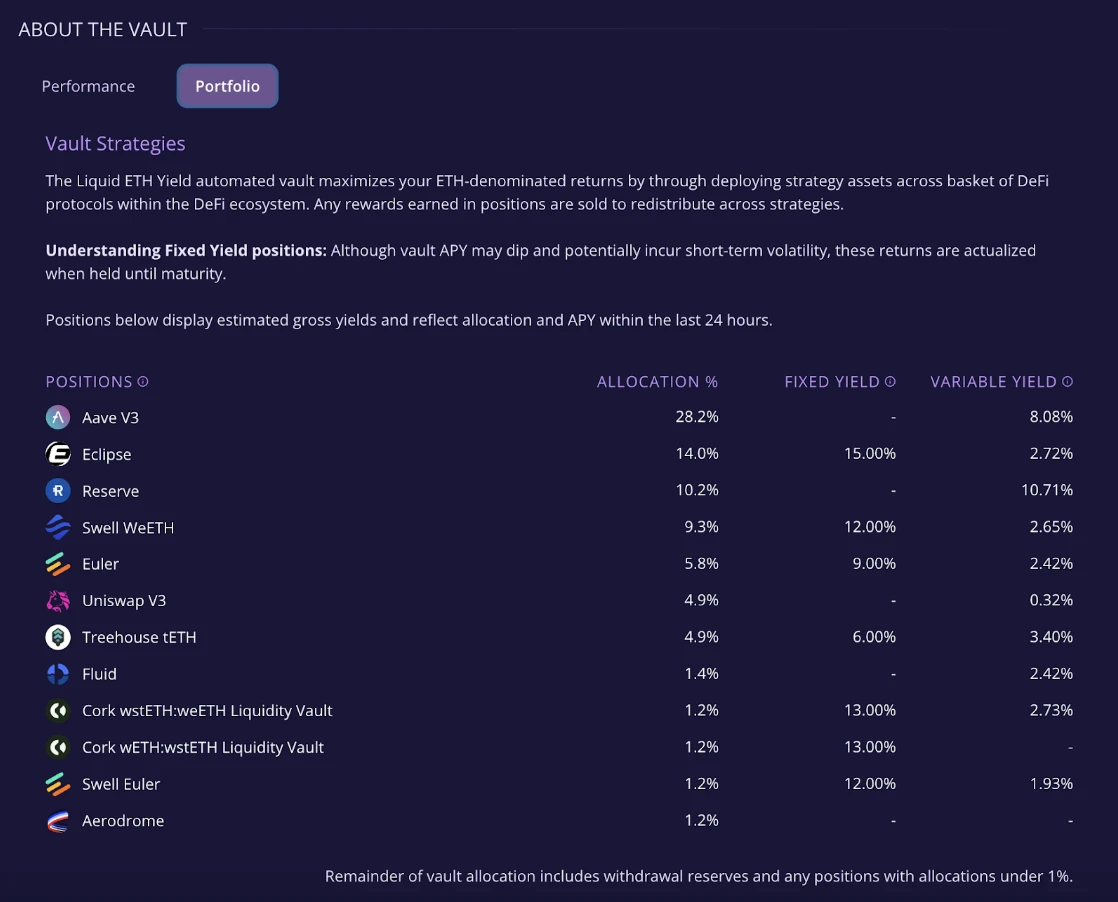

Each Vault page provides complete and clear information, including performance over the past 7 to 30 days, asset distribution, strategy providers, fees, and contract addresses. In Tyson Wynne's product demonstration video, we can learn how to view Vault strategy configurations in real-time on the interface and check contract asset distribution through DeBank.

Taking the Liquid ETH Vault as an example, ETH will be automatically diversified across multiple protocols such as Aave V3 (28.2%), Eclipse (14%), Reserve, Swell, Euler, Uniswap V3, etc. The asset allocation ratios and return structures can be viewed at any time on the platform.

In addition to the basic returns, there is currently an incentive campaign called "Mint, Spend, Earn" that is actively ongoing, with a total of 600,000 ETHFI tokens expected to be distributed. Rewards will be allocated to users who deposit into the Vault and those who use the Cash card for spending, serving as additional rewards.

Payment Methods

The Cash card currently offers two payment options:

Borrowing Mode: Users can borrow for spending by staking assets like eETH, eUSD, etc. The platform will automatically complete the borrowing process during the transaction. The borrowing interest rate during the current promotional period is 0%, and no Gas fees are required.

Pre-deposit Mode: Users can also pre-deposit tokens such as USDC, weETH, ETHFI, eUSD, eBTC, wETH, etc., into the Vault. When spending, the system will convert the required amount into USDC and complete the payment without triggering a loan.

Card transactions are settled in USD by default. In our tests, foreign currency payments incur an exchange rate conversion fee of about 0.98%. Regardless of which payment mode is used, transaction records and balance updates are reflected in real-time on the Vault page.

Security

All operations of the Ether.fi Cash are executed on-chain. Whether for spending, borrowing, or cashback, everything is completed through smart contracts. Users can view transaction details at any time, and assets are still managed by the users themselves.

The only downside is that the KYC materials required during the account creation phase can be quite complex, especially since the Cash card is not yet supported in certain regions.

Team and Enterprise Use

Another interesting point is that the Cash card also supports multi-member use, with its management backend having different roles: owner, administrator, and employee. Therefore, it is also suitable for team and enterprise organizational scenarios:

Administrators can set spending limits, issue/freeze cards, and view overall spending reports;

Regular members can only use within the allocated limits and cannot access the main team fund pool.

This mechanism is friendly for DAOs, remote teams, or companies managing on-chain assets, facilitating a transparent and controllable spending process.

Summary

From cashback, earning interest, to payment management, Ether.fi Cash provides a relatively complete set of on-chain asset usage tools. Users can earn token rewards from daily spending, invest idle assets into the vault to earn returns, and flexibly choose between borrowing or pre-deposit methods for daily payments. Teams and enterprises can also leverage the permission control system for multi-member collaboration. Throughout the entire process of "storing, using, and managing" on-chain assets, this card indeed offers a relatively practical solution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。